Think you've missed the AI boat? Think again

I was recently reading a fund manager's description of the AI theme; “We are only in the first innings, maybe the batter's box on AI”, and I couldn't disagree. AI will be a game changer the likes of the internet, but if 2000-2010 taught us anything, it would be a mistake to try and jump in now. Because when you miss a miss a boat, you don’t swim after it, you wait for the next one.

Has the first phase of AI peaked?

Comparisons to the 2001 tech bubble are an overused example of growth cycles. As Australian investors, we have thousands of examples of this development curve right under our noses, with junior mining company cycles in abundance. While it might sound ridiculous, bear with me!

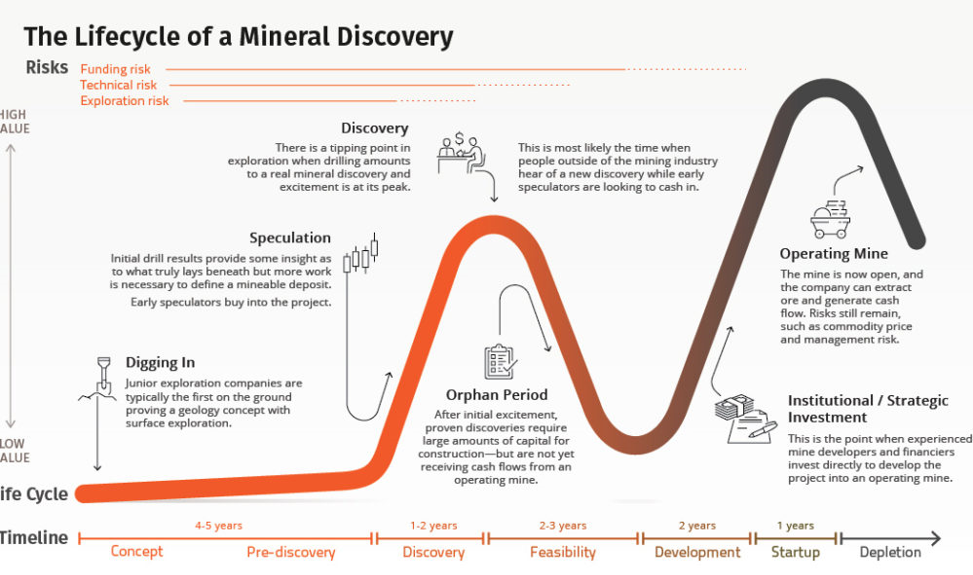

The Lassonde Curve, proposed by Pierre Lassonde, illustrates the typical trajectory of a resource exploration and development project, but there are huge parallels that can be drawn to any early-stage venture.

It depicts four distinct phases: the Conceptual Phase, the Discovery Phase, the Development Phase, and the Production Phase. Initially, there's little to no value as exploration begins. As discoveries are made and development progresses, value increases - peaking at the production phase when resources are being extracted and sold. However, once production declines, so does value.

Comparing these two concepts reveals intriguing parallels. In the early stages of both technology and resource ventures, there's often a surge of optimism and investment. During the Conceptual Phase of the Lassonde Curve, akin to the early stages of technology innovation, there's tremendous excitement and speculation about the potential success of a venture. This corresponds to the initial stages of the tech bubble, where investors pour money into unproven ideas and startups.

Similarly, the Discovery and Development Phases of the Lassonde Curve mirror the growth and expansion phases of the tech bubble. As companies make breakthroughs and move towards profitability, their values skyrocket, mirroring the exponential rise of tech stocks during the late 1990s.

In essence, both the 2001 tech bubble and the Lassonde Curve illustrate the cyclical nature of speculative markets and the importance of recognizing unsustainable growth patterns.

Where we believe they will differ is the length of time -

the cycle in AI will be faster.

Where is AI in the Lassonde cycle?

Realistically, we have seen the pre-discovery phase and are likely to be heading towards the end of the discovery phase. There are a litany of early warning signs we can learn from 2001, like risk premium, new metrics being invented, and valuations getting too far ahead of the economic pace.

Warning signs

Equity risk premium is the lowest since the highs of the Tech bubble

When risk premiums are low, the room for error is very small. So, no matter how good the company is, you have to understand you are risking far more than you are likely to make. Some of these trades may come off but in the long run, it's not a lasting strategy.

New Valuation Measures

As a rule of thumb, it is time to worry when the financial community starts inventing new valuation measures. In 2000, analysts introduced the ‘price to clicks’ ratio for internet stocks.

In the zero-interest rate environment, ‘price to revenue’ became a common metric used by the industry.

The introduction of the ‘price to innovation’ ratio to the market narrative should spark fears of a stock market bubble.

Ideas are not businesses.

Concentration risk

The "Magnificent Seven" are basically the only beneficiaries of the recent rally, similar to the late 90's.

In 1999, analysts said Cisco was the most favoured stock in the US. The company was unanimously loved despite a 110x PE and forward PE of 70x. Analysts dismissed this, saying "Its been high for a while and we've lived with it", and describing the chances of being the dominant player as "a slim chance of failure" and "even at high valuations, any adjustment period will be short-lived" (from a 1999 article on Bloomberg).

If you have read an analyst's report of the Magnificent Seven recently..... it sounds eerily familiar, doesn't it?

In 2001, four of the "Magnificent Seven" didn’t even exist but leveraged off the house that the internet built, leaving pioneers like IBM, Cisco, Netscape and AOL in the dust.

So, how do I play it?

Whether there is a bubble or not, markets always have a bad habit of assuming that the world can keep up with the future earnings investors have predicted. Akin to building a house, we know what it would look like and imagine ourselves living in it years before we ever do (and anyone who has watched "Grand Designs” will know, rarely does anything go to plan and always over budget!)

So be patient, don’t chase, and look for the new opportunities that will come from AI, because the best AI companies are unlikely to have even been started yet (and NVDA may be the next Cisco).

Join our exclusive webinar to explore the AI investment landscape, unlock strategies for timing your entry, and learn to navigate the next big wave.

AI Investing Webinar 22nd of February

3 topics