This is a huge buying opportunity

This is a huge (short term & long term) buying opportunity we are seeing right now. For short term traders we will get a big short term bounce.. but be careful. Last week, I said don’t buy yet – but now I think this week is the right time to start the buying.

All last week from Monday (& also in every report last week) I stressed the same thing – don’t buy yet. On Monday I said “I would not be stepping to buy the market yet, we look to now be finally seeing a reaction by markets to the virus. This fall could very easily move to -5% or even -10% fall.... if the US mkt gets spooked. So I myself am not buying anything just yet, happy to wait a week or 2 more before doing too much. “ (from last Monday 24th Feb).

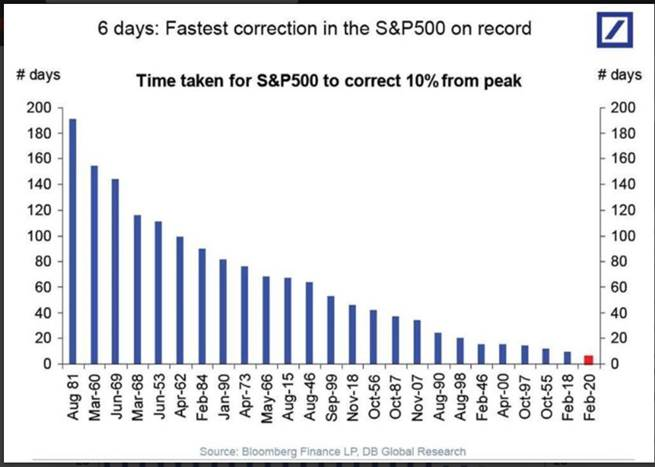

Ok now a week later markets went into free fall & the drop in the US was the fastest -10% correction ever, also worst week since GFC & so on. This shows the fastest -10% correction in the US - this is now the quickest.. so does it keep going ??

S&P 500 tumbled more than 10% from record highs in an unprecedented pace of just 6 days. According to Deutsche Bank, the speed of the decline is even faster than that during Black Monday in October 1987.

- So for me that plus numerous indicators I have used in the last 20 years - in times like this – are all slapping me in the face that this is a massive buying opportunity.

I think we saw the low - in this selloff - on Friday night in the US.

- Ok the US could do anything on Monday (or tonight for us) – some of the big market falls (and the 1987 crash) have come on Monday’s in the US (Tuesday’s for us) – as they usually come after a big fall in to Friday & then when the US opens on the Monday after all the investors in the US heard about how bad things are – then do their classic panic selloff.

- Not sure if it will happen this time (as I think we saw the panic selling on Friday), but if it does I still think last Friday or this Monday will be the low in this selloff.

- Also we know that the Dow closed down (just) -1.3% - BUT it was down at its low -1,085 points or -4.2% (but at its low on Friday - the drop has been -15.7% in just 7 days)

- the S&P 500 down -4.1% but closed down just -0.8%(but at its low the drop has been -4,667 points or an extraordinary -15.9% drop in just 7 days)

Ok why did the US rally +3% off its low - right on the close ?

- There was a massive +3% rally on the close – now that was despite MOC sell imbalance of -$5billion – that meant US was going to be smashed on the close & close on its lows & down maybe -5%.

- That would be a disaster for the US markets when they opened again on the Monday >>

- Some say it was position squaring by US institutions ahead of the weekend – that’s just crap (because it was 1 buy order worth a massive US$25billion !!) – it was something else …

We saw something extraordinary late Friday in the US-

- Someone (and I know exactly who it was) came in as a massive buyer of S&P 500 Eminis contracts -worth a huge US$25b was bought right into the close – hence the gigantic +3% rally on the close – so the US didn’t look as bad.

- So who was the buyer??

I suspect the US Government via the rarely used “ Plunge Protection Team”.

- It is triggered in times when the US stockmarket is under severe selling pressure after a series of big falls,

- It was in fact was established by President Reagan back in 1988 as a response to the October 1987 stock market collapse (when the Dow dropped -22.6% on 19th October 1987).

- Its job is a simple one “ prevent stock market plunges.”

- Its official name isn’t the Plunge Protection Team - the actual name is the Working Group on Financial Markets. The Team reports to the President, and officially includes just 4 members: the Chair of the Federal Reserve, the Secretary of the Treasury, the Chair of the SEC, and the Chair of the CFTC.

The last time it was in action the Dow rallied +5% the day they came in.

- Though this went largely unreported by the American media, Treasury Secretary Steven Mnuchin has admitted that the Plunge Protection Team met by telephone on the afternoon of 24th December 2018 – when the US mkt (and world markets) was in a terrifying freefall -to discuss the sharp decline in U.S. mkt.

- The next trading day – the 26th Dec 2018, the Dow rallied up over 1,000 points, its biggest single-day point gain ever, or as a percentage the rise was +5%.

- SO WE KNOW THEY act when they need to & I’d say without any doubt they were active last Friday & once they start they continue until the mkts stabilise.

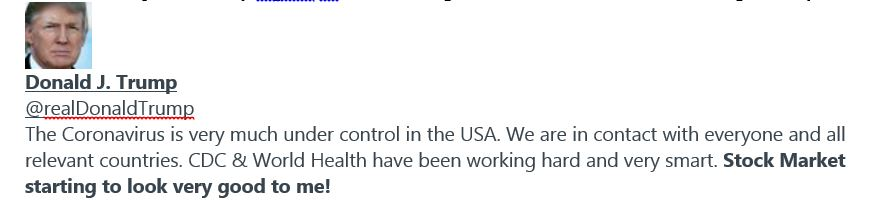

- Trump even hinted in his tweet the other day that the stockmarket was good buying here – so of course he will do anything to protect it..

This was trump on Monday night .. he looks like a goose – so of course he’s now acting covertly

Source Donald Trump

I’d say by the end of this week the ASX 200 could be up +5%,

- yes I know its sounds absurd – but that’s what I think.

- I think markets in the US & Australia will have the mother of all rallies this week.

- I have made these calls many times over the years & most times (apart from a shocker in October 2008 – pre Lehman’s ) have been very close to the bottom & the factors that indicate a (short term for now) bottom are all in place (I’ll go through some in a minute).

- I have a tendency of calling the bottom a bit early, but when it turns at least I’m set for the V recoveries - we will see - in many (but not all) stocks.

This bounce will be big & violent

- It always is when volatility is heightened.

- It will defy many experts who will be flabbergasted that the mkts could rally at a time of so much uncertainty.

- But I’ll show later why markets have rallied again & again – at times – when we are in the eye of the storm & things look very bleak.

No one rings the bell at the bottom - its always a very lonely place when you are there.

This rally will be violent but it will be sold into - mtks almost always -"go back & re-test their lows"

- Its also worth just mentioning that most times in the last 30 years that I have seen these massive selloffs & then big recoveries –almost every one has a 2nd downturn.

- When the market rallies (assuming it does of course) there will be plenty who missed selling- as the falls was so fast – that they will “sell the bounce”

So as we often seen, be it a week, a month or 3 months – markets have a tendency to go on & ”re-test their lows”

- Given the US selloff has been one of the most extreme ever at -15.8% in just 7 days- in may not happen this time – but there will be a second selloff sometime in the coming months.

- Still I’ll cover that in the future (weeks or a months ?) when we get to that point & we see the 2nd wave of the selloff.

- For now we need to see the rally first !

So I'm buying some stocks now, with the intention of doing more later on when we re-test the lows later on.

- The volatility will see a massive bounce - that will be sold into - mkts will then trade wildly as headlines see it drop - on credit concerns, more lock -down s& then bounce on Government stimulus & Central banks flooding their systems with liquidity.

- Volatility will reign supreme - but in my gut I think we could have seen the worst of the market fear, it'll take a lot more bad news to drive the US in to a Bear market (-a -20% correction).

I could be wrong & this selloff really is “different this time”

- Given the velocity of recent sell-off the fastest -10% correction in US history- possibly takes us into in uncharted waters & also the big unknown of course remains just how deep this will hit global economies - some which could be paralyzed while health authorities attend to it.

- Any vaccine, will take time & so very soon we’ll see governments around the world to step up on fiscal stimulus packages to cushion the economic impact.

- So one way of thinking about this is that when there is a natural disaster – all it does is it slows / impedes short term economic activity,but long term economic expansion then goes back to normal.

- The only way that this could be different is that if we saw a Spanish flu situation where it kills hundreds of thousands or millions – but we know that is not the case here – the death rate is very low.

- The Asian Times put it perfectly when they said ..”The economic impact of the virus stems from preventative measures, which temporarily suspend economic activity. Governments should step in and provide a fiscal bridge. This is no different than storm or flood damage.”

- So we will see governments intervene to cushion the economic slowdown that is stemming from the abrupt halt of trade & commerce in certain areas / countries – but the reality is - this is no different to any other natural disaster and as such the negative shock to the stock market should be no more than a glitch in the big picture.

- Trump will act swiftly to avoid any lingering effects on the domestic economy, especially as this is an election year & the election is now just 8 months away…

A few reasons why markets may have seen their lows..

Massive trading volumes = capitulation points

- When the US mkt saw its lows in November 2008 & again March 2009 we saw daily volume increased in the US both those time from 1.2b shares to over 2b as the market bottomed.

- On Friday night in the US we saw the biggest value night EVER (US$986b traded)

- We also saw on Friday a massive 2.6b shares traded vs 900m on a normal day.

Climatic Volumes always come at the at the lows - we are seeing the lows any day now..

- We saw climatic volumes in the US & Australia last week -as the markets were being sold off to their lows.

- Over the 5 days last week that the market here was smashed it fell -9.77% we saw

- On Friday the biggest value day EVER

Date Daily value that day (billions)

- 28/02/2020 (last Friday) $14,860

- 20/09/2007 $13,731

- 29/06/2007 $13,578

- 16/08/2007 $12,739

- 30/11/2007 $12,646

- 21/06/2007 $12,514

- 27/07/2007 $12,271

- 20/12/2007 $12,076

Last week was also the biggest value WEEK EVER

Date Daily value that day (billions)

- 28/02/2020 $51,215

- 21/12/2007 $47,672

- 20/09/2019 $45,032

- 25/01/2008 $43,893

- 17/08/2007 $42,549

- 19/09/2008 $42,523

- 26/10/2007 $41,687

- These unprecedented volumes always come at the time of massive “capitulation” – many are still too scared to go back into the market & we are likely to see the upcoming rally come as markets then climb that famous “ wall of worry”

What to BUY

Miners

- BHP Group (BHP)

- Rio Tinto (RIO)

- Fortescue Metals (FMG)

Energy: China recovering will see Oil bounce hard

- Santos (STO),

- Woodside Petroleum (WPL),

- Beach Energy (BPT)

- Oil Search (OSH)

Tech Stocks

- Afterpay (APT)

- Altium (ALU)

- Appen (APX)

- Nearmap (NEA)

- Wisetech (WTC)

- Xero (XRO)

High PE stocks

- Aristocrat Leisure (ALL)

- CSL (CSL)

- James Hardie (JHX)

- Macquarie Group (MQG)

- Resmed (RMD)

- Treasury Wine (TWE) though you have time on your side here

Healthcare: I was a buyer of both of these today

- Paradigm Biopharmaceutical (PAR)

- Medical Developments (MPV)

Plus: Offshore earners: with $A down at 65c - if it stays here, huge translation benefits to them.

I'm avoiding

- Airlines

- Travel stocks

- Banks - rate cut will not be good for them

- Any stock that has high debt levels & cashflows under pressure

Get more insights from the insto desk in the Coppo report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, Director - Institutional Sales and Trading, Bell Potter. You can find out more by clicking here.

You can also stay up to date with the latest news from me by hitting the 'follow' button below and you'll be notified every time I post a wire.

4 topics

13 stocks mentioned