Three fixed-income veterans name their top conviction trade for FY23

I recently stumbled across a daily markets report (by Mark Gardner at Maqro Capital, if you must know) which argued the "extraordinarily dour outlook" for price action suggests there is little room for downside. While the statement was actually in reference to US earnings season and global equities, I couldn't help but think whether the same could apply to the bond market.

As we revealed in part one, global bonds are having a year to forget with prices in free fall and yields skyrocketing. Even a forecast from strategists at Bank of America as recent as August this year is already looking old - and for now at least, unlikely.

Even Blackrock Investment Institute Chief Asia-Pacific Strategist Ben Powell told me they are still underweight government bonds in their asset allocation strategy because they believe the peak in yields may not be for a while yet.

So are there opportunities in bonds right now? Is the traditional "40" in a 60/40 portfolio still worthy of an underweight call? And how different is the investment case for Australia, when put in direct comparison to the United States or other key markets?

To answer those questions and more, I invite you to join me for part two of Livewire's fixed income and bonds collection - a part of our bigger super-series looking into the remarkable year for markets and the implications of it.

Australia versus the world: This year so far

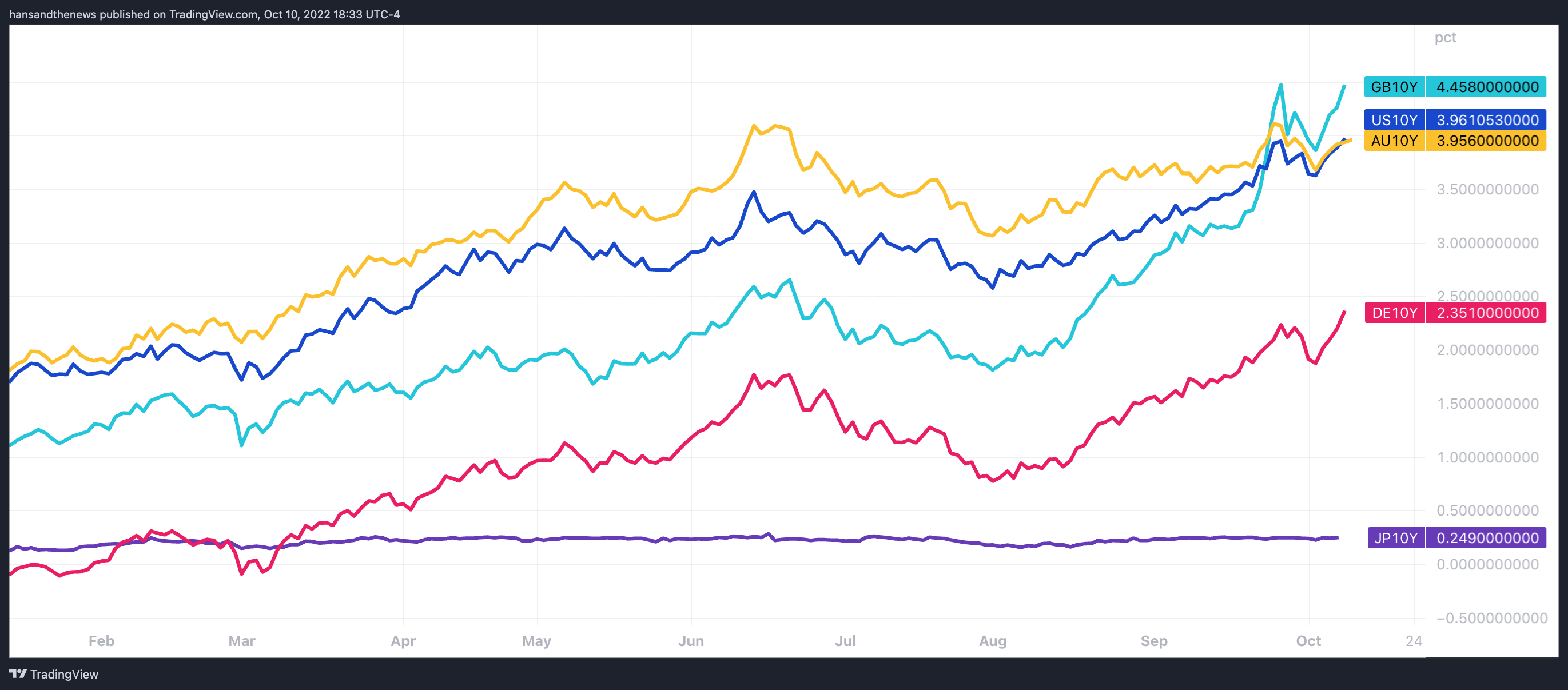

First things first - price moves inversely to yield. So the rise in yields over the year-to-date is also a direct indication of the fall in the nominal value of the bond. But how do we stack up against our international peers? If this chart is anything to go by, we're probably well in the middle, just behind the US but well ahead of other countries like Germany and Japan.

The other thing which is noteworthy is that Australian yields started off at a higher base compared to our global counterparts (the yellow line was hovering above the other coloured lines for a while) but that has come back sharply after the remarkable events in the UK, particularly around the Bank of England.

So does that make Australian assets more attractive?

Short answer: Yes, but it's not all gravy and it's not all across the board. But it does speak to why the Australian investment case is so different from other countries, even if the US is the proverbial 800-pound gorilla in the room.

"There are differences in the macro outlook for Australian fixed income but also structural and informational differences," Michael Korber of Perpetual Asset Management told me. He went on to add that times of earnings volatility are, paradoxically, the best times to be a credit investor because spreads are so wide and financial conditions are getting progressively tighter.

"Slowing economic and earnings growth concerns, alongside tighter financial conditions, have seen domestic credit spreads expand to their highest levels in a decade. As a credit investor, these conditions are where we can make the strongest returns."

See, there's always an investment opportunity somewhere! If earnings really are the next shoe to drop in the US (and Australia come February), then credit investments may provide a safe haven ahead of time.

In the first part of this series, we also highlighted reasons why the Reserve Bank of Australia's terminal rate (the peak in this cycle of cash rate increases) will almost certainly be lower than that of the Federal Reserve. But most importantly in the case of this story, the RBA will have to focus on financial stability due to our love (and sensitivity) to rising mortgage rates and high levels of household debt. Having said this, Jay Sivapalan of Janus Henderson argues this is also the reason why Australian fixed-income assets may attract higher yields and a better return on investment than overseas counterparts.

"We’ll likely see a real divergence over the next 6-12 months, with Australia, anticipated to perform better," Sivapalan told me. "When policy grips, we believe the RBA will shift its focus between the three mandates of inflation, full employment, and financial stability."

John Likos from BondAdviser has a different view again, despite reaching the same conclusion. He argues that our strong regulatory backing, supplemented by strong corporate balance sheets is the reason Australian assets will perform better in the immediate time.

"One is a strong, transparent, and proactive financial regulator in APRA and the other is the generally strong condition of corporate balance sheets amongst domestic issuers who have benefited from the strong economic growth Australia has delivered," Likos said. "We do believe the financial positions of those issuers are relatively strong which provides an attractive relative value opportunity," he added.

Our experts' top conviction calls

Given all the above, I suspect you will be totally unsurprised that our experts' highest conviction investment ideas all have a local flavour to them. But it's how you approach these ideas that differentiate them. For instance, Likos' approach is centered around short-duration debt (i.e. government bonds that mature in less than three years).

"Whether this is government bonds or investment grade financials/corporates, there are attractive returns on offer in these assets relative to domestic and global peers," Likos said. His example is a corporate bond from "tier two" - and that's where I'll let him pick up the explanation.

"Our largest tactical overweight currently is floating rate note domestic investment grade Tier 2 debt followed by floating rate note domestic major bank senior unsecured debt," Likos said. "Tier 2 sits higher on the capital structure than equity and we believe it represents an attractive risk-return proposition," he added.

Sivapalan has a different approach, arguing now is the time to be at the proverbial doorstep and not all-in.

"Our preference is to set some entry points and chip away, adding exposure with the aim of having the maximum exposure when the turning point occurs. The next major pivot by central banks will come as cash rates peak, or when the need for easing policy arrives. Whilst not imminent, once policy grips, central bank rhetoric will shift promptly."

Korber has a different view altogether. His wheelhouse of investment-grade credit is not the easiest asset for retail investors to access. But he does have views on how any investor can use this time to reassess where their cash is right now.

"I do think that this is a great opportunity for investors to diversify their asset class mix," Korber said. "2022 has been the worst possible year for a traditional 60:40 asset allocation. We’ve seen the benefits of integrating seemingly more esoteric asset classes across commodities, market neutral equities, options, and floating rate credit."

Conclusion

Next time, we'll look at the final part of this series - the lessons each of our veteran investors are taking away from this remarkable period in markets. It's not been an easy year to be a bond investor, but is there anything they will take with them into the future? The answers may surprise you.

2 topics

2 contributors mentioned