Upbeat tech earnings fail to lift the S&P 500, Meta posts a solid Q1, ASX to fall

ASX 200 futures are trading 16 points lower, down -0.22% as of 8:30 am AEDT.

Major US benchmarks failed to hold onto gains as hard-landing and renewed banking sector concerns outweighed better-than-expected tech earnings, Chipotle flexes its pricing power and posts a strong first quarter, Meta beats earnings expectations and shares surge 11% after hours, Visa warns that ticket sizes are falling but the consumer remains in good shape and a closer look at yesterday's inflation numbers.

Let's dive in.

S&P 500 SESSION CHART

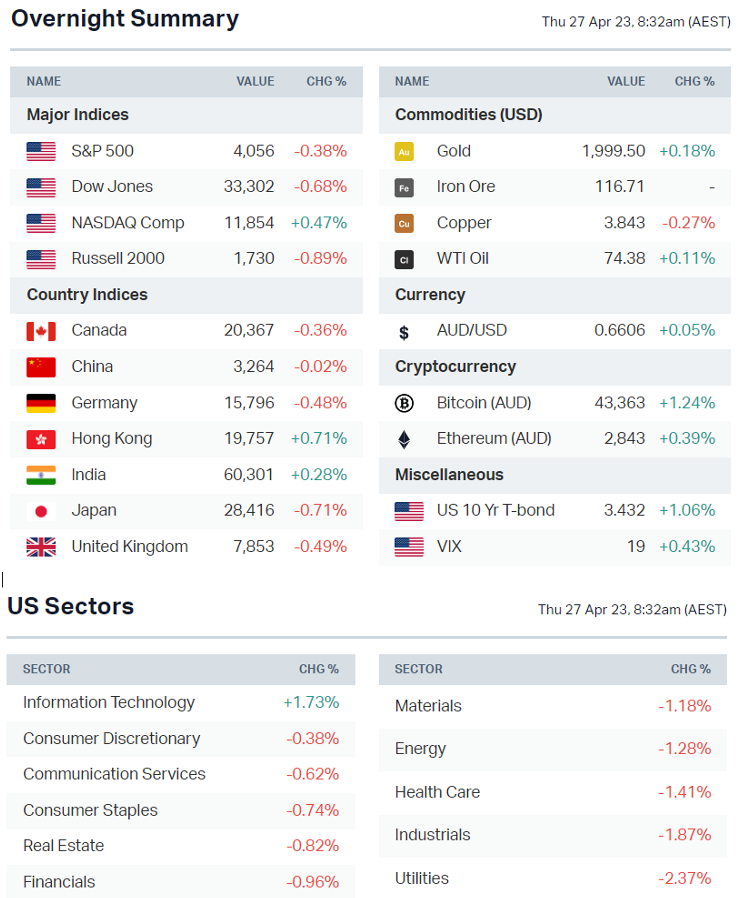

MARKETS

- S&P 500 fell from early session highs of 0.4% to close at worst levels

- Nasdaq positive thanks to better-than-expected megacap earnings but still down from session highs of 1.4%

- WTI crude down 3.6% after Wednesday’s 2% decline. It’s now given back all the OPEC production cut gains – where prices surged 6.3% to US$80 on 3 April

- US earnings season has largely been positive, with solid earnings from high-profile names like Meta, Microsoft and Alphabet. But this has not been enough to offset concerns over falling commodity prices, Atlanta Fed GDPNow downgrades, debt-ceiling delays and renewed banking sector woes

- Goldman Sachs says CTAs are out of buying ammo (Bloomberg)

- Druckenmiller says short dollar is the only high-conviction trade he has (FT)

- US-listed China stocks see $100bn wipeout in jittery month (Bloomberg)

STOCKS

- First Republic exploring sale of US$100bn of long-dated securities (Bloomberg)

- Tesla drops Model Y starting price below the average US vehicle (Bloomberg)

- Nvidia has new way to prevent AI bots from saying incorrect facts (CNBC)

- Boeing warns its production setback will hit summer air travel (FT)

EARNINGS

33% of companies in the S&P 500 have now reported first quarter earnings. The blended growth rate sits at -4.9% compared to the -6.7% expected at the end of the quarter, according to FactSet. Approximately 81% of results have topped EPS expectations, above the one-year average of 73% and five-year average of 77%.

Chipotle (+12.9%): Double beat, revenues rose 20% year-on-year to US$2.5bn, comparable restaurant sales up 11% and menu prices are up around 10% from a year earlier.

"Our base case does not include a recession or certainly not a meaningful recession… it looks like unemployment is holding up really well. It looks like consumer spending is strong right now.” – CFO Jack Hartung

Microsoft (+7.3%): EPS, revenue and cloud segments beat, Azure growth moderated to 31% year-on-year (38% in previous quarter) but better than analyst expectations of 30%, management talked up Azure OpenAI service that now has more than 2,500 customers.

Meta (+0.9%, after hours +11.5%): Double beat, daily active users in-line at 2bn, headcount fell 1% year-on-year to 77,114, posted highest free cash flow in 4 quarters. Some key comments from the Zucc:

- More layoffs: "So far we've gone through 2 of the 2 waves of restructuring and layoffs that we have planned for this year in our recruiting and our technical group. In May, we're going to carry out our third wave across our business groups.”

- AI race: "Now at this point, we are no longer behind in building out our AI infrastructure. To the contrary, we now have the capacity to do leading work in this space at scale."

- Ad recovery: “Relative to Q4, we certainly saw stronger ad demand, including the impact of lapping the Ukraine war which began in Q1 22 & in particular, we saw an acceleration among advertisers in China, targeting users in other markets"

Alphabet (-0.1%): Double beat, authorised a repurchase of an additional US$70bn shares, net revenues rose 2% year-on-year to US$58.1bn, Youtube revenue fell 3% year-on-year (from -8% in previous quarter) but showing some signs of ad revenue stabilisation.

Visa (-0.6%): Double beat, net revenues rose 12% year-on-year to US$7.9bn, payment volumes ahead of analyst expectations – up 7%, management flagged some slowdown in US consumer spending trends in March and April.

"Ticket sizes are declining as inflation moderates ... growth remains strong in services, .. travel and entertainment. Outbound travel from the US to all geographies continued to be strong at around 150% of 2019 levels ... We think the consumer is still in good shape."

Enphase Energy (-25.7%): Is a US-based solar, battery storage and EV charging station manufacturer. It missed revenue expectations, US sales fell 9% quarter-on-quarter and second quarter guidance was below expectations.

- "As long as interest rates are so high, we cannot -- we're not saying that the numbers are going to return back to where it were...The demand will unleash only when the interest rates are back to normal.” – CEO Badrinarayanan Kothandaraman

- “The installers aren’t signing up with more customers, because the interest rates are quite high relative to the utility rates ... solar financing is not going to be economical.”

Cool fact: Microsoft and Alphabet mentioned “AI” a collective 142 times last night.

ECONOMY

- US business spending on equipment weakening as demand for goods slow (Reuters)

- China's high frequency data shows economy continued to expansion in April (Bloomberg)

- China rolls out plan to boost trade amid weakening global demand (Reuters)

- German Gfk consumer confidence picks up for seventh straight month (Reuters)

- South Korean consumers' inflation expectations fall to 11-month low (Reuters)

- New York City's commercial real estate market faces a major crisis (NY Times)

- Australian inflation moderates, market leans against rate hike (Reuters)

-

Sweden central bank hikes 50 bps to 3.5%, says nearly done with hikes (Bloomberg)

Deeper Dive

Australian CPI Wrap

Let's cut to the chase - this quarterly inflation print is being widely viewed as enough to keep the cash rate on hold for another month.

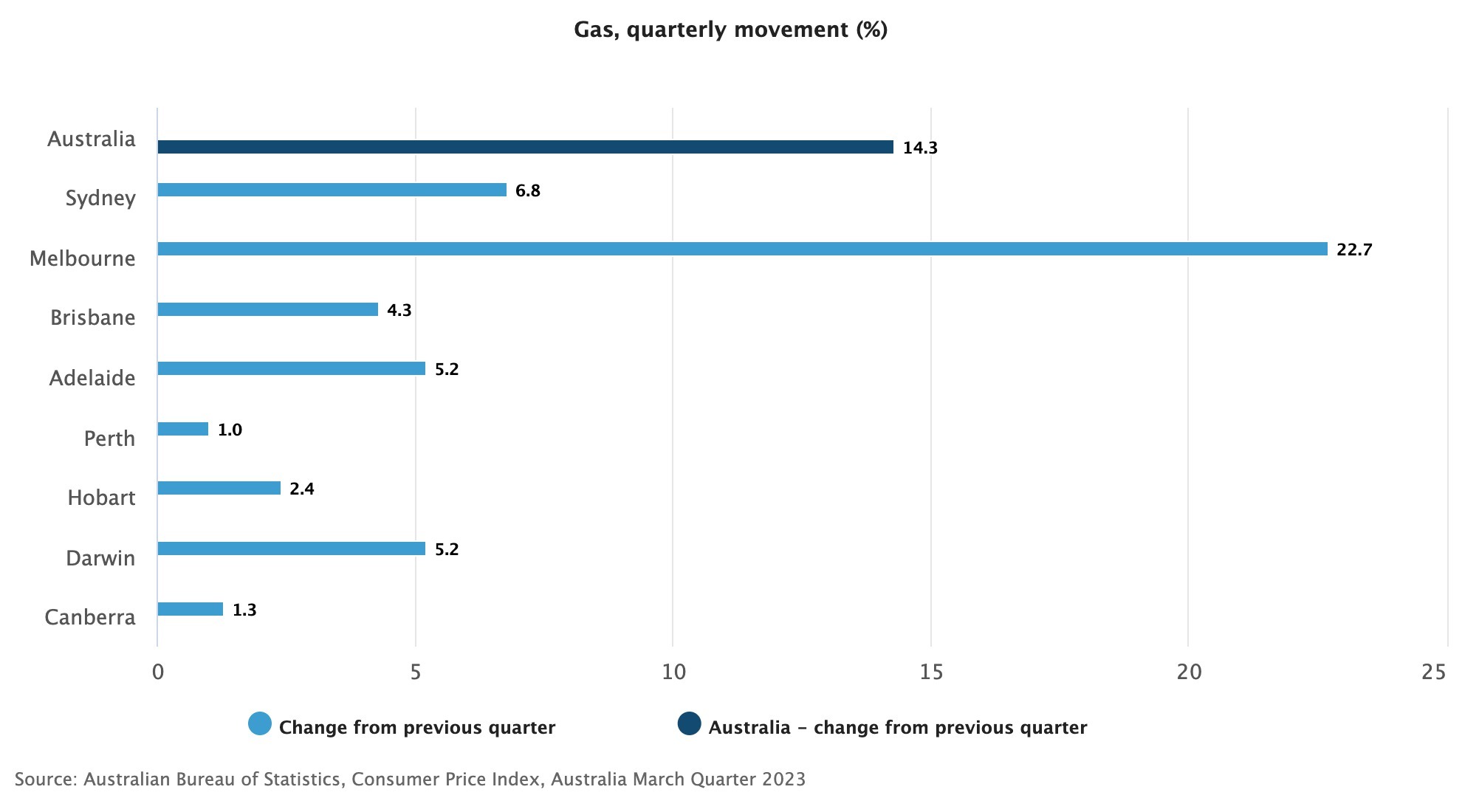

Inflation came in at +1.4% quarter-on-quarter (+1.2% on the core measure) and +7.0% year-on-year (+6.6% on the core measure). Pockets of deflation are starting to show in such baskets as clothing and household furnishings. But do not be fooled. There are still some concerns for the RBA Board:

- Housing inflation is up 9.8% year-on-year, driven by a humongous rise in utility bills

- Gas bills are up 14% (!!!) quarter-on-quarter. As the chart below shows, I suspect everyone in Melbourne will be migrating to an electric stove very soon.

- Education inflation is up more than 5% this quarter, but that's primarily due to a big shift in the HECS repayment interest rates.

- Insurance premia increased by the most last quarter since 2000 and the rise appeared to be across the board.

- Domestic travel and accommodation prices are up 25% year-on-year (+4.7% alone last quarter).

Either way, if the RBA pauses next week, it'll demonstrate to other central banks that its "pain threshold" is probably a lot higher than its international counterparts including the Federal Reserve.

%20(1).jpeg)

Sectors to Watch

These overnight sessions are getting quiet messy as solid earnings are offset by broader doom and gloom.

Iron ore: US-listed BHP rose 2.2% overnight. Singapore iron ore futures are currently trading at US$105.05 a tonne, up from Wednesday lows of US$99.90. Prices are starting to bounce after falling as much as 15% in the last six sessions. The question is, is this the kind of bounce that marks the bottom or just an oversold bounce?

Oil: US crude inventories fell more than expected overnight but the market is clearly more focused on growing recession fears. Oil prices have run full circle since the OPEC supply cut earlier this month. This could see some pressure for local energy names like Woodside and Beach Energy.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Gryphon Capital Income Trust (GCI) – $0.013, 360 Capital Enhanced Income Fund (TCF) – $0.035, Acrow Formwork and Construction Services (ACF) – $0.017, Streamships (SST) – $0.253

- Dividends paid: Turners Automotive (TRA) – $0.056, Clover Corp (CLV) – $0.0075, Ridley Corp (RIC) – $0.04, 360 Capital REIT (TOT) – $0.015

- Listing: Ashby Mining (AMG) at 11:00 am

Economic calendar (AEST):

10:30 pm: US Q2 GDP

This Morning Wrap was first published for Market Index by Kerry Sun and Hans Lee.

2 contributors mentioned