US inflation: What you need to know

In light of the United States’ (US’) August Consumer Price Index (CPI) report, I provide this latest report as an update to some of the key points that I previously articulated here, which I believe are critical to understanding the US’ future inflation outlook. Whilst the market was caught off guard by the August CPI report, I saw it as solidifying these key points, which I reiterate now, being:

1) A shrinking federal government deficit and continued tightening from the Federal Reserve (Fed) is contributing to an extraordinary deceleration in the year-on-year (YoY) growth rate of the M2 money supply, which has flatlined in 2022.

2) Flatlining M2, in the absence of another spike in energy prices, points to a significant likelihood that the YoY CPI growth rate peaked in June 2022.

3) Despite the likelihood of the CPI peaking in June, lower YoY comparables will likely prevent a major deceleration in the YoY growth rate of the CPI throughout the rest of 2022.

4) The nature of the COVID pandemic and the lagging measurement of shelter costs, makes it critical that CPI growth is broken down into its key categories, which reveals that:

i) YoY growth in the durables category clearly peaked in February 2022, with the YoY rate set to continue decelerating significantly from October 2022. An ongoing deceleration in M2 growth is likely to see the durables category return to a rate that is consistent with 2.0 per cent YoY growth over time.

ii) The outlook for nondurables prices remains highly uncertain, and forms the key flex in the CPI over the short-term, with further declines in gasoline prices seen so far in September.

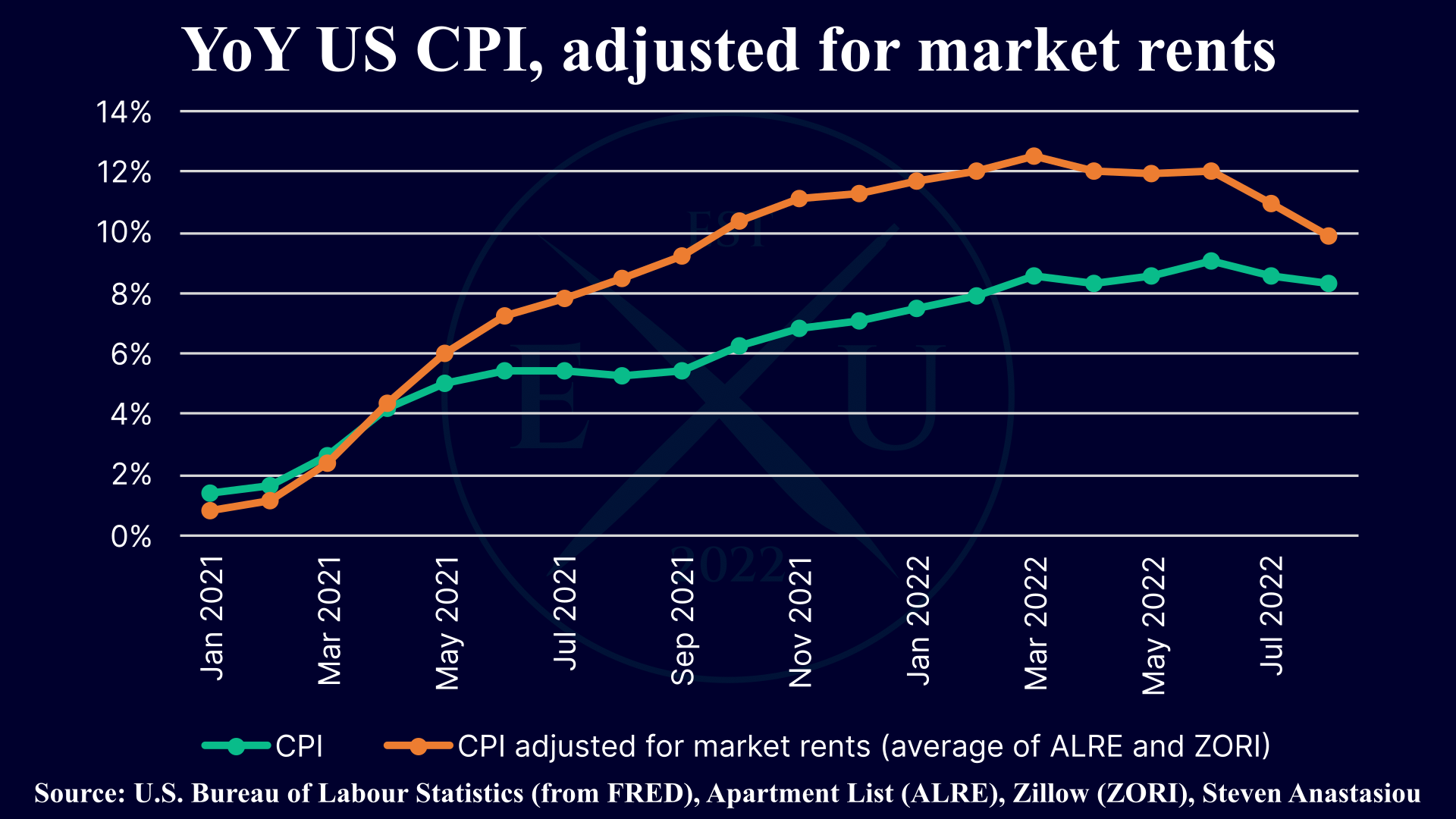

iii) While not seeing a surge to the same extent of that seen in the durables and nondurables categories, the services CPI category remains in an uptrend, and is likely to remain at elevated levels for a significant period of time, particularly on account of the lagging manner in which rental costs are measured.

5) While housing and rental price growth would be expected to decelerate

over time in light of flatlining M2, higher interest rates, and a

weakening economy, the lagging nature of rental cost measurement will

likely significantly lengthen the period of time required for this to

show up in the CPI and Personal Consumption Expenditures Price Index

(PCEPI) reports, significantly raising the risk of the Fed

overtightening and causing a severe recession.

The full report is attached to this wire.

In order to support, and keep up-to-date with my latest research, please consider subscribing/following Economics Uncovered on:

Substack Twitter Instagram Facebook

4 topics