Warning lights flashing red for Australia's property market

The opening chapter on inflation and the accompanying rate hikes are worrying property investors, though the story is a long way from finished.

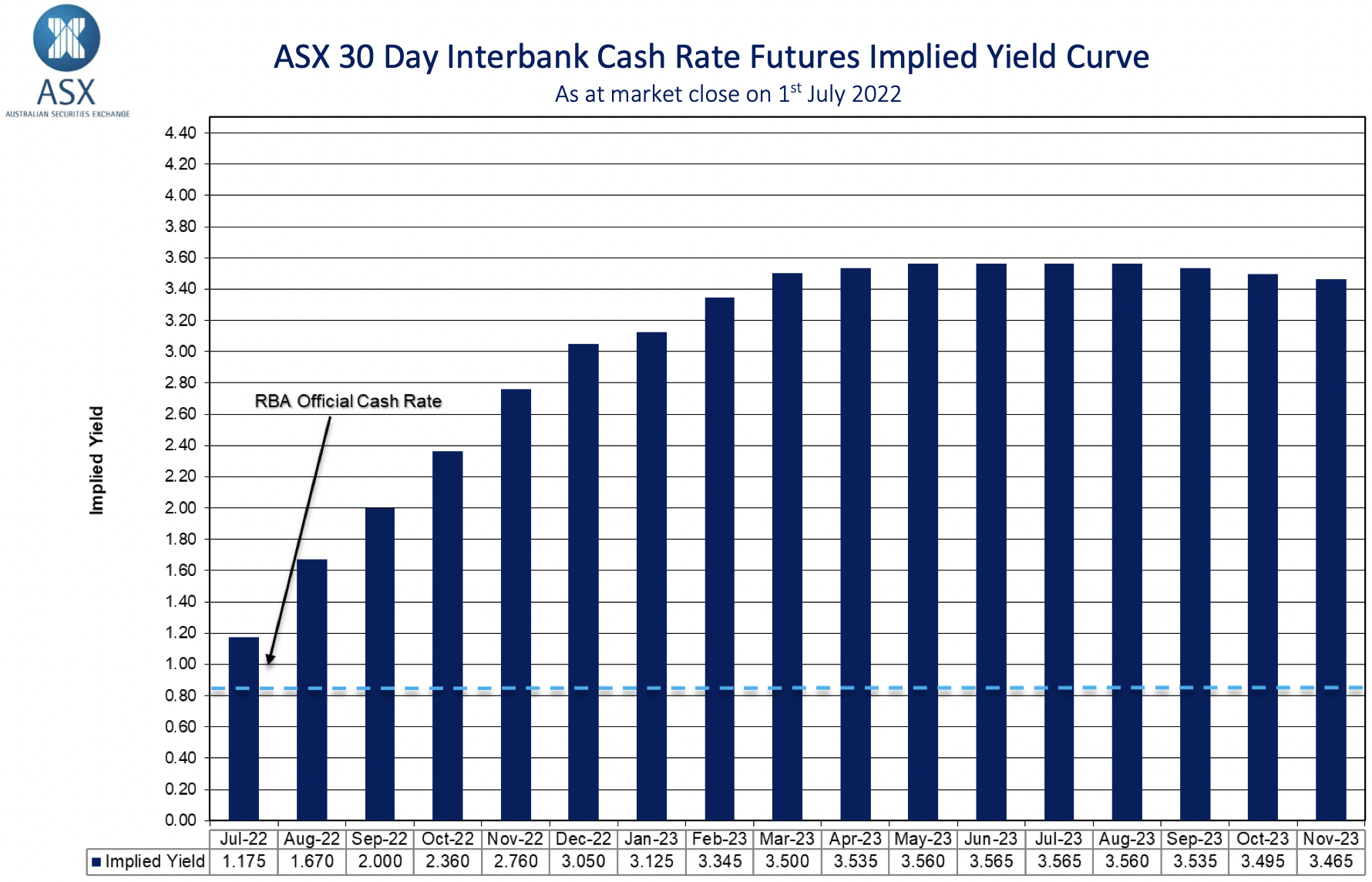

According to Aussie cash rate futures, the market is pricing in for cash rates to hit almost 3.6% by the middle of next year.

So, I reached out to Cameron Kusher, director of economic research at PropTrack, to find out what rate hikes portend for property values, household savings, and the all-important wealth effect.

I bookend this with a couple of simple tips homeowners can use to help ease the mortgage pain.

The property market hits the brakes

The signs aren’t good. CoreLogic just recorded a 55% preliminary clearance rate across the capitals – the worst result since April 2020.

It’s easy to assume that the property market correction is a rate hike correction. But it goes back further than that.

“Even prior to the first interest rate rise in May 2022, the rate of price growth nationally had been slowing since September 2021,” says Cameron Kusher, director of economic research at PropTrack.

“National home prices have fallen consecutively over the last three months, with noticeably larger falls in May and June as interest rates increased.”

That said, rates do share a strong inverse relationship with house prices.

“We expect national prices to fall from their peak by around 10% to 15%, with the potential for larger falls in more expensive markets such as Sydney, Melbourne and Canberra.”

Kusher adds one important caveat.

“Over the two years to the market peak in March 2022, national property prices have increased by 35.1%, meaning that they would have to fall by 26% just to get to their pre-pandemic level. A fall of 10% to 15% over the next year would mean home prices are still above pre-pandemic levels.”

Household coffers become hurt lockers

When it comes to household cashflows, it’s a toxic double whammy of rate hikes and higher prices for, well, just about everything.

“High inflation means that the cost of living is rising rapidly and we’re seeing this right now with the cost of food, petrol, electricity, and many other goods and services. If rates do rise that high, it will impact most households’ largest asset, their property,” says Kusher.

So far, fixed-rate mortgages have felt the most pain.

“Around 35-40% of outstanding mortgages are currently fixed-rate, mostly for terms of 2-3 years,” according to a recent report from Nomura.

“These loan rates fell as low as around 2% in 2021, under the Yield Target policy, but have already moved sharply higher, to around 5%, rising with swap rates.”

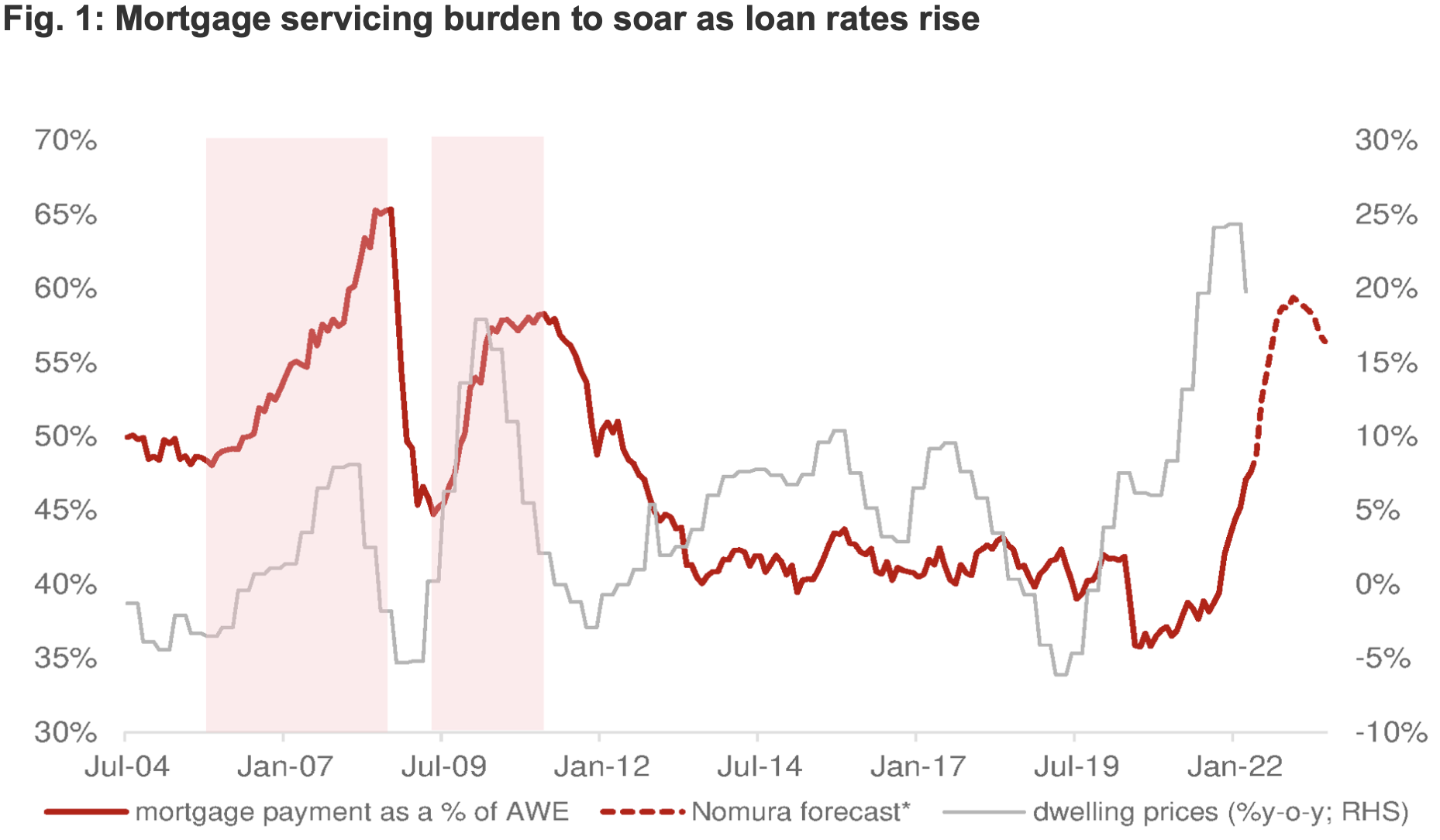

Nomura estimates the average home loan rate has already risen by around 170 basis points from the lows (of around 3%). As the cash rate rises further, they expect this to rise by around another 140 basis points, mainly due to an increase in variable home loan rates.

Wealth effect reversal

Australia's booming property sector and what it's done for the wealth effect has been a boon for Australia's economy.

As people become wealthier - thanks in large part to ballooning house prices - they consume more.

"Expected declines in the value of most households’ largest asset (their home) accompanied by the rapid lift in interest rates to battle surging inflation is likely to lead to a reversal of the wealth effect which has been particularly strong over the past couple of years," says Kusher.

"It is also likely to result in reductions in discretionary spending as the cost of essential goods and services rise alongside the rising cost of mortgage repayments."

Kusher points to restaurants, bars and cafes, travel, clothing and footwear, and household as goods and services most likely to be the most impacted as households limit discretionary spending in the wake of inflation.

"However, household goods may remain unimpacted if people continue to buy and sell homes, meaning they will need to furnish those properties."

Get ahead of the curve

While the pain could be deep and prolonged, it will not come as a sudden shock - which means you can plan ahead.

Mortgage stress can be managed with a phone call to your lender.

"They might be able to suggest ways to make loan repayments more manageable, even if it is just a temporary change," says Claire Charlton, Lending Specialist Manager at IOOF Finance Choice.

"This might include swapping to interest-only repayments, restructuring your loan or even accessing excess funds in your home loan (if you have an offset account, it could be possible to use these extra funds for repayments).

Of course, there's no free lunch.

"Changing your loan could increase the term of your loan and the amount of interest you may have to pay over the long-term, so it is always best to check with your lender or broker and speak to them about your options."

Fixing your rate over the last couple of years would've helped blunt the pain of this hiking cycle. But fixed rates may still be an option.

"Depending on how high mortgage rates rise, it still may be worthwhile considering fixing part or all of a mortgage as insurance against significantly higher increases in official interest rates," offers Kusher.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics