Where to find growth if inflation stays lower for longer

For investors at least, central banks have arguably become as important as the economies they oversee, as markets fixate on the ebb and flow of government bond-buying programs.

Typically, company fundamentals and economic strength drive bond yields, but the traditional signals – such as company debt and profitability – have for the last decade or so been “diluted” by central banks, says Nikko AM's Chris Rands.

“Investors have probably been better off assessing when QE policies will be implemented,” says the fixed income portfolio manager.

While rising numbers of people get COVID jabs and the economic recovery gathers pace, inflation remains anaemic. This is despite official interest rates sitting at all-time lows and little sign they’ll move north any time soon.

While acknowledging the stronger-than-expected economic recovery in Australia so far, Reserve Bank of Australia’s Governor Phillip Lowe last week warned the market not to get ahead of itself, emphasising interest rates aren’t likely to start rising until at least 2024. He cited sluggish wage growth of less than 3% and a 20-year high of 6.6% unemployment as reasons for the RBA’s continuing go-slow on rates.

These are some of the same metrics fixed income investors should continue to watch, says Nikko's Rands.

In the following Q&A, Rands discusses what investors should be keeping an eye on and weighs the likely result when JobKeeper switches off in a fortnight. He also reveals which parts of the credit space offer the most appeal and how they compare across developed markets.

Fixed income has copped a pretty bad rap in recent years, as poor yields forced many conservative income investors further out the risk curve. What’s gone wrong?

It’s not a question of what has gone wrong, it’s more a question of what conditions the central banks are trying to achieve. Zero interest rates and quantitative easing (QE) are designed to force investors out along the risk spectrum, encouraging investment and driving economic growth. Meaning, it is mostly policy design forcing conservative investors further out the risk curve.

Given central banks so far have failed to achieve their desired outcomes, yields have become hostage to central bank influence and so have been forced lower until inflation occurs. It is very likely that these policies will remain in place for years to come.

How can investors capitalise on this lower-inflation environment?

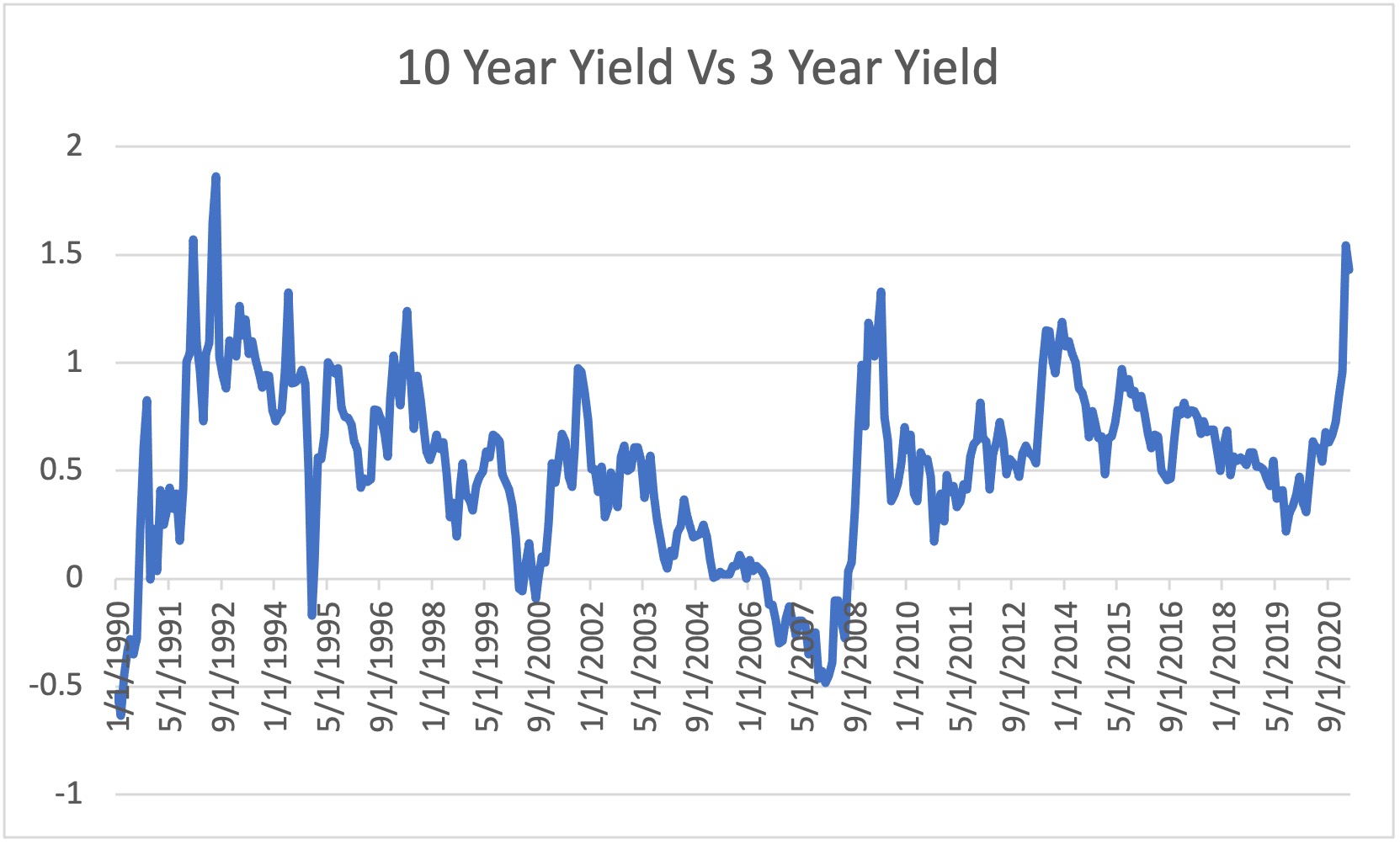

The simplest option could be to purchase long-dated government bonds, as fixed interest markets have now begun pricing in interest rate hikes over the next 24 months. Long-dated-bonds reflect views on the future path of the cash rate. If there is no sign of inflation and the cash rate doesn’t move, then owning long-dated-bonds should perform well. A good way to see this is by observing the yield curve, which is now at historically steep levels (long-maturity bonds very high relative to short maturity bonds). The chart below shows that 10-year bonds are now yielding 1.5% more than the 3-year bond, its highest level since 1991.

Source: Bloomberg

If there is no sign of inflation over the next three years, then the RBA will not hike cash rates, and short-dated bonds will remain around 0.1% yield. This means that an investor who buys a 10-year bond will now own a seven-year bond which has rolled down this curve in yield and should be closer to the cash rate than where it started. In addition to this, rates should also fall as market expectations of RBA policy will become dovish.

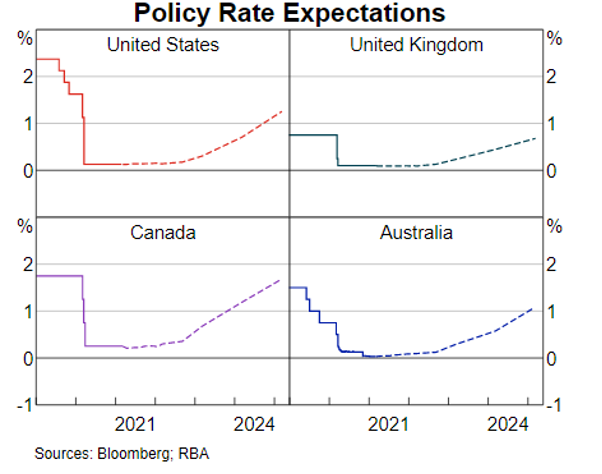

RBA Governor Phil Lowe spoke about market expectations just this week, saying that he thinks that the market is getting ahead of itself. The RBA has been at pains to tell the market that unless inflation actually rises sustainably to 2-3%, they will not hike the cash rate. And despite RBA projections showing that this is not expected to occur until the earliest as 2024, the market has begun pricing interest rate hikes as early as the end of next year (as shown in the RBA graph below). Therefore, if inflation does not increase, these cash rate bets need to be removed and bonds should rally.

Source: The Recovery, Investment and Monetary Policy – Phillip Lowe – 10 March 2021

How does your process differ from some of the other fund managers in the space?

Our process is focused on finding relative value in the bond market, rather than making outright directional calls. We look for small but regular opportunities between pairs of bonds and sectors, and we focus on the liquid high-grade markets – such as government, state government and supranational issuers (formed between two or more central governments) – more than credit markets.

We also target anomalies in the shape of the yield curve, in addition to generating yield from the best parts of the entire rate structure rather than just from credit spreads.

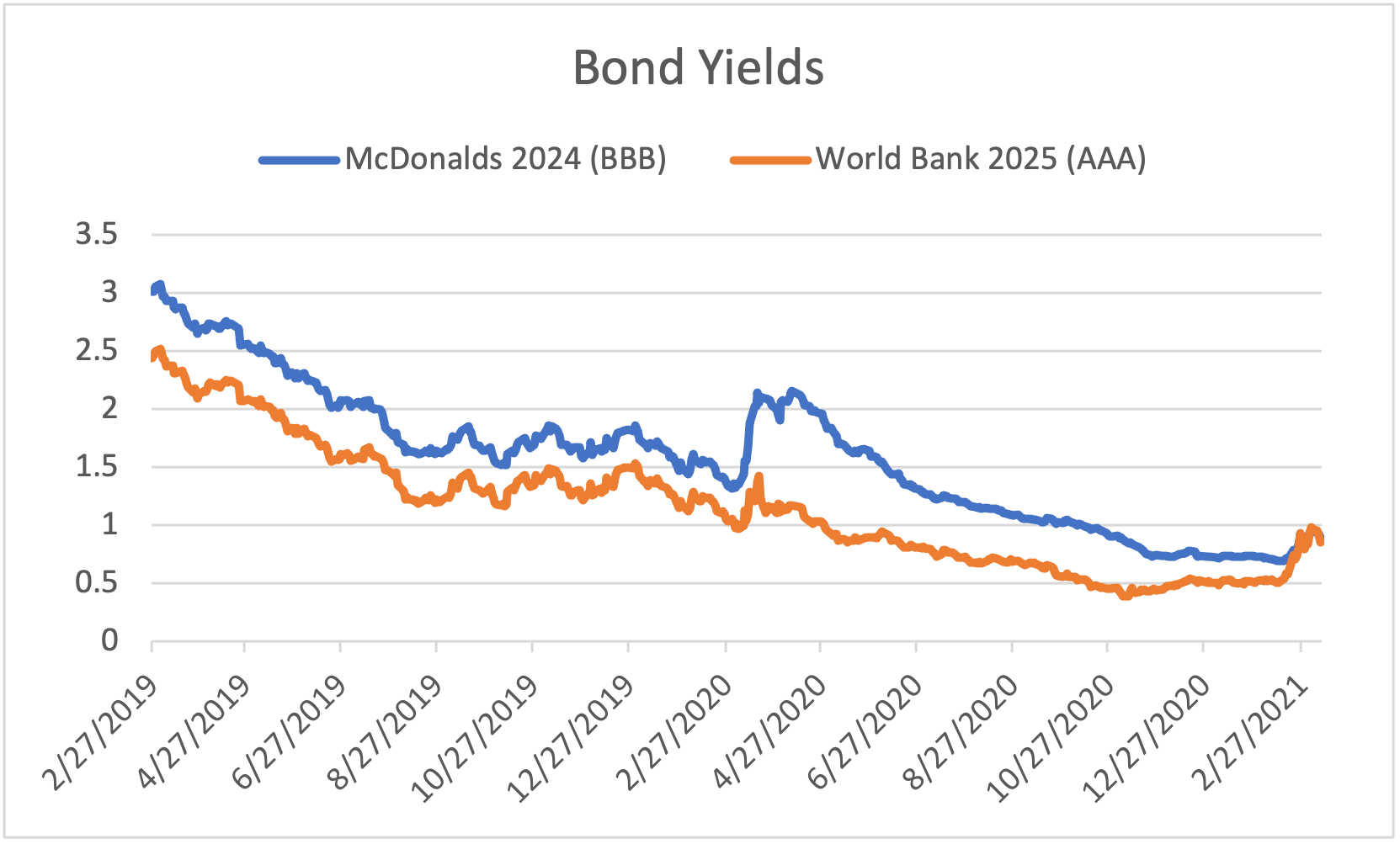

For example, corporate spreads are currently relatively tight (to higher grade issuers) and the shape of the yield curve means that bonds shorter than five years offer little yield. The below chart shows the yield of a BBB rated McDonald’s 2024 bond, versus the yield of a AAA-rated World Bank 2025 bond. The week ending 5 march is the first time since it was issued in 2019 that the McDonald’s bond yield has dipped below that of the World Bank bond. Our relative value process is designed to find these types of ideas across the Australian index, where one area of the bond market offers relatively better value than another. Explained another way, this type of opportunity adds one year of additional maturity risk versus seven notches of credit ratings. This process is designed to scour sectors, issuers, and curve shapes for ideas.

Source: Bloomberg

To help gauge where credit markets are headed, what metrics should income investors watch?

Company fundamentals and economic strength should drive credit spreads. Since you are lending money to businesses, it’s a question of whether those companies will be able to afford the interest and principal payments. This means you should look at aspects such as:

- debt loads,

- interest coverage ratios

- profitability, and

- the prospect of tough operating conditions.

From a corporate sector perspective, this usually requires focusing on how strong economic growth will be, and how quickly debt is growing. This is because a strong economy should improve corporate fundamentals, and company debt levels will reflect how much they have to repay.

Unfortunately, over the past five to 10 years these signals have been diluted by central bank intervention. Over this timeframe, investors have probably been better off assessing when QE policies will be implemented. Being ahead of central bank policy is often one of the most important variables, which means watching the following factors to help forecast credit spreads:

- inflation,

- unemployment, and

- equity market stability.

Is government stimulus having the desired effect? What are the risks?

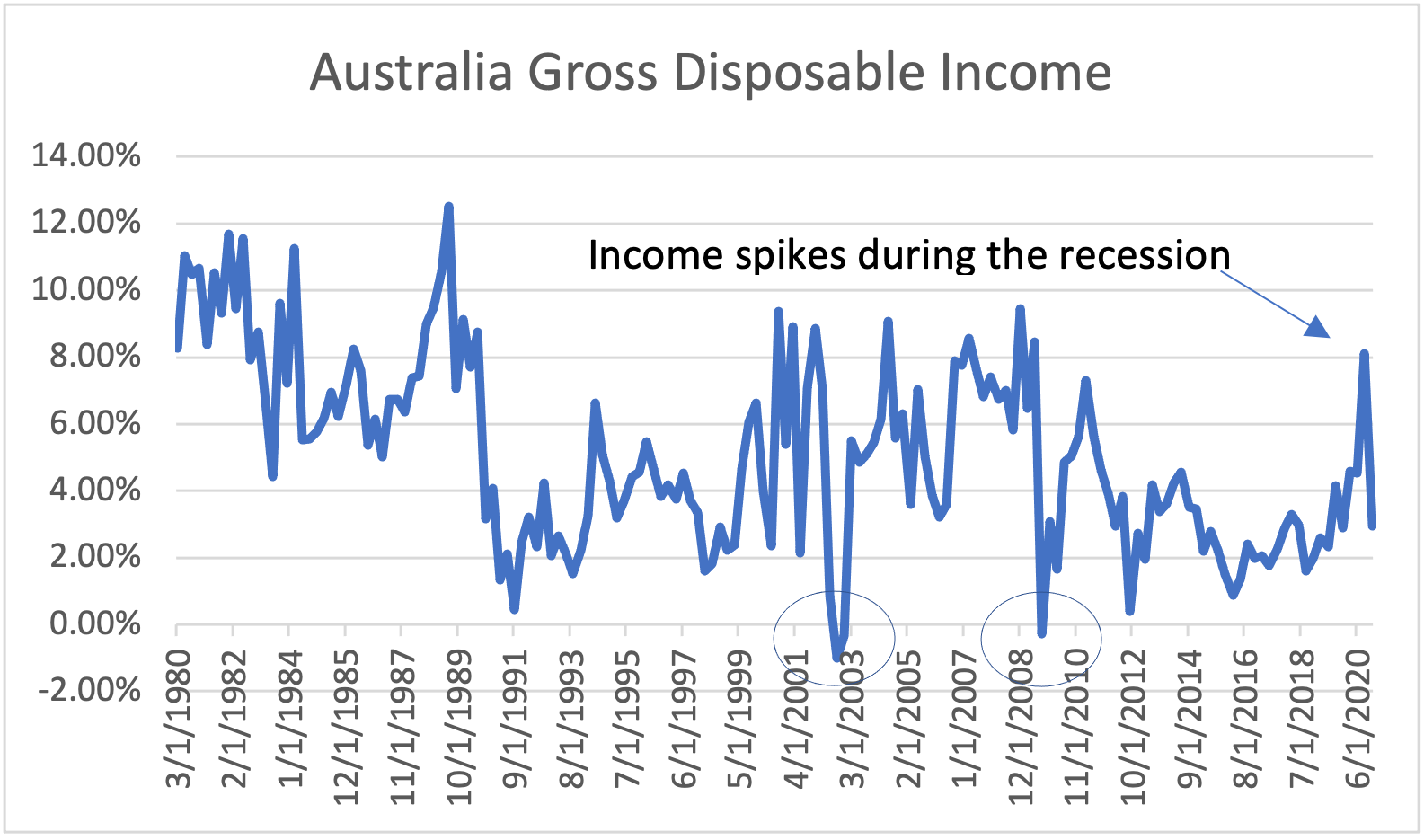

The government stimulus is having its desired effect, as the JobKeeper stimulus led to a spike in disposable income. Typically, in a recession, disposable income drops as unemployment rises, causing households to reduce spending and constricting economic growth. But this time, the government stimulus helped drive income to 10-year highs. This has meant households have been able to survive the worst of the recession due to strong government support.

Source: Bloomberg

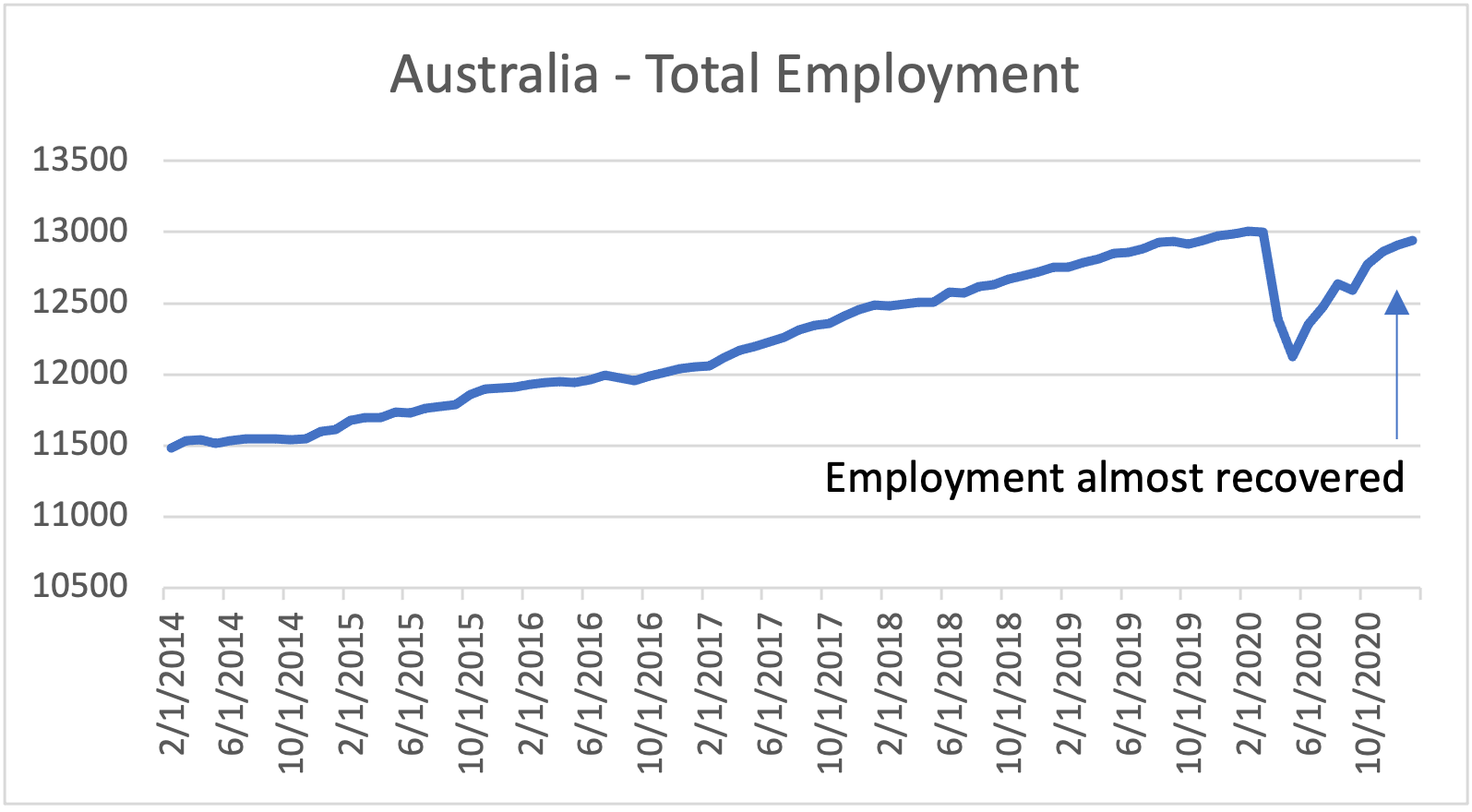

Over the next few months, as JobKeeper unwinds, disposable income should move back to 2015/2016 levels as wages growth becomes the predominant driver. Fortunately for the Federal Government, this will occur at a time when Australian employment has almost completely recovered to March 2020 levels.

Additionally, as the government reduces its economy-wide support, it is now expected to focus stimulus on sectors that remain impacted (such as tourism or education), to provide support where it’s required the most.

Source: Bloomberg

The risk to bond markets from this stimulus spending is its impact on continued low interest rates, from which cash rates may struggle to recover.

The market currently expects that the large debt loads globally will be able to be inflated away. But the past 15 years tells us that this is not an easy feat to achieve, even with ultra-easy monetary policy. If debt loads are not able to be reduced, then cash rates will need to be zero, or even negative, for a long time to come.

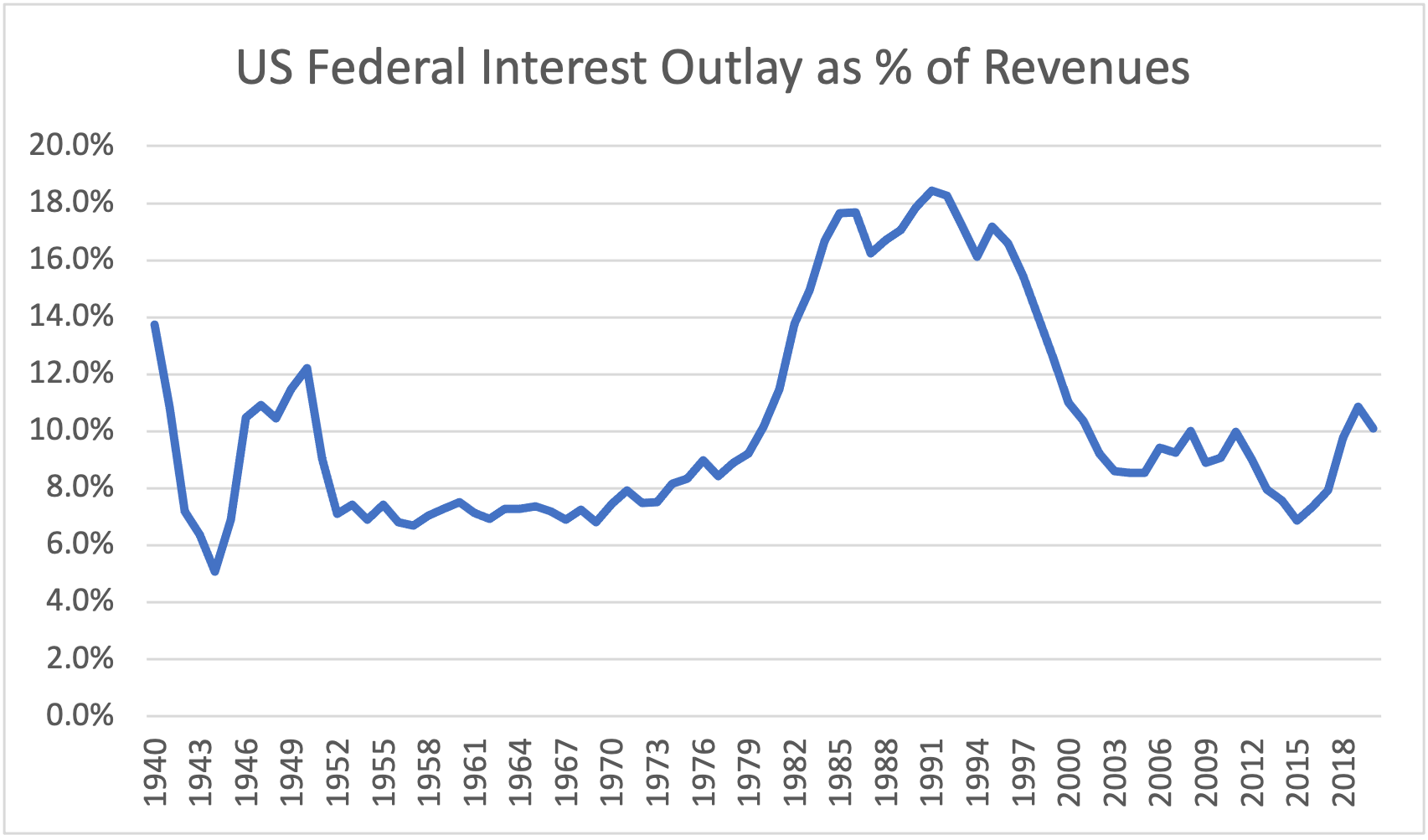

For example, look at the US government, which has provided more than $4 trillion of economic support via fiscal policy – at least 20% of GDP. For a government that already had 100% debt-to-GDP, this is putting the US government debt load in a precarious position. The more debt a government runs, the more expensive it becomes to service. From a historic perspective, the US government has typically paid somewhere between 10% and 18% of their total government receipts as interest, as shown below.

Source: FRED Database, Nikko AM

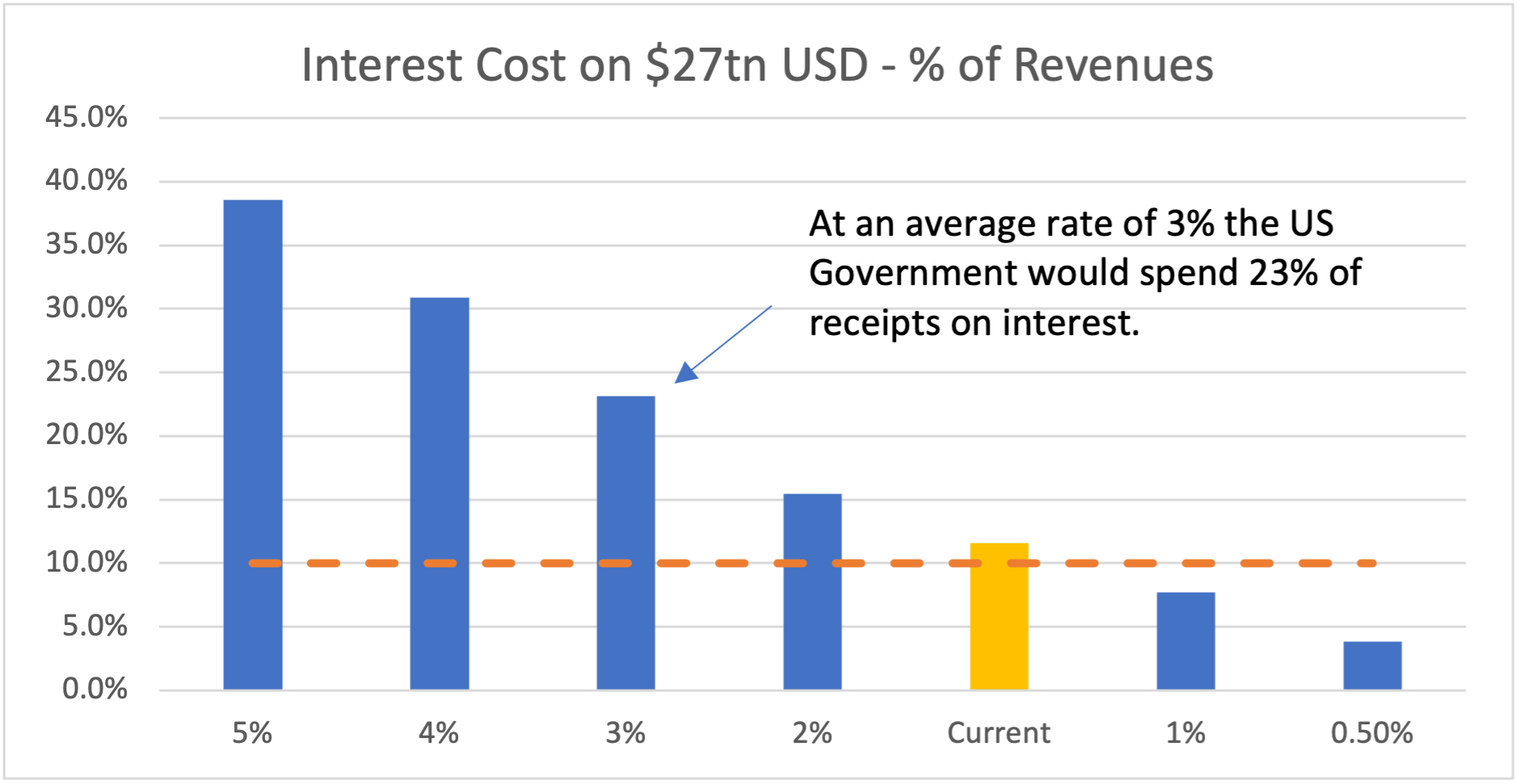

If we take the current US government debt load and apply different interest rates to it, we get the following interest cost as a percentage of government revenues. With more than $27 trillion of US debt (and rising), clearly the US government can’t afford 3% interest rates and may not even be able to afford 2%. Meaning the risk for interest rate markets is that economies are about to enter debt traps that require rates to be as close to zero as possible.

Source: Nikko AM

Which areas of fixed income currently hold the most appeal and why?

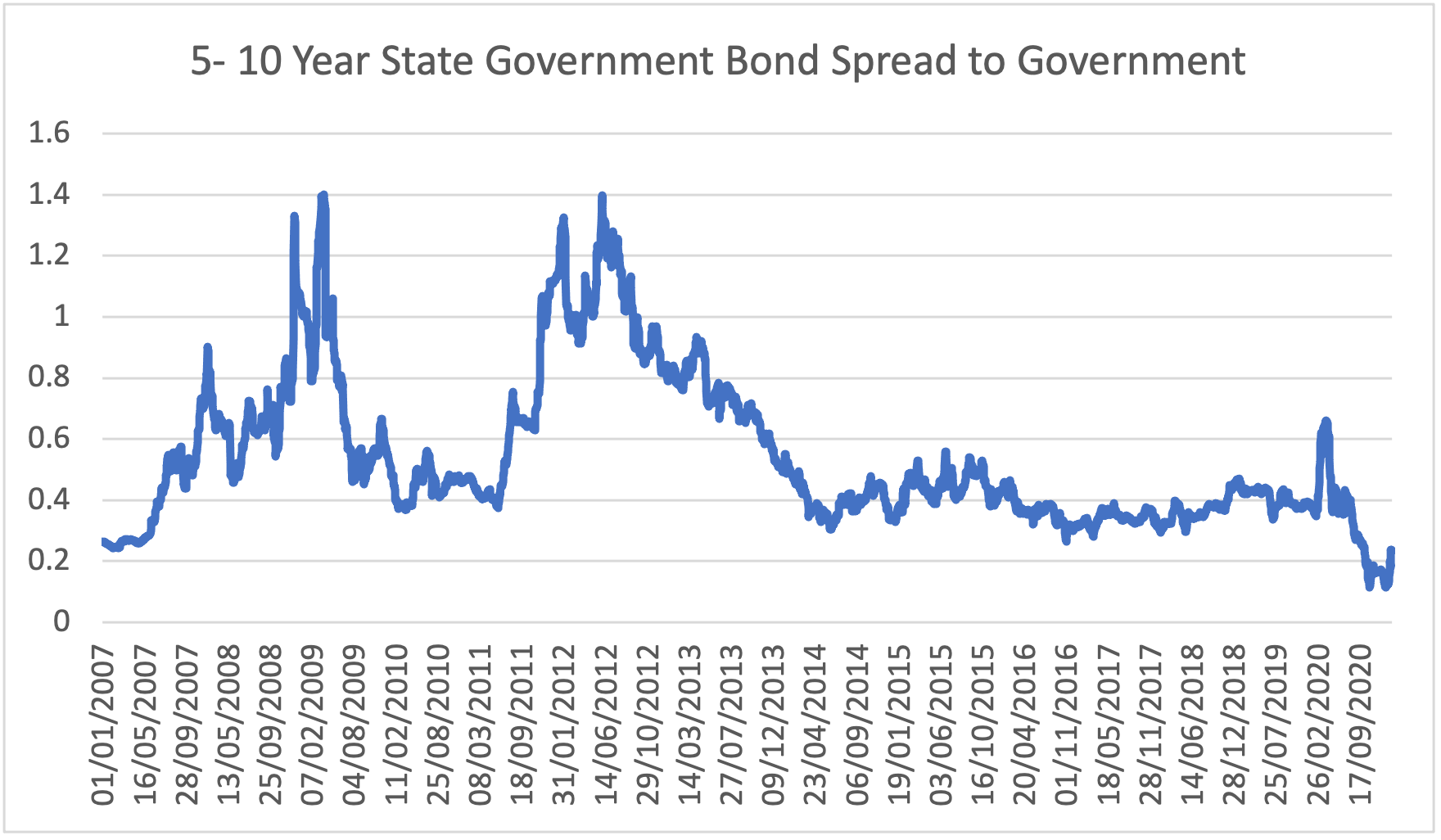

At the moment the curve shape offers the most appeal, as spreads have been squeezed to the point of offering very little excess return versus government bonds. As an example, the RBA’s support of the bond market has seen state government bonds less than 10 years to maturity trade at tight levels. This is true for almost all spread sectors, not just state governments.

Source: Nikko AM

Meanwhile, bond curves are now extremely steep by historical standards, offering a lot of pickup for extending out the bond curve. An example of this is the 5-year bond versus 3-year bond, which is sitting at 20-year highs.

A bond investor could buy a 5-year bond at almost 1% and if the RBA is still using Yield Curve Control in two years’ time, they could end up at 10 basis points.

While the market is obviously testing the RBA on its QE policies, if inflation does not increase as the market is expecting, the central bank will still have very easy policy in three years’ time – making these types of curve trades very interesting at present.

What are your preferred countries for government bonds in the current market environment?

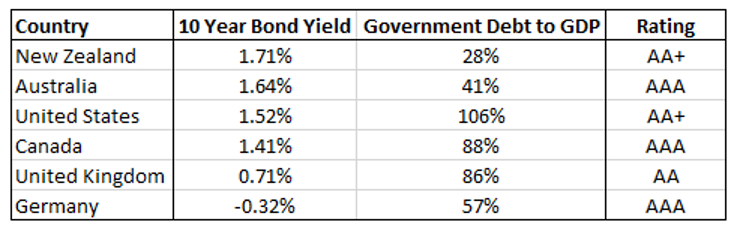

We are an Australian bond manager that focuses predominantly on relative value in the Australian market. But we believe the global fundamentals of the market matter. Since fixed-income funds are typically used for diversification – from equity and other riskier assets – with a focus on performance and stable income, our preference would be on high-quality markets that have strong ratings and low levels of debt.

In the developed world, this is both New Zealand and Australia, having higher interest rates than their peers with lower levels of government debt.

Source: Bloomberg, World Population Review, Standard and Poors

While there is a risk that interest rates could move higher in Australia and New Zealand, if there is a full-blown economic recovery, this should mostly be offset by higher equity prices. However, in the event that the economy or equity markets stumble, these countries have a large amount of fiscal power available to stimulate their economies and further for interest rates to fall than their peers.

Learn more

The award winning Nikko AM Australian Bond fund invests in a diversified portfolio of investment grade Australian fixed income assets that aims to deliver an active return for a competitive fee. For further information, visit Nikko AM's website.

Disclaimer

This material was prepared and issued by Nikko Asset Management Australia Limited ABN 34 002 542 038, AFSL 229664 (Nikko AM Australia) who is the responsible entity and issuer of units in the Nikko AM Australian Bond Fund ARSN 098 736 255 (Fund). Nikko AM Australia is part of the Nikko AM Group. The information contained in this material is of a general nature only and is not personal advice. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation and needs. Investors should consult a financial adviser as well as the information contained in the current Fund’s Product Disclosure Statement (PDS) which is available at (VIEW LINK) before deciding to invest in the Fund. Applications will only be accepted if made on a current application form. An investment in the Fund is not a bank deposit and distributions and the return of capital are not guaranteed. Past performance is not an indicator of future performance. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. Whilst we believe the information contained in this material to be correct as at the date of presentation, no warranty of accuracy or reliability is given and no responsibility is accepted for errors or omissions. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided that the positions will remain within the portfolio of the Fund. Any economic or market forecasts are not guaranteed.

5 topics