Which bank? The definitive guide to buying your next ASX bank stock

Are higher interest rates good or bad for banks?

Which bank has the best dividend yield?

Which bank has the most stable dividend yield?

Which bank is the cheapest?

Which bank has the greatest upside?

All pretty good questions, right?

Aussie investors love their bank stocks. I bet you’ve got at least a couple of them in your portfolio right now. I also bet, under the right circumstances, you’d probably want to add one or two more.

After all, they’ve generally been reliable investments over a long period of time – paying dividend yields better than what you’d get if you’d just parked your cash inside one of them. Talking about reliability, you can also rest assured our banks are world-class experts at squeezing every last cent of profit out of us poor consumers!

Long live Aussie banks!

This article is for the investor looking to add to their portfolio bank exposure, and who wants answers to the very important questions I’ve posed above. Let’s dive in!

Are higher interest rates good or bad for banks?

According to Morgan Stanley, higher interest rates are good for Aussie banks. This is because they tend to push up the interest rates they charge on mortgages relatively more than they tend to push up the interest rates they pay on deposits. Good for them, not so good for us! (I have to keep reminding myself that this article is about why we love to invest in Aussie banks, not why they’re our best pals!)

.%20Source%20Morgan%20Stanley.png)

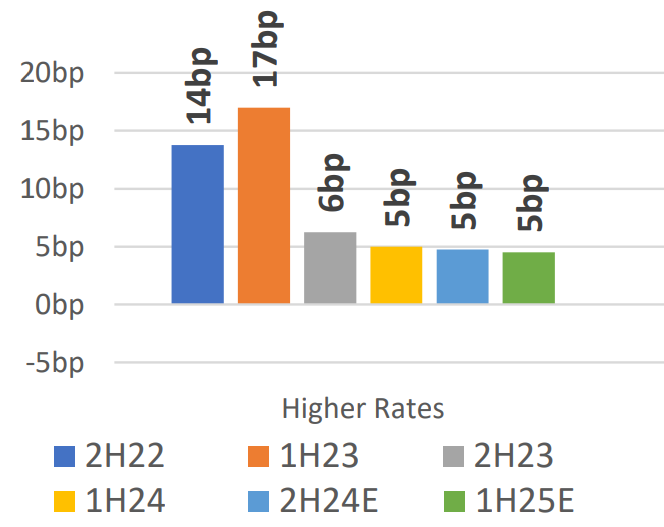

Major Banks: Key Drivers of Net Interest Margin Movements (h-o-h). Source: Morgan Stanley

As you can see in the above graphic, most of the benefit of higher rates is behind the banks – unless of course the RBA still has a nasty surprise in store for us! Still, the impact of higher rates is expected to add around 5 basis points to the banks’ net interest margins (NIM) through to the first half of FY25. (Note: 1bp = 0.01%)

Which bank has the best / most stable dividend yield?

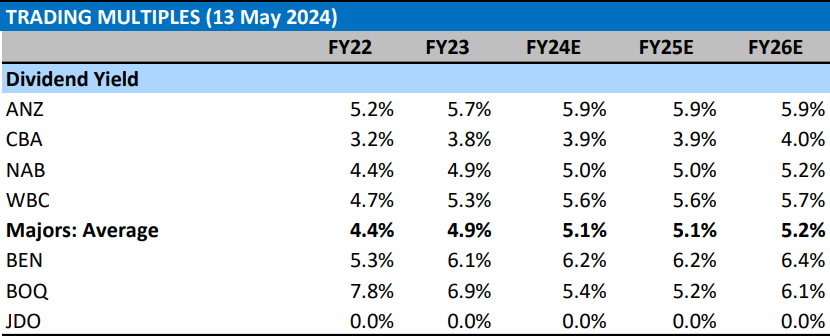

I bet this is the ‘big one’ you want answered, right? Again, according to Morgan Stanley, the majors consisting of ANZ Group (ASX: ANZ), Commonwealth Bank of Australia (ASX: CBA), National Australia Bank (ASX: NAB), and Westpac Banking Corporation (ASX: WBC) have an average dividend yield of 4.9% based upon FY23 numbers, and a forecast FY24 dividend yield of 5.1%.

Morgan Stanley historical and forecast dividend yield for Australian banks

Assuming the broker’s forecasts are accurate, ANZ will have the best dividend yield this financial year at 5.9% p.a., and indeed likely for the next two financial years (also at 5.9% p.a.). WBC is next with 5.6% p.a., then NAB at 5.0% p.a., and way behind is CBA with just 3.9% p.a..

If you’re prepared to venture outside of the Big 4, you might want to try Bendigo and Adelaide Bank (ASX: BEN) which is offering a potentially juicy 6.2% p.a. yield, growing to 6.4% p.a. by FY26.

I just did a quick Google search for 12-month term deposits at ANZ and BEN, and I can tell you they’re currently at 4.7% p.a. and 4.75% p.a. respectively. So, the old adage of buying the bank rather than storing your money in the bank appears to ring true.

Also consider that dividends from Australian banks are generally fully franked, which means that they’ve already had 30 cents in the dollar tax paid on them. So a 5.9% p.a. yield on ANZ, is more like 8.4% p.a. compared to a term deposit.

If you just thought…“That sounds too good to be true”, you’re correct in the sense that there’s no guarantee you’ll get all of your money back after 12 months invested in ANZ shares. You will have, however, with a term deposit from an Australian bank, because in most cases they're capital guaranteed by the Australian Government.

When it comes to Aussie bank shares, there are no guarantees on either the dividend yield you’ll receive, nor the price you’ll get for your shares in 12 months. It’s entirely possible your shares could be worth considerably less than what you paid for them. This is an important distinction between term deposits and bank shares that all investors must consider carefully.

History does suggest, however, that if you intend to hold onto your bank shares for a very long time, the probability of experiencing a negative capital return tends to diminish significantly.

Which bank is the cheapest?

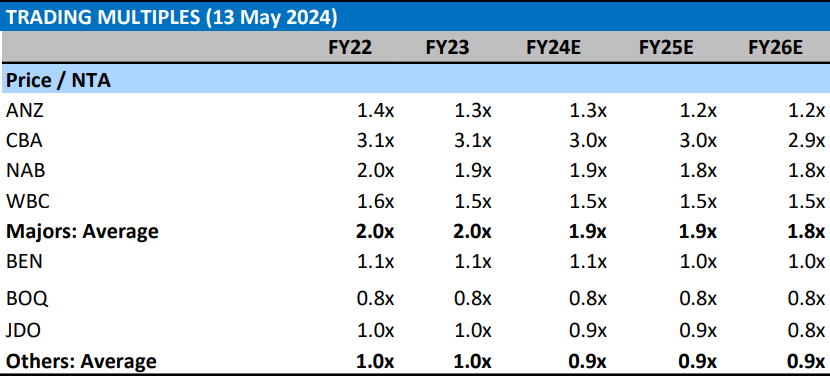

That last point is a nice segue into this question. In theory, if you buy a cheap asset, the likelihood of it rising in price is greater than if you buy an expensive one. So, which are the cheapest Aussie banks? First, let’s look at Price to Net Tangible Assets (P/NTA). Back to Morgan Stanley’s fantastic data tables!

Morgan Stanley historical and forecast Price to Net Tangible Assets for Australian banks

Lower is better when it comes to P/NTA because we want to pay as little as possible for a bank’s underlying assets. Based upon this metric, ANZ appears to come out as the winner again among the Big 4, with the lowest P/NTA of 1.3 times for FY24. This dips to 1.2 times in both FY25 and FY26.

As was the case with dividend yields, WBC is next at 1.5 times, followed by NAB at 1.9 times, and then CBA at a comparatively massive 3.0 times. Checking on the smaller banks, they’re all cheaper again, but keep in mind that smaller banks also tend to be more volatile than their major counterparts as they tend to have higher funding costs (we’ll discuss in greater detail soon).

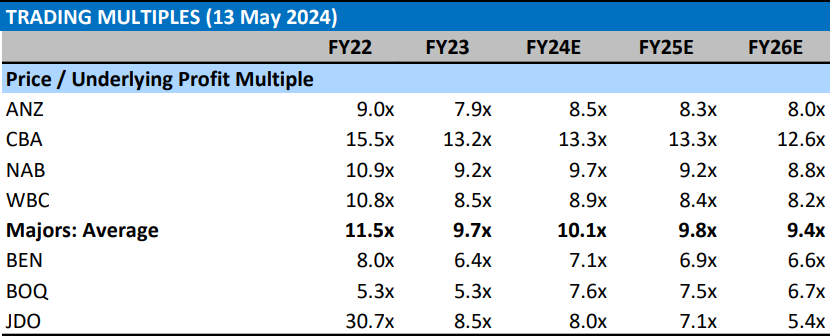

Switching to price to underlying profits now. Instead of how much we’re paying for a bank’s assets, like with P/NTA, this is how much we’re paying for a bank's profits – after all, it’s profit that determines dividends and share prices. Again, lower is better/cheaper here, so let’s check out Morgan Stanley’s numbers.

It’s the same story again. Looking at FY24 estimates, ANZ is the cheapest of the Big 4 banks at 8.5 times, then WBC at 8.9 times, NAB at 9.7 times, and CBA at a relatively lofty 13.3 times. The smaller banks are all cheaper in theory, with price to underlying profit multiples between 7.1 and 8.0 times.

Which bank has the greatest upside?

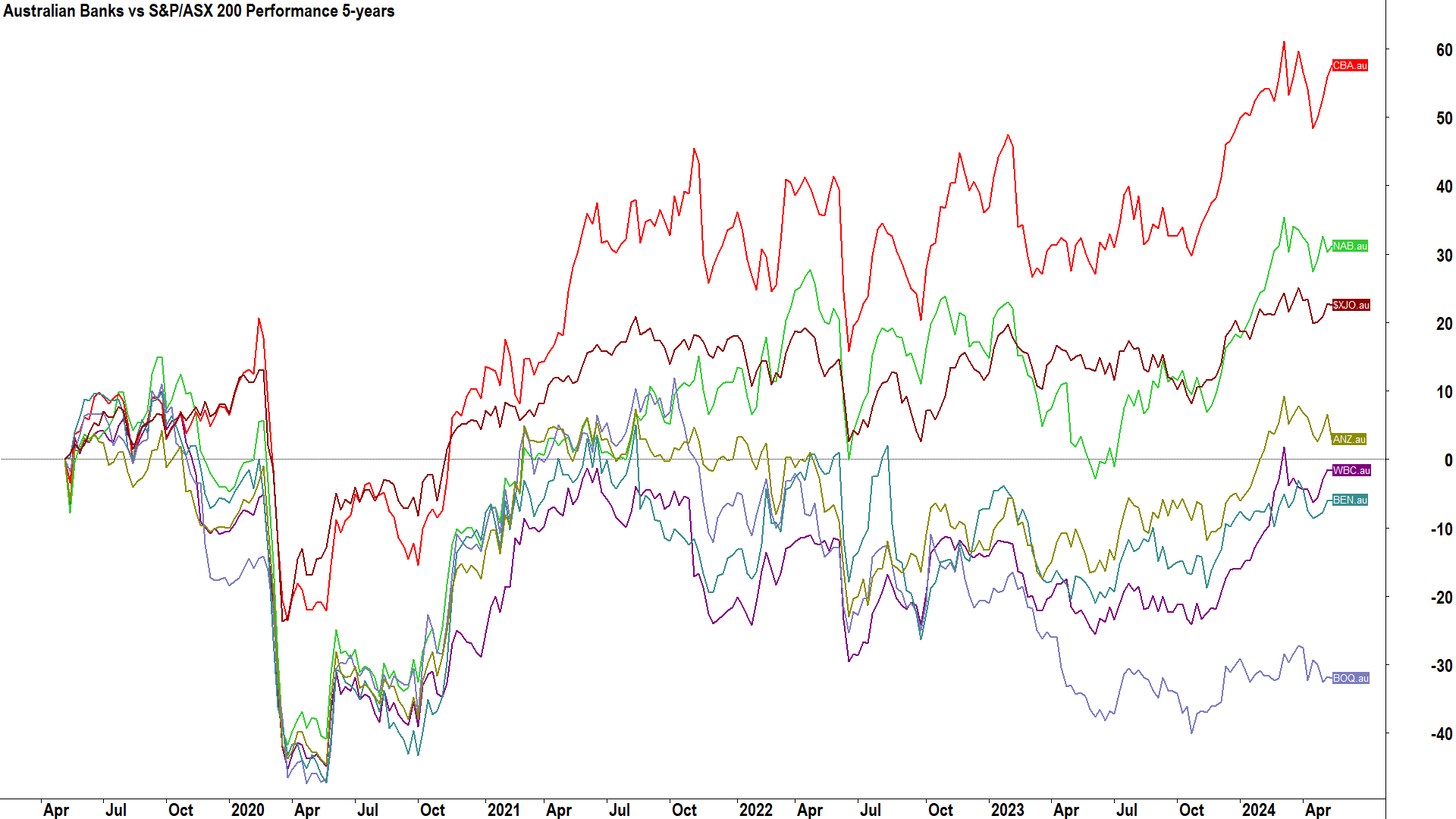

Before we look forward, let’s look back a little, and put the above-mentioned metrics into perspective. The chart below shows how each of the banks surveyed here have performed over the past 5 years. It's a good sample period because it takes a wide range of economic and trading conditions for the banks.

The first thing you'll notice is just how good CBA has performed compared to the others! I covered markets pretty much every day in the chart above, and my view is CBA was generally considered the most expensive bank with the lowest yield for the vast majority of that time.

Does it really matter if a bank, say CBA, has a 2% inferior dividend yield when it may deliver 20 or 30% more in terms of capital appreciation over the long term?

Also note the smaller banks have lagged – again perhaps speaking to some of the widely held opinions among the broking fraternity relating to smaller banks’ funding and quality issues. This potentially explains why they appear to trade at "cheaper" multiples – it's a matter of risk versus reward.

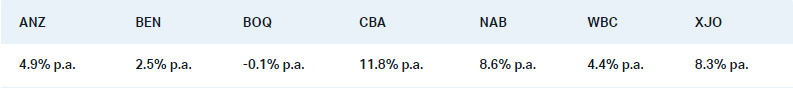

It’s important to note that the chart above is constructed on an ex-dividend basis. It's still a handy visual representation of the banks' relative performance to each other, and to the S&P/ASX200 (XJO) index, but it's also worth investigating their total returns. For this reason, 5 year total returns for each of the banks (excluding JDO because it hasn't been around that long) are shown in the table below.

%20of%20Australian%20banks.png)

Only two banks outperformed the XJO over the past 5 years, and BEN and BOQ delivered an inferior return compared to that which could have been earned on a concurrent rolling 12 month term deposit. You might even find it hard to argue that ANZ and WBC justified their risk premium compared to a term deposit over the period. Hmmm…paradigm shifting stuff!

Let’s look forward now. Granted, you probably started reading this article thinking you need to find the cheapest bank with the highest dividend yield. But it seems that the best performing bank turns out to be the most expensive with the lowest dividend yield. Why?

Answer: Because the market loves earnings growth and good management and it pays a big premium for it.

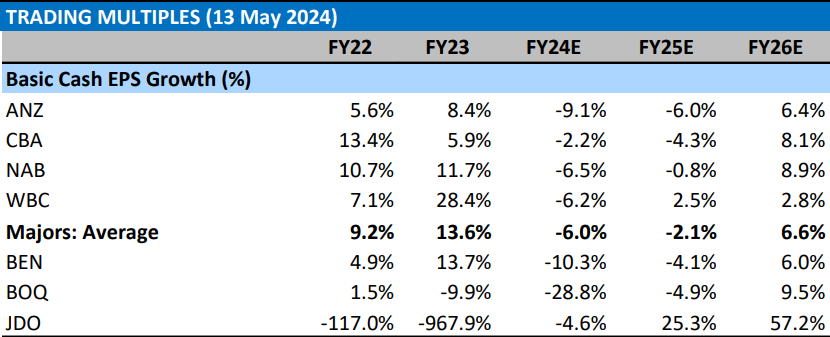

Check out the table below. It shows Morgan Stanley’s views on the banks’ historical and forecast earnings growth rates.

CBA has consistently delivered the best earnings growth, and it's expected to continue to do so. It’s also the most efficient at extracting the maximum return out of its limited resources as per Morgan Stanley’s data on the banks’ Return on Equity (ROE) shown in the table below.

%20for%20Australian%20banks.png)

Strong growth and highly efficient management are two highly prized attributes that major fund managers prioritise well above dividend yield. One could argue that given CBA is expected to continue its dominance over its peers in these two metrics, it could therefore continue to provide a superior total return (i.e., capital gains as well as dividends) to its peers.

Which bank?

Ultimately, the answer to this question depends on you and what you’re after in an investment. If it’s the highest dividend yield without any care of capital appreciation, then ANZ is one potential inference from the data presented here.

If it’s the highest yield (of any type) and total capital perseveration – then seriously consider the 5-year performance chart above and note the giant V-shaped dips well below zero – those are periods of capital destruction. If this concerns you then perhaps term deposits are more your thing?

If it’s the highest total return, that is, the highest capital appreciation and dividend yield combination, then CBA is one potential inference from the data presented here.

In each case it’s important to remember the future is unknown, term deposit rates, dividend payouts, and share prices will each fluctuate. Regardless, hopefully the data I’ve presented here has made your decision on which way to invest a little easier!

This article first appeared on Market Index on Tuesday 14 May 2024.

5 topics

7 stocks mentioned