Why diversity doesn't mean share price equality

Diversity issues have exploded into the global zeitgeist over the past few months as Black Lives Matter protests have rocked cities around the world. From an investment perspective, diversity is an interesting concept. There have been a lot of studies into the diversity of gender and race on company performance with, well, diverse results.

The arguments against

On the negative side, more diversity can lead to less communication, increases group conflict, lower satisfaction and increased staff turnover.

There are theories of tokenism that suggest that when minorities first enter an occupation that increased visibility creates expectations that are difficult to perform. Or that stereotypes increase the pressure on minorities leading to underperformance.

The stock price arguments focus on time-series analysis, showing that adding women to a board does not, on average, influence stock performance positively. In some studies, the share price is actually negatively affected, even while profitability is unaffected.

The arguments for

On the positive side, group diversity increases network connections, resources, creativity, and innovation.

Creativity and innovation are particularly important from an investment perspective because they contribute to a company’s ability to create and maintain a competitive advantage. Which in turn is fundamental to the sustainability of a company’s returns.

Evidence for this case comes from cross-sectional (rather than time-series) investment studies. These show that companies with more diversity have share prices that perform better.

Context first

First, I need to give you some background on how we treat ESG (Environmental, Social and Governance) investing.

Governance

From a quantitative perspective, corporate governance is a factor that outperforms. i.e. companies with good corporate governance tend to perform better than those with weak corporate governance.

But, as with all quantitative measures, it comes with some significant caveats.

- Buying companies with good corporate governance tends to work more than it doesn't. Still, there are plenty of counter-examples.

- Price matters. If I can buy two similar companies at a comparable price, then the one with good corporate governance is more likely to outperform. If, however, I can buy the one with poor corporate governance for considerably cheaper, the advantage disappears.

- Finally, corporate governance is a subjective measure. There are many shades of grey and weighting assumptions. For example, share structures that give the founders more votes than other shareholders is usually bad corporate governance. Having a large, diverse board with a majority of non-executive directors is good corporate governance. Google (Alphabet) has both – which is more important?

For governance scores, I prefer to use them as a negative screen rather than a positive one. i.e. bad governance can make a quality score worse and therefore the company needs to be cheaper before I buy it. But I'm not choosing to buy a company with 42% gender diversity over the one with 39% on that measure alone. Many of the governance scores are like that – there is a definite "bad" option, but there is little sense trying to rate the difference between two good options.

Social

We don't use social measures much. I find them too arbitrary. Reading about how a company rates on social impact can sometimes have the same intellectual rigour I expect to see in my horoscope.

Ethical

We treat ethical as an opportunity set problem. There are 1,600 stocks in the MSCI World Index – a common investing benchmark containing only very large companies. If you:

- give fund manager A the ability to invest in any stock

- give fund manager B the ability only to invest in 800 of the better ethical stocks

You are asking fund manager B to beat fund manager A with one hand tied behind their back.

The good news? Reducing the opportunity set that a fund manager has doesn't affect performance too much – especially if you are only cutting out a few sectors. There are plenty of periods where fund manager B will outperform.

The bad news? If fund manager A and B have the same skill, you have to expect the ethical one, in the long run, to have worse performance.

Many ethical funds have an all in or out strategy. i.e. you either get all the ethical exclusions or none. Some people think tobacco is horribly addictive and unethical, but gambling is each person's own choice. Others have exactly the opposite view. For most ethical funds you can either have both sectors or neither, regardless of your view.

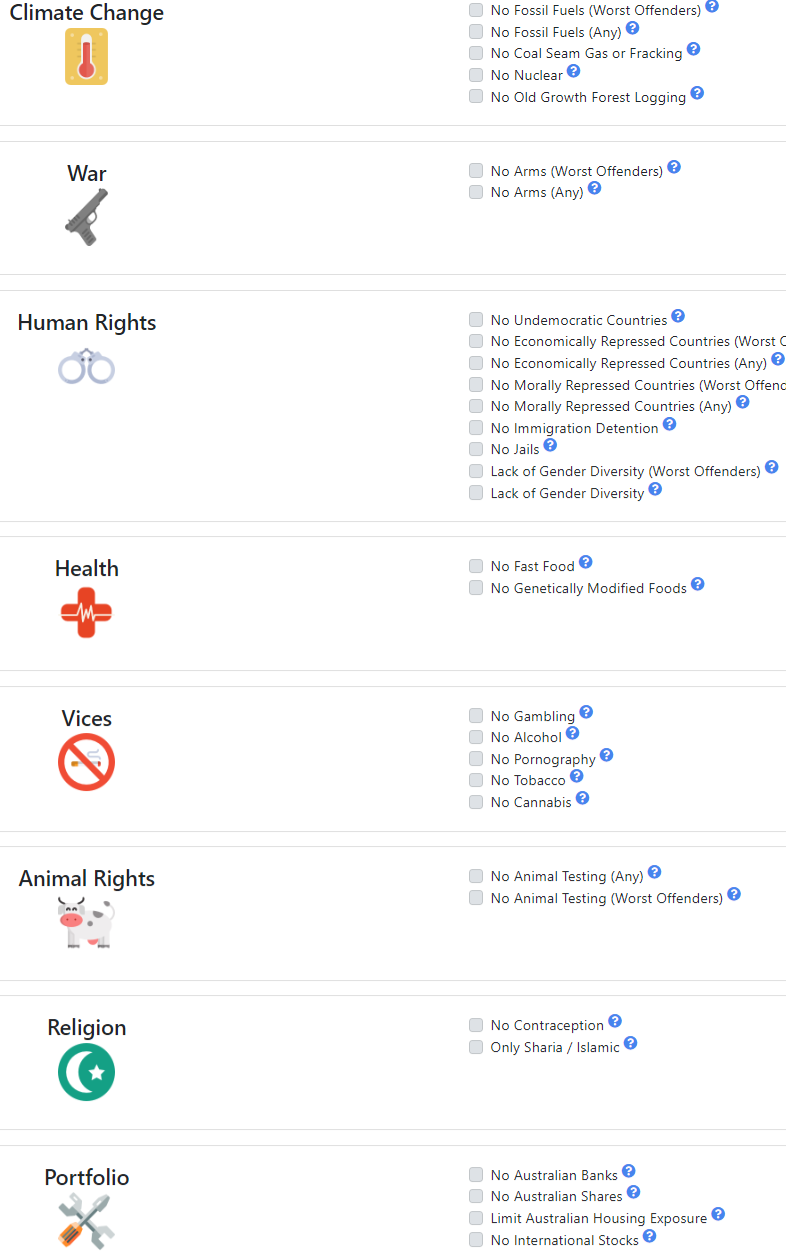

Our goal is to give every investor the broadest possible opportunity set. So we run every investor and superannuation client through a separately managed account where they can make these choices for themselves from over 30 different options:

We find about 2/3rds of our investors choose to exclude at least one sector. But the benefit of individual exclusions is that our Tobacco-less investor still has 99% of stocks in our portfolio and our Gamble-free investor has (a different) 99% of stocks. Each has the broadest opportunity set available.

Don't congratulate yourself too much

Positive investing is difficult – finding stocks that are good quality and cheap is hard enough. If you find a stock with very positive ethical characteristics that is only average quality and the stock is very expensive should you buy it anyway, expecting a poor return?

There are better arguments made to exclude stocks that don't align with your values. However, don't congratulate yourself too much.

If there is a cause you are genuinely passionate about and you want to support companies in that area, there are four monetary ways you can support that cause, in order of most helpful to least helpful:

- Make a donation. Are you trying to help or are you trying to make money? If it is the first then by donating you can feel good straight away, you get a tax deduction up front (rather than waiting to book a capital loss when you sell shares!). Donating directly to companies is not generally tax deductible – but I’m guessing if your cause is ethical then there will be industry bodies that are tax deductible.

- Buy the product yourself. Most companies want more customers rather than more shareholders – and the ones that don’t you shouldn’t be investing in.

- Buy shares from the company in a capital raising. That way your money will actually go to funding the company expand or its research and development.

- Buy shares on the market. This is the least helpful way of helping the company. All you have done is transferred money to another investor.

How we use diversity in our investment process

For me, more innovation and creativity trump any negative effects of increased diversity.

I also find the tokenism and stereotype arguments disingenuous. These may be issues in the initial years but are not reasons to avoid diversity forever.

I find the difference in the share price performance studies understandable. If companies with more diversity are more innovative, then companies with more diversity will tend to perform better. Which the cross-sectional studies show.

I don't think this is incompatible with the time-series findings. i.e. that adding a woman to a board doesn't improve share price performance. I suspect those studies are over-estimating the power of a single director in a 10+ person board. And there are a lot of companies where the entire board has little control over the direction of the company, let alone a single director. To put it another way, a diverse board and management is a sign of an innovative and creative company. Adding more women to a board will not immediately (or maybe ever) make a company more innovative.

I am also keeping in mind that all the focus on diversity might also create false signals going forward. It may be harder to see genuinely diverse and innovative companies vs the ones with token appointments and a politically correct front.

Diversity as an ethical choice

In the past, we have treated diversity as a measure of governance. A relatively minor warning signal in our overall assessment of the quality of a company.

.png)

And we are not looking to change that. Diversity still appears to be a good (but far from infallible) indicator of more innovative companies.

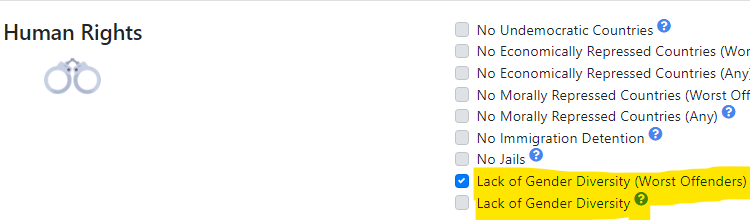

However, increasingly we are finding for some clients a lack of diversity in companies is more important than that.

So, we have also added diversity as an ethical exclusion, giving investors the option to strike companies from their portfolio that don't have enough gender diversity in their board and management team.

We won't congratulate ourselves too much

My goal as a fund manager is to invest in companies that I think have an appropriate mix of quality and value. An important part of that is considering the potential impact on share prices of companies in ethically dubious industries, which I try to do without too much moral judgement.

In a world of cancel culture, I don't think fund managers should be making non-investment "cancel" decisions on behalf of clients. I do however think people should be empowered to make the ethical decisions for themselves both in superannuation and in ordinary investments.

If you do "tick the box" to exclude stocks with diversity issues from our portfolios, keep in mind that this is only a small step.

In fitting with our philosophy, if diversity is something you feel strongly about then you should also be asking yourself whether there is a better way to help:

- Can you make a donation? Of see here or here for some options. Or donate your time to lobby boards and legislators.

- Can you boycott the product? Companies care more about people not buying their products than they do about you not buying their shares. It makes no sense to refuse to buy a company's shares if you use their shampoo every day.

- Are you buying the diversity product? As a manager yourself, or in your personal life.

Don't get me wrong, I want you to avoid buying shares in companies where you don't agree with the ethics.

But if you truly want to make an impact, don't stop there.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

3 topics