Why is the market valuing this stock so cheaply?

Dusk Group (DSK.AX) are a specialist retailer operating solely within the Australian market. Dusk is best known for its scented candles however, its range includes diffusers, essential oils and other fragrance-related homewares.

Historically, niche homeware retail segments have been largely a cottage industry with a long tail of small boutique merchants fulfilling demand. Dusk is the largest player in the local market holding approximately 22% market share, whilst running only around 115 physical stores.

The company foresees the potential to grow to around 160 stores throughout Australasia by 2024. Over the last 12 months, the company's online presence grew significantly making up at least 10% of overall group revenue.

Industry structure and business model

We have observed many instances of formally sleepy niches being disrupted and consequently dominated by a best-in-class brand and operation. In most instances, the easy availability and distribution of the product act as a demand generator from the consumer side.

There is no doubt that the effects of government stimulus and social restrictions have benefited Dusk. Broad swathes of Australian society have been forced to spend more time at home and as a result, have had more time to consider and improve their living environment. Whilst Dusk was forced to close its physical stores for a short period of time, growth was barely dented with LFL (like-for-like) sales growth of >17% for FY2020.

In terms of expansion, Dusk intends to penetrate its core Australian market fully and starting to roll out its stores in New Zealand. It aims to grow outside the ANZ region by establishing online stores in key geographies. We note that a significant portion of web traffic (1% or so) to the Dusk website originates from the UK & US - large markets where Dusk does not yet sell its products. In time and pending successful market entries, we would expect that Dusk may one day have larger international operations than domestic. The company intends to begin international order fulfilment and to test demand in overseas markets starting from FY2022.

History and team

Peter King, Dusk's CEO, joined in 2015 and has grown business consistently since. Store management is flexible and low cost, largely centred around a single central employee the manager, a part-time assistant manager and supplemented by casual staff. An online training platform ensures consistent customer experience between stores. Rewards program signups are a KPI and bonus metric for store managers and on average 1 in every 5 casual shoppers joins the rewards program. Accordingly, customer acquisition costs are effectively an embedded sunk cost into the business itself. Senior employee turnover is exceptionally low in the low single-digit percentages.

Financials and valuation

The Dusk business is reasonably seasonal with its revenues consistently skewed towards the 1st half of the financial year. 58% of revenues are accrued in this period, with the balance in the 2nd half. EBIT Margins for FY2020 were circa 15% and this period incorporated a period of time where the physical store network was shutdown. Dusk released a market update on the 29/12/20 which smashed its previous guidance and upgraded its H1/FY21 revenue to an estimated $90 million. LFL sales grew circa 49% with online sales up 120%. Extrapolating this revenue guidance normalised for seasonal variance provides us with an estimated projected revenue for FY2021 of $155 million or overall revenue growth of 54% vs FY2020. Assuming H2/FY2021's EBIT margin falls back to FY2020's EBIT margin of 15%, this gives us a projected EBIT range of between $33-$36 million for FY2021.

Dusk has an extremely simple balance sheet with zero long-term debt. The company guided that it would hold a cash balance of approximately $33 million at the end of December 2020. Assuming a market capitalisation of $145 million (share price of $2.30), this equates to a rough enterprise value of $112 million or an EBIT multiple of just over 3 times. This is extraordinarily cheap especially in the context of today's highly valued equity markets.

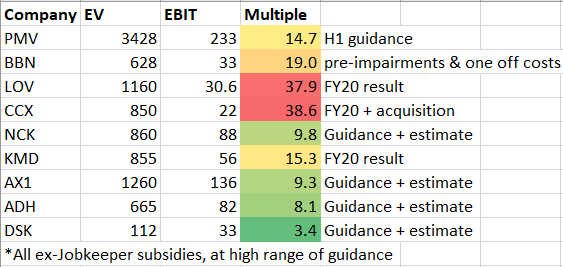

We demonstrate this via the following basic peer analysis:

As we can see Dusk's valuation is significantly less than its public listed peers in the Australian discretionary retail sector. If we assume as a conservative measure that Dusk can achieve the lowest valuation multiple out of its peers at 8.1x, we could expect to see the company trade at an enterprise value of $267 million or $4.24 per share (84% more than the current price). Note that this figure excludes the company's existing significant cash balance. No matter which way we examine the company, it still trades cheaply by any metric.

Risk factors

Our biggest question is why is the market valuing this stock so cheaply?

Our guess is that the IPO was effectively a sell-down by existing shareholders to the public rather than raising fresh funds for the business. It would not have made sense for Dusk to raise fresh capital considering the company was strongly capitalised at the time of the IPO. Accordingly, the IPO allowed the two largest holders, Catalyst and BBRC, to reduce their shareholding in the group. We are not concerned about this whatsoever, for a couple of reasons. Catalyst, being a private equity firm, need to cash out of their investments periodically to maximise the IRR metric for its fund investors. Catalyst still holds a controlling stake of over 25% in the listed entity. BBRC has also been invested in the company since 2010, and retain a 7.3% holding in the public entity. This is quite conventional for businesses that are listed or associated with BBRC from our observation.

Another factor that probably affected sentiment was the fact that the IPO was scheduled for March, however, was pulled due to the severe equity market conditions at the time. One theme that is prevalent in the retail space is that the Job Keeper government subsidies have led to a one-off bump in demand from the consumer side as well as benefiting companies from the cost perspective. Whilst this is true to a degree, it does not explain fully the large surge in the broader retail sector as well as data suggesting that Jobkeeper payments received by staff recipients have been used by many to improve their own financial position. Our thesis is that people are spending more on themselves and their home environment in lieu of travelling overseas and interstate. Whilst we cannot say with certainty when travel will become commonplace, we expect this time of restricted physical movement to last at least another 12 months.

One company that reminds us of Dusk is Lovisa which was previously floated by BBRC. Lovisa listed at a market value of around $200 million; it is now valued at around $1.2 billion with normalised EBIT of around $30 million. This company itself, we consider having lower growth potential than Dusk at this point given the product range and current geographic spread.

Conclusion

In summary, we consider that Dusk offers investors a potential strong growth opportunity while being priced as a value stock when viewed in the context of the discretionary retail sector as a whole.

Its low valuation offers the opportunity for significant value uplift over time that will be dependent on maintaining its current strong operational performance along with successful international growth.

This article is an extract of a detailed research note by Datt Capital.

We're always looking for new investment ideas

Datt Capital diversifies investments across asset classes and duration to reduce risk while maintaining relatively concentrated exposure to attractive investment opportunities.

To be the first to hear from us, click the 'follow' button below.

4 topics

9 stocks mentioned