Why you can be cautious on markets and 100% invested

2022 began with global stock markets around record levels, leaving many investors primed to sell equities. However, timing the market is more likely to reduce your returns than enhance them. Importantly, you can be cautious on the market and 100% invested provided you’re in the right stocks. Here’s why.

A December 2021 Livewire reader survey found that ‘overvalued stock bubbles’ are the #1 concern of readers, by a factor of two!

Many investors have an opinion, often strongly held, on whether the stock market in aggregate is cheap or expensive. If the market is viewed as being too pricey, they may increase the cash weight in their portfolio with a view to buying back into equities at lower prices. While conceptually appealing, history shows that attempting to profit from the market’s zigs and zags along its upwards journey is far more likely to detract from investment returns than add to them.

Aswath Damodaran, a highly esteemed Professor of Finance at New York University’s Stern School of Business, has studied market timing strategies. He looked at asset allocation mutual funds in the US, so called because rather than being 100% in equities they can time the market by moving between stocks, bonds and cash. As such, they should do better than the equity market.

Over the 10 years to 1998 these market timing funds on average underperformed the S&P500 by 5.0% p.a.

I recall telling clients in January of 2013 that markets are fully priced and to expect a zero return from the index in the coming year (the S&P500 put on 30% that year!). I’ve learnt a few things since then. Today, I have no view, positive or negative, on the value or the direction of the equity market in totality. Nor do I believe it’s necessary to have one as an equity manager.

Timing the market is an example of what is known as the fallacy of composition, meaning the belief that what is true of the whole is also true of all the component parts. It’s common for investors who’ve formed a view on the equity market in totality to then project this view onto all equities – all stocks and all funds. However, the returns from any individual security will look nothing like the average.

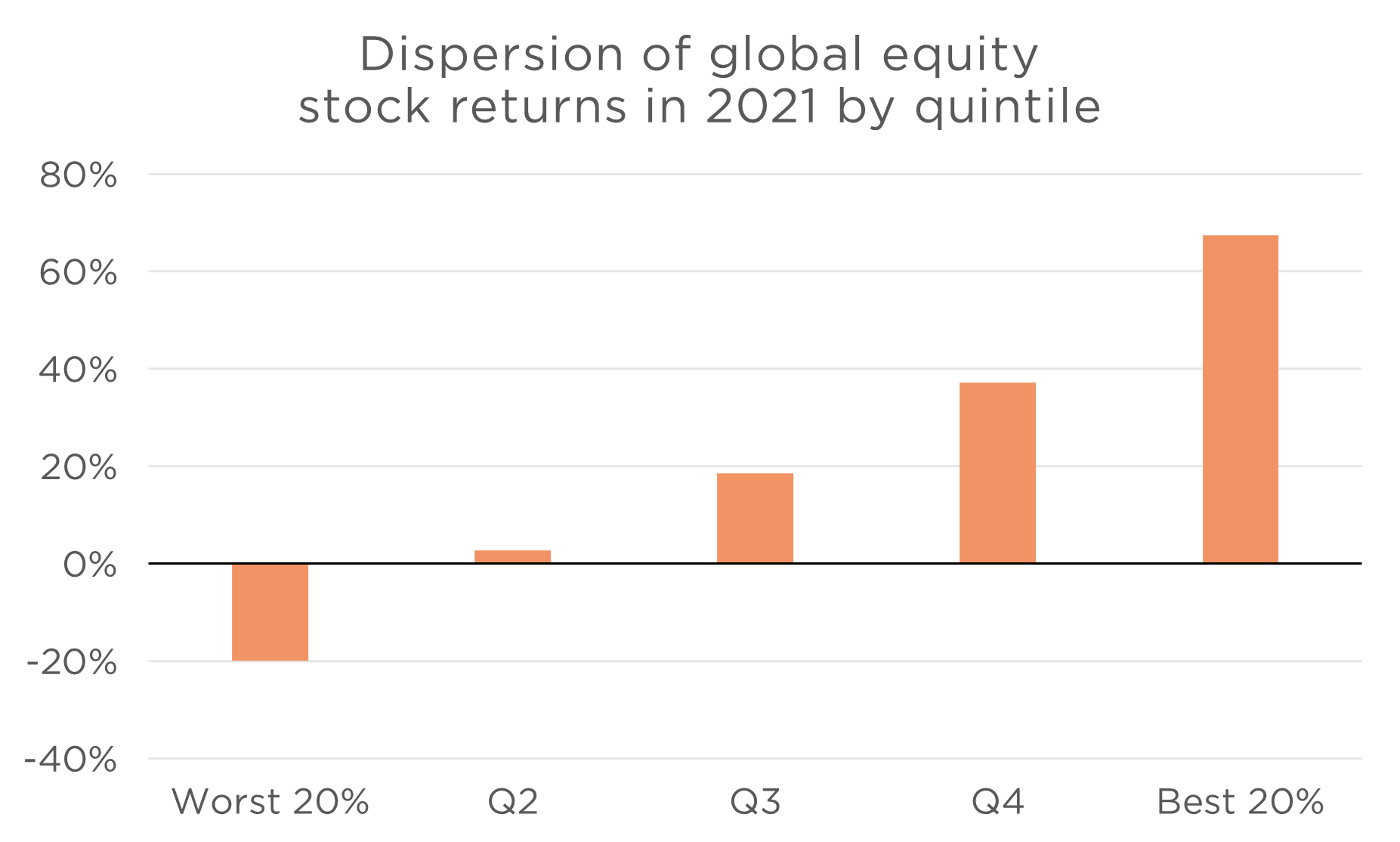

Thinking about equity market indices in aggregate misses the vast dispersion of stock returns within an index. To illustrate this dispersion, in 2021 the returns of the best 20% of the global equity market exceeded those of the worst 20% by almost 90%.

What matters is what you own, which in the case of Aoris is just 15 exceptional businesses. The index is mostly made up of businesses you don’t own. I’ve seen many poor investment decisions made as a result of confusing these two constructs.

What matters is what you do own. The index is mostly made up of businesses you don't own.

If you own the right type of business, and you own them at or below their fair value, then time is on your side and being fully invested makes sense. By the right type of business, I mean those that have been around a long time, are understandable, have leadership positions in growing markets, and grow earnings per share at an attractive rate on a sustainable basis.

I believe the intrinsic value of the 15 companies we own at Aoris is rising at a rate of around 10% a year and I believe we own them at or below their intrinsic worth. Therefore, cash represents a considerable opportunity cost. To hold $1 of portfolio capital in cash rather than in one of our companies, in the expectation that its share price may fall 10% or more from an already attractive level, would not be judicious. I believe it is far better to invest all of one’s portfolio capital in these types of businesses and participate fully in that 10% p.a. growth in value.

To maximise your long-term returns, recognise the futility of trying to optimise short-term returns. Invest to win the main game, the long-term game. Recognise that your equity portfolio is not the equity index. Rather, it’s a discrete set of businesses whose returns will look nothing like the market average. If the businesses you own are profitable, durable, competitively strong and growing in intrinsic value at around 10% p.a., and you own them at or below today’s fair value, then it makes sense to be fully invested.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics