Yuan is weighed down by monetary divergence – but supported by the current account

.png)

What governs the value of China’s renminbi? There are several factors that push and pull on the USDCNY exchange rate.

Central bank policies

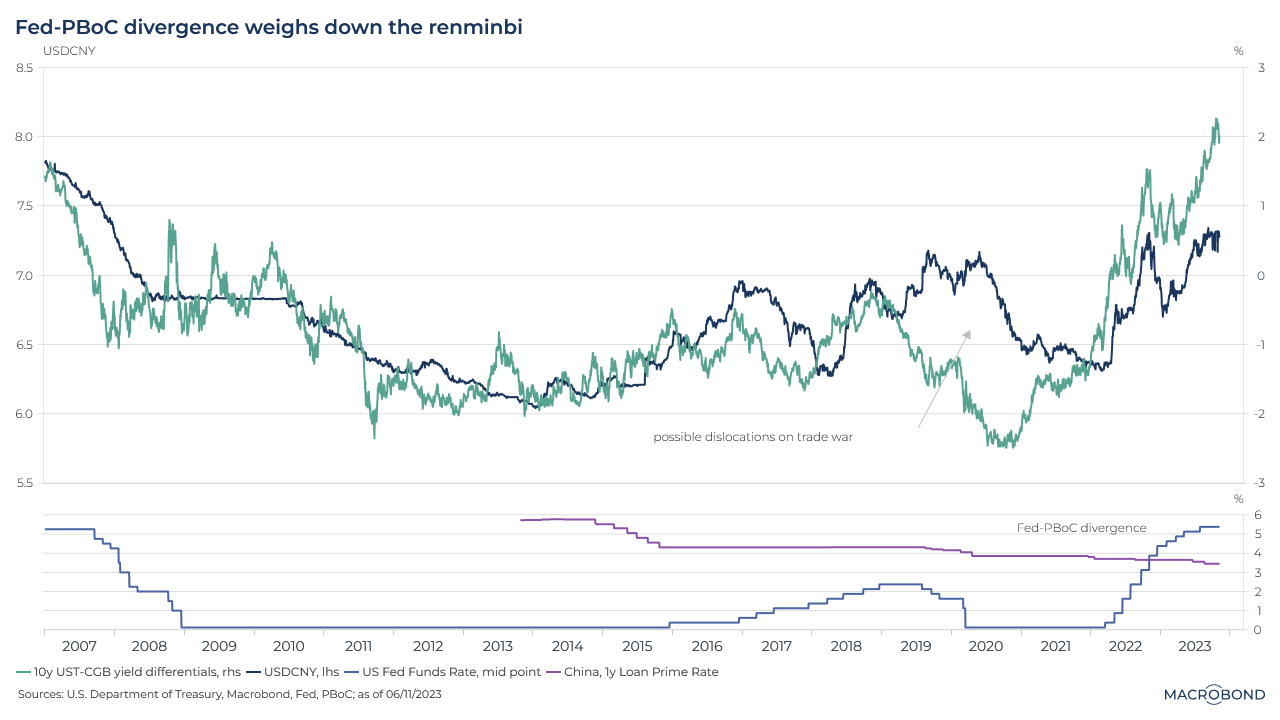

Our first chart tracks the effect of the differing monetary policies of the Federal Reserve and its Chinese equivalent over the past 15 years. The top pane charts the exchange rate – in blue – against the yield differentials between 10-year benchmark US and Chinese government debts (in green). These have broadly tended to track each other; as US yields have widened the gap with their Chinese equivalents, the yuan has depreciated; a dollar is worth about 7.3 yuan, near a 15-year high.

The second pane of our chart tracks the central banks’ key benchmarks; the sharp monetary tightening by the Fed contrasts with the gradual loosening by Chinese policymakers. Given the possibility of disinflation or deflation in China and persistent inflation in the US, it is conceivable that PBoC rates may be lower while Fed rates remain high for a longer period. This trend could continue, which would put downward pressure on the CNY.

Persistent surpluses

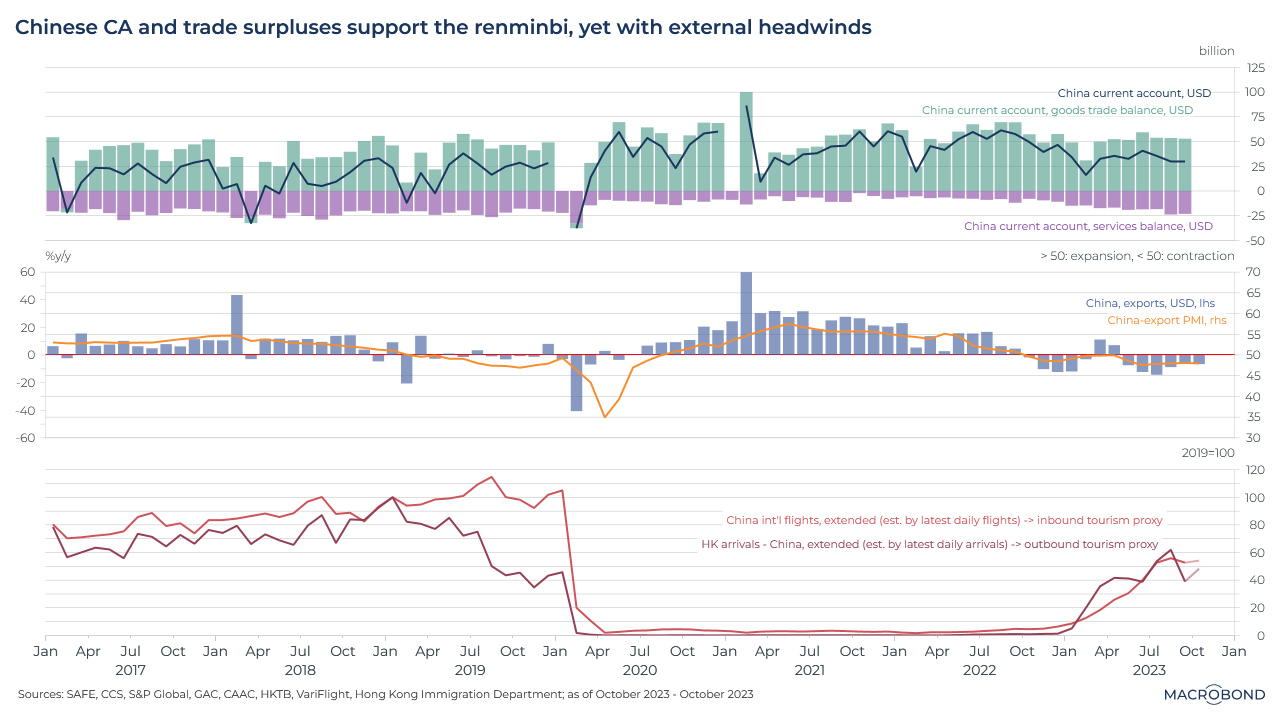

Our next chart addresses China’s current account, especially goods and travel trade balances. Historically, China’s persistent current-account and goods trade surpluses help support the value of the currency, but these trends are facing headwinds.

As the middle pane shows, exporters have been struggling due to a global slowdown. Exports have been falling year-over-year (the blue bars, measured on the left-hand axis) and PMI, a measure of economic sentiment, computed based on China’s exports is in negative territory (below 50 on the right-hand axis and measured by the orange line).

The bottom pane uses Chinese international flights as a proxy for inbound tourism, and arrivals in Hong Kong from mainland China as a proxy for outbound tourism. Both look to have a similar distance below pre-pandemic norms. This suggests that the tourism trade balance and the current account’s services deficit, which typically under-weighs goods trade surpluses, could be comparable to the previous normalcy.

Accordingly, the current account could stay positive amid challenges.

Net fund outflows persist

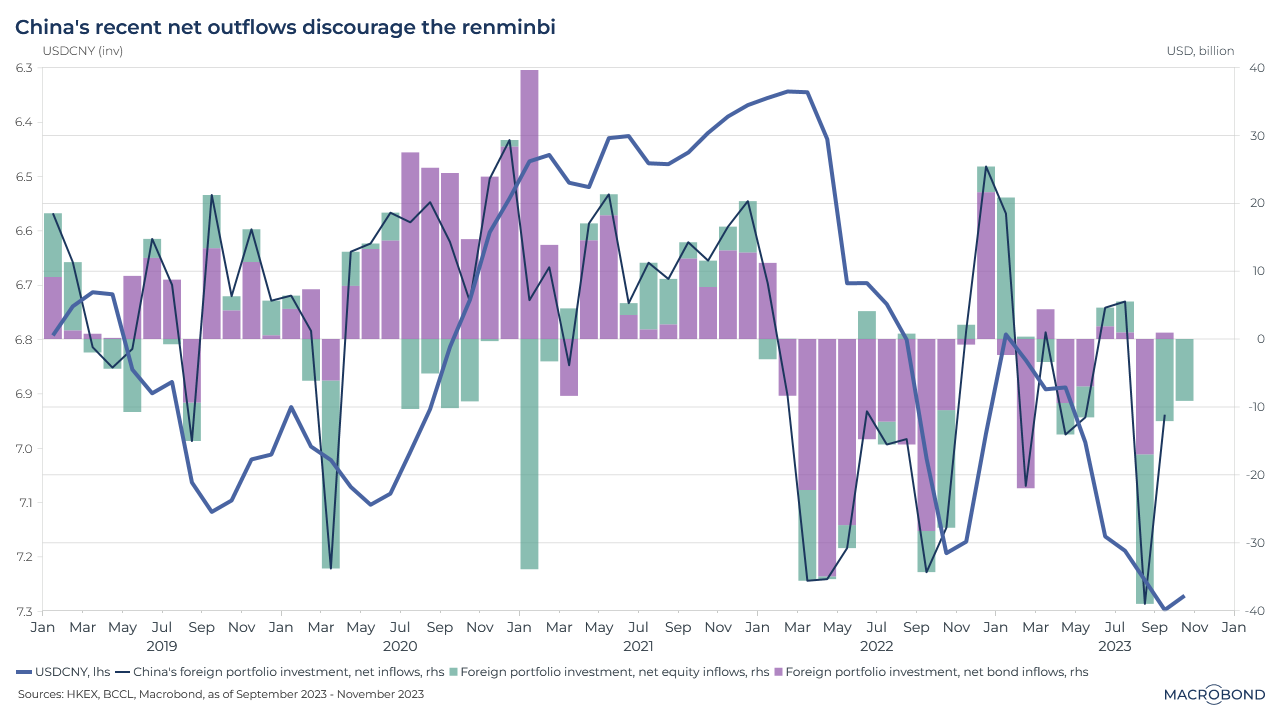

Next, we turn to net fund flows, which have an effect on the capital account. We’ll chart their evolution over the last five calendar years and watch the relationship, if any, with the exchange rate.

It seems that net capital flows from China have an impact on the yuan over time. Recently, there have been net fund outflows for both stocks and bonds since 2022, also influenced by the Fed-PBoC monetary divergence, which discourage the renminbi.

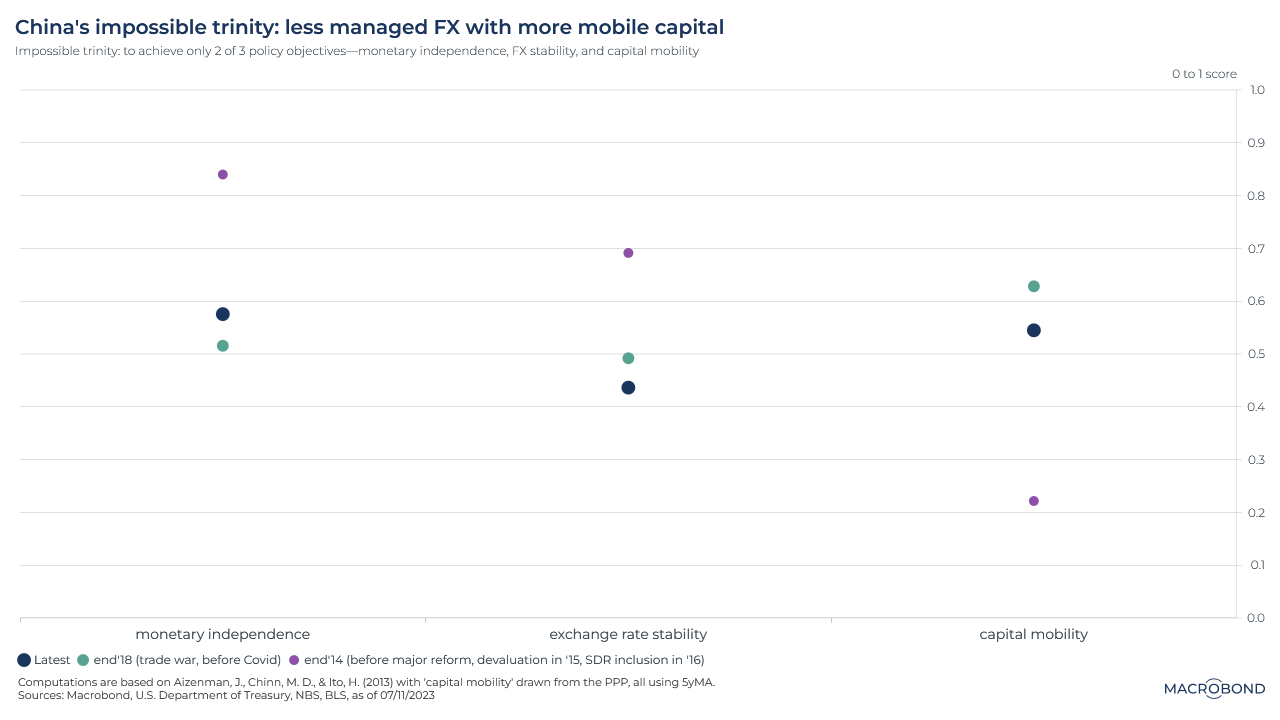

Finally, we turn to the “impossible trinity.” This is a monetary concept that asserts that a country can never have all three of the following at the same time: an independent monetary policy, a fixed (or at least stable) exchange rate and an absence of capital controls. China, of course, governs its macroeconomic framework through capital controls and manages the trading range of the USDCNY exchange rate.

More capital flexibility and the tradeoff with a less table currency

Broadly speaking, this chart measures the components of the trinity at three moments in time: the end of 2014 (before a major reform in 2015 and SDR inclusion in 2016), the 2018 Trump trade-war era and the present day.

Higher scores on the right-hand axis indicate greater monetary independence, a more stable currency and fewer barriers to capital mobility (The computations are based on Aizenman, J., Chinn, M. D., & Ito, H. (2013) with ‘capital mobility’ drawn from the Purchasing Power Parity or PPP). Since 2014, capital has become more mobile. To maintain monetary independence, the logic of the “impossible trinity” suggests something had to give; thus, the currency has generally become less stable.

In summary, the renminbi remains exposed to downside risks, predominantly due to rate differentials, slumping exports and net fund outflows. Nevertheless, the CNY could be shored up by the ever-present current account and trade surpluses.

In any event, we expect the yuan to become more flexible.

4 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)