10 funds with this CIO's tick of approval

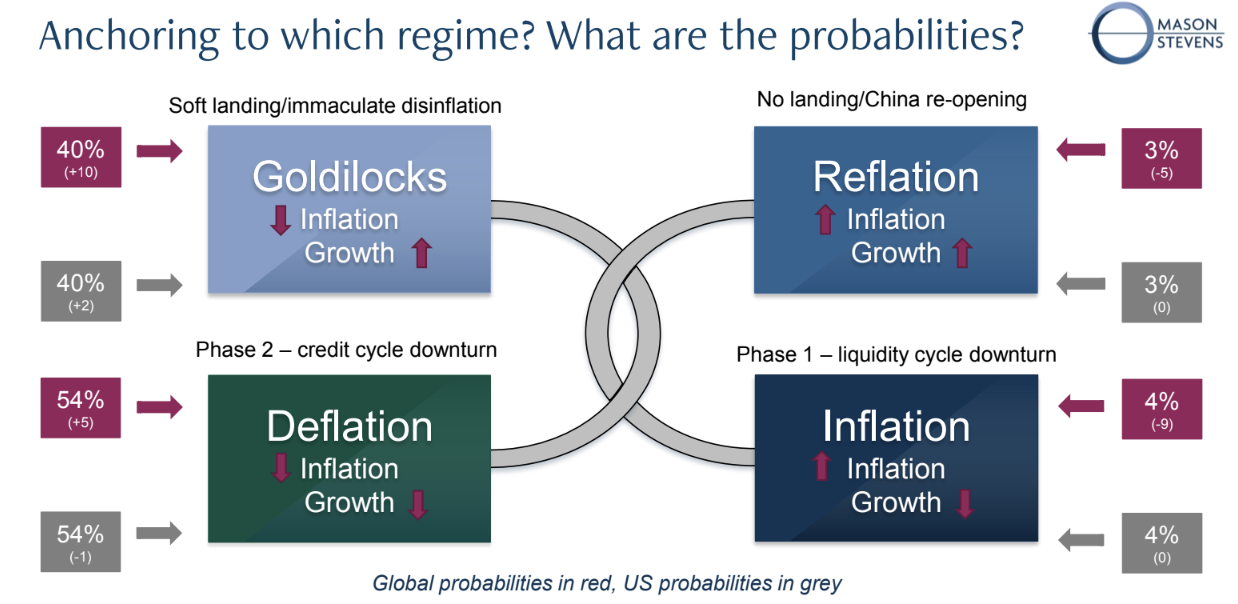

The probability of a Goldilocks scenario for global markets has drastically increased in recent months, but the risk of a deflationary environment is still higher.

That's according to Mason Stevens chief investment officer Jacqueline Fernley, who puts the probability of a soft landing at 40%.

"A typical economic cycle starts in the housing market, shifts across to the goods cycle, then the corporate profit cycle, then employment and then inflation. You look at the last 12 economic cycles in the US over the last hundred years, and it's a little bit like clockwork," she says.

While this time is different, the cycle is still following a similar path. The housing market is now rebounding after heavy losses, while the goods cycle is showing signs of bottoming as well. Corporate profits, which haven't been impacted as severely as many predicted, have also softened. The next shoe to drop, Fernley argues, is employment.

This is the data point she is watching to know when to take risk off the table for Mason Stevens' clients.

"If you look at previous cycles, the S&P 500's median increase is 16% for the 12 months prior to a recession. We are already at that give or take," Fernley says.

"I don't know whether we'll get a soft landing. Nobody really does. But what we do know is a soft landing looks exactly like a hard landing until it doesn't."

In the first of Livewire's new series Views from the Top, Fernley provides a thorough explanation of her views on the macro outlook and shares the 10 fund managers she has been recommending to clients to help navigate today's market environment.

Background

For those that don't know her, Fernley has worked for the likes of Credit Suisse, Suncorp, Magellan, WILSONS, Areté Investment Partners, and Colonial First State Global Asset Management in analyst and portfolio manager roles, before nabbing a position as the head of equities at JBWere. She has been the CIO of Mason Stevens for the past year and a half.

She's also a mother of two, and loves to cook, practice yoga and enjoy time with her friends and family. After all, we are so much more than our day jobs.

Mason Stevens was established in 2010 and is a specialist platform provider that focuses on managed accounts. The business offers an outsourced CIO service to support and partner with financial intermediaries, providing them with institutional-style investment services that meet the specific needs and requirements of each client.

Note: This interview was filmed on Wednesday 9 August 2023. You can watch the video or read a summary below.

Is there a possibility that the cycle has changed?

Given the recent modern monetary experiment of the world's central banks, Fernley believes it's important that investors take economic predictions with a grain of salt.

"Economists, as wonderful as they are, look to history to determine the future. And if the environment has changed or if the rules of engagement have changed, then the models are only as good as the data that's going into them," she says.

"The difference this time is our starting point. We've had an extraordinary three years in markets with COVID, an enormous amount of monetary policy and fiscal stimulus all hitting at the same time, which essentially built a corporate balance sheet and a household balance sheet that has been stronger than we've ever seen before."

This, as we know, has helped buffer against the several hundred basis point hikes we have witnessed in markets over the last 12 months.

"We don't know what is actually going to happen, but what we are seeing is a level of resilience in the US economy and globally, to an extent, that has surprised most pundits," Fernley adds.

"Does the...impact of that monetary policy mean that we'll have a different path? Again, I don't know the answer, but it's the thing that we're watching."

10 ETFs and funds the team at Mason Stevens is backing

With the probability of a Goldilocks scenario increasing in recent months, Fernley and her team have been adding back to risk assets. They are still slightly underweight domestic and international equities but have been busy identifying areas of these markets that remain undervalued.

"In the Australian context, we have actually been allocating to small-cap fund managers," Fernley says.

She points to Spheria Asset Management as an example, as well as OC Funds Management and Ophir Asset Management.

"There's a long track record, not only of those fund managers but small companies in general, where these fund managers actually add alpha consistently over time. And so we've started to put money back to work in that space," she says.

For global equities exposure, Fernley has been using the Betashares S&P 500 Equal Weight ETF (ASX: QUS). For those wondering, this gives investors exposure to a broader base of the economy, as its holdings are equally weighted to each company in the index - rather than market-weighted (which would favour the fabulous seven).

"As this rally extends, it will broaden out to other names, other than those top seven," she says.

She also reveals Mason Stevens' strategic asset allocation is currently overweight fixed income.

"We have still been adding predominantly into credit rather than adding to duration at this point in time. There is an incredible carry in the space across both defensive alternatives and into fixed income where we can generate income in the 5% to 10% levels with very little capital risk, albeit it is still credit, but we are watching it very closely," she explained.

"We are happy to bank that and just be a little bit overweight that sector and take a little bit of risk off the table."

She points to managers such as Macquarie Asset Management and Perpetual Asset Management as examples. From a defensive alts perspective, Fernley names Metrics Credit Partners and Challenger Investment Management, and mortgage-orientated players such as Barwon Investment Partners and the Qualitas Real Estate Income Fund (ASX: QRI).

"You do need to be selective in private credit and ensure that you are with a manager who has a long track record and has a depth of TAM that has proven they can manage through a cycle," she says.

"There are a number of instruments where you really can achieve quite a compelling return and it's certainly additive to a multi-asset portfolio."

When is it worth paying for active management?

For Fernley and her team, the decision comes down to whether a manager can deliver alpha relative to its factor bias.

For example, if it's a quality global manager, is it actually beating the global quality ETF? If they're not, it's cheaper to buy the passive product.

"We will think about which factor we want exposure to and then adjust the portfolio and work through that component of the sleeve - do we want an active manager or are we happy with a passive ETF?" She explains.

In addition, ETFs also provide the added benefit of liquidity - meaning it can be quicker for Mason Stevens to change its allocations when needed.

"We are very clear, both when we are entering or exiting a market or when we are thinking about our asset allocation, of the economic data we are watching and our playbook," she says.

Jacqueline's view from the top

"For me, it's always about probabilities rather than setting a portfolio or having a single view," she says.

Instead, investors should weigh up both the bear and bull arguments - understand the nuances of each, and then watch the data.

"Then you can shift from one to the other, but if you hold any of it too firm, it's really difficult to shift a portfolio because you're too emotionally attached to a view," Fernley says.

Mason Stevens' Disclaimer

Opinions expressed and/or information may change without prior notice and Mason Stevens is not obliged to update you if the information changes.

4 topics

2 stocks mentioned

2 funds mentioned