16 top stocks inside these high-performing Aussie equities funds

With the end of another investing year in sight, we've used the Livewire funds database to take a snapshot of the 12-month performance of Australian equities funds.

In proof that 2023 was another difficult year, Morningstar data reveals that only four of the 127 funds in this category delivered double-digit returns. In the following wire, I delve into the portfolios of these four top-performing funds to outline some of their largest stock positions.

One of the interesting observations from this exercise was the low number of overlapping names. Only three companies occurred more than once – Xero (ASX: XRO), Nanosonics (ASX: NAN) and Siteminder (ASX: SDR) – and all three stocks only featured twice.

The top holdings for each of the funds were sourced from the latest monthly or quarterly fund updates that are publicly available on the asset managers' websites. As a result, these lists are mostly current as of either October or November.

We've also used Market Index to source the broker consensus views for each of the companies, in addition to their 1-year performance charts.

How we found the funds

The following Australian equities funds are all listed on the Livewire 'Find Funds' menu (which you can find near the top right-hand corner of the home page). It should be noted that this is not an exhaustive list of all Aussie equities funds domiciled in Australia. There are other Australian equities funds which are not listed in Livewire's 'Find Funds' marketplace.

The steps involved in the process were:

- In the “Fund type” box, select “Managed Funds”

- In “Asset Class”, select the “Shares - Australian" checkbox

- We then filtered for returns by clicking on “Performance View” and then “Performance - 1-year".

Top-performing Australian equities funds

| Rank | Fund name | 1-year return |

| 1 | Hyperion Small Growth Companies Fund | 13.70% |

| 2 | Elston Australian Emerging Leaders Fund | 12.74% |

| 3 |

Perpetual Pure Equity Alpha Fund |

12.64% |

| 4 |

Lakehouse Small Companies Fund |

11.28% |

| 5 | Investors Mutual Small Cap Fund | 8.84% |

Hyperion Small Growth Companies Fund

The five largest holdings, as of the fund's October update, are:

Xero (ASX: XRO)

Broker consensus: STRONG BUY (15 buy, 5 hold, 0 sell)

The accounting software firm recently reported a miss on earnings due to gross margins and softer subscription growth in the UK. But Wilsons Advisory’s Rob Crookston believes it is oversold, according to his recent wire.

What the brokers think

- Macquarie on 10 November downgraded XRO to UNDERPERFORM from neutral, cutting its price target to $87 from $119.

- E&P downgraded the company to NEUTRAL from positive, cutting its price target to $100 from $138.

Xero shares closed at $101.79 on Tuesday 5 December.

Fisher & Paykel Healthcare (ASX: FPH)

Broker consensus: SELL (1 buy, 9 hold, 7 sell)

The medical device manufacturer was also cited by Yarra Capital Management’s Katie Hudson as an example of non-linear company growth.

What the brokers think

Jefferies rates FPH as UNDERPERFORM, with a price target of NZ$19.50

Macquarie on 4 September downgraded the company to NEUTRAL from outperform, with a price target of NZ$24.30.

Fisher & Paykel Healthcare shares were trading at $21.72 at the market close on Monday 4 December 2023.

Wisetech Global (ASX: WTC)

Broker consensus: BUY (10 buy, 8 hold, 0 sell)

The logistics software firm was caught up in some of the buzz around AI that boosted the share prices of many technology companies this year.

What the brokers think

- RBC Capital Markets rates Wisetech SECTOR-PERFORM with a price target of $75.

- CITI rates the company as NEUTRAL with a price target of $64.10

Wisetech shares closed at $66.73 on Tuesday 5 December.

HUB24 (ASX: HUB)

Broker consensus: BUY (7 buy, 9 hold, 1 sell)

The company is a top holding at QVG Capital, with portfolio manager Chris Prunty recently naming it among a handful of companies growing well above the market rate “with high incremental returns on capital and great balance sheets.”

What the brokers think

- Wilsons upgraded HUB to OVERWEIGHT from market weight on 22 November, lifting its price target to $37.23 from $33.66.

HUB24 shares traded at $33.57 when the market closed on Tuesday 5 December.

Domino’s Pizza Enterprises (ASX: DMP)

Broker consensus: BUY (9 buy, 5 hold, 3 sell)

The fast-food retailer has been a substantial holding of Hyperion's for more than a decade, as deputy CIO Jason Orthman noted in an October 2023 interview. He said that DMP has been something of a “problem child” over the last 12-18 months, as its balance sheet has been strained by DMP’s business model of selling high-volume, low-cost pizza and high-tech vision. However, he’s optimistic about the outlook for the company, particularly around the company's growth plans in European markets like the Netherlands and Germany.

What the brokers think

- Macquarie upgraded Domino’s to OUTPERFORM from neutral on 20 November, increasing its price target to $58 from $54.

- Citi on 12 October upgraded DMP to BUY from neutral, analyst Sam Teeger lifting the price target to $58.60 from $57.95.

Domino's shares closed at $52.45 on Tuesday 5 December.

Elston Australian Emerging Leaders Fund

High-conviction asset manager Elston Asset Management doesn’t list its top five holdings in its quarterly updates. But the following companies were discussed in its latest report, which was issued in September.

Siteminder (ASX: SDR)

SiteMinder is a supplier of guest acquisition, reservation, payments, and market intelligence software solutions to accommodation providers. The Elston team believes SDR has a large opportunity to grow its client base while expanding revenue per client, over the longer term.

What the brokers think

- Morgan Stanley on 2 November upgraded SDR to OVERWEIGHT from equal-weight, with a price target of $4.75.

- Wilsons on 30 October upgraded SDR to OVERWEIGHT, with a price target of $4.69.

SiteMinder shares closed at $4.94 on Tuesday 5 December.

Polynovo (ASX: PNV)

Broker consensus: STRONG BUY (9 buy, 1 hold, 1 sell)

A medical technology company, Polynovo develops synthetic substitutes for human tissue. In the September quarter, Elston increased its holding of the company on the back of its valuation metric and the team’s increasing confidence in the business.

What the brokers think

- Morgans rates Polynovo as ADD with a price target of $1.88 as of 6 September.

- CLSA on 23 August upgraded PNV to OUTPERFORM from underperform, but analyst Andrew Paine cut his price target to $1.70 from $1.75.

Polynovo shares closed at $1.34 on Tuesday 5 December.

Nanosonics (ASX: NAN)

Broker consensus: HOLD (6 buy, 7 hold, 2 sell)

In September, Elston cited the firm’s attractive valuation and the team’s increased confidence in the business. It was also one of several companies discussed by Longwave Capital’s Rachel White last month.

What the brokers think

- JPMorgan upgraded Nanosonics to NEUTRAL on 1 November, but analyst David Low dropped his price target to $3.65 from $4.10.

- Bell Potter rates the company as HOLD, upgraded from sell, as of 23 August. Analyst John Hester sets a price target of $4.85.

Nanosonics shares closed at $4.26 on Tuesday 5 December.

Perpetual Pure Equity Alpha

As an absolute return fund that holds both long and short positions in Australian listed companies, this fund doesn’t name its top holdings. But the following stock is one that Perpetual’s deputy head of equities and portfolio manager Anthony Aboud recently discussed as a favourite founder-led company.

Premier Investments (ASX: PMV)

Broker consensus: BUY (9 buy, 5 hold, 2 sell)

Firetrail portfolio manager Eleanor Swanson recently named the company among the “beaten-up cyclicals” she expects could do well from a “Santa rally”.

What the brokers think

- CLSA downgraded PMV to UNDERPERFORM from outperform on 4 December, with analyst Mark Wade cutting his price target to $24 from $27

- JPMorgan downgraded the company to NEUTRAL from overweight on 4 September, with its price target reduced to $25.50 from $26.

Premier Investments' shares closed at $25.71 on Tuesday 5 December.

Lakehouse Capital Small Companies Fund

Of the 23 stocks the fund held as of 31 October, the five largest positions were in the following companies:

Netwealth Group (ASX: NWL)

Broker consensus: SELL (4 buy, 7 hold, 8 sell)

Portfolio manager Donny Buchanan in September emphasised the financial services company’s pleasing full-year results. “Netwealth remains well placed to continue growing from its current 7- 8% market share as it captures a disproportionately larger slice of industry net fund flows."

What the brokers think

- Citi rates Netwealth as SELL with a price target of $13.45

- Unified Capital Partners rates the company BUY as of 11 October, with a price target of $15.70.

- JPMorgan downgraded Netwealth to UNDERWEIGHT from neutral on 13 July, with a price target of $12.30.

Netwealth shares closed at $14.66 on Tuesday 5 December.

Audinate Group (ASX: AD8)

Broker consensus: STRONG BUY (8 buy, 2 hold, 0 sell)

The leading digital audio networking company, Audinate reported a 51% sales surge earlier in the year, with pent-up demand from post-COVID chip shortages at an end. Management expects this positive momentum to carry through into 2024.

What the brokers think

- Jefferies downgraded AD8 to HOLD from buy on 22 September, analyst Wei Sim leaving the price target at $15.

- Macquarie rates the firm OUTPERFORM, with a price target of $11.

Audinate shares closed at $14.68 on Tuesday 5 December 2023.

The three other top-five company holdings in the Lakehouse fund were detailed previously:

- Nanosonics,

- Siteminder, and

- Xero.

INVESTORS MUTUAL SMALL CAP FUND

A2B Australia (ASX: A2B)

Formerly known as Cabcharge Australia, this firm provides technology and payment solutions for personal transport services. Not only is the firm a top 10 holding of the IML fund, it’s also been highlighted by Forager’s Steve Johnson. He alluded to the company as a deep value opportunity, referring particularly to a lucrative land deal A2B inked in 2023.

A2B shares closed at $1.72 on Tuesday 5 December.

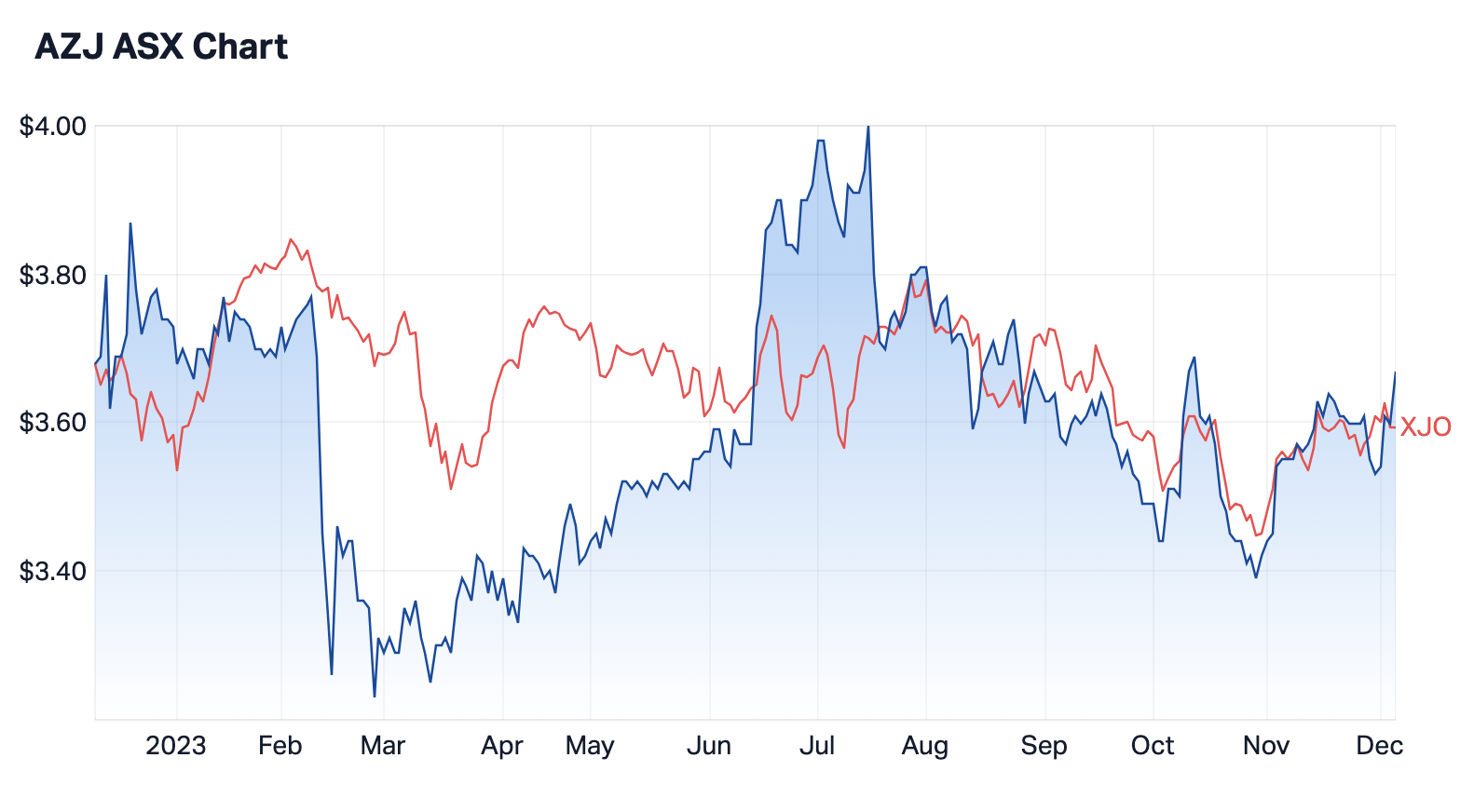

Aurizon Holdings (ASX: AZJ)

Broker consensus: BUY (9 buy, 7 hold, 2 sell)

The major rail freight operator was also called out by Tyndall Asset Management’s Brad Potter in companies he’s watching into 2024. He particularly likes the transport company’s leverage to the commodities space.

What the brokers think

- E&P upgraded Aurizon to POSITIVE on 10 October with a price target of $4.

- Morgans rates the company HOLD with a price target of $3.95.

- Goldman Sachs rates AZJ as NEUTRAL as of 19 June, with a $3.95 price target.

Aurizon shares closed at $3.60 on Tuesday 5 December.

SG Fleet Group (ASX: SGF)

Broker consensus: BUY (6 buy, 1 hold, 1 sell)

The fleet management, vehicle leasing and salary packaging service provider was mentioned in another episode of Buy Hold Sell by IML's Simon Conn.

"It's a fleet leasing business, and it also plays in the novated lease space. It's on about 9-10 times. It looks very cheap, and I think it's a business sector that has reasonable contracted revenue. And I think with the lease plan synergies coming through, it can continue to grow earnings," Conn said.

What the brokers think

- CLSA rates SG Fleet as OUTPERFORM as of 17 August, with a price target of $2.90.

- Canaccord Genuity rates the company as BUY with a price target of $3.72.

- Macquarie rates SGF as NEUTRAL with a price target of $2.98.

SG Fleet shares closed at $2.25 on Tuesday 5 December.

Skycity Entertainment Group (ASX: SKC)

Broker consensus: BUY (7 buy, 2 hold, 1 sell)

Skycity owns and operates entertainment complexes, including casinos and hospitality venues, in Australia and New Zealand. The company’s management problems in recent years were recently mentioned by Tyndall Asset Management’s Jason Kim in an episode of Buy Hold Sell. “Once we get over this regulatory uncertainty, it should be at least a market multiple stock. So, we see significant upside from here,” he said.

What the brokers think

- CLSA rates the company OUTPERFORM as of 24 August, with a price target of $2.30.

- Barrenjoy rates Skycity as UNDERWEIGHT, with a price target of NZ$2.50.

- Forsyth Barr rates the company NEUTRAL with a price target of NZ$2.80.

Skycity Entertainment shares closed at $1.72 on Tuesday 5 December.

Clearview Wealth (ASX: CVW)

A financial services company focused on life insurance and wealth management, Clearview hasn’t received much coverage on Livewire Markets in recent years.

What the brokers think

- Taylor Collison rates the company BUY with a price target of 83 cents.

Clearview shares closed at 57 cents on Tuesday 5 December.

Tell us what you think

If you own any of the above companies in your portfolio – or if you're expressly avoiding them - feel free to let us know why (or why not) in the comments below.

2 topics

16 stocks mentioned

5 funds mentioned

7 contributors mentioned