28% of ASX 300 stocks are loss makers: Here's why Macquarie is still backing 15 of them

Off the back of the August reporting season, Macquarie has found that 28% of the S&P/ASX 300 are loss-making businesses. But you shouldn't necessarily avoid all of these stocks.

In fact, this is below the historical standard. On average since 1995, 32% of the benchmark has been loss-making, while 18% of the MSCI World Index were considered loss-making businesses. However, Macquarie found that individual loss maker types are ABOVE their long-term average.

21% of these Aussie businesses were NPAT loss makers (the long-term average is 18.6%), while businesses whose net cash flows minus their operational activities (CFO) were 15% of the index (the historical average is 12%). Those that reported losses in both categories made up 12% of the S&P/ASX 300 (that's significantly above the long-term average of 9%).

So why now? Well, Macquarie notes that these loss makers are "most vulnerable" during times of economic weakness - like what we are seeing right now. And while there are legitimate reasons why a business may report a loss - for example, a cyclical downturn, or heavy investment into growth (like that seen in early-stage growth businesses), it may be worthwhile taking a better look at any loss makers in your portfolio.

In this wire, I'll summarise the latest research from Macquarie on loss-making businesses, as well as the 15 stocks that could outperform from here (and the 15 you should probably steer clear of).

Lossmakers that turn profitable are lucrative

While Macquarie notes that stocks that become loss makers tend to be "lower quality, higher risk" and lack momentum, those that become profitable again can reward investors with some nice outperformance.

"Those that become profitable again generated 12% outperformance p.a., but this only occurred 38% of the time," Macquarie said.

"The remaining 62% underperformed by 13% p.a."

As the majority of these loss makers underperform, high conviction (and significant research) is required when investing in these businesses.

With this in mind, the investment bank penned that "cheap, less risky lossmakers, with good momentum, helped distinguish winners from losers lossmakers in Australia".

Meanwhile, those that are cashflow loss makers were typically a red flag, underperforming during the cycle with higher volatility - particularly when the economy was weak.

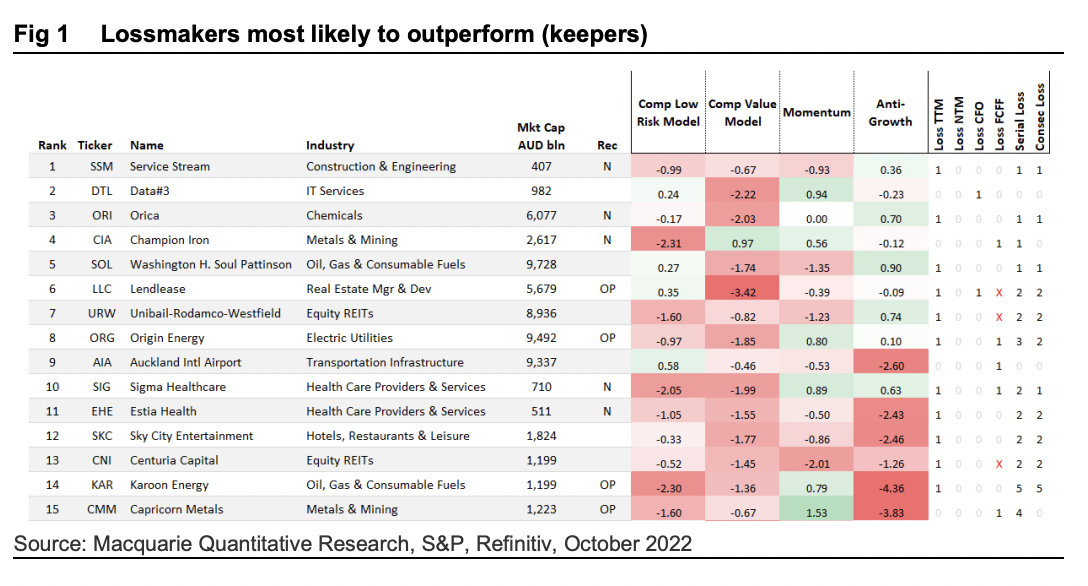

The 15 loss makers that could outperform...

Macquarie has outlined 15 loss-making stocks that are most likely to outperform. The stocks below all experienced some kind of loss - whether it be NPAT, CFO, FCFF (CFO minus after-tax interest expense minus net CAPEX), or NTM losses (next 12-month consensus analysts EPS loss makers).

The numbers in the final column highlight how serial these losses have been over the past five years, and whether these were consecutive losses too.

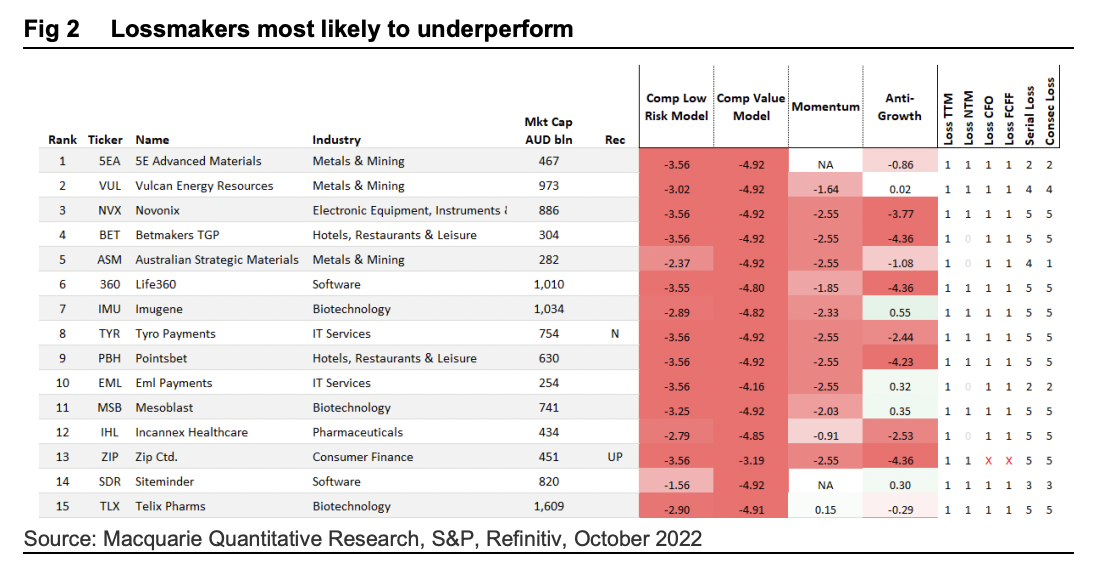

... And the 15 that Macquarie believes won't

These are the 15 stocks that Macquarie believes currently look the least attractive within the loss-making universe. According to the bank's modelling, all of these stocks have unfavourable characteristics and are likely to underperform.

How to deal with loss-making investments

Continuing to hold a loss-making investment is a considerable risk - particularly now, Macquarie wrote, and thus, deciding what to do with these investments is critical to a portfolio's success.

And by the way, this is not just an issue for small-cap investors - on average, less than half of these businesses are small caps.

Macquarie recommends investors ask themselves what type of loss maker they are facing. Is it:

- A temporary/cyclical loss-making business that is likely to recover;

- A pure growth play (with strong long-term expectations;

- A declining business (catching a falling knife); or

- A business with a turnaround on the horizon (typically mature companies)

The last type is particularly difficult to correctly identify and time, Macquarie said, and requires special due diligence to ensure it has a viable core business (trading at below its potential intrinsic value), as well as in-depth research on the likelihood of the business achieving strong returns.

However, it's important to note that only a small number of loss-making businesses have a good chance of not underperforming - let alone, outperforming - and thus, any businesses that are not on Macquarie's outperforming list "should be reconsidered", it said.

"Said another way, if you don’t have high conviction, the historical odds are very low of outperformance and of high risk," it said.

So which lossmakers are likely to outperform? Well, usually they pay dividends, haven't previously been a loss-maker, face fewer extreme events and are more likely to have reported positive earnings surprises in recent results.

These companies are usually within the transportation, insurance and real estate sectors. Meanwhile, loss-making stocks within the biotech, telco, media and diversified financials sectors are the most likely to underperform.

How to predict if an investment will become a loss maker

Macquarie reverse-engineered its analysis to work out what factors can help predict a loss-making company. According to the investment bank, future loss-makers boast these five traits:

- The stock is more expensive on a book-to-price ratio.

- The stock is riskier or a smaller company with poor earnings stability.

- There is poor sentiment around the stock (momentum and earnings revisions)

- It has poor profitability, both in the past and forecasted and is poorer quality.

- It has high forecasted growth, with some elevated incremental CAPEX.

In contrast to the winning stocks within this arena, Macquarie notes these stocks often lack dividend payments, have repeatedly reported losses, experience extreme events and have reported negative surprises in recent results. These factors should be seen as hallmarks of potential losses to come, it added.

Stocks that are most likely to become loss makers are often found within the materials, energy, transportation and insurance sectors - while banks, food and drug retailers, and real estate companies were the least likely (even despite the meltdown of the Global Financial Crisis).

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

30 stocks mentioned