4 actions to take right now to protect your investments against recession

It is a tale as old as time. This time is different.

Those of us who have invested through multiple recessions have heard it again and again. The hope that this time is different means investors remain committed to risk. Yet inflation is falling rapidly in the US and Australia. Labour markets are softening. Earnings growth is moving toward recessionary levels. Consumers are feeling pain and will retrench further through 2024.

Hope is no investment strategy, and right now, investors should avoid chasing risk and instead hunker down into asset classes that will build resilience through 2024.

Inflation is falling rapidly in the US and Australia

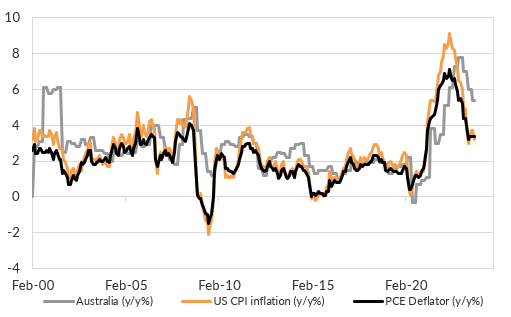

Inflation is slowing from peaks in 2022. The Fed hiked more aggressively than the RBA, and that means inflation is cooling slightly slower in Australia than in the US.

Chart 1: Inflation has fallen from its peak in the US and Australia.

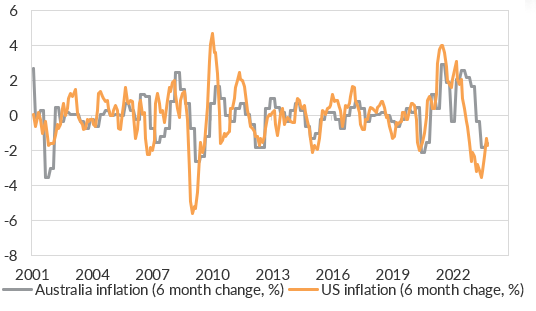

But for all the worrying about inflation, it is slowing incredibly quickly. Chart 2 shows the 6-month rate of change of inflation. Yes, inflation has slowed faster during the GFC in the US and Australia. But inflation has slowed faster than during the pandemic in the US and odds are that by the time Q4 ends, that will be true in Australia. Clearly, rates are restrictive.

The two central banks that matter most for Australians have inflation falling faster than any time in the past 20 years except for the worst recession most of us will see in our lives. The bottom line is, rates are very restrictive. True, Australia's disinflation has been a little slower than the US experience. But that is going to accelerate as the Australia mortgage belt rolls off fixed rate loans to floating. The RBA will pause to gauge that effect, and by end of Q1 rolls around, I expect Australian inflation will be collapsing.

Chart 2: Inflation is slowing incredibly quickly.

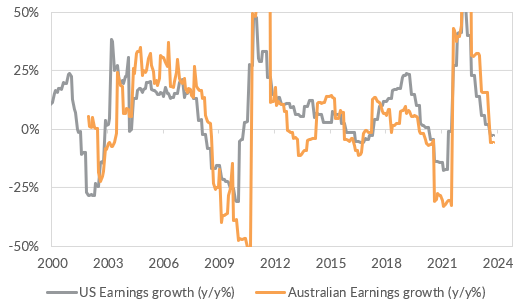

Corporates are feeling the pain and more is yet to come

Declining sales revenue and profit margins that are well below their peak have left earnings growth negative in the US and Australia. Consumers are feeling cumulative pain from rate hikes and higher prices.

A good indicator of that pain is one-year consumer inflation expectations in the US that increased to 4.5% from 4.4%, even as actual inflation is collapsing. Consumer spending is going to slow. Revenues will fall further. Margins will fall further. Earnings will fall further. This time is no different. This is true in Australia as well as the US.

Chart 3: Earnings growth is already pointing to a recession.

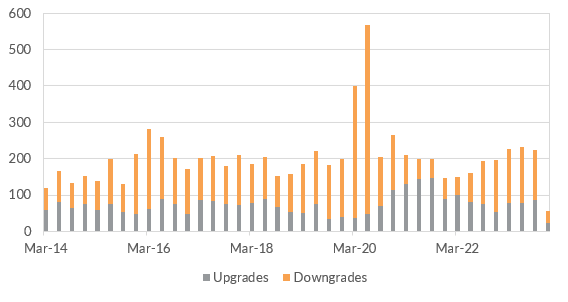

Avoid credit as the economy slows

Credit spreads have remained remarkably tight in both investment grade and high yield. This has been a key driver of the hope that this time can be different. Yes, corporate Treasurers termed out their debt at low yields in the US.

But there is a maturity wall approaching and with Treasury yields much higher than we’ve seen in a decade, high-yield corporates are going to be refinancing in 2024 at yields typically associated with distress. The fundamentals are already showing difficulties as credit rating downgrades are surging.

Chart 4: Credit downgrades are trending in a worrying direction for the high-yield market.

A recession could happen in the US and Australia sooner than most expect.

The Fed is done hiking. The recent minutes all but confirmed that. The RBA is also likely to do everything it can to avoid hiking again. We know from history that around 6-9 months after the Fed implements its final hike, the US economy crashes and rate cuts begin.

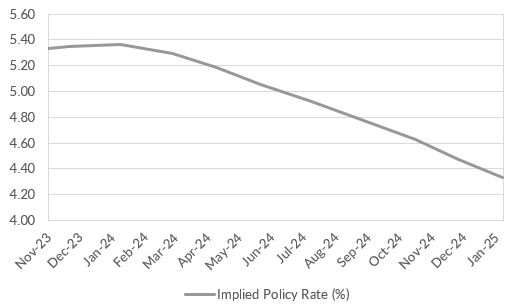

In a recent wire, I highlighted three key metrics that show we are already on that path. Given a final hike in July, I expect March could be confirmed as the beginning of a US recession. Pricing for 4 cuts is likely to be way under the mark. A total of 8 to 12 cuts is more likely. Markets are not pricing that in. The hope is that this time is still being priced in.

Chart 5: The US Fed Funds rate is likely to be cut more aggressively than markets expect.

What does it mean for investors?

In summary, this time is unlikely to be different no matter how much the soft-landing brigade hopes it will be. The economic data are already deteriorating, and the Fed and the RBA are likely to be cutting sooner and more aggressively than the market has priced in. This has some clear implications for investors.

1) Do not chase equity risk: This equity market rally is absolutely typical at the end of the rate hike cycle. Fundamentals are bad and deteriorating. Broad equity market beta - represented by a passive index - is likely to be hammered at some stage in 2024. Use rallies to lighten up exposure.

2) Move to defensive equity positioning: A slowdown in consumer spending will hurt cyclicals - think consumer discretionary and real estate. We currently favour quality value both in Australia and globally. This includes sectors like consumer staples and health care. This has been beneficial during Q3, but painful during November. It could be painful in December as the Christmas rally is delivered. But it will be critical in protecting the downside in the first half of 2024.

3) Shift to highest quality credit: High-yield credit has performed well over the past year. But the fundamentals are already deteriorating and high-yield credit delivers equity-like losses in recessions. We have shifted to the highest quality, short-spread duration credit. That means a bias towards Australian credit.

4) Government bonds are critical downside protection: We have been overweight government bonds through 2023, with a bias towards short-duration Treasuries. We extended duration as yields surged by buying longer-dated Treasuries. While longer-dated Australian Government bonds currently offer higher yields than US Treasuries, we expect the Fed will cut more aggressively than the RBA, and that leaves us preferring US Treasuries over Australian bonds.

5 topics