A thoughtful Federal budget

Morgans Financial Limited

The Budget balance is set to improve at a steady rate. This will reassure the rating agencies. The understanding that house prices can be brought down by increasing supply has been suggested previously by the RBA. This Budget provides policies based on that insight.

Increasing Housing Supply

This Budget shows that there has been considerable development of policy detail over the last year. An example of this is in the housing sector. We have commented previously on RBA Governor Phil Lowe’s speech in Melbourne in which he pointed out the problem of house prices is a problem of under supply.

This under supply was in turn a problem of underdevelopment in infrastructure, particularly transport infrastructure.

This Budget approaches this issue in a number of ways. Firstly, there is increased investment in Urban Infrastructure, particularly Transport Infrastructure. Secondly, there is an approach towards investment incentives to increase the supply of housing.

For example, the Commonwealth will replace the National Affordable Housing Agreement that provides $1.3 billion every year to the States and Territories, with the same level of funding but requires the States to deliver on housing supply targets and reform their planning systems.

In addition, there is a $1 billion Housing Infrastructure facility to fund City Deals that remove infrastructure impediments to developing new homes (City Deals involve Federal government loan money provided to municipalities.

This money is paid back in the long term by a very small increase in city rates). One of these City Deals will be in Western Sydney. This should help to deliver tens of thousands of new homes.

In addition, the capital gains tax discount is increased to 60% for investments in affordable housing. This will increase investment in affordable housing and increases supply.

These policy initiatives are much more intelligent than others which sought to increase taxes on investment in housing. These initiatives would have reduced the supply of housing.

The Big Bank Levy

This Budget introduces a six basis point levy on big banks liabilities. Six basis points is 0.06%. This bank levy appears to be based on the model used in the UK. The forward estimates suggest this will secure $6.2 billion for this Budget and future Budgets.

These kinds of levies assume that the big banks are in a position of non-competitive advantage where they can generate excess profits.

Infrastructure

The Budget is remarkable for the number of infrastructure initiatives. The Western Sydney Airport Corporation is provided with $5.3 billion in equity over the next ten years. $10 billion is invested in a National Rail Program.

Programs in Adelaide, Brisbane, Melbourne and Sydney all have the potential to be supported through this program (subject to a proven business case). $8.4 billion will be invested in the Melbourne to Brisbane Inland Rail Project.

Construction of this 1,700km project will begin in 2017/18 and support 16,000 jobs at the peak of construction. The project will benefit all of the regions along its route.

Fiscal outlook

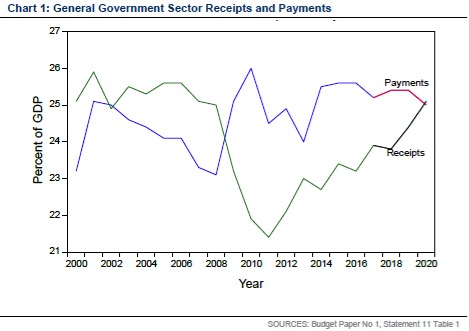

In Chart 1 above we see receipts and payment for the Australian general government sector over the period from 1999/2000 up to and including 2019/2020. The chart shows us the extraordinary expansion spending in 2009/2010 and the slump in revenue at the time of the Global Financial Crisis.

The struggle has been in recent years to get the Budget back into the kind of balance that it was before the Global Financial Crisis.

The path of the move back to balance is remarkably similar to that of last year’s budget papers. This must be calculated to support the confidence of rating agencies. In 2017/18, receipts are expected to be 23.8% of GDP. This moves up to 25.1% of GDP in 2020.

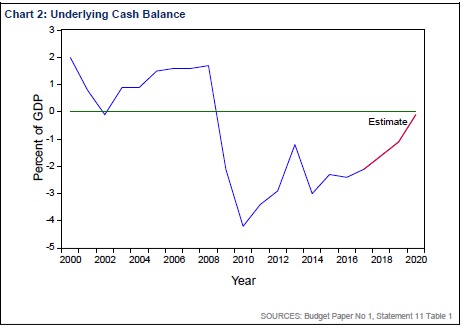

Payments in 2017/18 are 25.2% of GDP. The Budget Papers suggest that this will move sideways to 25.0% of GDP in 2019/20. This generates an improvement in the underlying cash balance. This balance is shown in Chart 2.

The underlying cash deficit in 2016/17 is estimated to be 2.1% of GDP. This eases to a deficit of 1.6% of GDP in 2017/18. By 2019/20, the Budget should be in balance with a deficit of only 0.1% of GDP. The following year sees a small surplus of 0.4% of GDP.

Where the money is going

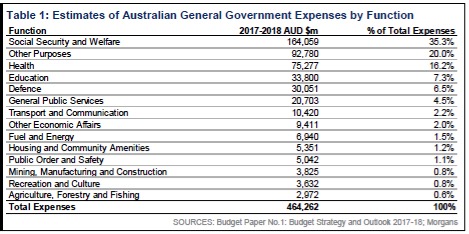

In Table 1 above, we can see where the money is going. In 2017/18 the largest single sector of expenditure is Social Security and Welfare. $164 billion or 35.3% of the Budget goes to this area. Other Purposes is the next sector.

What, you ask, are other purposes? This sector is the amount that we pay on servicing the debt for the money we previously spent. This is 20% of Budget expenditure. It is a total of $92.8 billion.

Next comes Health. Here we spend $75.3 billion or 16.2% of the Budget. Education comes next with $33.8 billion of expenditure. This is 7.3% of total spending. Only then do we think about defending the country. Here, we spend $30 billion a year. This is 6.5% of the Budget.

It is worth observing that we spend five times as much on Social Security and Welfare as we do defending the country.

The Economic Outlook

Budget Paper No 1 suggests that the Australian economy is recovering. Treasury expects 2.75% growth in 2017/18. This increases to 3% in 2018/19 and remains at that level for the next three years. This is slightly less optimistic than the outlook provided by the International Monetary Fund. The IMF sees growth moving forward at about 3.1%.

The Budget papers show unemployment of 5.75% in 2017/18. This unemployment rate then stabilises at 5.5%. We think this is a reasonable estimate of where unemployment is going. Still, we remark that the IMF is far more optimistic. The IMF sees unemployment declining to 5% and lower over the next few years.

The CPI is expected to increase by 2.0% in 2017/18. It then increases to 2.5% by 2019/20. These kinds of estimates of future inflation are similar to those of the RBA. We do not think that any of these estimates are too optimistic.

Compared to the IMF, for example, the outlook contained in the Budget Papers is modestly conservative.

Conclusion

The Budget balance is set to improve at a steady rate. This will reassure the rating agencies. The assumptions upon which the Budget is based cannot be described as too optimistic. In fact, they are modestly conservative.

What we see in this Budget is a rare example of thoughtful policy development at a detailed level. The investment in infrastructure is much to be commended.

The understanding that house prices can be brought down by increasing supply has been suggested elsewhere by the RBA. That politicians can bring forward policies based on such correct insights as we see in this Budget, seems in Australian politics, a sadly rare event.

Contributed by Michael Knox, Chief Economist and Director of Strategy: Original blog here: (VIEW LINK) or listen to podcast here:

1 topic

Morgans is Australia's largest national full-service retail stockbroking and wealth management network with over 240,000 client accounts, 500 authorised representatives and 950 employees operating from offices in all states and territories.

Morgans is Australia's largest national full-service retail stockbroking and wealth management network with over 240,000 client accounts, 500 authorised representatives and 950 employees operating from offices in all states and territories.