America at a policy crossroads

President Trump’s policy approach thus far has focused on cutting taxes, redefining the US relationship with major trading partners – most notably triggering the trade war with China – and weakening regulation, particularly with regard to environmental protection. While he has not released an explicit set of policy proposals for this election, we would expect his behaviour to be similar in terms of having a preference for keeping taxes low, regulation loose and reigniting tensions with major trading partners, particularly China.

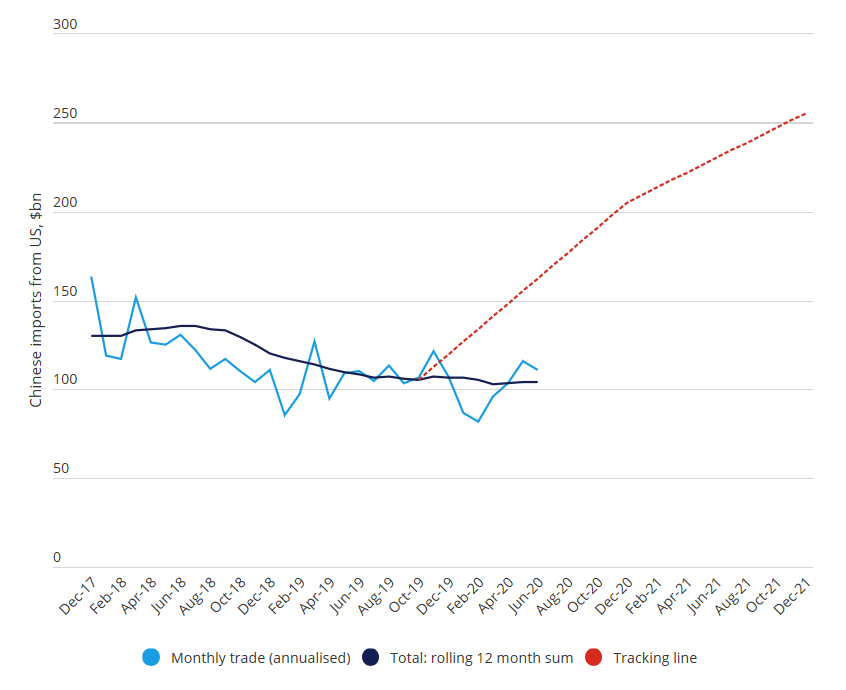

It is perhaps easiest to predict with confidence the policy outlook for those areas in which the President holds significant executive power, such as regulation and trade policy. On the former, we expect much of the same: expect the unexpected. If the Phase 1 Trade Deal doesn’t fall before the election, it is highly likely to do so in the second term, particularly as Chinese purchases seem likely to undershoot the agreed $2bn. Further political escalation is also likely and increasing concerns about wider US-China conflict will rise. Beyond China, we expect that President Trump would also continue to spar with the EU, particularly on the issue of digital taxation and trade balances.

Chart 1: US-China trade deal under even more pressure in a second term

Similarly, the President holds significant executive power around regulation, and we would expect Trump to continue to support looser regulation, particularly on the environment and financials while tech and pharmaceuticals are likely to see some regulatory tightening at the margin.

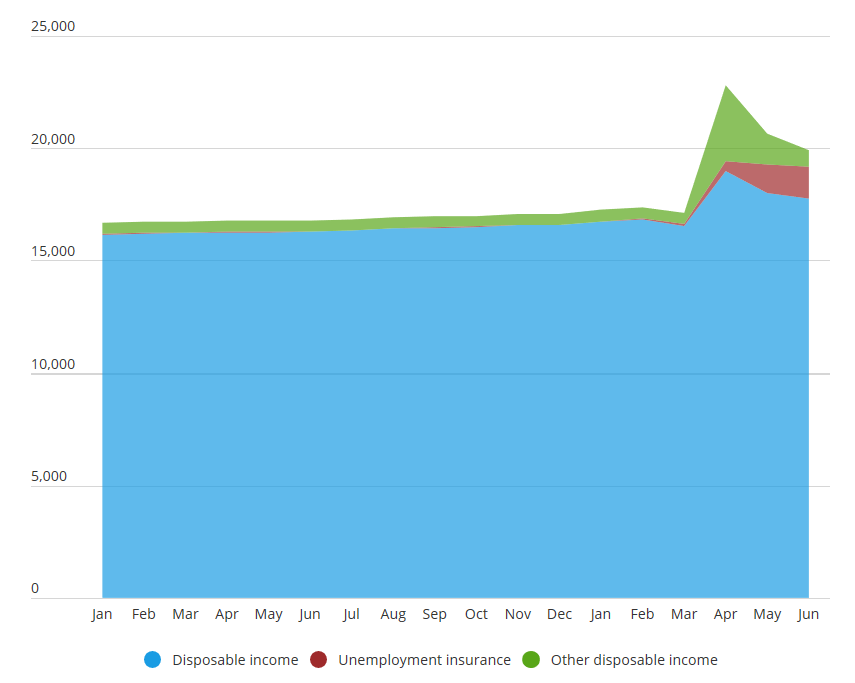

However, those areas in which the President is required to work with Congress are more complicated. When it comes to fiscal policy, Trump’s administration has hemmed closely to the traditional Republican notion of cutting taxes while resisting major expansions of public services, and successfully delivered a tax cut plan with the help of a Republican Congress early in his term. However, the coronavirus crisis has led to huge temporary expansions of entitlement expenditure, tax rebates, funding for state and local governments and support for businesses, delivered by a split Congress.

The fallout from this shock and its severe impact on the public finances is expected to define at least the early stages of the next Presidential term.

Trump has shown that he favours tax relief style measures, such as payroll tax cuts and stimulus cheques, but has been open to a broader range of policies aimed at kick-starting economic activity. More generally, it is not apparent that the President shares the concerns that some of his Republican colleagues hold over debt.

Chart 2: US Stimulus has shielded incomes so far

The President’s ability to carry out fiscal policy in a second term will depend crucially on the makeup of Congress. If Republicans have control of both House and Senate, we expect fiscal policy to reflect a slightly more generous but still traditionally Republican fiscal approach. We would expect a gradual tightening of fiscal policy, following the explosion in the deficit this year, particularly on the government spending side, while taxes would remain low. If managed carefully, this consolidation does not need to weigh very significantly on headline growth. Moreover, low taxes would provide support for corporate earnings and may be well-received by markets. Indeed, Trump seems likely to try to extend expiring individual income tax cuts and corporate tax reform provisions such as bonus depreciation, and may push for further tax relief.

If the Democrats hold a majority in the House, we would expect that fiscal negotiations would be more challenging but might actually result in greater government spending, depending on how the politics plays out in budget negotiations. The CAREs act provides a good example of how bipartisan legislation can become large, albeit during a period of acute crisis. However, in this environment further tax cuts look very unlikely given Democrat objections in the House.

One key tenet of Trump’s election strategy that is likely to return is an infrastructure bill, which he did not manage to secure in his first term. The challenge for Trump will be squaring the circle between Democrats who want the government to fund infrastructure spending through higher taxes or borrowing and Congressional Republicans who strongly prefer incentivising a smaller private sector-led/public-private approach.

Otherwise, the President has put significant pressure on the Federal Reserve, and in particular Chair Powell, to deliver supportive monetary policy settings, and has nominated a number of political appointees for Federal Reserve Board vacancies. Judy Shelton is currently awaiting a confirmation vote in the Senate and has been criticised for her politicised policy stance. Powell’s term is due to end in 2022 and it seems unlikely that the President would want him to serve a second term.

If Shelton makes it onto the Fed Board, the President could nominate her as the new Chair. This would need to be approved by the Senate, and this controversial choice would meet significant resistance from a Democrat-led Senate, and potentially even a Republican Senate, particularly with a small majority. However, if successful, a Shelton-led Fed would raise grave concerns over the independence of the central bank.

How different would policy look under a Biden Presidency?

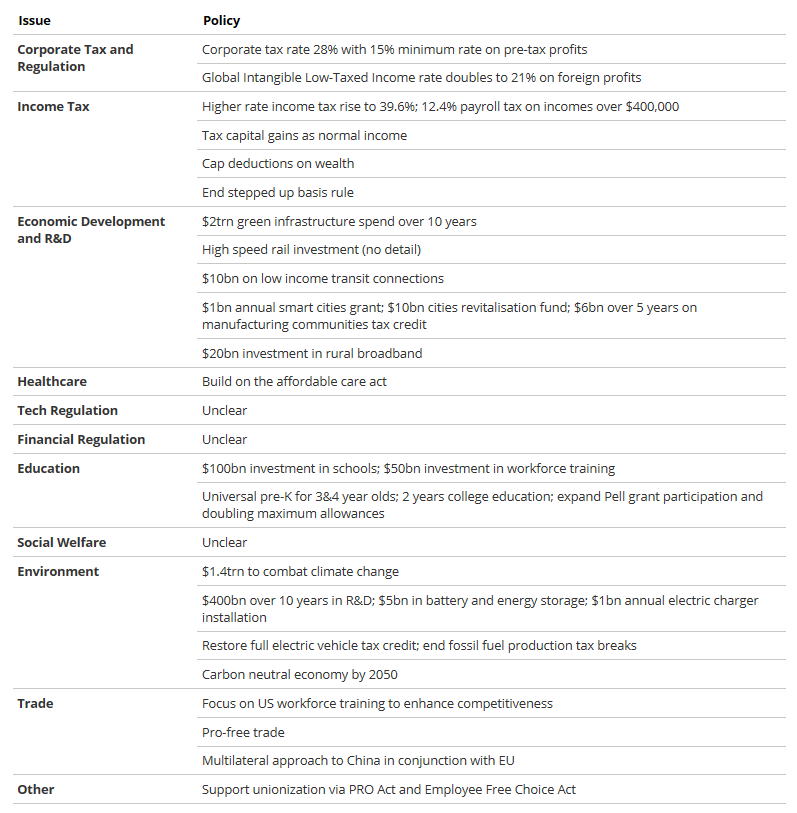

Biden would face the same economic and fiscal challenges around the Covid crisis. However, his preferred response is likely to be quite different. Biden’s policy proposals suggest a substantial shift in the composition of fiscal policy towards greater spending funded through higher taxation, in particular through hiking corporate tax rates and taxes on higher income households (see Table 1). He is also likely to take a very different line on a host of regulatory issues and foreign/trade policy.

Again, focusing on the areas in which he would have most control first, regulation would be likely to tighten for certain sectors under Biden. We expect energy, tech and financials to be high on the agenda though precisely which regulatory changes are likely remains to be seen.

Biden would also tighten regulation and endorse legislation to tackle climate change and boost renewables. The combination of focus on green infrastructure and job creation in his policy proposals alongside a tightening in regulatory standards on emissions and empowering the Environmental Protection Agency are likely to challenge traditional high-emitting industry but make winners of renewables providers and suppliers to the sector.

While Biden does hold significant executive power around regulation, there is a strong likelihood that tightening policy prompts legal challenges. This will pit him against the judicial system and Supreme Court. Following significant appointments of judges (and a Supreme Court justice) over recent years by President Trump, there is a chance that the legal system resists some of these efforts.

Otherwise, we would expect Biden to strike a more strategic, multilateral approach to trade policy, notably improving relations between the US and European allies. One likely consequence of a more constructive US-EU partnership is progress on the OECD digital taxation initiative. On China, Biden is unlikely to rapidly reduce trade barriers with China given the domestic political backdrop, opting instead for a strategic review of the relationship and engaging with multilateral organisations more. This should nonetheless help reduce headline volatility and fears of de-globalisation.

On fiscal policy, Biden has set out a series of significant increases in taxation. The Tax Foundation and Tax Policy Centre (TPC) have estimated that a range of higher corporate and individual taxes would raise between $3.8-4tn over the next decade (absent growth effects), representing 1.5% of GDP over this period, and more than reversing the tax cuts delivered by President Trump. Tax hikes of this magnitude have only been seen during WWII and the Vietnam War, which might place some caution around the scale of these plans. The tax increases would be highly progressive, with the TPC estimating they would increase average tax rates by 12% for the top 1% of earners, and 16.3% for the top 0.1%.

These revenues are intended to fund a significant increase in expenditure. Biden has announced a host of prospective policies including a large green infrastructure and jobs investment plan ($2tn), changes to social security, education investment, housing assistance and a public insurance option for Affordable Care Act Marketplaces.

Table 1: Biden policies signal major shift in tax and spending

Congress would be crucial for any fiscal plans if Biden was to win the Presidency. The probability of a Democrat majority in the Senate has increased in recent weeks, which would make legislating his policies easier. Most of these measures look possible through the reconciliation process, although these would have to be in aggregate budget neutral after 10 years to avoid falling foul of the Byrd Rule. Similarly, the size of the Democrat majority is crucial: the narrower the majority, the more challenging it will be to pass his fiscal plans in full. It also matters who makes up that majority: Senators from states with a stronger Republican lean or who are themselves centrists may baulk at significant tax hikes. Of all of our scenarios, this appears to imply the most significant change in terms of composition of tax and spending, with winners likely to be low-middle income families and corporates that interact with key spending areas like healthcare, education and infrastructure.

Meanwhile, if Republicans retain the Senate, this would torpedo Biden’s broader policy objectives until the midterms at the earliest. Worse, there is a good chance they will follow the conservative playbook from the Obama years and try to force a more abrupt and aggressive fiscal tightening, leading to a substantially weaker recovery.

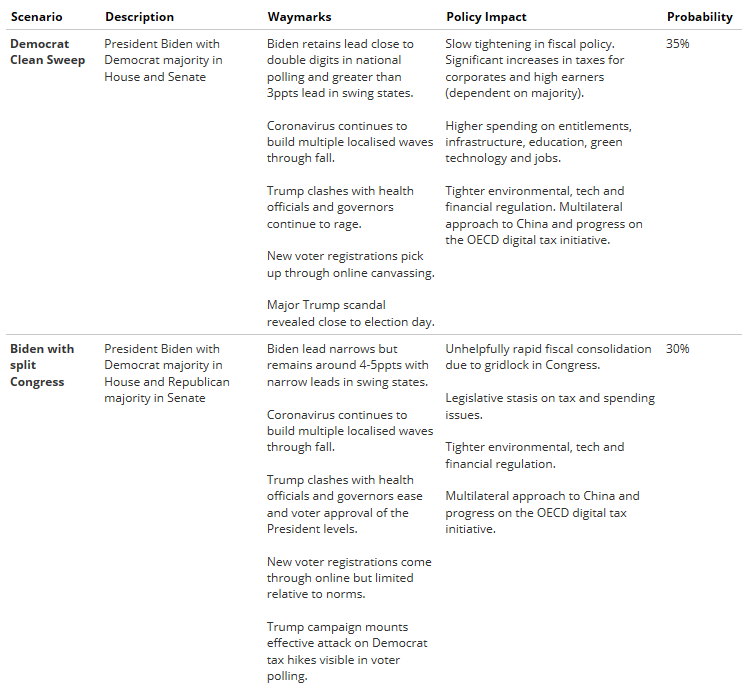

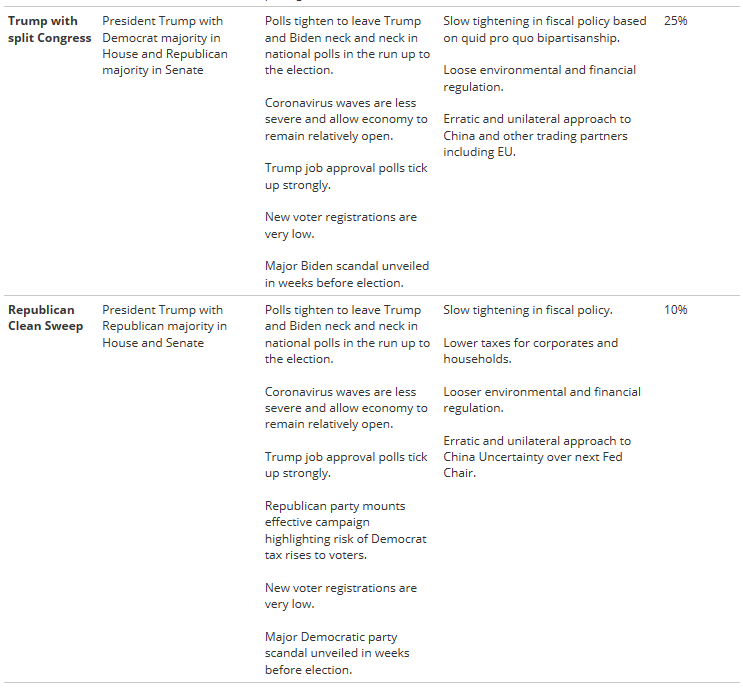

What is the likelihood of each of these outcomes?

As things stand, we think that Joe Biden is in a strong position to win the Presidential election thanks to his strong polling at national and swing state levels as well as voter demographics, the latter of which we will discuss in the next long-form edition of this series.

- However, with almost 100 days to go, there is plenty of time for the Republican Party’s campaign to erode Biden’s lead. The waymarks we are watching include:

- Signs that Biden’s demographic advantage is not coming through in terms of new voter registrations and approval from key voter groups

- Economic data that suggest substantial improvements in unemployment rates in key states

- Trump’s approval ratings in terms of the economy and coronavirus, particularly in swing states

- The prevalence of the virus across Republican and swing states in particular and the economic impact of any re-imposition of local lockdowns

Table 2: US Election Scenarios

Interested in macro insights?

Jeremy Lawson is Head of our Research Institute providing projections and scenario analysis for the global economy. Follow him here to stay up to date with our latest content.

3 topics

1 contributor mentioned

.png)

.png)