Are broker stock ratings worth the paper they're written on?

It's not uncommon to hear broker research ratings being dismissed by investors. So, in this brief wire, I'll outline some of the Plato Investment Management team's data and perspectives on the topic.

One key area of criticism is conflicts of interest. It is true that investment banking (advisory and underwriting) is one of the most lucrative revenue sources at the very same companies that produce company ratings.

At the three largest global banks, JP Morgan, Goldman Sachs, and Morgan Stanley, investment banking makes up 50%, 40%, and 40% of revenue respectively. The investment banks of course counter that Chinese walls are in place preventing the corruption of analyst research by their investment banking departments.

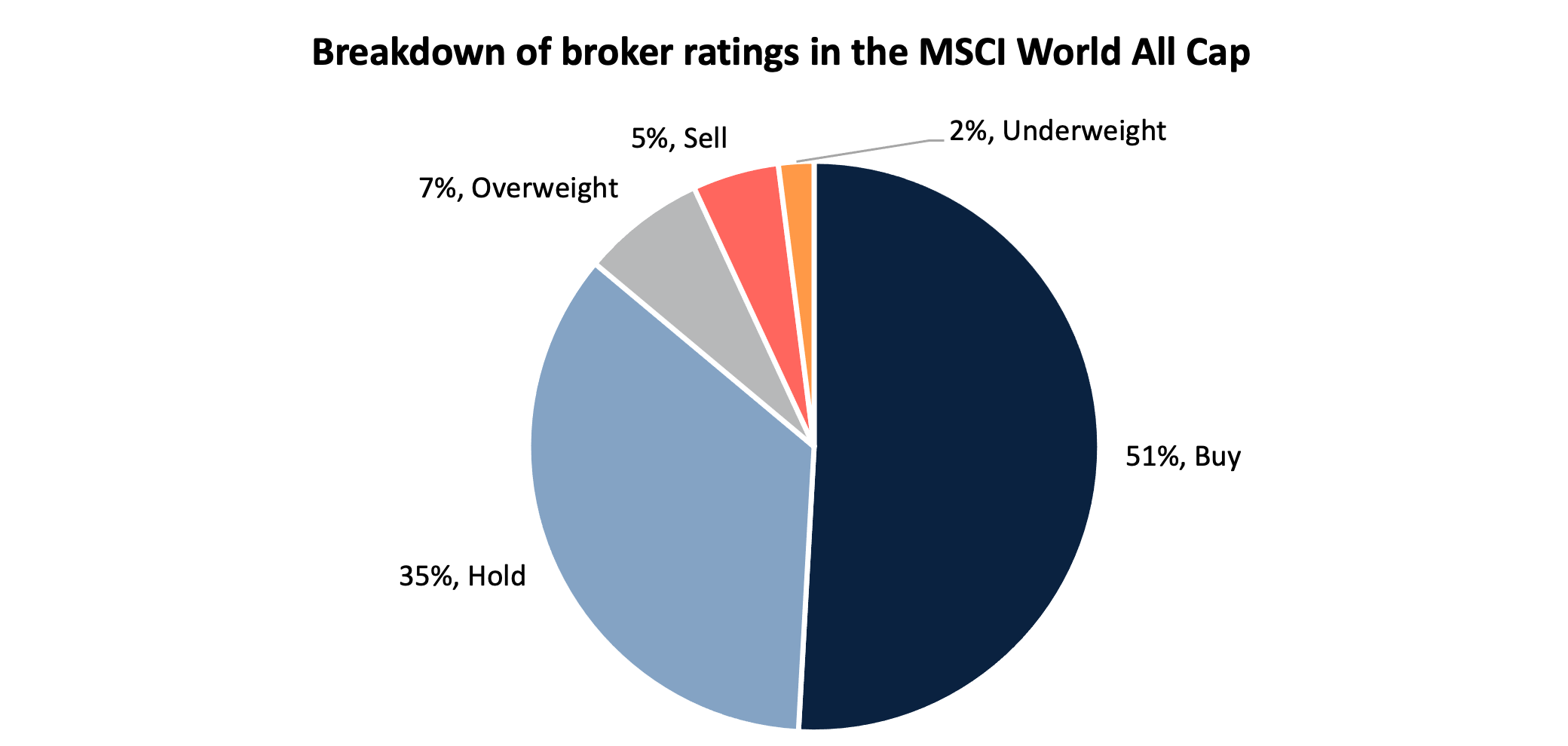

The chart below shows the breakdown of ratings globally as of this morning - 51% are Buys and just 5% are Sells.

If the market is even close to equilibrium, one would expect the number of buy and sell ratings to be roughly equal. This bias towards Buys is persistent over history, and rightly shakes confidence in the utility of broker ratings.

So, how well do broker analyst ratings predict future stock price performance?

The result may surprise you.

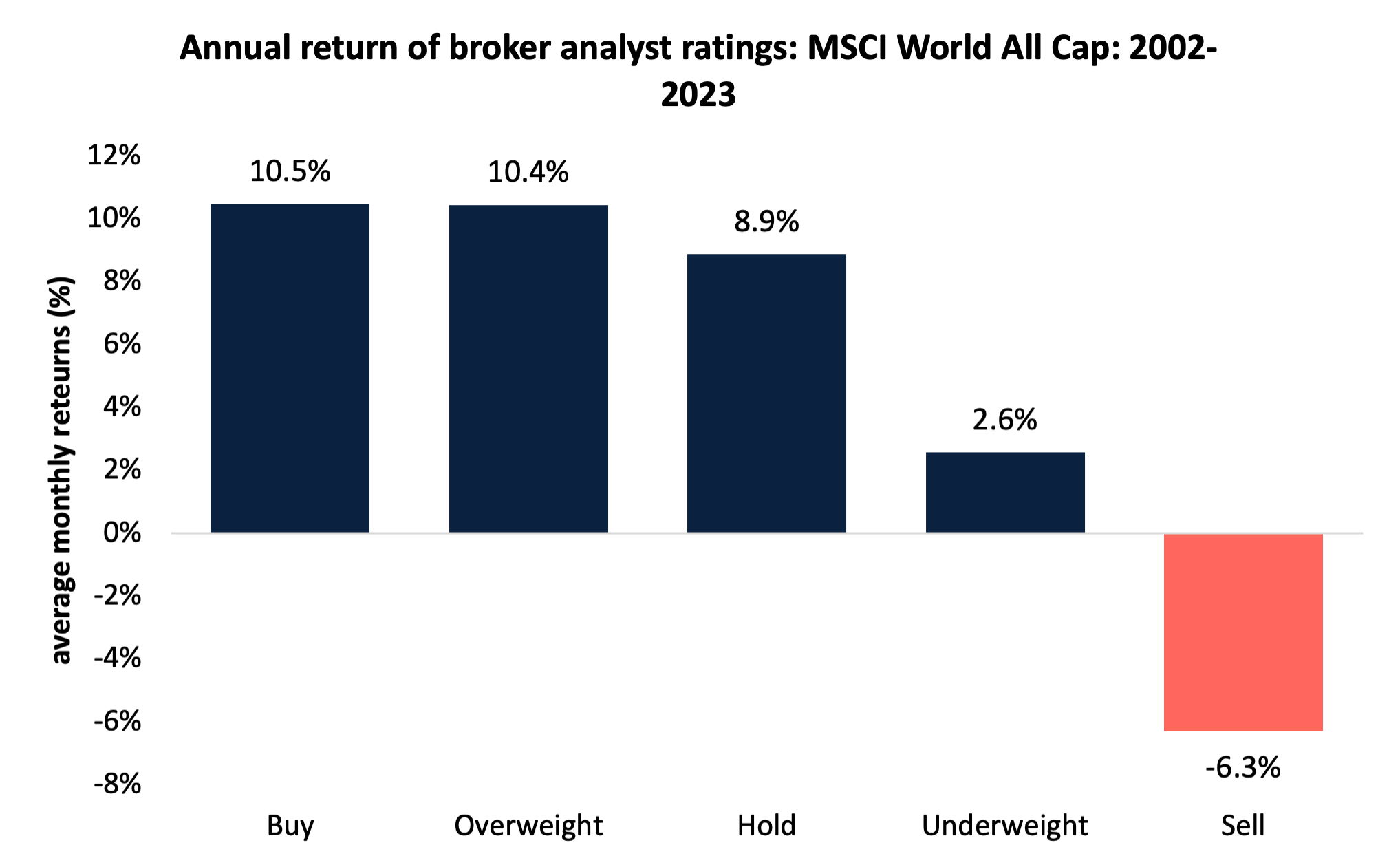

In the chart below we show the one year forward total return of stocks by consensus broker rating for companies in the MSCI World All Cap index for the period 2002-2023.

Buys (10.5% p.a.) outperform Overweights (10.4% p.a.), Overweights outperform Holds (8.9% p.a.), Holds outperform Underweights (2.6% p.a.), and Underweights outperform Sells (-6.3% p.a.).

The Sell ratings are particularly informative.

The potency of Sell ratings makes perfect sense when you consider internal pressures. For a broker to give a company a Sell rating, you could indeed surmise the company needs to be a real basket case.

A large number of Sell ratings is one of Plato’s 100+ Red Flags that we look at before making any investment, long or short.

Here are the top five ASX 300 stocks with the poorest consensus sell-side ratings.

Poorest consensus broker ratings |

||

Company |

GICS sub industry |

Analyst consensus |

BWP Trust |

Retail REITs |

Sell |

Appen Ltd. |

IT Consulting & Other Services |

Underweight |

Reece Limited |

Trading Companies & Distributors |

Underweight |

Platinum Asset Management Ltd |

Asset Management & Custody Banks |

Underweight |

Sigma Healthcare Ltd |

Health Care Distributors |

Underweight |

And here's five of the strongest.

Strongest consensus broker ratings |

||

Company |

GICS sub industry |

Analyst consensus |

Resolute Mining Limited |

Gold |

Buy |

Life360 Inc. |

Application Software |

Buy |

Lake Resources N.L. |

Diversified Metals & Mining |

Buy |

Boss Energy Limited |

Coal & Consumable Fuels |

Buy |

Vulcan Energy Resources Ltd. |

Diversified Metals & Mining |

Buy |

Final word

The severe slant towards Buy ratings suggests analysts are loathe to give companies Sell ratings.

However, despite the potential conflicts that do cloud views research ratings, the hard data shows that on average and across time, broker analysts tend to get it right.

For full transparency, The Plato Global Alpha Fund is currently short Australian commercial REIT, BWP Trust.

Fund in Focus: Plato Global Alpha Fund

1 topic

10 stocks mentioned