Charts and caffeine: Morningstar's two newest, best ASX ideas

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,831 (+0.19%)

- NASDAQ - 11,772 (+1.68%)

- CBOE VIX - 27.86

Markets started slow but eventually reversed their losses overnight. Corporate earnings will start to flow through this month in the US.

- FTSE 100 - 7,025 (-2.86%)

Big news overnight with two key senior cabinet ministers in the Johnson administration resigning. The two are Chancellor (aka Treasurer) Rishi Sunak and Health Secretary Sajid Javid. Johnson vows he'll stay on - but for how long is the question.

- STOXX 600 - 400.68 (-2.11%)

- USD INDEX - 106.53

- US10YR - 2.829%

US Treasuries rallied as talks of easing tariffs on China imposed by the former administration failed to alleviate recession fears.

In currencies, the US Dollar is (again) the safe haven of choice while the Euro hit a 20-year low against the greenback. Parity anyone?

- GOLD - US$1,765/oz (-2.01%)

- WTI CRUDE - US$99.67/bbl (-8.09%)

- COPPER FUTURES - US$3.44

Commodities from oil to copper remained under pressure. Oil closed under $100/barrel for the first time since May, gold is at six-month lows, and copper futures are not looking hot either.

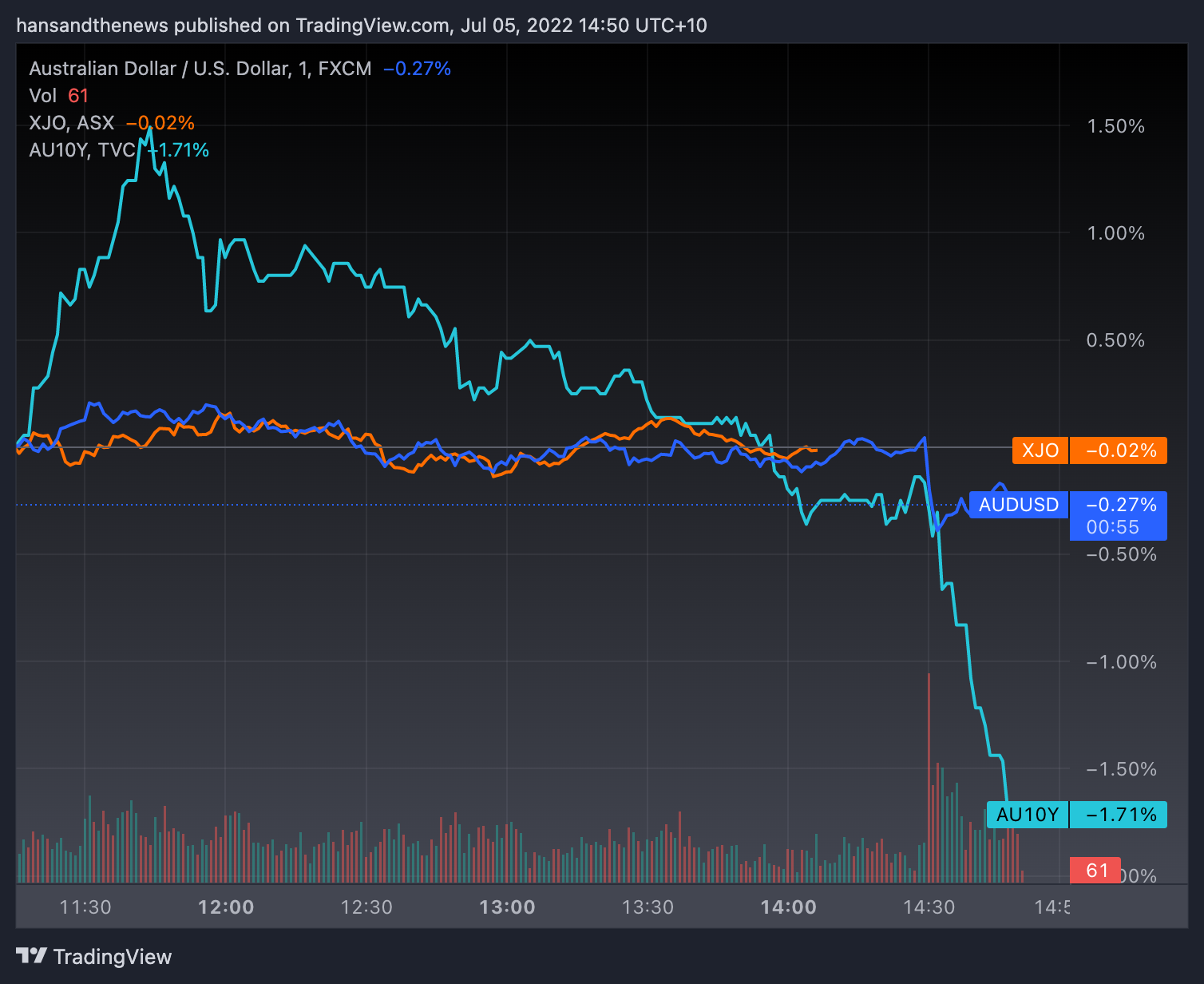

RBA WRAP

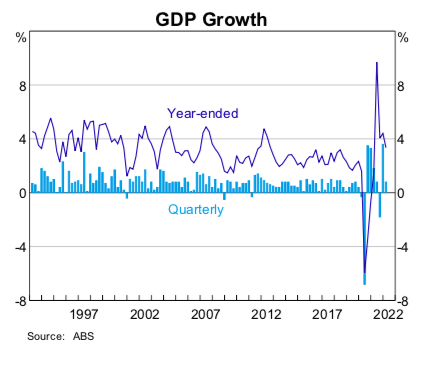

Yields headed south while the Australian dollar was essentially left unnerved following the RBA's decision to hike rates by 50 basis points to 1.35%. It's the first time ever that the RBA has hiked rates by 50 basis points on back-to-back occasions.

There was not much new in the actual statement, but the reference to the east coast floods was widely expected (it adds fuel to food price inflation etc.) Other than that, the RBA is (still) data-dependent and inflation expectations will need to remain anchored so that consumer confidence doesn't get out of control.

Its colour commentary from here will be absolutely crucial - especially if it wants to keep this track record.

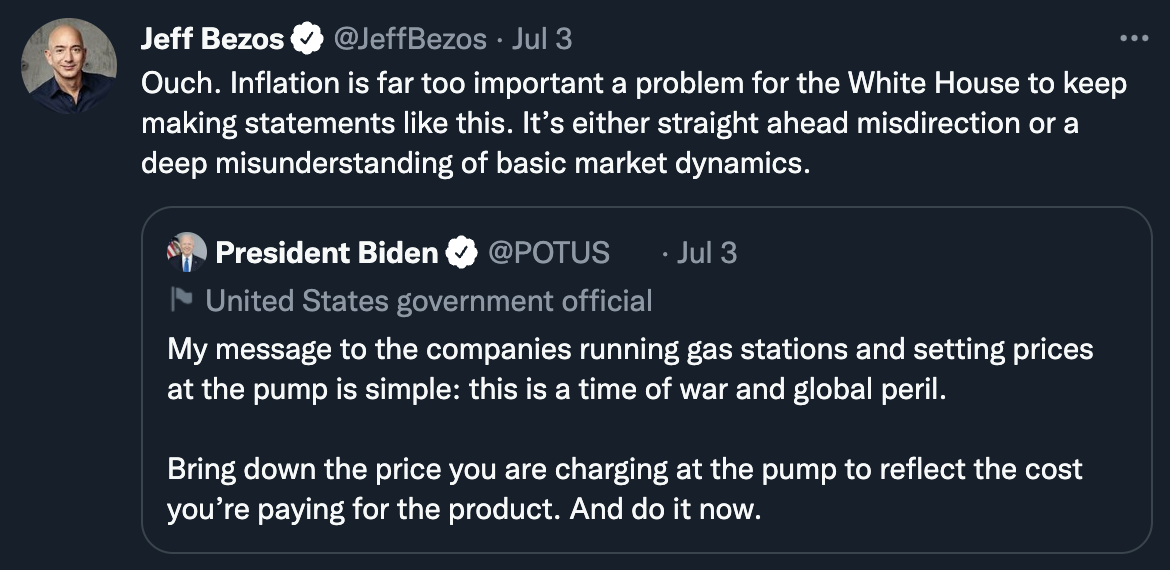

THE TWEET

THE CHART

STOCKS TO WATCH

Today's stocks to watch come from Morningstar's "best ideas" list. From 200+ companies, the team (led by Mathew Hodge) narrow it down to 15 names they would back.

Notably, Morningstar does not use a "buy, hold, sell" type system (outperform, add, underweight, lighten, etc etc). They prefer to think of companies as being "undervalued" (or over) and having a wide (or narrow) economic moat.

Knowing this information will be vital as we go through this month's list.

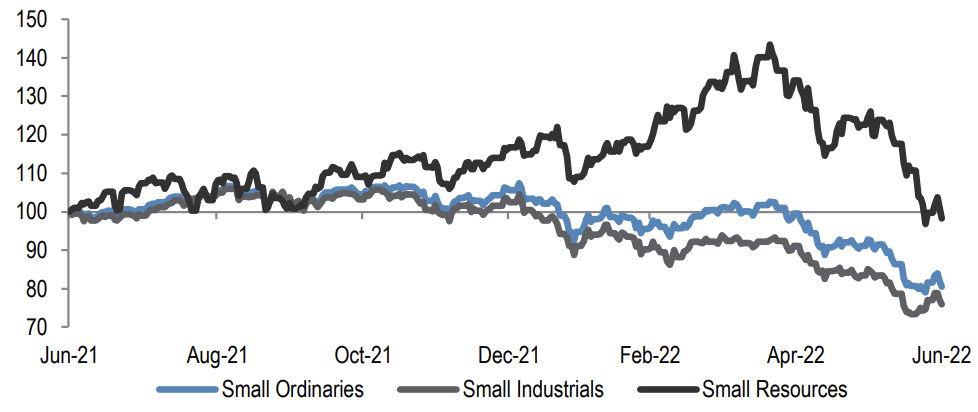

There are two additions to the 15-stock "portfolio" - Fineos (ASX:FCL) and Newcrest (ASX:NCM).

On Fineos, the team thinks the market is underestimating the potential upside which comes from adopting cloud software. Plus, the company's customers are becoming increasingly sticky (remember, recurring customers equals more sticky which equals brownie points.)

Notably, Fineos is picked as a 'best idea' but not any of the other insurers (e.g. IAG, QBE, SUN). Perhaps the disruptor is the way to go?

Their choice to add Newcrest, however, is far more interesting. Newcrest does not have a moat but analysts think it's still the pick among the miners. Traditionally, recessionary concerns have increased gold’s appeal as a safe-haven asset.

But as usual, it all comes down to production efficiency and costs. And that's Newcrest's largest challenge.

For the rest of the list, you can read the PDF attached to the end of this wire.

THE STAT

20% in May and 50% in June: The year-on-year increase in coal shipments from Russia to China. (Source: S&P Global Market Intelligence)

This is a particularly important stat for Australia. Why? We used to export a lot of coal to China. But since relations became frosty between Beijing and Canberra, coal shipments from Australia have been left stranded at the door.

The Xi administration now says it's interested in taking more imports from Russia and Mongolia. It will also ramp up more coal production inside the country.

Conclusion? Don't bite the hand that feeds you (even if you are still the number one coal exporter on Earth.)

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

2 stocks mentioned