Charts and caffeine: UBS reassesses ASX energy stocks

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,900 (-0.3%)

- NASDAQ - 12,008 (-0.81%)

- CBOE VIX - 27.40

- FTSE 100 - 7,258 (+0.69%)

- STOXX 600 - 415.08 (+0.52%)

- USD INDEX - 103.96

- US10YR - 3.204%

- WTI CRUDE - US$109.82/bbl (+2.04%)

THE CALENDAR

Pending home sales in the US came in a lot better than expected - up 0.7% on the month. Economists were expecting a large contraction.

Tonight, it's the all-important consumer confidence print in the US. Economists are expecting a big fall in the top-line number - in line with what we've seen in the UK. High inflation and even higher expectations do not make for happy households.

The G7 meetings are also ongoing and ECB President Christine Lagarde is delivering a speech at a forum in Portugal.

A Portuguese holiday away from the markets doesn't sound like a bad idea, right now...

THE QUOTE

Scholz could go down in history as the climate backtracking chancellor.

Speaking to France24, E3G's Alden Meyer wins our spot for our quote of the day. As Europe continues to wrestle itself out of the energy crisis, German leaders have proposed a walk-back on fossil fuel project financing.

Last month, the German climate minister said halting climate change can be accelerated by the phase-out of coal power. It even had "concrete steps" to bring forward plans to eliminate coal-burning in eight years.

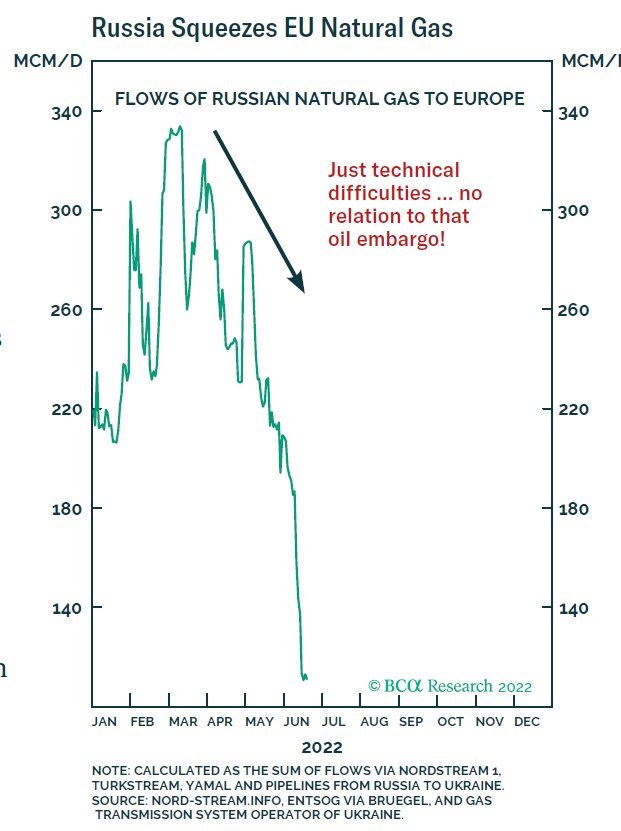

How times change. This chart from BCA Research accentuates the problem.

THE CHART

STOCKS TO WATCH

Speaking of energy, I thought we'd take another look at the ASX energy sector. This time, we'll look at it through the insane demand for natural gas.

The team at UBS lifted their forecast for natural gas prices by 14% - with the pass-on cost to consumers set to increase by 10%.

So what do rising gas prices mean for these companies' balance sheets?

For one - it's good news for struggling Origin Energy (ASX:ORG). Unlike its compatriots, shares are only up 7% this year. But Origin has the strongest position to capitalise on rising gas prices. The rising prices are also opportune for the company given its Eraring power station is back at full capacity - just in the nick of time.

Other companies to watch from this will be Beach Energy (ASX:BPT) and Santos (ASX:STO). In contrast, it's not so good news for AGL (ASX:AGL). The team expects higher domestic gas prices will pass on further gas margin pressure for AGL, which has additional gas supply to procure over the next few years.

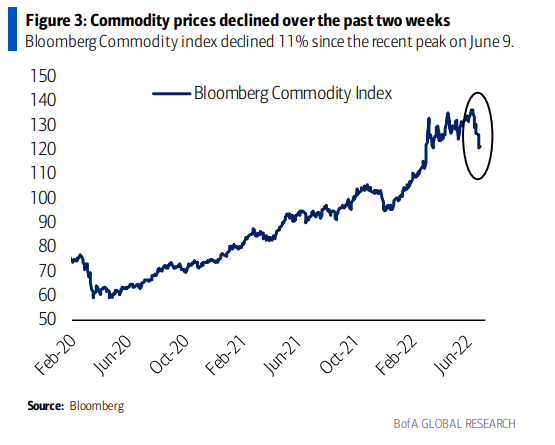

The good news for consumers is that prices have come off the boil. The bad news for consumers is that it hasn't been a lot of a drop in the grand scheme of things.

A side note (still on energy but not directly related to gas) - Ord Minnett has upgraded Qantas (ASX:QAN) to a buy after the company said it would be reducing capacity to combat higher fuel and resource prices.

While it's likely that their upgrade was more around Qantas' ability to survive in this tough market for travel, that was still interesting to read in its trading update.

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

5 stocks mentioned