Do LIC managers add value?

We’ve previously written about how the 14-month period from 31 January 2020 to 31 March 2021 provided the perfect opportunity to assess whether your fund manager has done a good job. That’s because January 2020 was the last monthly high before the pandemic hit markets. Then, March 2021 was the month the ASX200 Accumulation Index broke even again. Had you invested in the ASX200 at the January 2020 month-end high until March 2021, your return would have been just 0.7%. The index only recovered back to the starting point in that last month.

By looking at this period, you can get a feel for how a manager performed in both the downturn and the upswing. Although it’s a short period, it is, in effect, a complete market cycle. These are the periods when active managers should outperform (and earn their fees). But if they haven’t, you’re quite entitled to ask some hard questions as to why.

We’ve often spoken about how we believe the average LIC manager is vastly superior to the average unlisted fund manager. So, we took a look at those 14 months from market high to market high to see how the LIC managers went. Who made money, and who didn’t? Read on to find out whether LIC managers add value.

How we did it

For this exercise, we wanted to measure the investment performance of the LIC manager. So, we decided to ignore changes in LIC share prices and look only at the change in underlying NTA, plus dividends/distributions. This allows us to isolate the manager’s investment performance. But it excludes the impact of other market forces (i.e., change in discounts to NTA).

We may consider looking at the overall returns based on changes in share prices in a later article. But generally, discounts and premiums magnify market ups and downs. For example, if you had taken the plunge and bought an LIC in March or April of 2020, it’s almost certain that the current premium or discount is better than it was when you bought. That is, your returns would have been enhanced by the discount closing or even turning into a premium.

Now, back to manager investment performance.

We looked at the change in pre-tax NTA plus dividends and distributions paid between January 2020 and March 2021. This does penalise LIC managers slightly by including the impact of any tax on realised gains/profits. It also does not consider the effect of any corporate actions such as options and capital raisings. Even so, as you will see below, most managers still performed admirably even after this handicap. For LITs, the trust structure means that, like ETFs and unlisted managed funds, there was no direct tax cost to handicap them.

To make it easier to assess results and highlight areas where active management has worked best, we’ve broken down performance by strategy. In many cases, particular LICs could have qualified in more than one strategy. We’ve placed LICs with the peer group we feel is the best fit.

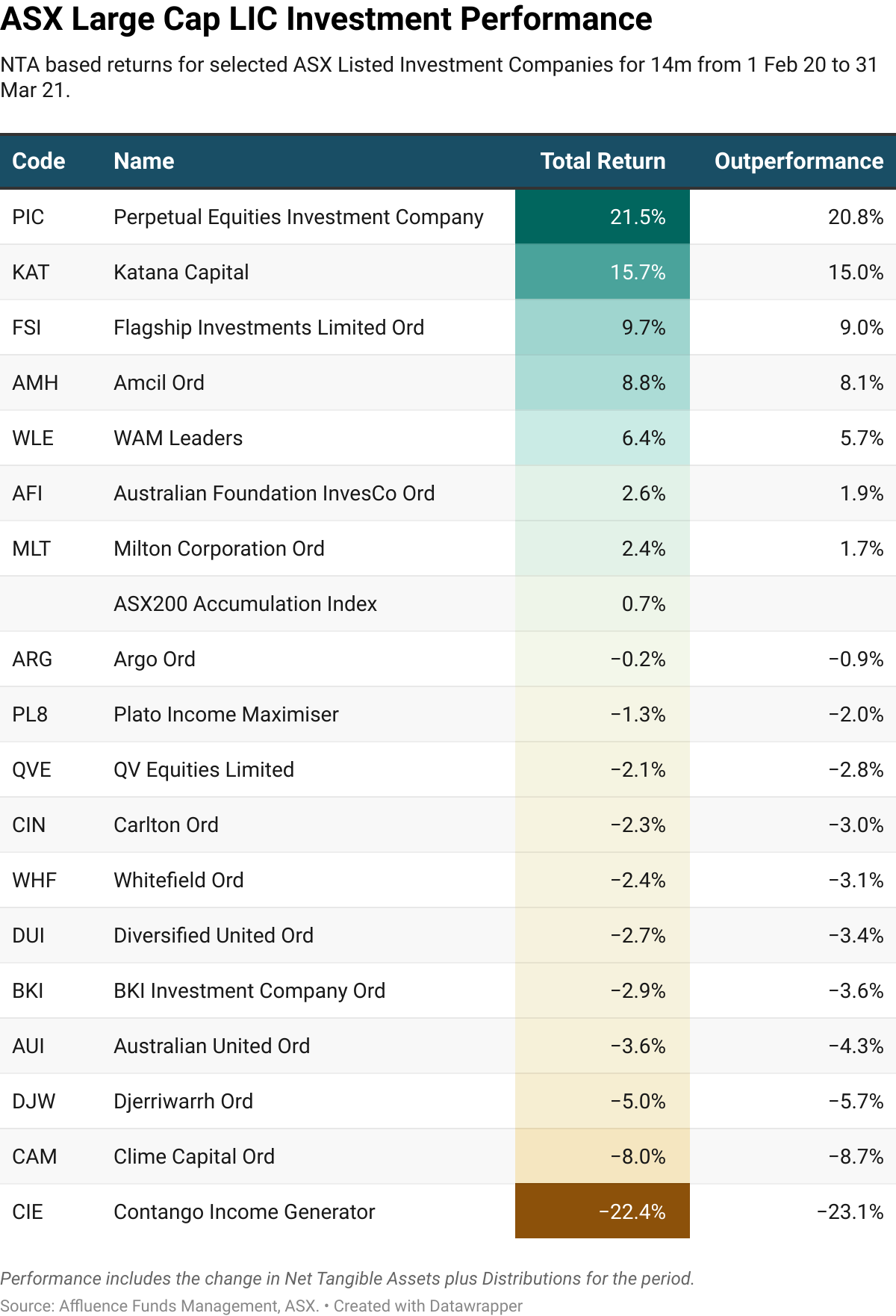

Australian Large Cap Equities

First up, let’s look at those LICs investing mainly in larger ASX stocks. Since the ASX200 Accumulation Index delivered 0.7% for the period, we’ve used this as a fair benchmark.

As you can see below, results have varied widely.

No doubt the star of the show was Perpetual. PIC delivered a total return of 21.5%. The result was helped by a small allocation to global equities and a resurgence in some of their favoured value stocks. Perpetual is one of the very few sizeable Australian fund managers that are genuinely differentiated from the index, and it has shone through. Other key outperformers were Katana Capital, helped by a decent allocation to resources, Flagship Investments, AMCIL and WAM Leaders.

What about the three largest LICs? AFIC and Milton added a small amount of value. Argo very slightly underperformed.

At the wrong end of the table, we have AFIC stablemate Djerriwarrh, where some upside from the recovery may have been lost via their strategy to write call options. In addition, Clime Capital performed poorly. Contango Income Generator also suffered badly as income stocks got hammered during COVID. This eventually resulted in the manager completely changing this LIC's strategy.

So, a mixed bag from large cap LICs. There was more than a 40% return difference between the best and worst performers.

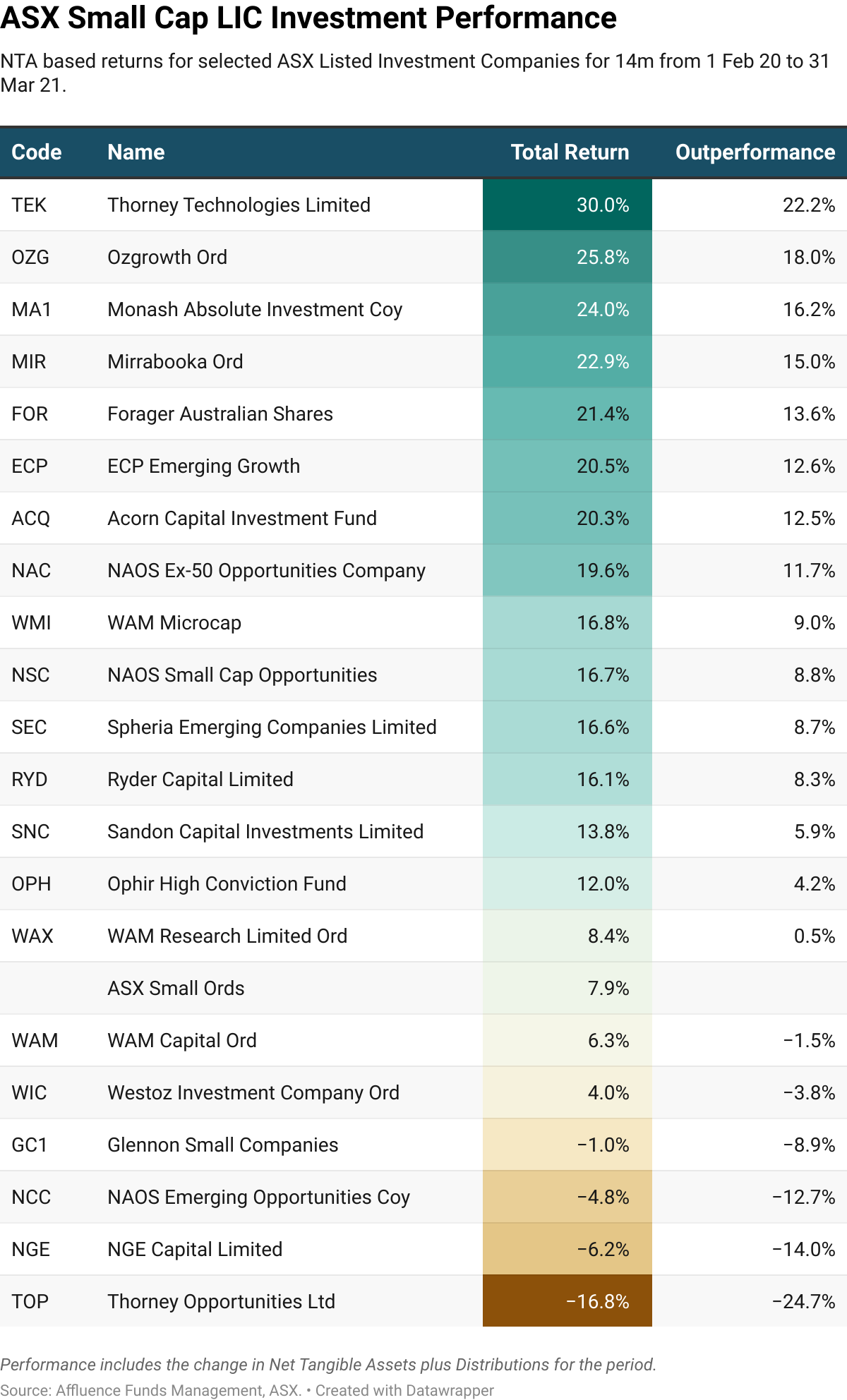

Australian Small Cap Equities

Small caps are where the real opportunities exist for active managers. And by and large, these managers delivered in spades. The ASX Small Ords Accumulation Index did better than the ASX200 Accumulation Index over the period, with a 7.9% total return for small caps compared to 0.7% for the ASX200.

Overall, 15 of the 21 small cap LICs, or around 70%, outperformed the Small Ords, many of them handsomely.

There were a range of exceptional performers. Many of the small cap managers made the best of the opportunities available.

Special mention must go to the team at Monash, who performed significantly better than most in the downturn and continued to add value during the recovery. In addition, they recently completed the transition of MA1 from an LIC to a listed managed fund, eliminating the considerable NTA discount that had previously prevailed and introducing a 6% per annum distribution target.

Quite unbelievably, both the top and bottom performers were managed by Thorney. This shows the stark difference that an investment style can make, even when run by the same management team. The technology focused TEK delivered a 30% return to top the tables. On the other hand, old school value hunter TOP was the worst performer by far, with a -16.8% return.

The TOP performance was made significantly worse by the management agreement with Thorney, which allows the performance fee hurdle to be reset every year. This meant the $35 million loss suffered by shareholders in the 2020 financial year could be ignored. It resulted in a performance fee of $5.5 million being accrued in the second half of 2020 despite shareholders still being well underwater.

The small number of underperformers also included the growth focused Glennon Capital, one of the NAOS LICs (though the other two performed very well) and NGE Capital.

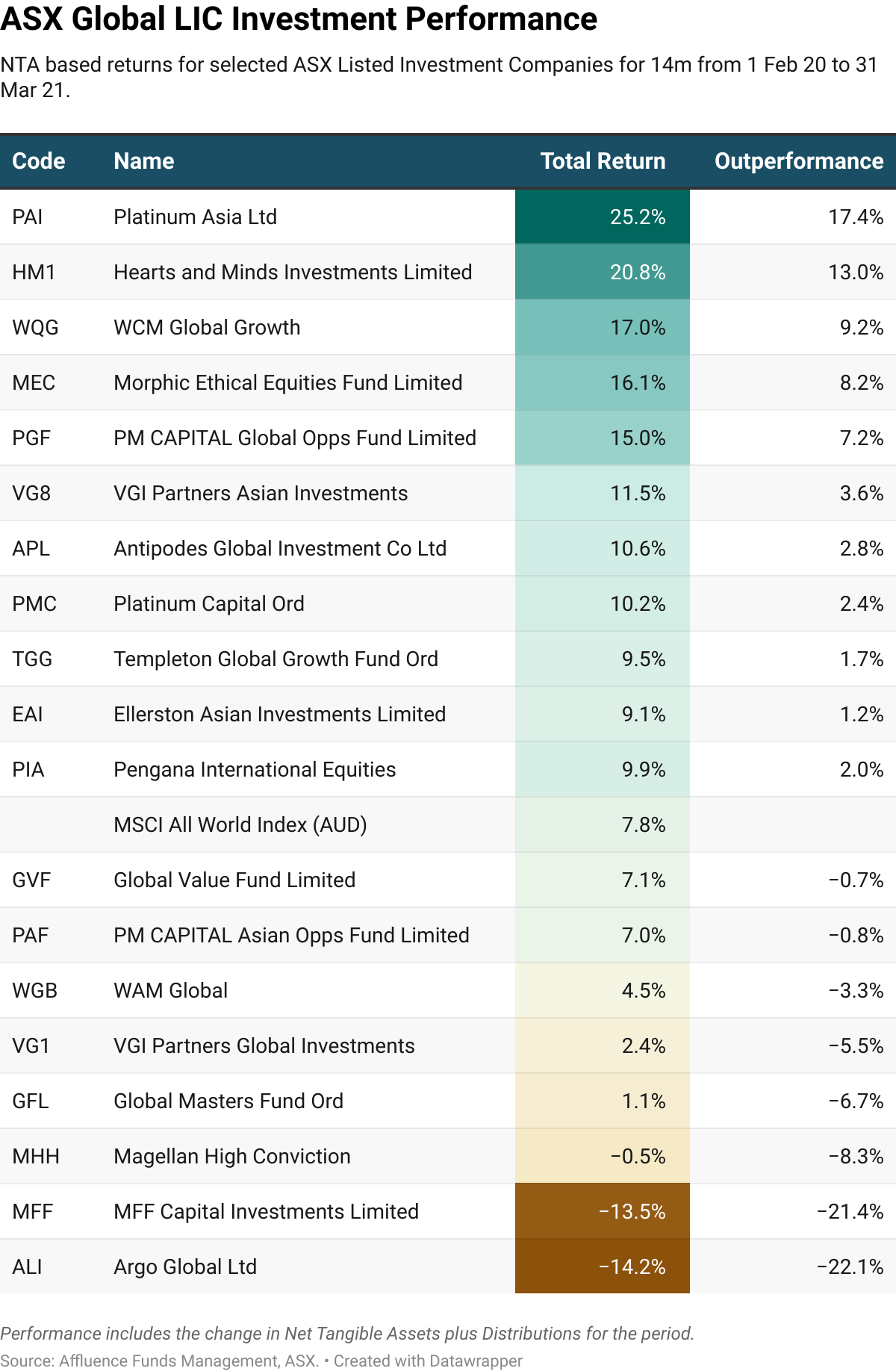

Global Equities

Looking at global focused LICs, we again see quite a range of results. Global markets, on average, delivered better results than the ASX200. The MSCI All World Index returned 7.8% for the period, while US and many Asian indices fared even better. Below are the results for global equity LICs.

The top performer was Platinum Asia, with a 25% return. The flagship Platinum Capital also had a good 12 months, as the value style slowly started to come good after a long period of underperformance. Other good performers included the exceptionally successful Hearts and Minds Investments, WCM's US focused global growth strategy, Morphic Ethical Equities and PM Capital, another value manager.

Two poor performers stand out. MFF Capital investments struggled after remaining overweight cash and missing a significant portion of the recovery. Argo Global is focused on listed infrastructure, which has remained one of the areas most impacted by COVID.

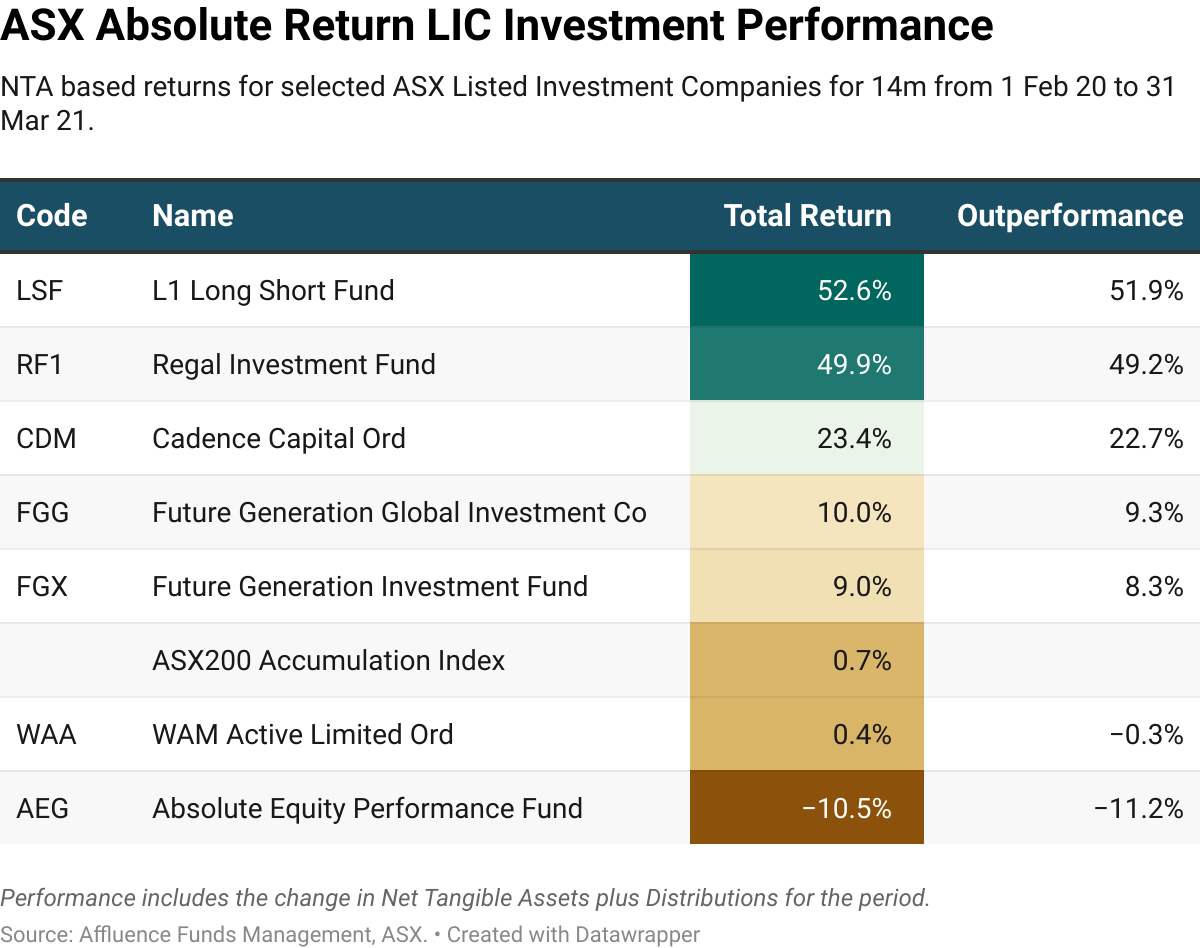

Alternative Strategies

The alternative strategies group covers several LICs that seek absolute returns, using tools such as shorting or carrying significant extra cash to assist in this goal.

Among the alternative strategy LICs, there were two standouts. L1 Long Short Fund, despite being one of the most impacted on the downside, has recovered spectacularly. They correctly recognised early in the recovery period that vaccines were likely to be highly effective and positioned the portfolio to benefit from value plays and the recovery trade. Regal Investment Fund, which incorporates a range of investment styles from the Sydney based hedge fund manager, has also performed very well. This was somewhat assisted by gearing embedded in several of their strategies.

Cadence Capital and the two Future Generation funds also performed well.

On the flipside, AEG, a geared market neutral fund, has struggled in an environment where value stocks have made a bit of a comeback.

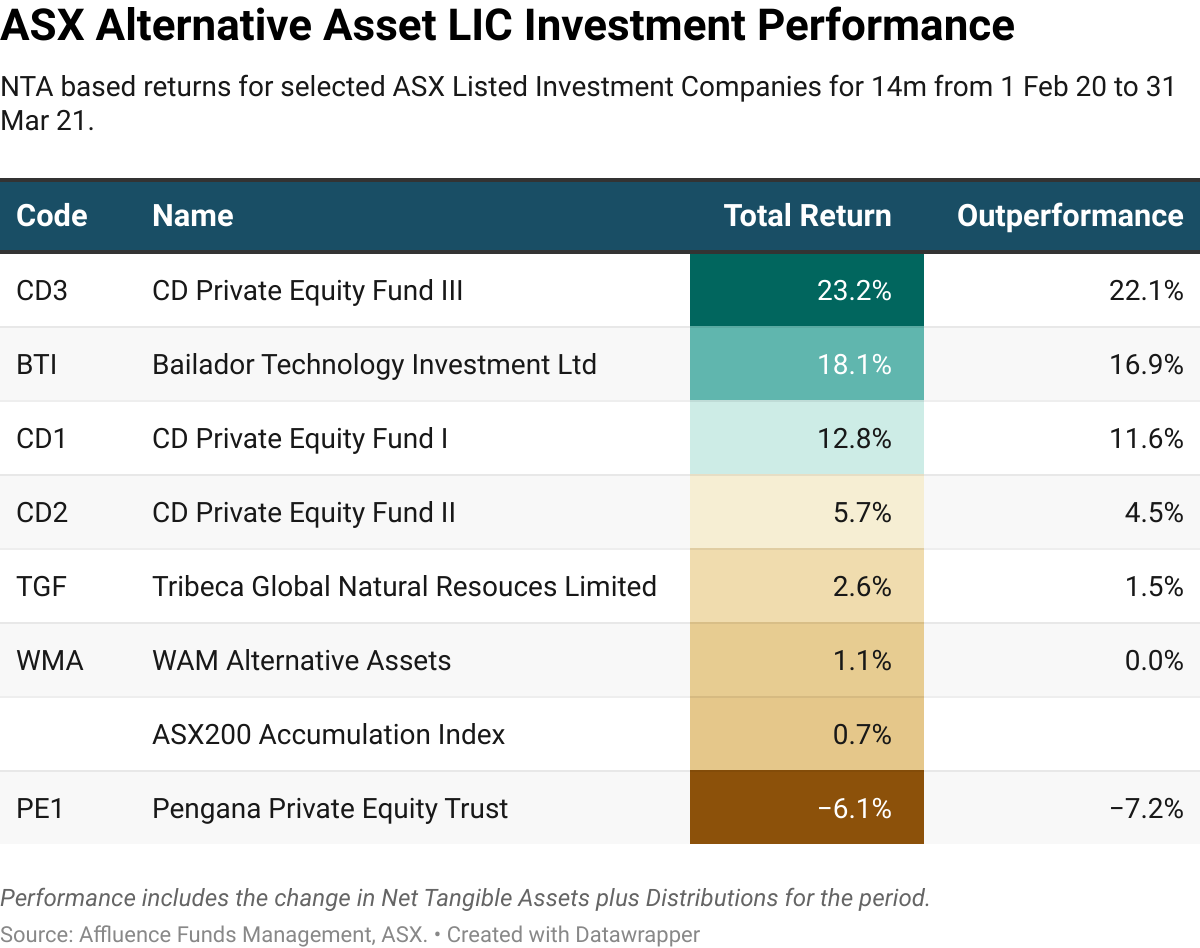

Alternative Assets

Our alternative assets group includes LICs investing in non-standard asset classes.

Outperformers included all three of the CD Private Equity Funds and Bailador's Technology focused private equity LIC.

The one disappointment was Pengana's Private Equity LIC. Despite weathering the downturn well, the recovery has been meagre for Pengana. It was not helped by the appreciation of the Australian Dollar nor the additional capital raised by the manager.

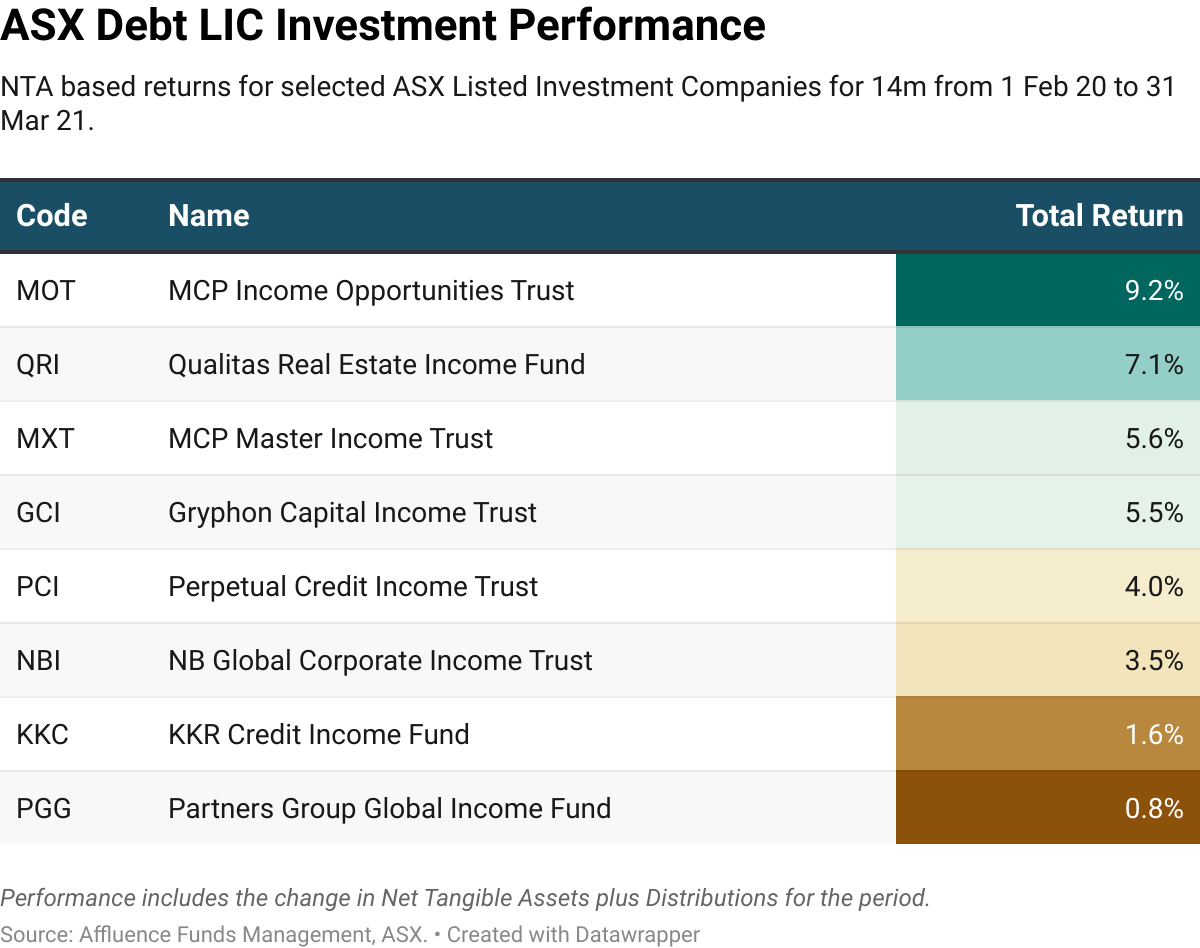

Debt LICs

Despite being a relative newcomer to the sector, debt focused LITs have primarily done their job. However, most of them traded at substantial discounts to their net asset value at some stage in 2020. So you had to be brave and hold on through that to get the returns.

At the top of the table are two LITs from Metrics and one from Qualitas, two very high quality Australian managers. All three of those LITs delivered good results with no material loan losses. Of course, it helps that they hold private or unlisted debt, which is not marked to market like publicly traded debt.

On the flipside, LITs from KKR and Partners Group generally have exposure to offshore publicly traded debt, which has not fared as well. We would also argue that this type of asset has a higher embedded risk. Indeed, these were also two of the most volatile LICs last year.

So, what have we learned?

From market peak to trough, and back to peak again. We've seen surprisingly diverse results from LIC managers, including a lot of outstanding performers. Many of these LIC managers added significant value, just when we needed them. So, what lessons can we learn from this? Here are eight key takeaways. Many apply not only to LICs but also to managed funds in general.

- The more a manager can deviate from a benchmark, the higher their chance to outperform. Of course, this also comes with a risk that they underperform. But if you choose talented managers with an excellent long term track record, you've probably made a good start.

- Look carefully at what the manager is doing and ask yourself what their competitive advantage is. For example, it's much harder to outperform when you're investing only in the biggest stocks. On the other hand, small cap managers and alternative strategies where the manager can have an information or skill advantage can deliver outsized results when markets get choppy.

- Diversification is important. Picking one or two LICs might work, or it might not. It would be better to have 5-10. More if you can. That way, it's possible to construct a very diversified LIC portfolio.

- Investment style matters. Certain styles will outperform or underperform, potentially for long periods. Sometimes, that means two different LICs run by the same manager can have vastly different results.

- Bigger is not better. The performance of larger LICs was pretty average. Most of the stellar results came from the medium and smaller sized LICs.

- Alternative strategies and alternative assets can be attractive diversifiers for your investment portfolio. They can perform relatively well when your other investments aren't.

- Debt LITs did their job. But you were better to stick with Australian assets and Australian managers. You also had to be prepared to stomach some share price volatility along the way.

- Finally, LICs can be an attractive addition to your portfolio. Increasing your allocation during times of market stress, when NTA discounts are higher and active managers can do their best work, can deliver outstanding investment results.

We hope that was helpful.

1 topic

80 stocks mentioned