Filling up the glass: Orora's acquisition of Saverglass

Orora (ASX: ORA) is certainly not shy about pursuing acquisitions. Since its demerger from Amcor (ASX: AMC) in 2013, it has acquired Worldwide Plastics in 2014, Jakait and GlobalFlex in 2015, and Bronco Packaging and Pollock Packaging in 2018.

Its latest proposed acquisition, Saverglass, is certainly noteworthy. To recap on the broad details,

Orora has entered into a put option agreement with the vendors of Olympe SAS giving them the option to sell the shares in Olympe SAS to Orora for a total price of $2.16 billion

As you might reasonably expect, there are a couple of steps to be completed before the deal is binding: completion of certain mandatory French works council consultation processes under French labour law (put option); and various conditions precedent customary for a transaction of his nature, plus regulatory approvals (transaction agreement)

The Acquisition will be funded via a combination of a fully underwritten equity raising up to $1.345 billion via a mix of institutional and retail placement, plus $875 million of debt financing via a bilateral debt finance facility.

Approximately 498 million new fully paid ordinary shares in Orora will be issued under the equity raising, equivalent to 59% of existing Orora shares on issue.

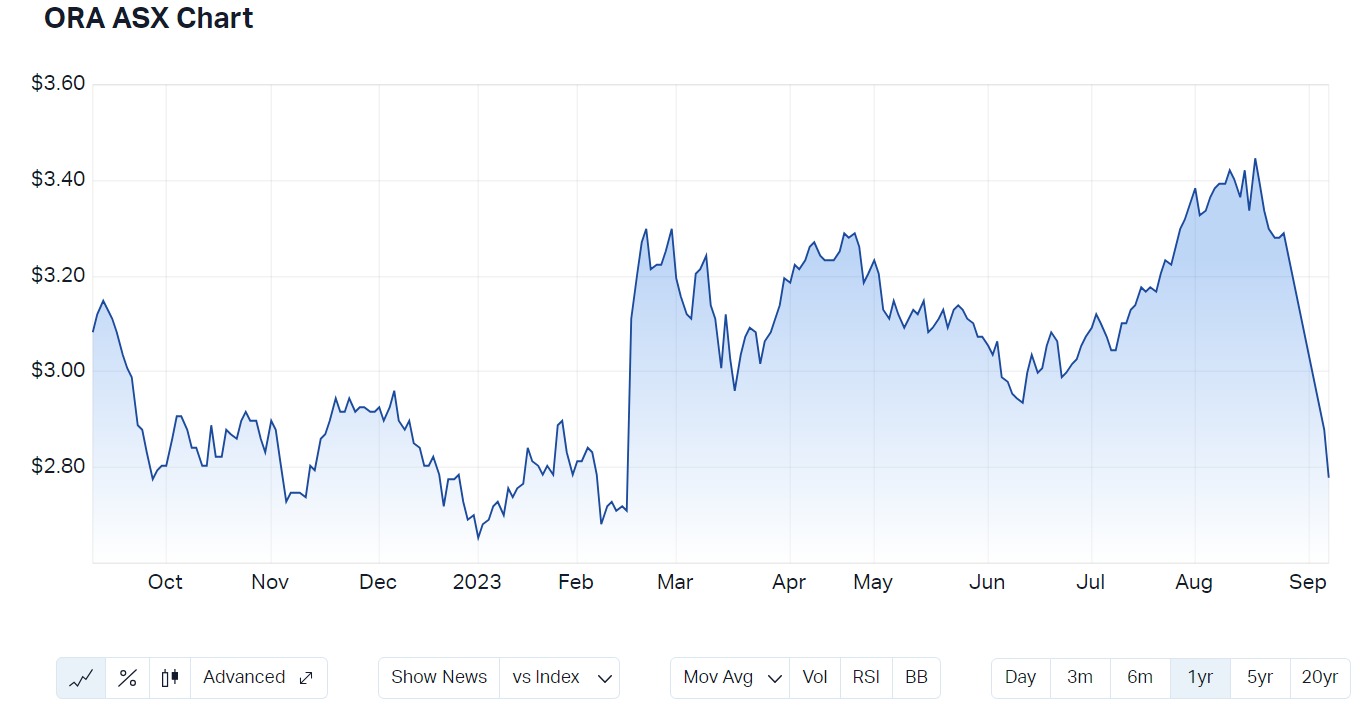

The offer price for all shares is $2.70, which is a 21.3% discount to closing share price of $3.52 on Friday 25 August 2023 adjusted for the $0.09 cents per share final dividend

The $450 million institutional placement has been completed for 167 million shares; while under Institutional Entitlement Offer, Orora has agreed to issue approximately 247 million new shares at $2.70/share to raise approximately $668 million. Approximately 83% of entitlements available to eligible institutional investors were taken up. These shares are expected to commence trading on 14 September 2023.

Completion of the acquisition is expected to occur in Q4 2023.

Orora shares are down around 16% to $2.78 since last Friday, trading close to the offer price of $2.70.

To break down the deal, I spoke with Chris Schade from Martin Currie. His overall view of the transaction is summarised as follows:

"We like the Saverglass business as a specialized provider to growth segments in premium spirits and wine. It makes Orora’s glass business a more differentiated global platform and improves the mid-term growth outlook. It’s a global business, and we think its market positions are good. We also see the business as having a positive sustainability pathway, with a path to both significant interim emission reductions, and ultimately net zero by 2050."

.png)

Note: This interview took place on Thursday 7 September 2023. Martin Currie holds shares in Orora.

Consumer brand trends towards luxury

Saverglass is a global leader in the design, manufacturing, customisation and decoration of high-end bottles for the premium and ultra-premium spirit and wine markets.

Orora is pitching the value proposition as adding to and extending Orora’s core competencies in premium sustainable value added beverage packaging. But as a luxury brand manufacturer, Saverglass is in a different part of the market to where Orora is now in its glass business. And that’s something Schade likes.

"We see that the market has some favourable tailwinds in the premiumisation trend towards luxury. The Saverglass focus categories are growing faster than the market. We’re impressed by its organic growth outlook and the fact that the business has spare capacity to both grow with the market and we think they can grow faster than the market.”

Management track record matters

It also helps that Orora’s management have a good track record with running the business to date. While Schade acknowledges that it's a big acquisition, belief in management's ability to execute is important.

"We've liked what this management team has done with the business over the past three or four years. While they had some issues with acquisitions undertaken by prior management in North America, they have far exceeded our expectations in addressing those issues. We like the skills mix of the team, particularly the CEO, who is a disciplined operator who really understands what it means to be successful in packaging and we think the CFO is astute."

Shared vision for sustainable production

Glass manufacturers like to tell us how their product is infinitely recyclable and Schade agrees. But it's not just about placing our empties into the recycling bin or dropping into our local recycling centre. It's about the reuse of that glass in manufacture.

“A key to reducing those process emissions is not to use the raw materials like the lime and soda but to instead use existing glass. Orora’s tracking towards 60% recycled content by 2025. Saverglass has a broadly similar target.

[You also need to consider] the mix between coloured and clear glass because it's easy to put the recycled content into coloured glass because you have to worry less about impurities than you do with clear glass.”

With the largest source of emissions coming from energy used in the manufacturing process (Schade notes that "Roughly 20% of glass manufacturer CO2 emissions are process emissions, while 80% are energy emissions), a focus for glass manufacturers is how to generate enough heat to produce glass while using energy sources other than gas. It appears that Orora and Saverglass are on the same page in terms of how to reduce their greenhouse emissions in their processes.

Gawler is subject to the safeguard mechanisms in Australia which requires industrial facilities above a certain size to proportionately contribute to the Australian government’s 2030 climate targets. the Gawler plant is already using renewable energy sources including solar from the Mannum Solar Farm, and it is currently in the site preparation phase for the new oxygen plan to upgrade the G3 glass furnace at Gawler to oxyfuel technology.

Saverglass is subject to EU regulation (as well as regulation in the other countries where it has processing plants). It is one of the companies participating in the Furnace of the Future project in the EU. Schade explains

"To get to 100% renewable energy is quite a challenge. Currently the furnace energy mix is around 80% gas and 20% electricity. It's quite a technical challenge to flip that mix around. But that's what the Furnace of the Future project is. It's about switching to reach 80% electricity which obviously would be green electricity, plus initially 20% gas that is still needed just because of the temperature requirements – albeit the idea is the gas would ultimately transition to green hydrogen over time. A commercial pilot plant is due to be completed by the F4F coalition later this year in Germany."

The two companies share similar emissions reductions goals as Schade notes, “Orora is targeting roughly 40% reduction and emissions by 2035. And Saverglass is targeting 50%.”

Fundraising update

Eligible retail shareholders (registered as at 7 pm on 7 September 2023 with an Australian or New Zealand address) will be invited to participate in the retail component of the Entitlement Offer (“Retail Entitlement Offer”) that will open at 9.00 am Sydney Time on Tuesday, 12 September 2023 and close at 5.00 pm Sydney Time on Monday, 25 September 2023.

5 topics

2 stocks mentioned

1 fund mentioned

2 contributors mentioned