Finding counterintuitive countercyclical growth

As the world enters a more challenging economic environment characterised by low or negative GDP growth, finding companies that can grow earnings regardless of macro headwinds becomes particularly important. Fairlight first profiled Acquisitive Compounders in 2020 and in the three years since has continued to find and purchase for the Fund businesses that fit this investment type. These companies often operate in slow or no-growth industries but have counterintuitively been able to compound shareholder value at double-digit rates for decades due to management’s excellent capital allocation skills. One of the key attractions of this business model is that revenue growth is primarily sourced from acquisitions, a growth lever that is cycle-agnostic. Indeed, as global interest rates rise it is likely that market valuations for acquisition targets will decrease providing a fertile deal environment for prepared management teams with a well-honed process for acquisitions and dry powder on hand.

Low-risk acquisition strategy

Interpump’s origins date back to 1977 when Chairman and major shareholder Fulvio Montipò came up with a better design for high-pressure piston pumps which considerably lengthened their lifespan. Today Interpump has a 40-50% global market share in this niche market but this business accounts for less than 30% of the Group’s total sales.

Montipò has always been a believer that growth, in his own words, ‘brings safety’. So once market share gains in the original business were exhausted, he supported a policy of reinvesting profits into acquiring many niche industrial businesses following a low-risk formulaic approach:

- Interpump only acquires companies that are relatively small, thus reducing the risk of one or a few bad deals jeopardising the success of the whole strategy.

- It only acquires businesses that operate in mature markets and are already highly profitable. This means Interpump can value them reliably.

- Acquisitions are not integrated and so success is not predicated on the realisation of significant revenue or cost synergies.

- Finally, incumbent management, often the founders, are incentivised to stay while being granted significant autonomy. This decentralised approach has allowed Interpump to become an acquirer of choice which in turn helps Interpump to keep acquisition multiples low.

Business diversification and quality steadily improving

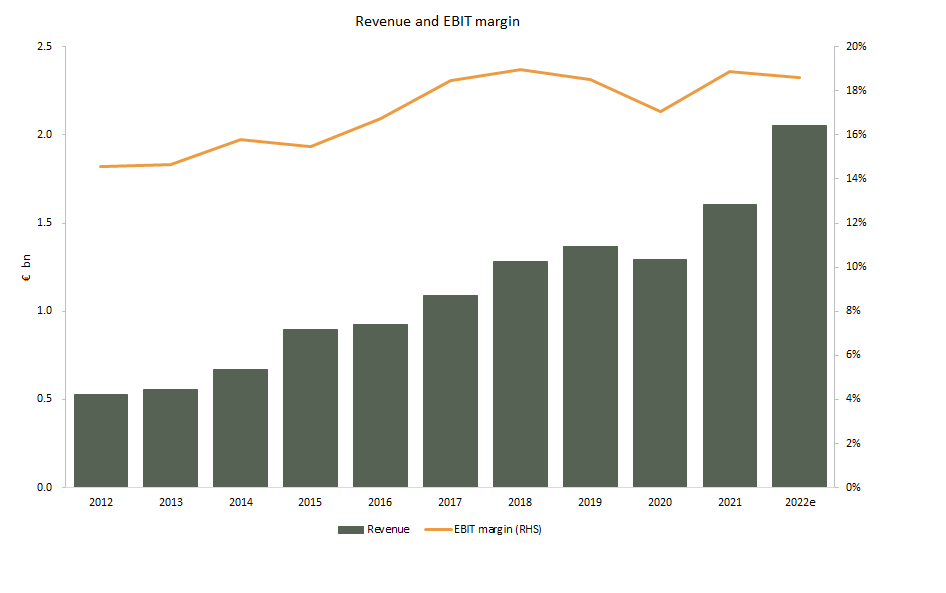

Interpump’s business has performed particularly well during the last few years despite the COVID-19 pandemic, supply chain disruptions and rampant inflation. Overall sales for the current financial year are expected to be 50% higher than in 2019 and margins have proven resilient through the period (Figure 1). This was due to several reasons:

- Interpump is a collection of light manufacturing businesses. Its factories are relatively easy to stop and restart without incurring high costs.

- Interpump generally focuses on mission-critical products where quality matters most to clients which give it the ability to pass on cost inflation with a relatively short time lag.

- Management has a long-standing strategy of always holding relatively high levels of inventory. While this adds to the business’s capital intensity it has also helped the business to gain market share during industry shocks and cement its position as a supplier of choice.

- As management continues to execute on the above-mentioned acquisition strategy, the Group’s revenue base continues to become increasingly diversified. Interpump currently sells into more than 25 broad application markets across the globe.

Figure 1.

The Fairlight View

Fairlight’s strategy is centred around finding businesses that can generate earnings growth over the long term while maintaining high returns on capital. While strong organic growth is one avenue for creating shareholder value, it is our view that businesses, such as Interpump, that can ‘create’ their own growth via a repeatable, low-risk acquisition strategy can provide underappreciated countercyclical characteristics to a portfolio.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics