GARY Top 10: Dynamic strategy delivering in the bear market

As we move into 2023, the bear market cycle of 2022 continues, causing the markets to oscillate between central banks' pivot and hope for stimulus, and the stark reality of economic slowdown. Unfortunately, global growth is slipping into a weaker growth cycle, and some parts of the world are experiencing a recession. Inflation remains stubbornly high, and a return to normal levels may take years to achieve. The central banks' efforts to stimulate the economy with artificially low interest rates have resulted in historically high inflation and asset prices, leaving them unable to curb the inflation as they depend on asset bubbles.

Consequently, investors are faced with a market cycle that lacks a playbook. While the central banks push the soft-landing rhetoric, investors must manage risk in an environment where most asset classes are correlated and offer little protection.

As we move forward, a multi-dimensional risk-managed investment strategy will be necessary, rather than a single-style or size-based investment strategy. Investors must remain flexible and pragmatic in the macro environment ahead.

US regional bank crisis to linger for years to come

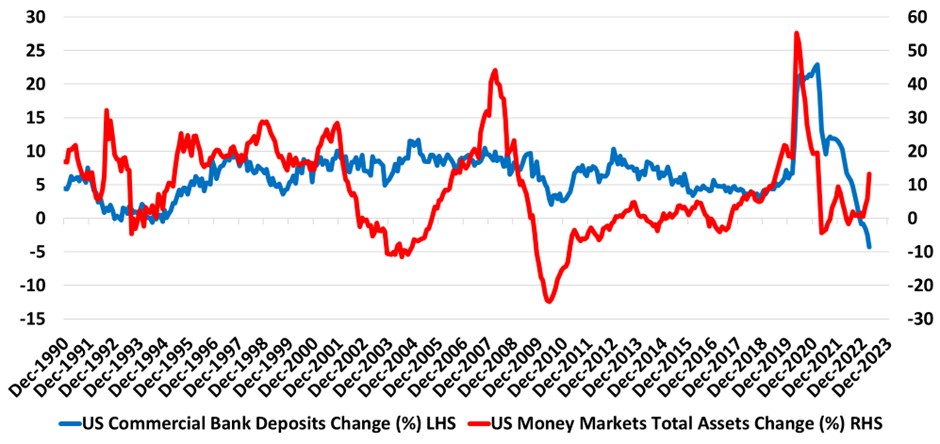

The US banking crisis has resulted in the largest deposit flight from commercial banks, particularly affecting regional banks. These banks face numerous challenges, including higher rates, weak mortgage demand, deposit flight, and potential increases in regulations.

Money markets have been the primary beneficiary of this deposit flight, with assets beginning to grow once again. This is the first time since the 1990s banking crisis that the deposit flight has hit negative territory. Historical trends indicate that investors will likely continue to move their funds into the money market, increasing the risk for weak regional banks.

The bank crisis in US and Europe are mainly due to the structural problems that festered over the last decade. They are rising to the top as the global economy slows and manipulated markets unwind.

Risk weighted outlook suggest more segments of the global economy will start to breakdown as markets start to market-to-market their assets under the new macro environment.

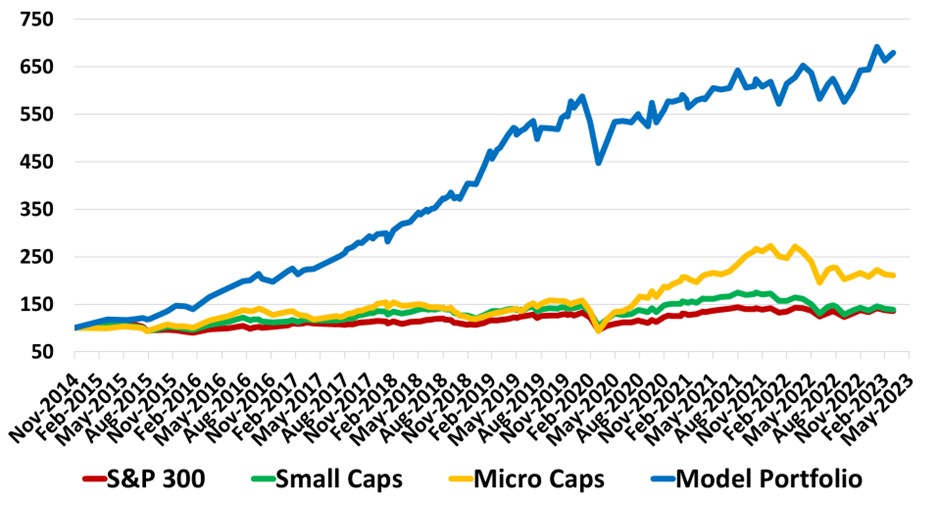

Investing through the cycle means the strategy must accommodate for all stages of the market cycle while managing risk. At Deep Data Analytics (DDA), we evolve with market trends and manage risk to deliver outperformance in all market cycles. The GARY (Growth At Reasonable Yield) model offers exposure to the best 10 stock ideas that manage growth, value, yield, and risk in the current volatile bear market. The model is managed dynamically using data analytics and will evolve over time with changing macro/micro data.

The GARY Top 10 at the end of March 2023

- Austal (ASX: ASB)

- ASX (ASX: ASX)

- Codan (ASX: CDA)

- Elders (ASX: ELD)

- Evolution Mining (ASX: EVN)

- Nine Entertainment (ASX: NEC)

- Regis Resources (ASX: RRL)

- Telstra (ASX: TLS)

- Wesfarmers (ASX: WES)

- Woolworths (ASX: WOW)

Note: DDA may or may not have made changes to the model holdings since the end of Dec. We continue to see the cycles changing and the model portfolios evolving with that.

GARY keeps delivering through the market cycles. The performance chart excludes dividends.

5 topics

10 stocks mentioned