Great Aussie housing bust gets worse: August officially the worst month since 1983

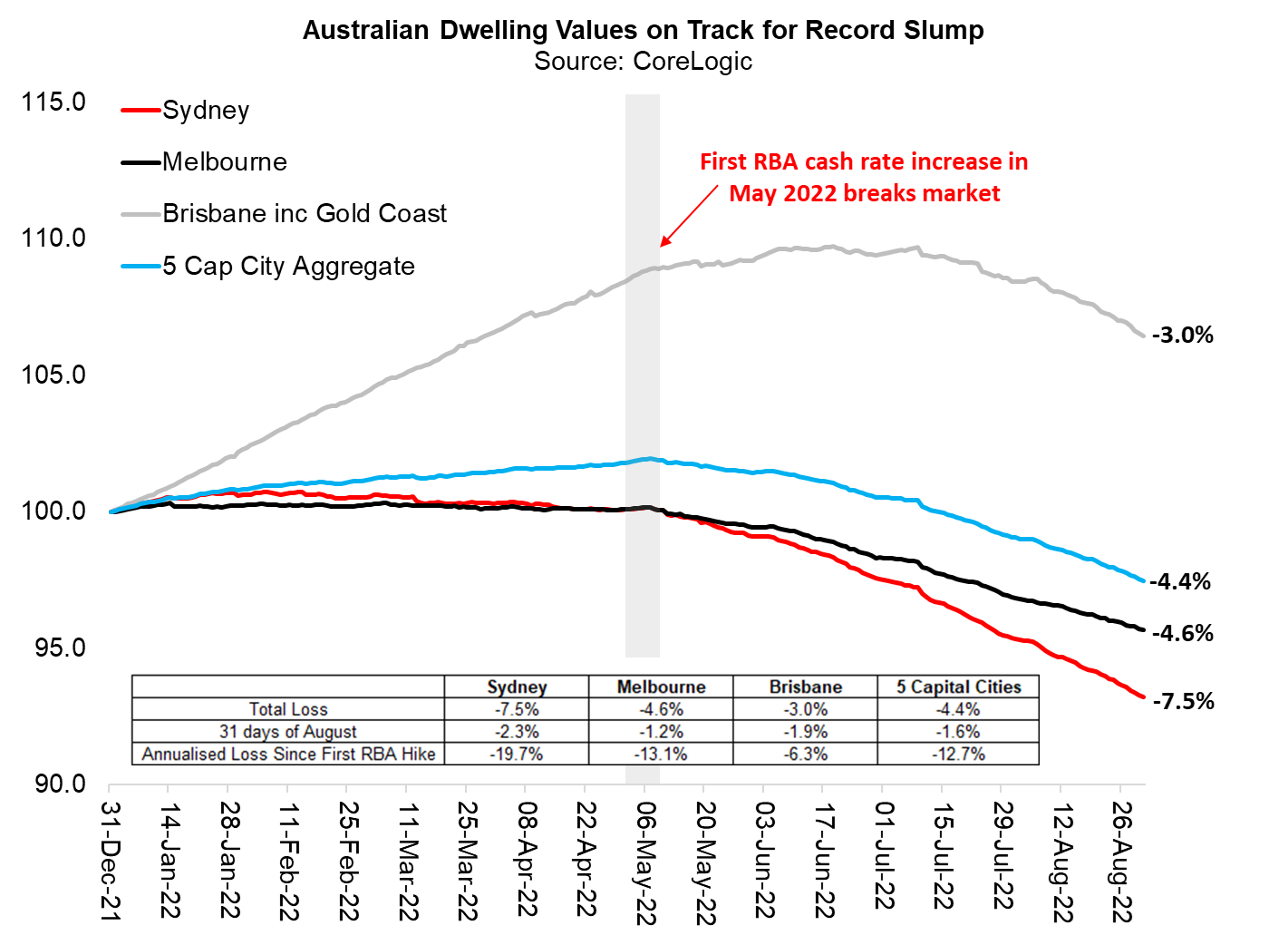

CoreLogic have just released their official housing data for the entire month of August 2022, which confirms what we feared: both the 5 capital city and 8 capital city indices have registered their single largest monthly house price declines since 1983. And with the RBA set to pre-emptively hike interest rates by 50 basis points for the fourth month in a row, imposing an extraordinary 225 basis points of hikes on unsuspecting borrowers, the great Aussie housing crash is only going to get a lot worse...

The individual capital city losses in August have been breathtaking, albeit consistent with our highly contrarian October 2021 prediction for a never-before-seen 15% to 25% decline in national dwelling values. Indeed, dwelling prices declined in every single capital city across Australia with the only exception being Darwin.

And, for the avoidance of any doubt, the only driver of the great Aussie housing collapse has been the record spate of interest rate increases delivered by the RBA, which risks making yet another policy mistake. These house price changes currently have nothing to do with employment, incomes, population growth and/or building approvals. They simply represent a profound reduction in purchasing power as the RBA massively increases the cost of borrowing.

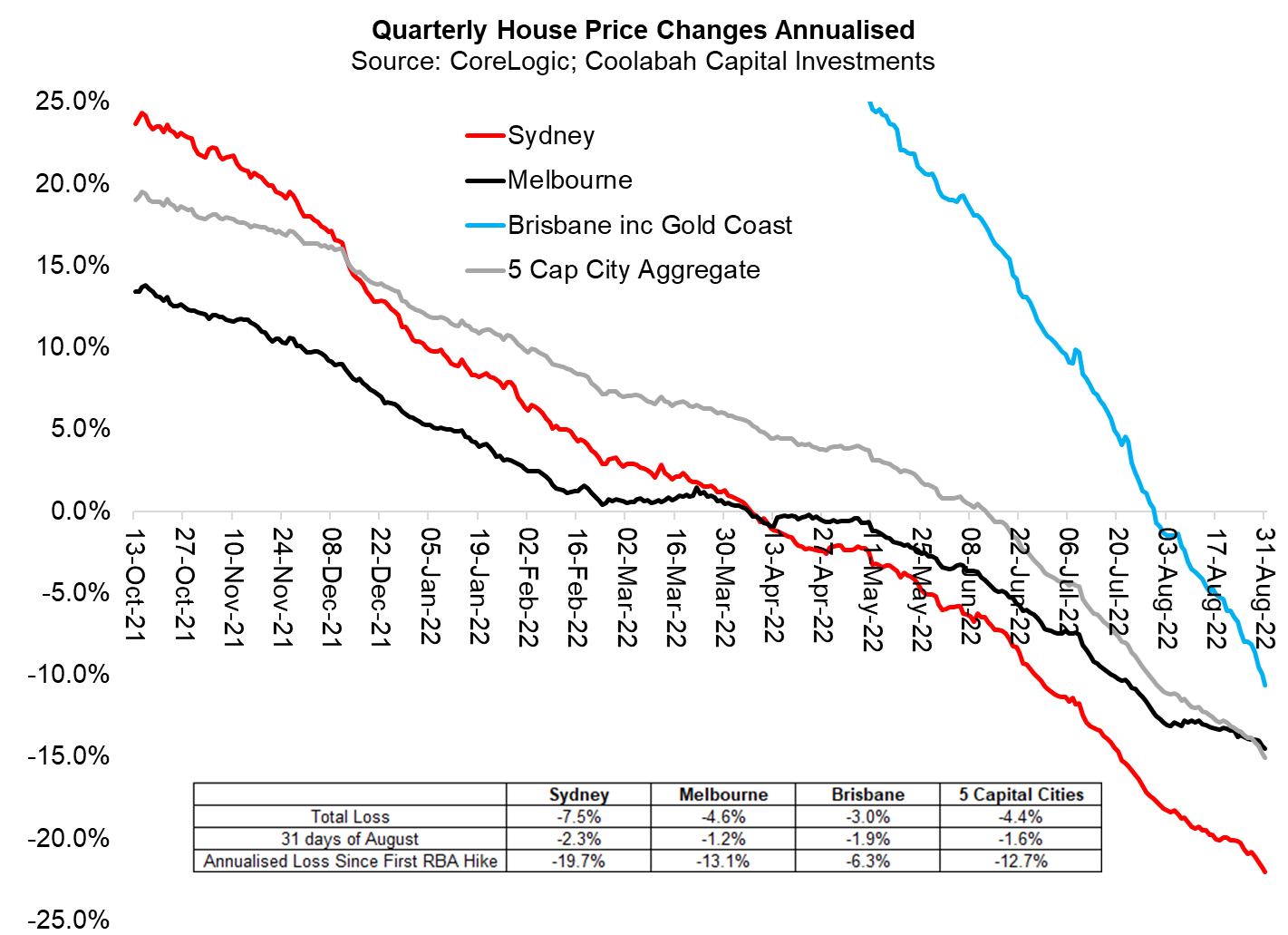

After Sydney home values fell by a staggering 2.2% in July---the biggest draw-down since 1983---the losses accelerated in August (as we warned they might mid-month), with the final monthly decline coming in at an incredible 2.3%. Sydney dwelling values are currently shrinking at a 19.7% annualised pace based on the last quarter of daily house price data (annualising quarterly data is quite common amongst central banks and statistical agencies). The second chart below shows the annualised pace of house price declines using rolling quarterly data. It is fascinating insofar as it shows that the rate of losses in Sydney, Melbourne and Brisbane--and across the 5 largest cities---continues to accelerate. Total peak-to-trough losses in Sydney are now almost 8%, which should exceed 10% within 1-2 months.

The correction is currently a little more orderly in Melbourne where home values tumbled another 1.2% in August, which was a slower rate than the 1.5% loss experienced in July. Total peak-to-trough losses in Melbourne are approaching 5% with the annual pace of price declines now exceeding 13% based on the last quarter of data.

The big news has been the total capitulation of Brisbane property, which in August fell by 1.8%. That is the single largest monthly loss since CoreLogic records began 42 years' ago in 1980. The data I use for my intra-month updates for Brisbane includes the Gold Coast, which combined suffered a slightly larger 1.85% loss.

As we had flagged was likely, the Adelaide market has finally rolled over. Adelaide had been flat-lining since May, but lost 0.1% in August. While this might sound small, the directional change is key: Adelaide house prices are likely to start falling much more rapidly. Perth also seemingly gave up the ghost in August with prices shrinking by a modest 0.2%. Having said that, Perth prices look cheap compared to the other major cities. The median price of $562k is way below the medians in Sydney and Melbourne of $1.1m and $782k, respectively.

While these developments might come as a surprise, they have been highly predictable, as our October 2021 analysis anticipated. Our housing forecasts remain unchanged. That is, after the RBA implements its first 100 basis points of rate hikes, which it has now done, national home values will fall 15-25%. This forecast range was quite explicitly designed to capture the RBA hiking rates by more than 100 basis points. Most economists have embraced this projection in 2022.

Using the RBA's own internal housing model, we have previously shown (see here) that if the central bank hikes to a very extreme, 4.25% cash rate, which is higher than we allowed in our forecast range, the RBA's research implies that Aussie house prices would have to decline by 30-40%. This is not, however, our central forecast.

3 topics