Housing bears are becoming an extinct species

In the AFR today I write that Aussie housing bears are quickly becoming an extinct species, as we had previously predicted. Read the full column here (or try this twitter link here). Brief excerpt enclosed:

In terrific news for the post-COVID-19 recovery, house prices have started climbing again across six of Australia’s eight capital cities and throughout non-metro regional markets. This accords with our heterodox March 2020 forecast for the local market to suffer negligible losses of between zero and negative 5 per cent over a six-month period followed by capital gains of 10 per cent to 20 per cent.

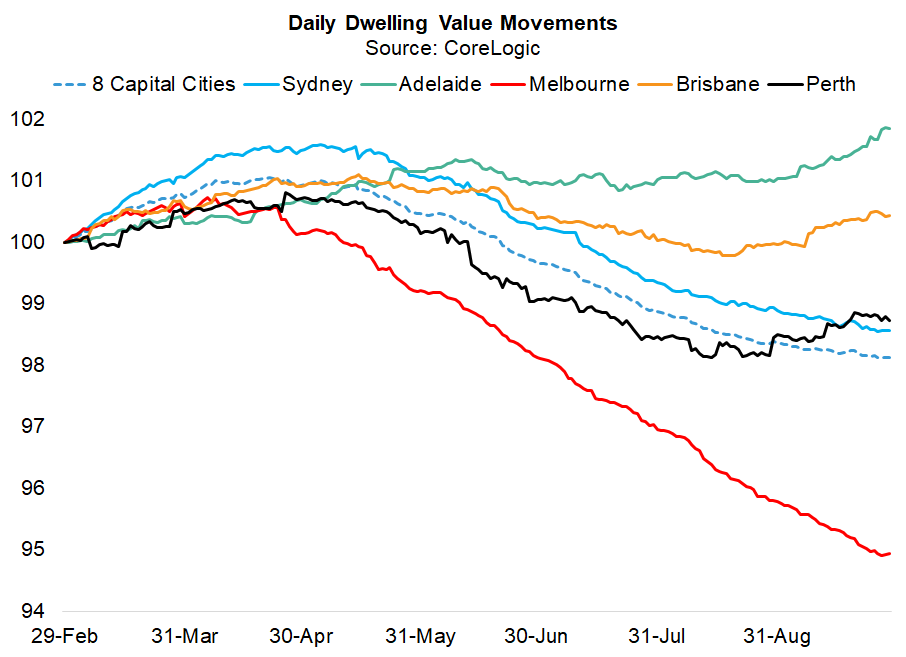

Throughout Australia’s eight capital cities, the cumulative loss to date has been just 2.8 per cent according to CoreLogic, and would have been a lot less were it not for Melbourne’s entirely unnecessary second COVID-19 wave.

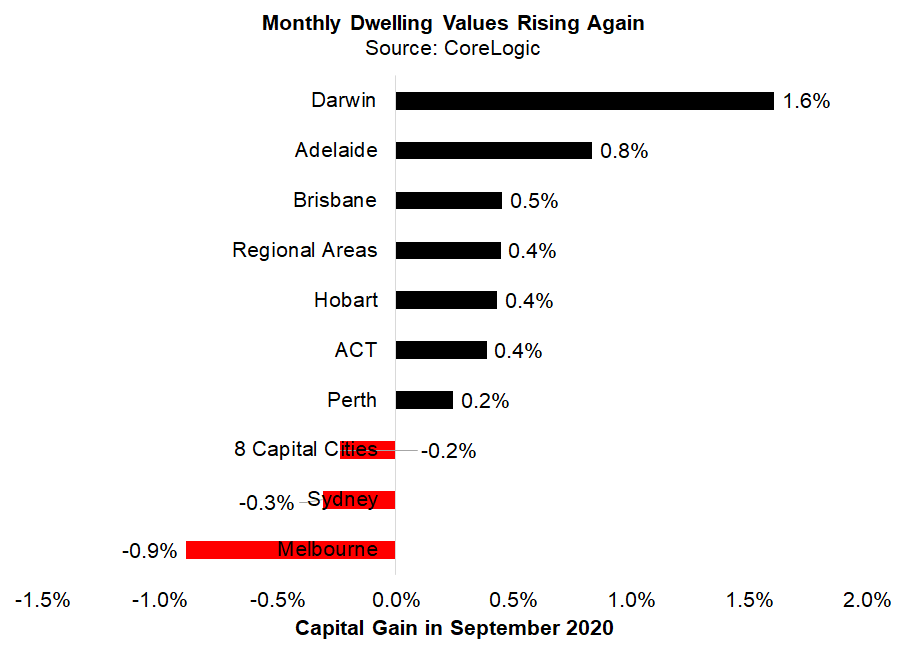

In September, dwelling values recorded capital gains in Perth (0.2 per cent), Canberra (0.4 per cent), Hobart (0.4 per cent), Brisbane (0.5 per cent), Adelaide (0.8 per cent), and Darwin (1.6 per cent). Home values also appreciated in all non-metro regional areas (0.4 per cent). The tide is similarly turning in Sydney, which registered its smallest capital loss (minus 0.3 per cent) since the market rolled over in May.

Given a jump in purchasing power care of lower mortgage rates and higher incomes, bullish auction clearance rates, and the advent of "positive gearing" (where rents more than cover mortgage repayments), we expect Sydney home values to start punching out capital growth again soon.

The laggard is the locked-down Melbourne metropolis where dwelling values dropped another 0.9 per cent in September, making for cumulative losses of 5.5 per cent since its March peak. Yet with Melbourne likely to come out of lock-down shortly, stability should return as the auction market comes online.

Australia’s resilient housing performance has again made a mockery of the consensus’s extremely bearish forecasts for large price falls of 10 per cent, 15 per cent, 20 per cent, or 30 per cent. Housing bears are becoming an extinct species with the likes of CBA and Westpac discarding their dire outlooks for much more bullish perspectives. The latest bear to drop is Capital Economics, which was anticipating losses of up to 10 per cent, but now predicts only a 3 per cent correction. And next year it believes home values will surge 7 per cent higher. Other bears like ANZ, NAB and UBS should roll-over soon.

Enjoy this wire? Hit the 'like' button to let us know. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics