How the billionaires are investing in 2022

Several months before the pandemic began, Pulitzer Prize-winning author Liaquat Ahamed wrote a piece for The New Yorker with a bold headline aimed at a contentious issue: “The rich can’t get richer forever, can they?”

In the nearly two years of what now feels like a post-apocalyptic dystopia following endless lockdowns and a barrage of bad news, the answer so far to Ahamed’s question is a resounding yes. The rich can – and have - become obscenely richer. And there's not a single tax law that can stop them.

In 2021, the world’s five wealthiest people added a whopping US$240 billion in wealth between them to boast a combined treasure chest of US$917 billion, according to data from the Bloomberg Billionaire Index.

Tesla founder Elon Musk, Amazon founder Jeff Bezos, Louis Vuitton CEO Bernard Arnault, Microsoft founder Bill Gates, and Alphabet co-founder Larry Page are now an almost US$1 trillion quintet, or the size of the Dutch economy.

But at Livewire we don’t seek to cast judgment on one’s wealth. In our third annual iteration on the world’s tycoons, we explore what’s driving their riches, whether they’ve made any new investments, and learn what lessons we can from their success.

And due to popular demand, we’ve carved out a section on select Australian billionaires who have seen meteoric rises in their net worth and control listed or to-be-listed companies.

THE HIGHLIGHTS

Let’s begin this New Year read by highlighting key developments among global and Australian tycoons in 2021.

Global synopsis

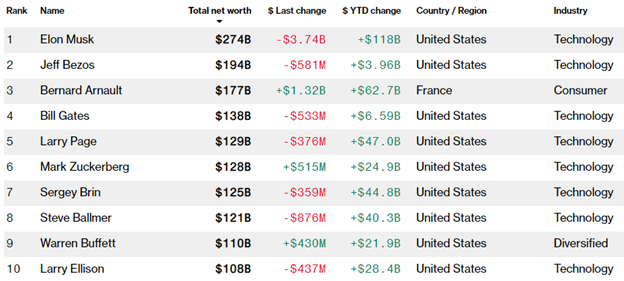

- For the first time in history, the world’s 10 richest people all became centibillionaires; that is, they all had 12-digits to their name.

- With a fortune of US$274 billion thanks to a massive run-up in Tesla’s share price, Musk displaced Bezos to become the richest person alive.

- Page, who co-founded Alphabet subsidiary Google, made his debut within the top five of the global rich list.

- Berkshire Hathaway CEO Warren Buffett’s ranking continued to slip; he was #6 on the list in 2020 and is now at #9.

- Eight of the top 10 billionaires globally are CEOs or founders of technology companies, and nine are American.

Below is a summary of the top 10 global billionaires, their wealth rank and total net worth, how it changed over 2021, and the country and industry they primarily operate in.

Source: Bloomberg Billionaires Index (as of 31 December 2021)

Domestic synopsis

Our local magnates haven’t quite reached centibillionaire status just yet. Nonetheless, the AFR Rich List shows their wealth is increasing at a rapid clip and stems from a more diverse range of industries.

- Seven of Australia’s 10 richest people made their fortune in resources, agriculture, property, or manufacturing, but technology wealth is on the rise.

- Hancock Prospecting’s Gina Reinhart is the richest Australian, exceeding $30 billion in wealth, while Fortescue’s Andrew Forrest is #2 at $27 billion.

- Atlassian’s Mike Cannon-Brookes and Scott Farquhar saw their fortunes jump 20% to $20 billion each following another stellar year for enterprise collaboration software.

- Canva’s Melanie Perkins and Cliff Obrecht entered the top 10 for the first time.

- In addition, Perkins became the richest self-made female under 40 globally.

WHAT DROVE GAINS IN THEIR WEALTH?

We’ll now examine the factors that drove gains in wealth for the top five global billionaires, as well as select Australians and point out any new investments they made during the year.

We’ll also look at fundies and analysts’ recommendations about the companies they manage, given the recent interest in founder-led businesses on Livewire.

Elon Musk: US$277 billion (+ US$118 billion in 2021)

If there’s one person who’s had an extraordinarily good year, it would be Musk. So much so he was named TIME Magazine's 2021 Person of the Year.

His electric car company Tesla (NASDAQ: TSLA) surged 60% and hit a US$1 trillion market cap for the first time after a deal to supply 100,000 EVs to Hertz validated the company’s outlook. Musk has been selling down some stock to fund looming tax obligations on exercised options, but he still retains an 18% stake in Tesla.

Then there was his aerospace company SpaceX, which launched the world’s first all-civilian crew into orbit and achieved a valuation of over US$100 billion, making it the world’s second-most valuable private company.

What do the fundies say?

The consensus among 41 analysts tracked by the Wall Street Journal is that Tesla is a hold, with a median price target of US$925 or 12% below its 2021 closing price.

That said, Aussie fundies are bullish on the stock. At a 13% weighting, Hyperion Asset Management's Mark Arnold has Tesla as the largest position in his A$2.37 billion Hyperion Global Growth Fund (ASX: HYGG), while Holon’s Tim Davies believes the company provides a “once-in-a-generation” buying opportunity at current prices with an expectation it will triple in value.

“Tesla is structured to actually innovate rapidly but reduce the costs of innovation through artificial Intelligence and machine learning based simulations," Arnold said.

Jeff Bezos: US$194 billion (+ US$4 billion)

As Musk raced to #1 on the wealth list, Bezos’s Amazon (NASDAQ: AMZN) stagnated, gaining only 2% last year.

The founder of the diversified internet giant stepped down as CEO in July to focus on other ventures, handing the reins over to Andy Jassy, who previously led Amazon Web Services (AWS), its gargantuan cloud computing division. Bezos remains executive chairman of Amazon and still owns just under 10% of the company.

What do the fundies say?

With Jassy at the helm, Montaka’s Daniel Wu believes that Amazon offers hidden value to investors.

“We believe this promotion elevates AWS and the cloud opportunity to the highest priority within Amazon, which is unsurprising considering Jassy believes only 5% of global IT spend is currently in the cloud … Indeed, we believe the risk-reward of owning Amazon today may still be as high as 4-to-1 and expect the stock to remain a core position in the Montaka portfolios over the long term," Wu said.

The consensus among 43 analysts tracked by the Wall Street Journal is that Amazon is a buy, with a median price target of US$4,107 or 23% upside from the mega-cap's 2021 closing price.

Bernard Arnault: US$177 billion (+ US$63 billion)

Arnault is Europe’s richest person thanks to his 45% stake in Louis Vuitton Moet Hennessey (ETR: MOH), the world’s largest manufacturer of luxury goods, where he holds both its chairman and CEO titles.

He steered LVMH through the pandemic by pivoting to e-commerce and virtual fashion shows to keep the brand top-of-mind among high-end consumers, and then benefited from the re-opening trade.

LVMH shares more than doubled from their March 2020 lows and advanced another 43% in 2021.

What do the fundies say?

The consensus among 41 analysts tracked by the Wall Street Journal is that LVMH is a buy, with a median price target of €789 or 9% upside from its 2021 closing price.

Aoris Investment Management’s Delian Entchev counts LVMH as a core holding given its unmatched brand strength, direct-distribution business model, diverse product portfolio, and ability to innovate and adapt.

“Against the odds, luxury goods giant LVMH has become more desirable over many centuries, and emerged from this disruptive period stronger than ever," Entchev said.

Bill Gates: US$131 billion (+ US$7 billion)

Despite donating billions to philanthropic causes and finalizing his divorce from Melinda French Gates last year, Bill Gates’s wealth continues to grow, thanks in part to the strong performance of Microsoft (NASDAQ: MSFT), the company he co-founded and retains an approximately US$34 billion stake in, according to Bloomberg.

Putting the marital split aside, the majority of Gates's US$131 billion fortune is derived from Cascade Investment, a holding company that was created with the proceeds of Microsoft stock sales and dividends over the years.

What are some of his biggest investments (and what’s new)?

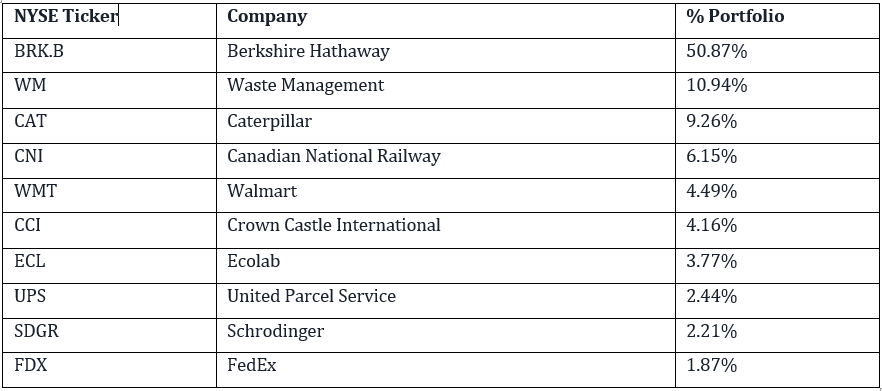

Gates takes a long-term view when investing and rarely tinkers with his portfolio. The list below, derived from U.S. regulatory filings, shows the stocks he owned at the end of the third quarter of 2021. These holdings are virtually unchanged from the last two years.

It should be noted Berkshire Hathaway (NYSE: BRK-A/BRK-B) comprises an outsized part of Cascade’s portfolio as Buffett has pledged to donate most of his wealth, in the form of Berkshire stock, to the Bill & Melinda Gates Family Foundation. The former couple has agreed to keep running the foundation together for the foreseeable future.

Source: Cascade’s top 10 investments based on 13F disclosures (as of September 2021). Note: Gates’s Microsoft stock is not held via Cascade

There were two notable developments during the year outside of Gates’s top 10 investments:

- First, it emerged the Gates became America’s largest farmland owners. The Land Report discovered Gates and French Gates quietly accumulated US$690 million of pasture across multiple states. It's not clear whether the Gates’ sought farmland for investment returns or philanthropic purposes.

- Second, the Gates made a sizeable bet on the revival and future of luxury travel after Cascade agreed to take control of the Four Seasons Hotels and Resorts by buying about half of Saudi Arabian Alwaleed bin Talal's stake for US$2.21 billion. They now control 70% of the iconic brand, valuing it at US$10 billion.

What do the fundies say?

Given Gates has a vast portfolio, we’ll keep the focus on his biggest holding: Microsoft. The consensus among 40 analysts tracked by the Wall Street Journal is that Microsoft is a buy. The median price target is US$370 or 10% higher than where it finished in 2021.

Alphinity’s Trent Masters said the world’s second-biggest company is “hard to ignore” given its business positioning, return metrics, earnings leadership, and supportive valuation.

“Growth of 15-20% in operating income is expected to continue over the medium term as cloud migrations, digital adoption and the general recognition of the value of the Microsoft product offering continue to underpin business momentum in the years to come," Masters said.

Larry Page: US$129 billion (+ US$47 billion)

The majority of Page's fortune is derived from his 6% stake in Alphabet (NASDAQ: GOOG/GOOGL), the parent company of Google, operator of the world’s largest search engine and video content platform.

Alphabet, which Page co-founded with Sergey Brin, soared 68% in 2021 and eclipsed a US$2 trillion valuation as local businesses worldwide clamoured to advertise their brands online via Google Search and YouTube amid public health restrictions.

What do the fundies say?

The consensus among 49 analysts tracked by the Wall Street Journal is that Alphabet is a buy. The mega-cap has a median price target of US$3,342 or 15% above its 2021 closing price.

Alphinity’s Masters believes the company is a "long-term win" as it moves beyond search and develops positions in a range of other adjacent industries including autonomous transport, healthcare, and artificial intelligence.

“Alphabet generates more than 25% operating margins, more than 20% ROE and ROIC, has more than $100 billion of cash on the balance sheet and trades on 28 times PE 1yr. The combination of business momentum, positioning, return outlook, positive earnings momentum and valuation makes Alphabet a compelling high conviction long term structural growth investment in both our Alphinity Global Equity Fund and Alphinity Global Sustainable Equity Fund," Masters said.

Andrew Forrest: $27 billion (+ $4 billion)

Most of Forrest's fortune is derived from a 36.7% stake in Fortescue Metals Group (ASX: FMG). While the iron ore giant’s stock price fell 18% in 2021, income investors have benefited from fully franked dividends of $3.58 during the year, putting it at a yield of nearly 15%.

Forrest is pushing for the company to expand into green energy through its Fortescue Future Industries arm, but he’s also big moves last year to diversify his own wealth beyond bulk commodities. His notable transactions in 2021 include:

- Acquiring Noront Resources (TSXV: NOT) via his private equity firm Wyloo Metals in a deal that values the Canadian nickel miner at more than C$600 million to gain access to the nickel-rich mining district in Ontario dubbed “Ring of Fire” and tap into the EV boom.

- Purchasing $108 million of shares in Bega Cheese (ASX: BGA), giving him a 6.6% stake in the dairy company and making Forrest its fourth latest shareholder.

- Investing $5 million in Perth health technology company Emyria (ASX: EMD) to access the potential of medical cannabis.

What do the fundies say?

While Forrest is upbeat on a number of ventures and industries, not everyone is bullish on Fortescue: the consensus among 17 analysts tracked by CommSec put the miner at a hold.

And back in November, Sage Capital’s Sean Fenton said the stock was a prime candidate for shorting.

“On the short side, we are looking at companies like Fortescue, which was tricky at the start of the year because it looked really cheap with massive free cash flow yield. But because it's a pure iron ore play and particularly that 58% grade discount is widening, its cash flow is rapidly plummeting. We still see short potential there," Fenton said.

Mike Cannon-Brookes and Scott Farquhar: $40 billion combined (+ $6 billion)

Cannon-Brookes met Farquhar at university and the pair founded Atlassian (NASDAQ: TEAM) in 2002. Now, they are Australia's third and fifth-richest individuals, respectively, with Atlassian's stock accounting for most of their A$20 billion individual fortunes.

With 10 million monthly active users across 190 countries using its collaboration tools like Jira, Trello, and Confluence, Atlassian has grown to become more-than-10-bagger since its 2015 float. It surpassed US$100 billion in value at one stage last year after its stock soared over 60%.

Both are backers of Canva and have made investments in a variety of renewable, software, hardware, and life sciences companies over the years, as well as luxury homes.

What do the fundies say?

Livewire’s Angus Kennedy’s excellent profile of Lumentary Investment Management’s Lawrence Lam, the fundie who “pioneered the founder-led strategy”, explains why companies like Atlassian are so successful.

“I like the founder’s philosophy that Mike Cannon-Brookes and Scott Farquar adopt with how they run Atlassian," Lam said. "They’ve elected to pay themselves a salary of $77k - the minimum wage. You’ll often see this with true founders (Buffett included). Atlassian’s approach to reinvestment shows they’re not resting on their laurels, they’re still hungry and want to entrench themselves further in their customers’ ecosystems. They will continue to compound for many more years."

The consensus among 24 analysts tracked by the Wall Street Journal is to “overweight” Atlassian. The median price target is US$500 or 31% higher than where it finished in 2021.

Melanie Perkins and Cliff Obrecht: $8 combined (+ $3 billion)

If there was a local story equal in grandeur to Musk, it would be that of Canva co-founders Melanie Perkins and Cliff Obrecht, who made their top 10 debuts on the AFR Rich List after announcing their September 2021 funding round helped lift the design platform's valuation to US$40 billion.

The raising, supported by the likes of T. Rowe Price, Greenoaks Capital, and Atlassian’s Cannon-Brookes, saw the couple’s equity stakes revalued 133% higher to A$8 billion, making Perkins the world’s richest woman under 40.

Canva said it has over 60 million monthly active users for its online graphic design platform and was on track to exceed $US1 billion in annualised revenue by the end of 2021. Media reports suggest the company may list within 12-24 months in the U.S.

What can we learn from the billionaires?

As I reflect on this wire, it's apparent billionaires are successful because they’ve created innovative businesses that serve genuine needs on a global scale. They put customers first, think long-term, and aren’t interested in making quick gains in their ventures.

The founders of these businesses are also never ones to stand still. Whether it’s Musk announcing the next Tesla model or Forrest expanding into nickel, they’re always seeking to innovate and expand into new verticals and industries.

Most of the billionaires mentioned in this wire opt to reinvest vast sums of capital back into their own businesses to innovate as opposed to paying high dividends. This is, perhaps, the reason why the likes of Amazon, Microsoft and Atlassian have made investors – and their founders – very, very rich over the last decade.

Be sure to catch the rest of our 2022 Outlook Series

Hit the ‘follow’ button below for our fundies’ number one picks for the year ahead and other great content from our 2022 Outlook Series. Enjoyed this wire? Hit the ‘like’ button to let us know or click the button below to view all the content on the dedicated landing page.

5 topics

3 stocks mentioned

5 contributors mentioned