How to take advantage of the biggest opportunity in decades

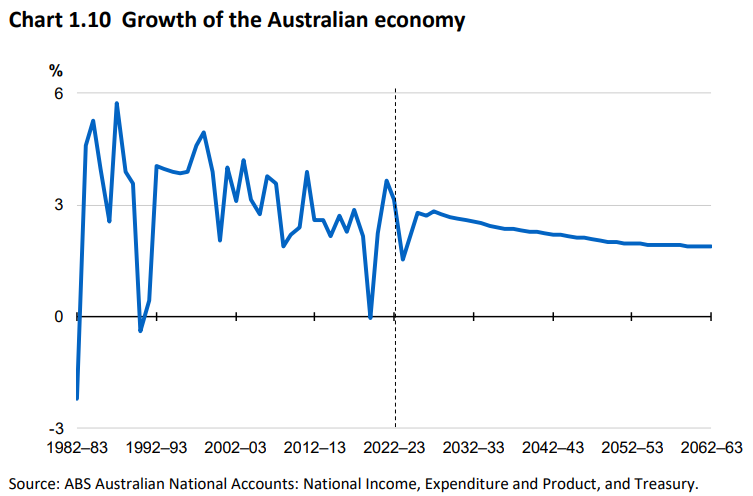

The latest Intergenerational Report (IGR) from the Australian Treasury Department is predicting a slower pace of growth for the Australian economy, with real GDP projected to grow at an average pace of 2.2% from FY23 to FY63.

Productivity is the key driver of economic growth. But that growth has slowed in Australia since the mid-2000s. Treasury assumes productivity over the next 40 years of 1.2% per year, based on recent historical performance but also to reflect headwinds to productivity growth.

Treasury identifies five forces it believes will shape the Australian economy over the next 40 years. The transition to net zero is one of the five. And they see three different themes to the investments required to achieve this.

Investment in the net zero transformation facilitated by government programs to accelerate investment in clean energy businesses, with the aim of increasing competition, supporting the diffusion of green technology, and growing firms.

Investment to buffer against the headwinds caused by changing temperatures and rainfall patterns on productivity in industries such as agriculture, tourism, construction and manufacturing.

Investment to improve resilience to extreme weather events to reduce their overall impact on productivity by 'effective investment in adaptation measures'.

To understand the investment implications of the net zero theme in the IGR, I turned to Alphinity Investment Management and asked Stephane Andre, Principal and Portfolio Manager, as well as the sustainability team for their take on this investment theme.

Note: the written responses were received in late September 2023. Alphinity has a position in the stocks mentioned in this wire but note their comments below about stocks excluded from the Alphinity Sustainable Share Fund.

Investing in legacy energy sources

LW: IGR talks about net zero over the next 40 years, which suggests renewable energy stocks are the way to go. But, right now, are there still opportunities in the less-loved sectors of coal, oil and gas?

Andre: We believe that the transition to net zero CO2 emissions through electrification is going to be disorderly and will still require some usage of fossil fuels during the journey. Gas, for instance, will most likely remain a source for firming renewables for some time.

Right now, although renewable power is expanding rapidly, fossil fuels still maintain an 82% share of the world’s total primary energy consumption (according to the Energy Institute’s annual review, and 73% of Australia’s.

And, according to the International Energy Agency (IEA) Stated Policy Scenario, 2050 projections for oil and gas in particular show production rates will stay fairly static. With the growth of renewables however, it is expected production rates of thermal coal will steeply decline.

"So in terms of investment opportunity, it’s important to remember that even to maintain existing supply of oil and gas, new developments will be needed to replace reservoirs that deplete overtime. We therefore expect that ongoing investment opportunities will emerge in this sector however we also expect that strong contenders for capital will be those that are forward-thinking in terms of diversification and decarbonisation."

Perversely, a lack of investment in fossil fuels may lead to shortages which would push prices up and, with it, returns.

Government policy risk

LW: Moving to energy generation, AGL (ASX: AGL) has been significantly impacted by shifts in government policy. As an investor, how do you think about this risk in the portfolio you manage?

Andre: AGL is an interesting case. Whilst it is presently one of the largest emitters in the country, it has aggressive decarbonisation plans to be Net Zero for scope 1 and 2 following the closure of its coal-fired power stations by 2035 (if allowed to by the government), and it intends to largely replace this capacity through an additional 12GW of renewable and firming generation which it estimates will cost $20bn. An elevated electricity price will help fund this transition but government intervention is a risk, as recently demonstrated.

We hold a position in the company (although not in our fossil-free Sustainable Fund) as we believe that the national renewable transition will most likely be disorderly and be accompanied by higher volatility and gas prices, and therefore elevated electricity prices.

We are however cognisant of the government intervention risk and would adjust our position if/when we see that risk increasing.

Building up Australia's energy infrastructure

LW: The IGR highlights the need to build up our energy infrastructure. How far behind are we? How much do we need to invest?

Andre: Earlier this year the IEA published its energy policy review for Australia. In the review the IEA highlighted that it is possible for Australia to reach its 2030 emissions reduction targets and net zero by 2050 but that further effort is needed to improve energy efficiency and boost clean energy investment. The review estimated that a 60% productivity improvement would be needed for a net zero aligned trajectory. It also stated that currently only 27% of the country’s power is from renewable energy today. This needs to increase to 82% to meet the Government’s emissions reduction goals.

The biggest challenge right now is the delay in getting renewable energy infrastructure designed and built, especially the transmission part. In NSW for example, five renewable energy zones need to be established and large upgrades to transmission infrastructure will be needed to replace the state’s existing coal-fired power plants. Most of this is still in the early design phase. The delay risk is therefore very real.

Climate change adaptation

LW: The report also highlights the need for timely investment in climate change adaptation. What opportunities are you seeing currently for investment in companies that are leaders in climate change adaptation, either as adapters or as providers of technology and/or services to other companies to facilitate adaptation?

Andre: There are a number of ways companies or industries are potentially benefiting from and facilitating adaption.

There are direct listed beneficiaries in Australia supplying the required raw materials such as the lithium and graphite producers for energy storage systems including Pilbara Minerals (ASX: PLS), IGO (ASX: IGO), Syrah Resources (ASX: SYR), the infrastructure such as AGL, and engineering companies such as Worley (ASX: WOR) required for the energy transition.

There are also those that benefit from funding the energy transition. The major banks have been restricting funding to fossil fuel projects such as new thermal coal mines, and have been keen funders of green and energy transition projects. While relatively small to date, it represents both an opportunity and a threat.

The company with the most exposure on the financial side is Macquarie Group (ASX: MQG), which is a facilitator, funder, developer and owner of a large number of green energy projects around the world through its Green Investment Group. It will also benefit directly from the Inflation Reduction Act in the US. Macquarie’s energy trading division can also benefit from the volatility in energy prices that a transition may bring – however that also presents potential risks.

Where to invest

LW: Let’s cut to the chase for investors: How much should investors care about this?

Andre: Investors should absolutely care. There is a global movement to decarbonise our economy and there will be many winners and losers along the way. Right now, there is still plenty of investment opportunity in transition metals such as copper and lithium, and in the longer term we expect the business case for renewable energy utilities and developers to improve.

Alphinity is currently invested in a number of companies which will be beneficiaries of this transition. While we believe the demand is a structural tailwind, the investment merit of each individual company for us will be assessed against our investment philosophy which is to invest in quality, undervalued companies that are in an earnings upgrade cycle.

Footnote: Agarwala and Martin, Environmentally-adjusted productivity measures for the UK, 2022, Bennett Institute for Public Policy, University of Cambridge.

2 topics

7 stocks mentioned

2 funds mentioned

2 contributors mentioned