In an arms race - Own the weapons manufacturers

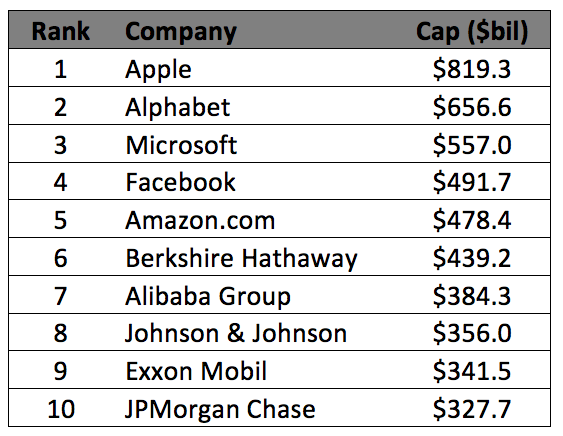

The five biggest listed stocks in the US are all tech stocks, with an aggregate market cap of US$3 trillion, roughly the same as the GDP of Germany. Nick Griffin from Munro has likened this vast tech sector to being in ‘an arms race’, and speaking at Livewire Live, he told the audience: ‘You want to own the weapons manufacturers’.

When asked what big trends in the tech sector he thought have the most potential, he expanded saying:

“Its an arms race to see who gets there first. It’s either a fulfillment arms race, data arms race or a computing arms race. And in any arms race you want to own the weapons manufacturer. So from our point of view, the semiconductor companies are a great place to be.”

The semiconductors category, which includes memory, microprocessors, and integrated circuits, are the ‘resources’ of the tech industry. As raw materials of the sector, they have performed very strongly for the last decade, like tech stocks. The iShares Semiconductor ETF is the biggest of all such ETFs with $1.1 billion in assets, and shows the trend clearly.

The industry is highly competitive, and it is also highly cyclical, as companies have to deal with constant changes in demand with popularity for particular consumer tech items constantly shifting.

This cyclicality can be advantageous, however, and extending the resources analogy, Nick told the audience that, as happened with commodities, semiconductors could be in for a prolonged structural upswing:

“Just like there was a supercycle in resources, there will be a supercycle in semi-conductors. Ultimately it’s a war. There are other investments apart from the big platforms. Clearly semiconductors is one of them”

Watch the short video below to get the full story, and to hear one other area that Nick likes.

How to find the next digital winners

We also recently interviewed Nick to ask him the criteria he uses to identify great growth companies, what the market has wrong at the moment, and how he goes about finding the next digital winners: (VIEW LINK)

2 topics

1 contributor mentioned