Is the free money era over? Why the jury is (still) out

Ask the average punter about the impact of higher interest rates on their lives and you'll likely get some colourful responses. What won't be in doubt is that the impact has been profound. A 60% rise in grocery bills in the last 12 months will attest to that.

That's why it was somewhat surprising when the panel at Livewire Live offered somewhat divergent views on both the impact and future path of higher interest rates.

And whilst the panel was viewing the hikes through the lens of economics and investments, the lack of consensus across a range of subjects from rates to housing and China was notable.

The panel included the following guests, and was moderated by Hans Lee:

- Alexandre Ventelon, Head of Research and Investment at Morgan Stanley Wealth Management

- Andrew Clifford, Co-Founder and CEO at Platinum Asset Management

- Diana Mousina, Deputy Chief Economist at AMP

-

Martin Conlon, Head of Australian Equities at Schroders

The impact of interest rate hikes

With his multi-asset hat on, Ventelon argues we haven't actually seen the end of the washout from COVID yet. With the earnings yield now being essentially on par with bonds and cash, investors are now thinking far more critically about the risk that comes with stocks.

"From a consumption and earnings momentum, we’re still riding what's left of the wave of the post-COVID environment with a lot of pent-up demand and some excess savings that is being washed through," he said.

Clifford characterised this part of the business cycle as "more confusing" one than most. But he says the corporate washout is more a symptom of the "COVID bust" rather than the global economy itself.

"I think what we are yet to see is the impact and the delayed reaction to corporate earnings that we're used to seeing 18 months to two years after those rate hikes," he said.

With her economist perspective, Mousina argued that we are already in a consumer recession given how retail sales have fallen sharply. She, alongside AMP chief economist Shane Oliver, argue there will be no more rate hikes in this cycle.

"I think you can see the pain in terms of all the rate rises that we've had and the impact on share markets," she said while adding that interest rates are still not at high levels by historical standards. "The accumulated savings argument is more or less over."

Conlon says the impact of interest rate rises has been broadly less than expected this cycle, confounding the theory that rate rises have huge impacts on valuations across a slew of asset classes. Why is that the case?

"I think, in part, it's the extent and duration of that interest rate decline cycle that you pointed to earlier. Behaviours have become so ingrained over very long periods of time that people are letting go of those," he said.

Where rates are headed?

Mousina gave her extended rationale for why the AMP team believe that there will be no more rate hikes in this cycle. She also told the conference about why she believes rate cuts could start as soon as Q1 2024.

"It's really our view that inflation is going to surprise to the downside and that consumers are not as resilient as what most people expect them to be and that the accumulated savings argument is more or less over," she said.

Ventelon had a different view and one that is openly against market pricing.

"Our macro team expects that we get one more hike in November given uncertainties and upside pressure around wages and sticky rents in Australia. But beyond that into next year, we think around the month of August, the RBA should have enough certainty that inflation is running around 3% or less on an annualised basis or quarterly annualised basis and by then they'll be happy to cut," he said.

Clifford wouldn't call whether there would be a cut next year but did argue that the top of the cycle is near.

"Maybe there'll be one more, two more, but I don't think there's going to be anything dramatic. But I think the real question here looking forward is not whether we get another rate rise or not, it's like how deeply can they be cut?," he said.

Conlon had a completely different view altogether. While he believes the RBA is done, it's not necessarily for a complimentary reason.

"Interest rates are a very blunt tool and arguably aren't solving the problems that we have. I'm not sure that interest rates are proving the right tool. I'd probably say that raising interest rates further will not be the right solution," he said.

What are the unintended consequences of the surge in interest rates?

Ventelon thinks investors are finally starting to understand central bank messaging - rates will need to remain higher for longer. He thinks the biggest unintended consequence of all these rate hikes is the fact that investors may need to reassess their base cases.

"A number of investors need to go back to their spreadsheets and revalue their assets, and that's something that's just started in some industries like real estate. So I think it's going to change the way we approach investments in the year ahead as well," he said.

Clifford's view reflects the crisis being seen in the US housing market. That market is wed to fixed interest rate mortgages, meaning people literally cannot afford to move out of their existing home let alone buy another one.

"[Higher rates have] created a very unusual circumstance in US housing where mortgage rates are quite a bit more than bonds because of the fixed interest rates people can't afford to move. But that means if you do want to buy a house, your only chance is to buy a new home. So there's a boom perversely in a massive housing recession," he said.

Mousina took a lead from Clifford's chart, arguing the biggest impact of all these monetary policy changes will actually be on fiscal and corporate debt/borrowing policy.

"It would be the impact on budgets and budget deficits. It was on the right path and now it's gone back the complete other way because one of the largest growing components of budget deficits, whether it's here or in the US, is interest expense," she said.

Conlon went in a completely different direction, arguing interest rates have not had a good effect on life for people outside of finances.

"The issue of social stability is probably the main one. Any economy has to rest on a relatively even spread of wealth, and we've pushed that to extremes. A lot of policies are going to be about chopping down some of those tall poppies," he argued.

Chart Talk

Each member of the panel also brought along a chart to highlight one of the key macro themes they are focused on right now.

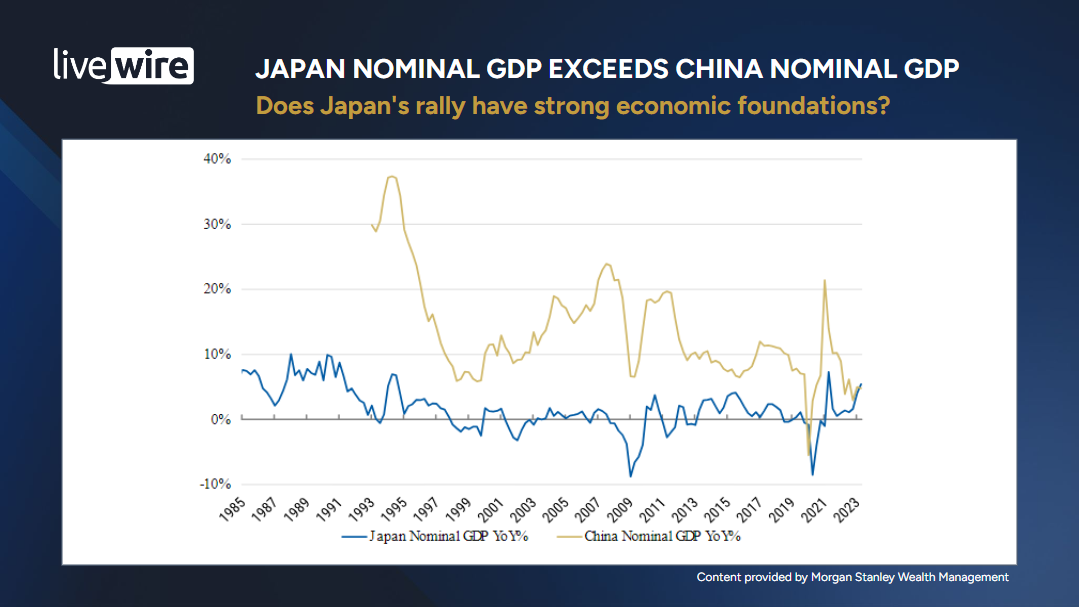

Alexandre Ventelon, Morgan Stanley - The Japan opportunity

"What [the chart] is telling us is that the world is changing.

China fell into outright deflation in the last GDP print. So I think it's a milestone, a negative one for China and it adds to the long stream of issues that have been quite public now.

I don't want to be the big bear on China. They're going through a restructuring of their economy and clearly the high level of debt, the ageing population, all these things must be taken into account".

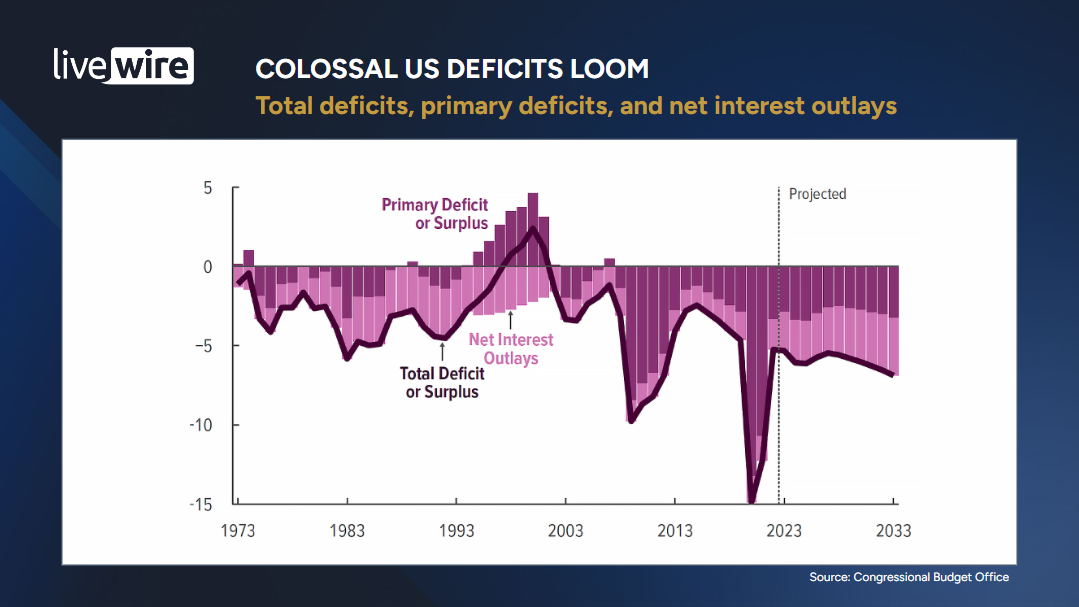

Andrew Clifford, Platinum Asset Management - US deficits

"I think that long-term interest rates, the most important one, the 10-year, is going to be at plus or minus 50 points from where we are today.

But don't expect them to go back down to two.

Don't expect short rates to get down to particularly low levels either. That would be the base case".

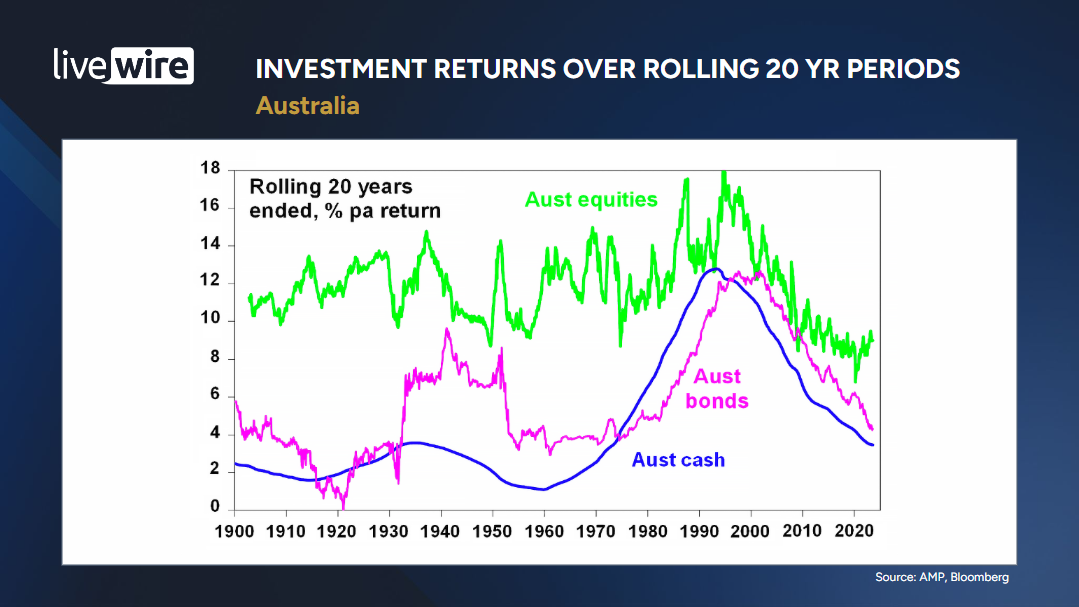

Diana Mousina, AMP - Long-term investment returns

[The chart] shows you that since we've seen the structural decline in interest rates over the past few decades, you can see that the long-term returns on equities have gone down in line with the returns of cash and bonds.

If interest rates remain elevated as we expect, then I think you can reasonably expect that you're not going to see the same returns on equities like you have in periods where interest rates were lower.

At the same time this chart shows you that you still have to be invested in equities because despite all the fluctuations that you can have on a short-term basis, you can still see that they have performed very well on a very long-term horizon.

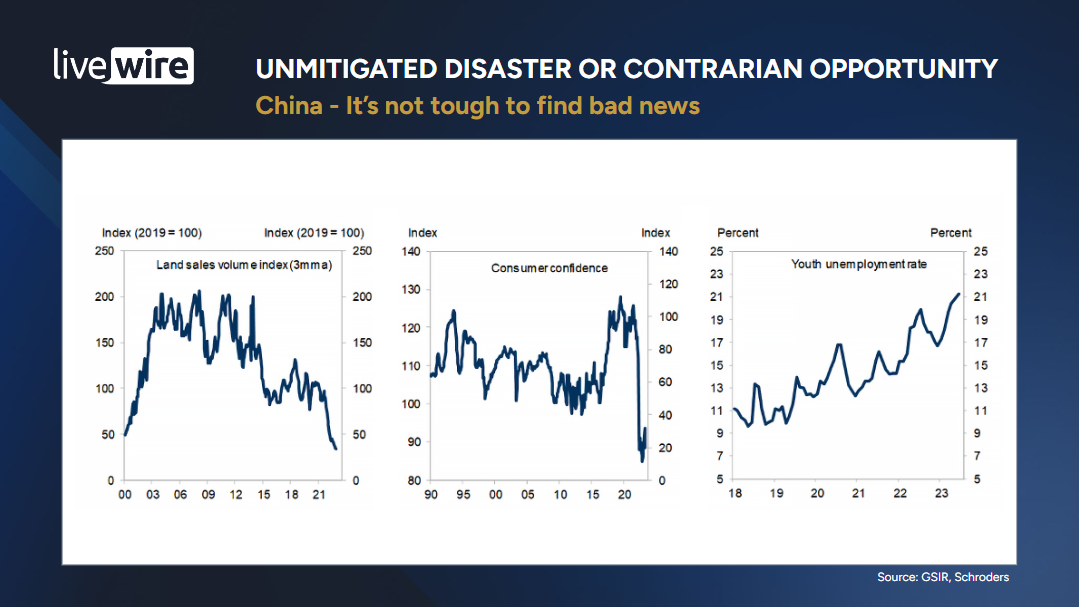

Martin Conlon, Schroders - The China Story

"I find China interesting because it's almost the opposite of Australia.

They've built way too much housing over the last couple of decades. So land sales are collapsing, consumer confidence is extremely low and they haven't, despite their efforts, been able to build a consumer economy in China at all.

We sit here in the western world with exactly the opposite set of problems. We're generally importing labour from Asia as a supposed cure to an ageing population - don't get me started on that.

China's pretty disastrous at the moment, but arguably they do have the advantage that they've got lots of manufacturing capacity, and lots of housing. What they can't get people to do is spend on consumption goods".

Watch the full session here

2 topics

6 contributors mentioned