Is there still opportunity in the BNPL space?

Livewire Markets

Buy Now Pay Later (BNPL) has put in an astonishing performance in recent years, growing from a barely known niche to an ASX powerhouse since 2017. In FY20 alone, Australian BNPL revenue amounted to AUD 680m, and is predicted to double by 2023. Investors must pay handsomely for that growth though, with the combined market capitalisation of the sector reaching $33.66 billion.

Assisted by the move to online retail as a consequence of COVID-19, it seems like everyone wants a piece of this up and coming thematic.

We all know and love Afterpay, the space's biggest player and an ASX darling. But since 2017, 7 Australian players have entered the market, all claiming to be the best and slightly different from its many competitors.

With a new BNPL company entering the market so frequently, I wondered whether the space was beginning to become overcrowded? In part 1 of this 4 part series, I reached out to three BNPL experts to get their take on whether there is still opportunity in this space.

Responses come from:

- Dushko Bajic, First Sentier Investors

- Emanuel Datt, Datt Capital

- Jun Bei Liu, Tribeca Investment Partners

The race is not over, yet

Dushko Bajic, First Sentier Investors

The addressable market for ‘buy now, pay later’, whichever way you cut it, is enormous and the key players in this space have only scratched the surface of it.

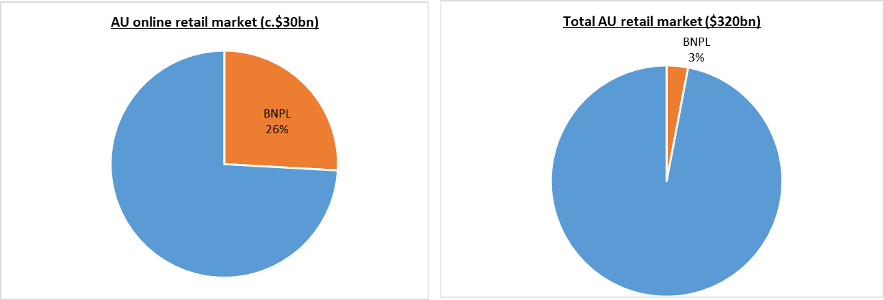

Source: Statistica 2019, NAB Online: Retail Index Dec-18, Company data

(Afterpay, Zip Co, Flexigroup, Openpay FY20 ASX investor presentations) as at

August 2020.

In Australia, the BNPL sector now represents over 25% of online retail sales, an impressive feat achieved within just 5 years. We agree with the mainstream view that the shift towards online retail is permanent, which means the online addressable market for BNPL will only expand over time. More interestingly, the BNPL sector only represents 3% of the total Australian retail market (based on A$320bn market size) today. Even with shrinking share, in-store sales are likely to remain the majority of retail sales over the near-term – representing an even larger untapped market for BNPL, for both old and new players. Although changing in-store consumer behaviour can be challenging, the dramatic shift to contactless payments in the Australian market over the past 3 years provides precedent of consumers adapting to new technologies.

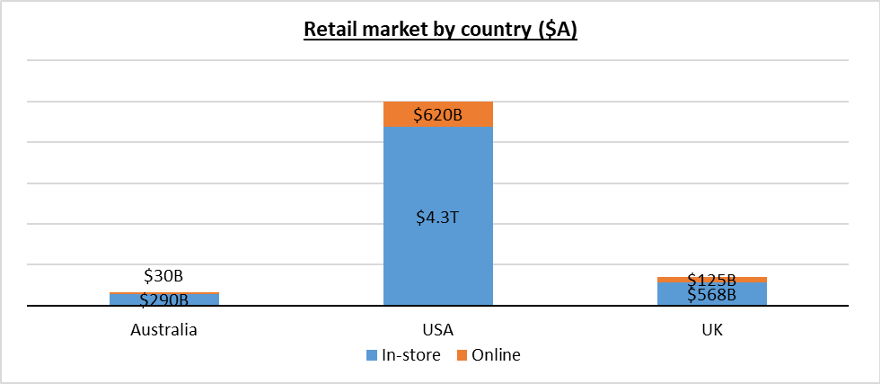

Source: Statistica 2019, NAB Online: Retail Index Dec-18, FTI consulting

group 2017, National Retail Federation 2019, Retail Economics UK 2019. Data as

at respective report dates.

Looking at the US, the retail market here is 15x larger than the Australian market – 20-fold when comparing eCommerce only. We estimate that the top 5 BNPL players have only penetrated c.5% of the US online retail market to-date, leaving plenty of room for growth in both existing and new players. Similarly to Australia, US in-store sales remain a large proportion of the total retail market, presenting ample opportunity for BNPL to penetrate the market.

When we extrapolate these trends and statistics to other geographies across Europe and Asia, it shows they are even less penetrated by BNPL. The size of the global opportunity for BNPL suggests it is a space yet to become saturated over the coming years.

No more room in Buy Now Pay Later

Emanuel Datt, Datt Capital

In our opinion, we believe the BNPL space is too crowded at this point for a startup play to be successful. Whilst there may be some opportunities in particular niches, we think that the consumer-focused BNPL space is very competitive given the number of incumbents and challengers competing for the same customer.

This is exemplified by the broad rise in ‘CAC’ (customer acquisition costs) for the BNPL sector. Two years ago, Afterpay the industry leader, was acquiring customers for less than $10. Today the figure has risen dramatically, and we estimate the overall CAC for the sector to be in the high double digits. This is just one example of the necessity to be well capitalised to enter the space at this point in time.

We believe there is still broader opportunity in the BNPL sector largely via the growing market share of BNPL payment methods versus other payment methods. In line with past experience, we expect the largest players in the sector to pick up the lion’s share of further incremental growth relative to newer entrants.

Just look at Afterpay

Jun Bei Liu, Tribeca Investment Management

There is still a significant amount of opportunity in this buy now, pay later space if you simply take a longer-term view. As investors, we find it very difficult to grasp the future opportunity. However, you merely have to look at Afterpay. The total addressable market has expanded significantly for the market leader. When Afterpay first started in Australia, we thought their entire market will be the Australian market. And then they moved to the US and to the UK, now Europe and Canada, and just more recently they have acquired a small business out of Asia.

The digital payment space is enormous and is a thematic that will continue to grow. If Afterpay can achieve what they have achieved in Australia, the earnings growth will be substantial even over the next two, three years, just out of the US market.

There is still a significant amount of opportunity over the long-term. For the short-term, yes, the sector has attracted a lot of interest, and there are a lot of market players. However, this presents the opportunity to be a little bit tactical. As an investor that normally takes a longer-term view, we believe the future opportunity and growth of the space is enormous.

Conclusion

If we look at what BNPL players have achieved in Australia in only a few years and extrapolate this success to the US with its much larger addressable market, it's clear that 'blue sky' potential still remains for the incumbents provided they execute well.

But that does not mean clouds won't appear - as more entrepreneurs recognise the staggering growth potential in BNPL, more players will join to compete and drive up acquisition costs in the sector. In that sense, it will be important for investors to think about how the rising cost of business could impact profitability, and the best way to invest in this space accordingly.

Enjoy this wire? Hit the 'like' button to let us know. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 stock mentioned

4 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.