Is uranium the new lithium?

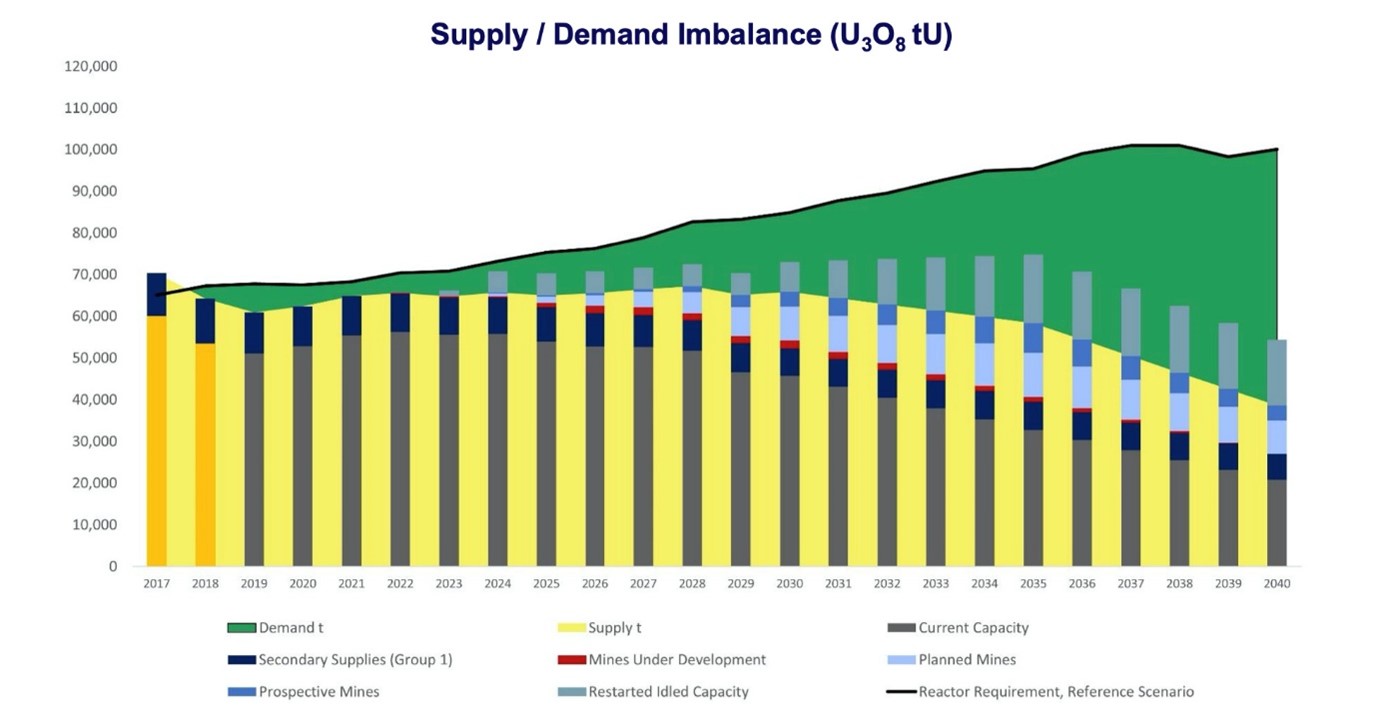

Similar to the early days of the lithium rally, those companies that correctly precited a commodity shortage or supply gap will be big winners no matter where the stock market ends up in 2024. Despite the sector making solid gains this year, should uranium stocks follow the same pattern as the lithium rally, 2024 could be its year.

Spot lithium had its first big up year in 2021, rallying around 90%+, but from December 2021, lithium supply gaps caused a price squeeze that topped out 300% higher during 2022 as the ASX went into a lithium frenzy.

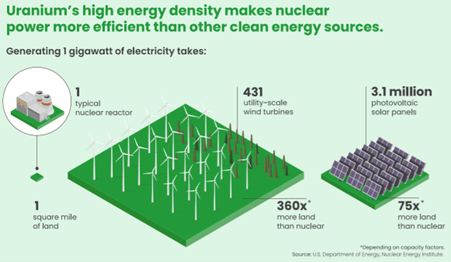

The price of uranium has risen 60% in 2023, rising from $50 a pound to over $80 a pound, a modest gain compared to the 2021 lithium rally. Uranium is in high demand, thanks to its role in clean energy transition and with 22 nations, representing 43% of the global economy, recently committing to tripling their nuclear power over the next 25 years, we are expecting the rally in uranium to continue.

Here we outline 3 ways to get uranium exposure and rank them in order of Good, Better, Best.

GOOD (non-pure play): BHP (ASX: BHP)

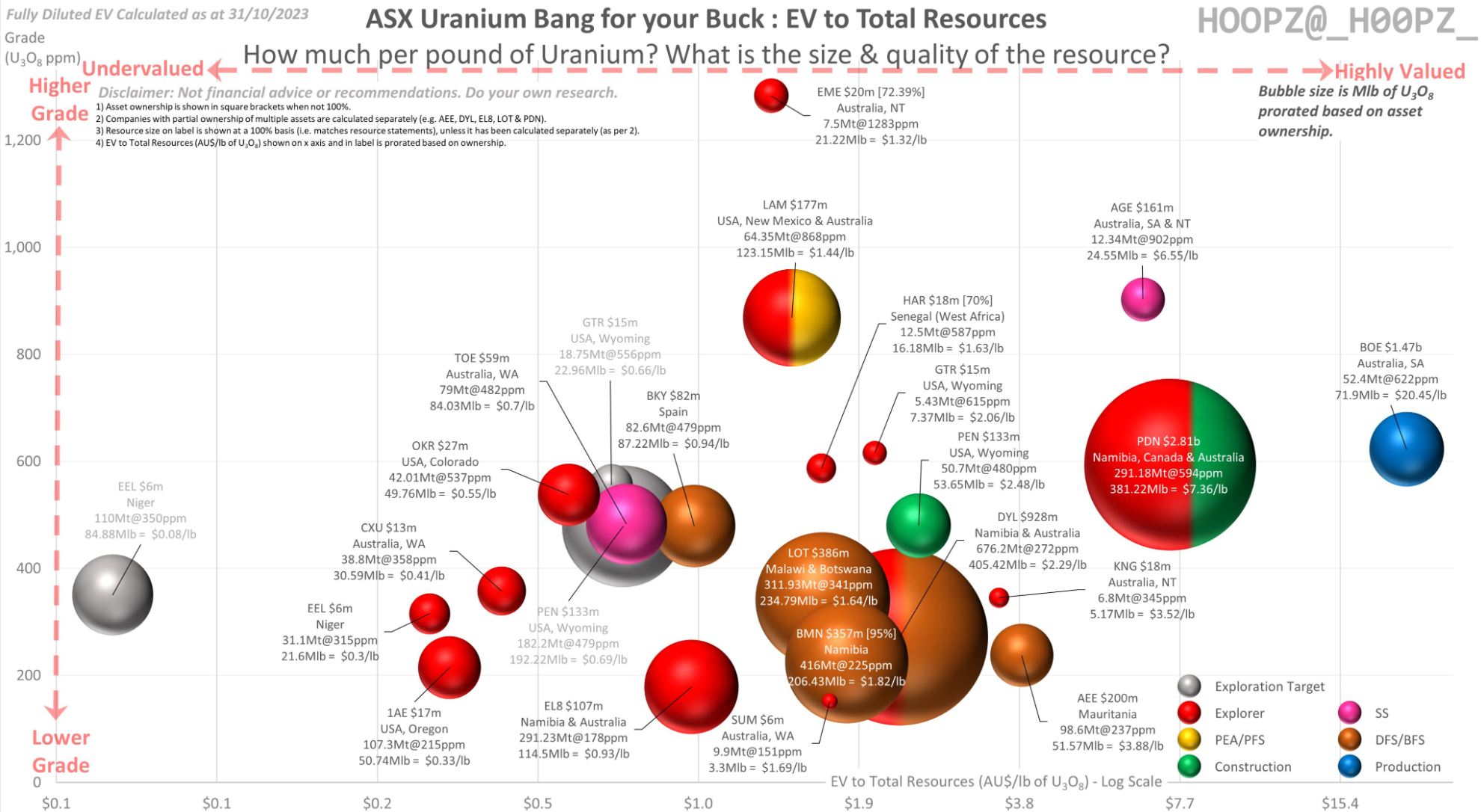

In the world of ASX-listed uranium production, BHP stands out like a shining star, producing 3,406 tonnes in FY23, a whopping 43% YoY jump. To put it simply, BHP owns nearly 7% of the global uranium production scene, making it a big player. Boss Energy (ASX: BOE), the closest pure-play uranium producer, hopes to catch up in the next three years but is still a way off.

While uranium isn't the main act in BHP's profit show (that's iron ore and copper's gig), there's potential – roughly 6-8% – if they decide to dance more with uranium, especially considering Olympic Dam's immense uranium resources. Keep an eye on BHP's moves - the uranium plot might just get thicker!

BETTER: Boss Energy (ASX: BOE)

Boss Energy is beating other upcoming producers to the punch with its Honeymoon mine in South Australia, already in full swing, just about 400 km southeast of BHP's Olympic Dam. BOE isn't waiting around – they've been at it since 2015, reviving the mine closed post-Fukushima due to low uranium prices. The cool part? By kicking off production now, Boss joins the big guns like Kazatomprom, Cameco, and BHP, set to ride the wave of high uranium prices. Their goal? Pump out 2.5 Mlbs U3O8 annually for 11 years, which is hefty but still only one-third of BHP's output. Plus, with a $150 million uranium stash and ongoing drilling, Boss is gearing up for an encore in the uranium spotlight.

EVEN BETTER: Paladin Energy (ASX: PDN)

Paladin Energy holds

a commanding 75% stake in Namibia's Langer Heinrich mine, strategically

positioned in a renowned uranium province with established mining

infrastructure. The stability of mining jurisdictions is a hallmark of

Paladin's projects, aligning with the investor-friendly locales of Olympic Dam,

Honeymoon, and Rook I. Despite global mineral asset nationalizations, Namibia

stands strong as a "mining friendly" haven, with uranium standing out

as a key export. Langer Heinrich, Paladin's revitalization project, is racing

toward an 80% completion milestone, targeting first production in Q1 2024

within the allocated US$118 million budget. Boasting 120 million pounds U3O8 in

Measured and Indicated resources, Langer Heinrich eyes a peak production of 6

Mlb p.a., potentially contributing 4% to the global uranium supply. With 48%

offtake agreements secured and the majority of production exposed to

market-driven pricing, Paladin is fully funded, emphasizing expansion through

exploration and highlighting a robust uranium portfolio across Canada and

Australia.

BEST: Betashares Global Uranium ETF (ASX: URNM)

URNM provides exposure to leading global companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or that hold physical uranium or uranium royalties. With management costs of only 0.69% p.a., URNM provides cost-effective exposure to the nuclear energy thematic in a single trade. One of the main benefits of investing via URNM is that global uranium exposure has vastly outperformed ASX listed shares this year.

In short, don't be afraid to buy with momentum, because as we saw with the recent scramble for supply in the energy transition, quite often prices can rally to extreme levels before common sense prevails.

Founded by Investors for Investors

MPC Markets' mission is to empower every investor with the knowledge, tools, and guidance necessary to unlock their financial potential. Find out more.

4 topics

4 stocks mentioned

1 fund mentioned