It’s (almost) all about the yield

Two big questions asked this week had a common thread. The questions were; are stocks overvalued and why doesn’t the RBA undertake more quantitative easing? The common thread is that central bank actions are driving asset prices. Investors spend a great deal of time trying to guess what central banks will do with overnight rates and quantitative easing. They are doing this because if central banks take away the metaphorical punch bowl, the party would quickly become a riot with asset prices trashed.

Asset prices

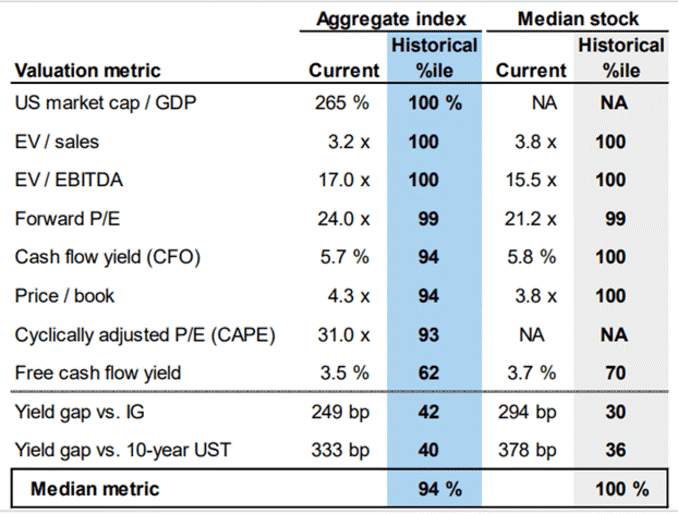

The “stocks are somewhat overvalued” argument has put forward many times in recent years and was well made this week by Roger Montgomery. Asset prices generally seem high and there’s plenty of irrational activity occurring. However, when compared to bond yields, stocks in the US and Australia aren’t that bad at all. The table below from Goldman Sachs highlights this point, with US valuations below average in the bottom two metrics that compare equities to corporate and government debt but extremely high on almost all other metrics.

It’s not just equities that can be argued to be overvalued. Recent decades have seen bubbles in the US in high yield debt, tech firms (both public and private), SPACs and housing. It can be argued that all of these sectors are now looking bubbly at the same time.

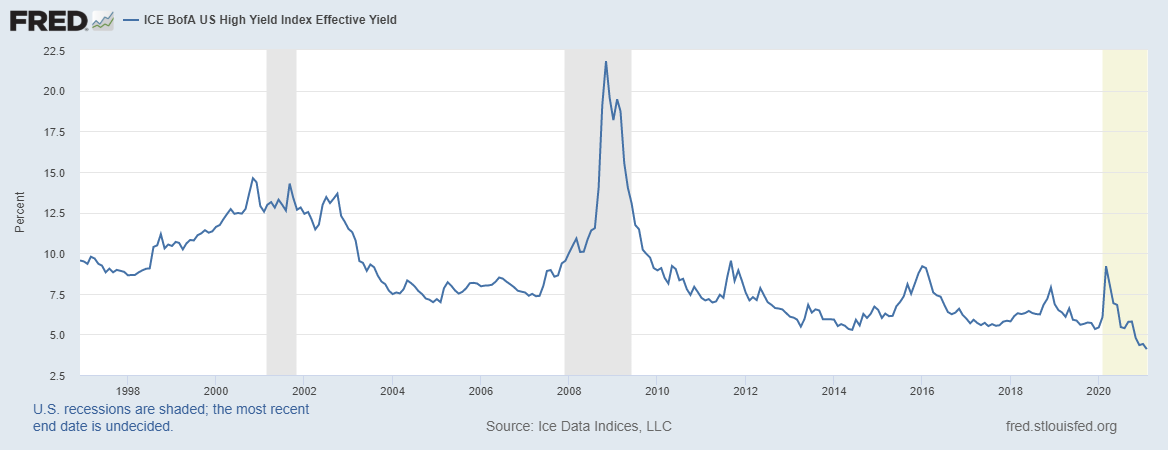

US high yield bonds are in the same position as equities. The credit spread component today at 3.50% is well below average, but this metric spent periods in 1997 and early 2007 below 3.00%. However, when looked at from an all-in (credit spread plus interest rate) basis the total yield of less than 4% today is the lowest it has ever been.

There’s two key takeaways on valuations. If you look at the historical performance of equities, when most of the metrics are saying overvalued, future returns should be poor. This level of overvaluation points to a lost decade ahead for stock returns. However, with the never before seen levels of interest rate suppression and money printing by central banks, history may not be a good predictor of the future. If central banks get the heated economies they want, equities could become a good (nominal) performer as inflation picks up.

More quantitative easing?

The back and forth this week between Andrew Leigh, politician and former academic economist, and Philip Lowe and Guy Debelle of the RBA was intriguing. Andrew Leigh pressed the points that unemployment is elevated, and inflation is below the target range. In his mind, the RBA should ramp up quantitative easing to increase employment and inflation. This logic is akin to a drug addict who figures that if one dose feels good, a double dose will be even better.

Lowe and Debelle responded that what has already been done is very substantial, its impact is not easily modelled and that there should be some time to see how the recent moves play out before going harder. Given they were being questioned by a politician the more accurate and beneficial responses would have been something like:

· We are doing unprecedent things with monetary policy which carry the significant probability of ending badly

· Debt levels, asset/house prices and zombie companies are already excessive with savings inadequate

· We have no idea how or when to normalise interest rates and unwind quantitative easing

· The inflation target band is too high, (only politicians, central bankers and academic economists worry about low inflation, sane people prefer lower prices) please change our mandate so that low inflation is acceptable

· Fiscal policy is also stretched, future generations will pay the price for the profligacy of the current generation of politicians through higher taxes, lower employment and lower growth

· The current generation of politicians has done nothing on tax reform or productivity reforms, so you are in no position to lecture the RBA when it has already done far more than was reasonable

3 topics