Manufacturing in a credit crunch, inflation impacts and Thai rice

.png)

This week’s charts begin by tracking the links between previous credit crunches and downturns in US manufacturing. Moving on to inflation, we show how French spending on food has plummeted in real terms, and then dissect the decades since the 1960s to show how inflation eroded the yield from bonds in different environments. As the euro rebounds against the greenback, we show the effect on the Dollar Index. In Thailand, we demonstrate how rainfall is far below its historic range due to El Nino, threatening rice crops. And finally, we examine a mystery of international trade: Italian exports to China are surging.

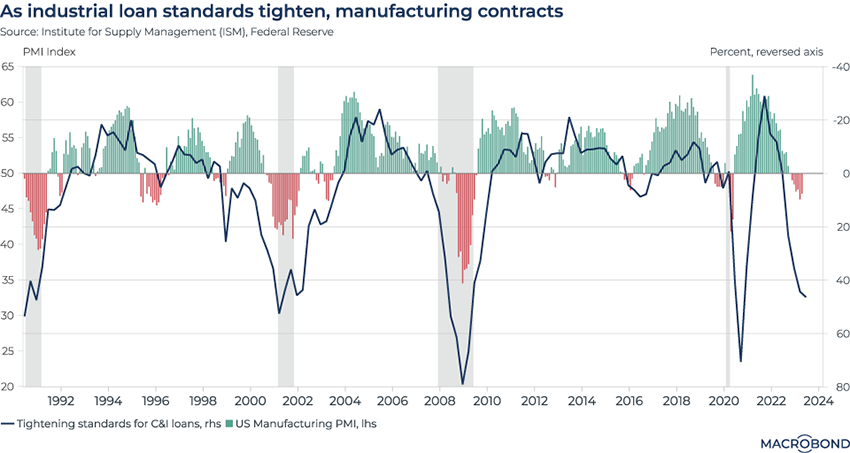

Manufacturing gets hit when credit crunches take hold

We’ve previously explored worries about a credit crunch in the US. This week, we turn to big business – showing the historic link between tightening loan conditions and manufacturing output.

This chart compares the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) with the Institute for Supply Management’s purchasing managers index (PMI), the well-known survey of manufacturing executives.

PMI readings below 50 indicate economic activity is contracting. For the SLOOS series, which tracks Commercial & Industrial (C&I) loans, the inverted axis shows the net percentage of bankers reporting tightening credit standards. (I.e., a negative reading is good news, as it means more loan officers are reporting that standards are easing.)

The simultaneous troughs in previous recessions are clearly visible – as is the tandem move today; PMI has shown contraction for six months.

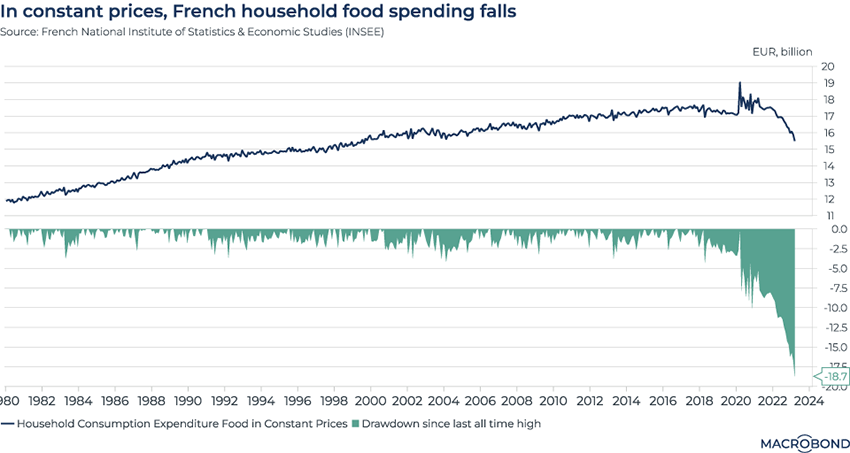

The French are economising on food as inflation bites

.png)

As French food inflation surged, recently accelerating to an annualised 15 percent rate, households coped by imposing spending discipline unseen in recent history. (Emmanuel Macron’s government, meanwhile, moved to cap retail prices for staple foods in March.)

This chart shows monthly food consumption in constant 2014 prices, removing inflation from the equation. As households broadly grew more affluent, the real household spend increased gradually from 1980 to the late 2010s. After spiking as consumers hoarded food at the start of the pandemic, this measure of spending has plunged almost 19 percent from its peak, as the second panel shows.

While this trend undoubtedly reflects consumers opting for discount retailers, swapping big brands for private labels and choosing cheaper cuts of meat, it’s also reasonable to see the decline as a proxy for a shrinking volume of food consumed.

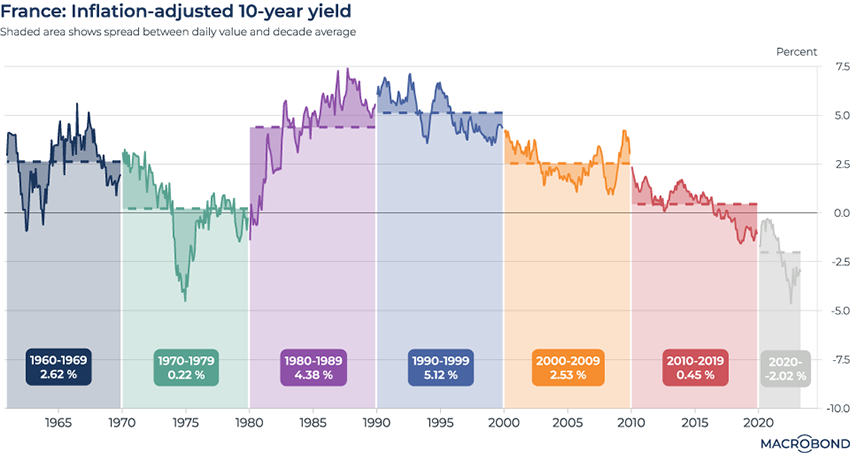

Decade by decade, inflation and rates hit bond investors differently

.png)

This chart visualises the environment for buyers of French bonds over the decades, assessing the interplay between interest rates and the inflation that erodes real returns.

Our chart shows the evolution of real 10-year yields (subtracting inflation from the absolute yield), as well as month-by-month divergence from the decennial average.

The disinflationary 1980s and 1990s were a golden era for fixed-income investors in many countries; after inflation, French bonds yielded well over 4 percent for the better part of 20 years.

The current environment is even tougher than the famously inflationary 1970s. That decade saw real 10-year yields average little more than zero – while since 2020, the average real yield is well into negative territory.

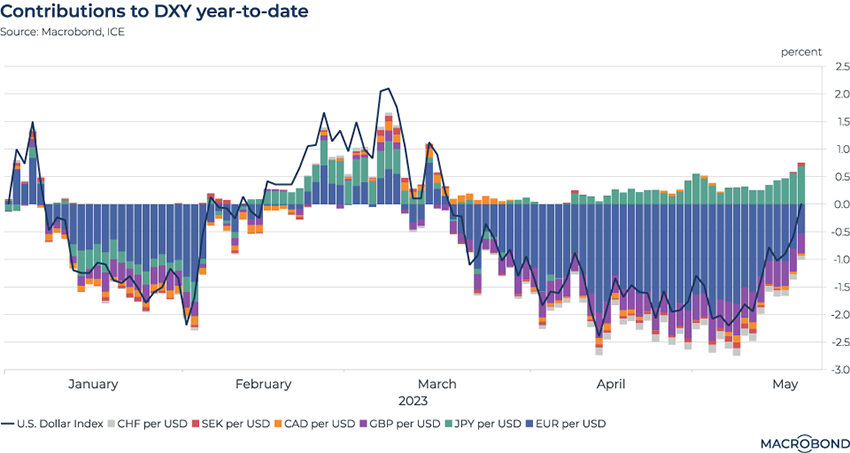

The Dollar Index and the euro’s rebound

.png)

We wrote repeatedly last year about King Dollar: the greenback was rising against almost every other currency in the world.

This year, that trend has reversed.

Our chart breaks down the 2023 performance of the Dollar Index (DXY) – a benchmark that measures the greenback against the currencies of major US trading partners.

In recent weeks, only the yen is depreciating against the global reserve currency.

The biggest contributor to DXY’s drop has been the rising euro. While many observers of the Fed think that Jerome Powell has finished with rate hikes, the European Central Bank is perceived to have a relatively hawkish bias. That’s the reverse of 2022, when the Fed hiked aggressively, the ECB was slower, and the euro slid to parity with the dollar as funds flowed to the higher yields available in the US.

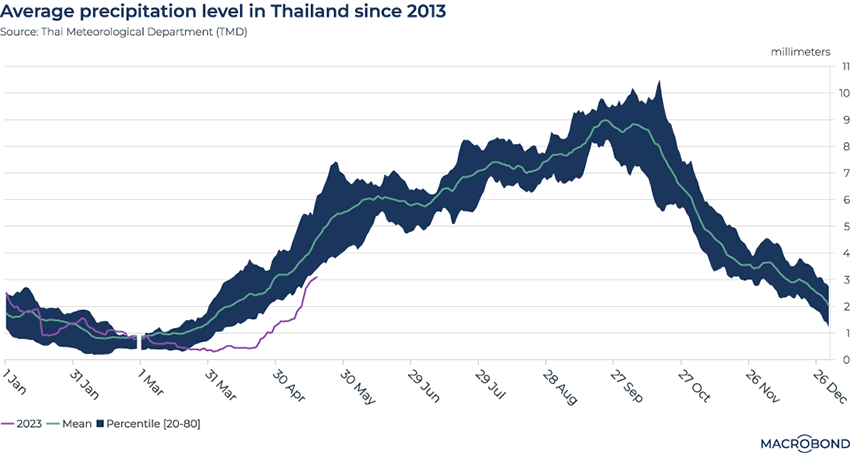

Thailand’s drought threatens global rice stocks

.png)

With the El Nino climate phenomenon back in the news, severe heat is hitting southeast Asia. Thailand is preparing for one of its driest years in a decade, and that’s important as the world grapples with rampant food inflation.

As our chart shows, since March, precipitation in the southeast Asian nation has been well below the average since 2013. It’s also been well below the 20-80 percentile range.

Thailand is the world’s second-biggest exporter of rice. It usually grows two water-intensive crops a year of this dietary staple. This year, the government has asked farmers to grow only one rice crop. The resulting drop in output has the potential to drive up global food prices more broadly.

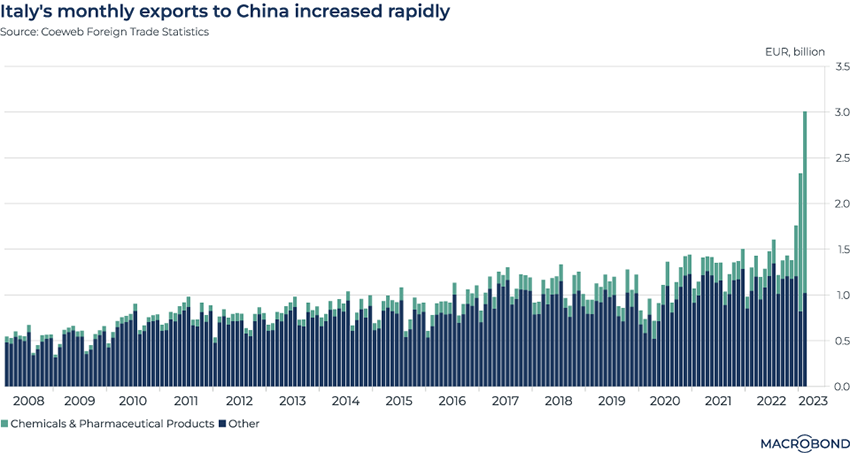

The Italy-China trade conundrum

.png)

Europe’s economy is sluggish. China’s reopening has been disappointing to some. But somehow, Italian exports to China are undergoing a massive boom – even as Prime Minister Giorgia Meloni threatens to pull out of a trade deal with Asia’s biggest economy.

As our chart shows, recent monthly figures have broken from the recent trend. One might suspect surging Chinese demand for Italian luxury goods, given how that narrative has lifted France’s LVMH.

However, when breaking down the sectors, we see that the subcategory “Chemicals & Related Products,” which includes pharmaceuticals, is the overwhelming driver.

As Bloomberg News recently reported, one theory is that China’s consumers are buying a generic liver drug that’s dubiously believed to be effective in preventing Covid-19.

Other theories speculate that medicines produced elsewhere in the European Union are being routed through Italy for re-export.

4 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)