Markets may be losing their grip

It’s fair to say that small-government, free-market ideas have dominated the political economies of many countries for the past few decades.

They’ve been so persuasive that they were taken up not just by centre-right parties – think of Mrs Thatcher’s Conservative government in the UK and President Reagan’s Republican administration in the US – but also by their successors, which, of course, included governments of their centre-left political opponents.

In the UK, Labour prime minister Tony Blair broadly accepted the Thatcherite settlement with its emphasis on competitive product and labour markets.

Bipartisan acceptance of market-driven economics in the US was signposted by Democratic President Bill Clinton’s 1996 State of the Union Speech, when he declared: "The era of big government is over."2

Labour parties in Australia and New Zealand, in the 1980s, floated their countries’ currencies, cut income tax rates, broadened tax bases, removed protectionist barriers, and privatised many public assets.

Western Europe too, which historically has been dubious about ‘Anglo-Saxon capitalism,’ eventually succumbed to the intellectual tide, exemplified in Germany, where Social Democrat chancellor Gerhard Schröder reformed the country’s labour market and social welfare system.

Market-oriented policies have not been exclusive to wealthy countries. Developing countries, from Mexico to Brazil, assumed the Washington Consensus,3 as it became known.

Attempting to prove a simple straight-line relationship between public policy and financial market performance is thorny, but it’s probably more than a coincidence that investment market returns have been strong over this multi-decade cycle.4

CIO Market Insights: Possible swing towards greater government intervention

Now there are signs that market-oriented principles may be losing their grip. After all, these ideas didn’t appear in a vacuum.

They were once a minority view in policy circles and amongst other opinion influencers. However, they won the intellectual high ground when the activist government policies of the post World War II period ran aground with the terrible stagflation of the 1970s.

New and different concepts were sought to tackle the malaise, and market-driven ideas were embraced as the way forward.

Now, on the great political economy seesaw, free marketism could be pushed aside for something that looks more like interventionist government.

CIO Market Insights: Surprising political figures breaking the free market consensus

Intriguingly, two of the political figures who have broken with the free-market consensus – Donald Trump and Boris Johnson – are of the political right, not left.

Though President Trump’s tax-cutting and light-regulation policies were straight out of the small government playbook, his trade, industry, and immigration policies were not.

He was anti-free trade and anti-globalisation, citing the impact on blue-collar America and traditional industries. He sought deep cuts to legal (as well as illegal) immigration, arguably for nativist as much as employment and American workers’ wage reasons.

He was pro-tariff on the grounds that free trade was disadvantaging America and destroying US manufacturing. He looked to undo global supply chains so that industries would return home.

For his part, Prime Minister Johnson has spoken of “levelling up”5 left-behind communities suffering lower life expectancy, poor educational attainment, and depressed incomes. Instead of small government, Mr Johnson proposes a “catalytic role for government”.6

Recently, he won a House of Commons vote to raise taxes to the highest level on record, including on dividends, to fund health and social care.7

Mrs Thatcher must be rolling in her grave!

Recent events in China, where the government has struck out at the tech sector, targeted high-profile individuals, including wealthy entertainment industry figures, and attacked private education providers, can be viewed through a similar lens.

In former Australian ambassador to China, Geoff Raby’s observation, “The leadership has seen that globalisation has become associated with rising income inequality”8 and the widespread crackdown is a response to “popular sentiment about inequality and unfairness.”9

Among major industrial country leaders, President Biden is rolling out what is probably the most ambitious government program since President Lyndon Johnson’s Great Society. To “reverse income and wealth inequality, Mr Biden favours large direct transfers and lower taxes for workers, the unemployed, the partially employed, and those left behind”.10

Joe Biden and Donald Trump are far apart philosophically and tonally, but the current president “has maintained the Trump administration’s tariffs on China and other countries, and introduced stricter ‘buy American’ procurement policies, as well as industrial policies to re-shore key manufacturing sectors”.11

Finally, there’s the COVID factor, as communities look to governments and public institutions to safeguard health, and cushion against the worst impacts of economic disruptions. Security of supply, especially of essential items such as pharmaceuticals, is paramount.

That’s likely to mean more local (and higher cost) just-in-case production versus just-in-time global production.

CIO Market Insights: We consider multiple futures

It’s unwise to assume that the future will simply be a straight-line continuation of the recent past. On that basis, it’s possible that the interventionist government inclinations of recent years won’t take hold and free-market ideas will return to the driver’s seat.

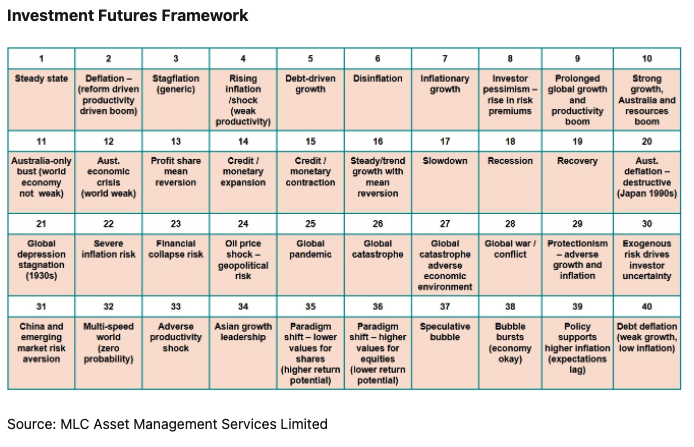

We are considering both possibilities, and many others, through the Investment Futures Framework, which underpins the management of MLC’s multi-asset funds.12

Rather than imagining one or even several sets of outcomes and their associated investment returns, the Investment Futures Framework recognises the possibility of a vast number of scenarios (see chart) with a great breadth of return possibilities.

Many futures are possible

The Investment Futures Framework forces us to think about a range of possibilities as distinct from guessing what will happen. Investment professionals can easily fall into the trap of trying to land on a preferred base case and position portfolios accordingly.

Moreover, a single base case scenario, or even instances where an upside case and downside case are also developed, runs against the world’s complexity.

CIO Market Insights: Potential investment implications

Nevertheless, for the sake of following through on the theme of this commentary, the possibility of a turn towards activist government, let’s speculate on some possible high-level investment implications.

An increased role for government to address social and economic inequalities would require funding, in part, through higher taxes on business, wealth, and high-income earners. Debt, financed by issuing many more government bonds, would be the other side of the funding equation.

While investors may be reluctant to own more government bonds, central banks may be persuaded to do so to prevent interest rates climbing uncomfortably high. In this scenario, higher inflation would probably be tolerated by governments as a way of keeping a lid on public debt levels.

Higher inflation would have mixed effects on share markets as industries and companies with pricing power could pass on higher costs. Price-takers would have to absorb rising costs, crimping their profitability in the process.

Assets offering inflation-protection, such as infrastructure and select commodities, might attract more investor support.

While this is conjecture, for now, rather than dismissing these possibilities, we think it’s sensible to map them out and consider the investment implications.

CIO Market Insights: ‘Participate and protect’ is tried and tested

In our view, investment diversification through our ‘participate and protect’ approach is the best way of dealing with uncertainty. There are no short cuts or magic bullets to long-term investment success.

The portfolios we manage for clients participate in the higher return potential of growth assets, including shares, private equity, and infrastructure, while looking to protect them against the risk of market downturns through innovations including sophisticated derivatives strategies.

This tried and tested way of investing has steered our clients’ portfolios through many investment conditions over the past four decades, and we think is up to the job of doing so into the future.

Learn more

Our portfolios combine our best thinking on asset allocation with a disciplined investment process, developed over 35 years, that optimises returns and reduces risk. Stay up to date with all my latest insights by clicking the Follow button below.

For all article sources, please visit our website

1 Historical Investment Returns Calculator. Compare historical stock, commodity, real estate and fixed income returns, (VIEW LINK), accessed 16 September 2021.

2 President William Jefferson Clinton, State of the Union Address, US Capitol, January 23, 1996, (VIEW LINK), accessed 16 September 2021.

3 How have the Washington Consensus reforms affected economic performance in sub-Saharan Africa?, Belinda Archibong, Brahima Sangafowa Coulibaly, and Ngozi Okonjo-Iweala, February 19, 2021, (VIEW LINK), accessed 16 September 2021.

4 Historical Investment Returns Calculator. Compare historical stock, commodity, real estate and fixed income returns, (VIEW LINK), accessed 16 September 2021.

5 The Prime Minister's Levelling Up speech: 15 July 2021. Prime Minister Boris Johnson gave a speech on his vision to level up the United Kingdom, (VIEW LINK), accessed 16 September 2021.

6 Ibid.

7 Johnson wins health care vote to push UK taxes to highest ever. Alex Morales and Emily Ashton, 8 September 2021, (VIEW LINK), accessed 16 September 2021.

8 Xi Jinping wards off China-style populism. Geoff Raby, September 6, 2021, (VIEW LINK), accessed 16 September 2021.

9 Ibid.

10 Spot the populist: Donald Trump and Joe Biden, who has stuck with several of his predecessor’s economic policies. Nouriel Roubini, August 4, 2021, (VIEW LINK), accessed 16 September 2021.

11 Ibid.

12 MLC’s multi-asset funds are listed in the Important information at the end of this article. PDSs are available at mlcam.com.au or at mlc.com.au

4 topics