Peak liquidity — and what it means for markets in 2023

‘Global liquidity flows like a river

a force of nature wild and never to be tamed

it’s power immense

a tide that shapes the world’s defense

Like a storm that rages through the night

It gathers force, it gains its might

With every passing day it grows

an endless stream that always flows

It brings life to markets far and wide

It drives growth and fuels our pride

It shapes the future that we see

a rolling river wild and free.’

The poem above on global liquidity is by ChatGPT, the new artificial intelligence program. It comes from Michael Howell, a recent guest on The Grant Williams Podcast. He asked ChatGPT to come up with a poem on global liquidity in the style of Dylan Thomas.

Given my last Livewire article was all about liquidity being the driving force of the recent market rally, rather than fundamentals, I thought it would be a good place to start this wire.

That’s because it’s been an increasingly popular topic in the world of finance lately. I’m always interested in what the key talking points are because it tells you what is priced in. Remember, if it’s in the news, it’s in the price.

With this in mind, there’s anecdotal evidence that we may be at ‘peak liquidity’, at least from a short-term perspective.

I say this because in the past week or so I have heard from global liquidity specialist Michael Howell twice — on The Grant Williams Podcast and the Forward Guidance Podcast.

Out of interest, I looked him up and he has also appeared on two other podcasts recently.

So that’s one in December and three in February. Given he’s not on a book-flogging tour, he’s a man in demand.

When ‘everyone’ is asking the same bloke questions about ‘liquidity’, you know the story is long in the tooth. Or at least it’s well-known and largely ‘priced in’, especially because his narrative is a relatively bullish one.

If you’re interested in this topic, I recommend listening to what Michael has to say. He has some very good insights into the effect of liquidity on markets.

He made the case that global central banks are again adding liquidity to markets (especially China and Japan), despite rising interest rates.

He says the Fed isn’t really doing quantitative tightening (QT). Or, at the very least, QT has slowed considerably. In fact, I showed you in my previous article how the Treasury General Account and Reverse Repos combined to slow the impact of QT in the US in the second half of 2022.

Now, liquidity is a difficult concept to communicate. But you get the gist: When liquidity is ample; it drives assets markets higher. When it is scarce, prices fall.

Bond markets and liquidity

One of the biggest insights I got from listening to Michael’s interviews was learning that one of the key sources of global liquidity isn’t necessarily central banks. Rather, it’s the bond market.

Government bonds are a key source of market liquidity because they’re used as collateral for short-term lending.

When bond prices are volatile, the volume of lending and liquidity dries up. But when the bond market is stable, this collateral-based lending increases, as does liquidity.

Liquidity leads stock prices, so this is an important concept to understand.

Let me show you what I mean…

The chart below shows the bond volatility index — known as the MOVE Index — in black. I have inverted it, so a declining line means rising volatility and vice versa.

Below the MOVE Index is the S&P 500. You can see the correlation. When bond market volatility picks up (which impacts liquidity), the S&P 500 comes under pressure.

When volatility falls, as it has been doing since September/October last year, the S&P 500 rises:

Source: Optuma

What caused bond market volatility to ease (and the S&P 500 to rise) in September last year?

That was when it became apparent that inflation had peaked.

The market went from a very uncertain interest rate environment to pricing in rate cuts by the end of 2023. This increasing certainty saw volatility and bond yields fall and stock prices rise.

In a sure sign of ‘liquidity’ returning to the market, you’ve seen all the low-quality stocks that did well in 2021 surge again. Meme stocks, stocks with broken business models, stocks with no earnings, and cryptos are all benefiting from increased liquidity this year.

But as I’ve been arguing, I think investors have gotten ahead of themselves.

While the US economy is clearly slowing, and inflation is falling, it’s not happening fast enough for the Fed to change its tune on interest rates.

They’ll keep rates higher for longer than the market currently thinks. And they’ll continue with the policy of quantitative tightening, even though there are factors that offset some of this tightening.

Various Fed governors are out on the speech circuit making the case for higher rates. Last week, board member Loretta Mester said:

‘At this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5 percent and hold it there for some time to be sufficiently restrictive to ensure that inflation is on a sustainable path back to 2 percent. Indeed, at our meeting two weeks ago, setting aside what financial market participants expected us to do, I saw a compelling economic case for a 50-basis-point increase, which would have brought the top of the target range to 5 percent.’

And James Bullard is hawkish too…as MarketWatch reports:

‘St. Louis Federal Reserve President James Bullard on Thursday said he joined Cleveland Fed President Loretta Mester in advocating a 50 basis point interest rate hike at the central bank’s meeting earlier this month.

‘In comments to reporters following a speech to a business group in Jackson, Tenn., Bullard also said that he would like to see the Fed get its benchmark rate to a range of 5.25%- 5.5% and get there “as soon as you can.”

‘That would be an additional 75 basis points from where the Fed’s benchmark rate is now.

‘Bullard and Mester are not voting members of the Fed’s interest-rate committee this year, having rotated off after voting last year.’

Still, that doesn’t mean their views aren’t important.

While a 50-basis-point increase from the Fed at the upcoming meeting in March is a low-probability event, this at least gives you an idea of what the Fed is thinking.

That is, interest rates will stay higher for longer.

While the market is coming around to this viewpoint, it’s only happening slowly. The risk here is that bond market volatility picks up again, which will put pressure on the S&P 500 and stocks in general…especially the low-quality stuff that has rallied big time this year.

There’s evidence that is starting to happen. The early-year rally has run out of steam. In Australia, with reporting season now underway, stocks are selling off. Share prices simply got ahead of the earnings reality.

Having said that, as Michael Howell points out in his interviews, there are a few reasons to be broadly positive about global liquidity in 2023.

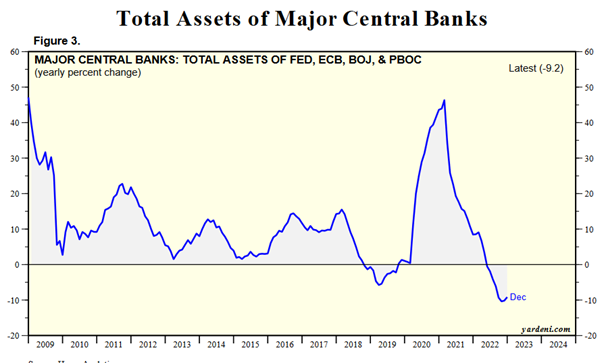

To explain, have a look at the chart below. It shows the yearly percentage change in the size of the major central banks’ balance sheets. This includes the Fed, the European Central Bank, the Bank of Japan, and the People’s Bank of China.

In the 12 months to December, these combined balance sheets contracted by 9.2%. It’s just started to turn up again, which is a positive for the liquidity story:

Source: Yardeni Research

So that’s a good thing. It should give you confidence to retain exposure to the markets this year and take positions without worrying about a 2008-style wipeout.

However, a positive liquidity outlook is not everything. With the Fed set to keep rates higher for longer and in the process push the US economy into a recession (even if it comes later than expected this year), I see corporate earnings as a risk and therefore valuations as still too high.

To put it simply, 2023 looks like a year of liquidity tailwinds and fundamental/valuation headwinds.

This means volatility…an arm wrestle between the bulls and the bears…and sharp sell-offs followed by convincing rallies.

From an overall market perspective, I doubt you’ll see much in the way of capital appreciation in 2023. Looking at the ASX 200 in the chart below, every time it has reached these levels in the past 18 months, it’s sold off:

Source: Optuma

With interest rates continuing to rise and a whole bunch of monetary tightening from 2022 coming down the pipeline, I expect the market to struggle this year.

But as you know, it’s a market of stocks, not a stock market. And there’ll be plenty of opportunities this year, as there always are.

Our investment strategy is ideal for this market. Having a conservative valuation model ensures that we don’t pay too much for stocks. It doesn’t mean we get them all right, but it does tilt the odds in our favour.

I use a discount rate of 8% to estimate value on large-cap stocks. With the 10-year bond yield at less than 4%, this represents an ‘equity risk premium of more than 4%’. That is, you get an extra 4% potential reward above the bond yield for taking on the risk of owning equities.

Whether a 4% equity risk premium (ERP) is big enough is up for debate. But I can tell you that not many companies are priced for an ERP of 4% or above. There's not a great deal of value in this market.

But a decent ongoing sell-off from here will improve that picture.

As long as you are disciplined in buying out of favour stocks at an attractive price, you should continue to do well in this tricky market

Enjoyed this piece? Check out my publication for more

If you're interested in staying up-to-date with Greg’s latest analysis on the Australian market, click this link now to get access to Greg’s publication The Fat Tail Investment Advisory.

1 topic