Profiting from the ‘weaponisation’ of commodities

Heightened geopolitical conflict and a shift from a global economy to a multipolar one has bought with it a renewed recognition of the importance commodities play in economic development. The supply of raw materials as an example will be a critical component in the US reshoring story which is set to play out over the next decade. It is no surprise that this renewed focus coincides with a period of underinvestment in the resources sector on one hand and rising metals demand from transportation, energy transition and AI.

Increasingly it has become obvious who is long and who is short key resources and with this, these resources have become a tool in economic warfare – we’ve seen it with uranium, rare earths, copper, battery metals, the list goes on.

This dynamic has and we believe will continue to cause considerable disruption in commodity markets as geopolitics adds another element to the demand, supply equation. We believe this will create opportunities for long-term investors.

In recent months we’ve seen this play out in the copper market. In February, President Trump signed an executive order directing the Commerce Department to investigate the national security implications of copper imports and assess the potential for tariffs. Trump noted a single foreign producer dominates global copper smelting and refining, controlling over 50% of global smelting capacity and holding four of the five largest refining facilities. Also, that this copper dominance directly threatened US national security and economic stability.[i]

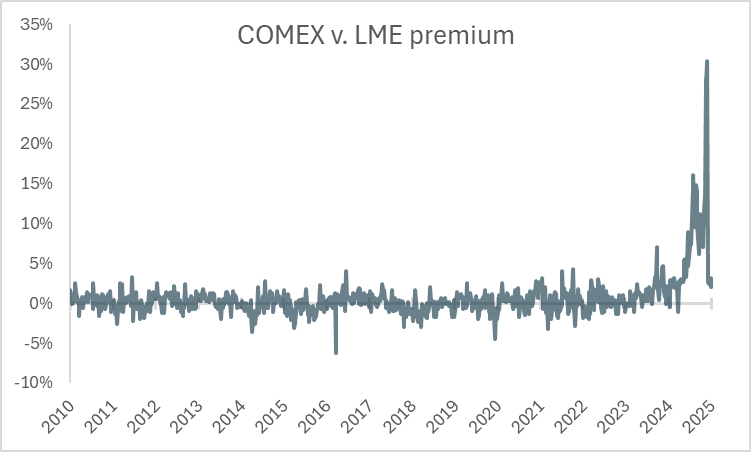

This triggered the spread between Comex and LME copper futures (the price difference between copper futures on the COMEX in the US and the London Metal Exchange) to diverge dramatically as investors anticipated the additional cost of supplying copper into the US. Historically these two prices have tracked one another closely as traders arbitrage the differences.

In late July it was announced the US would impose a 50% tariff on US imports of semi-finished copper products, but not copper concentrate the predominate output from mines. The news saw the LME-COMEX spread rapidly unwind, as the chart below shows.

Commodity scarcity

Commodity scarcity and supply constraints is not a new theme at PM Capital, for several years, we have argued supply constraints could fuel the current commodity super cycle coupled with emerging new demand drivers provides a perfect backdrop for certain commodities.

This has led to us investing in a material way across the commodities complex in both our global and Australian equity strategies since late 2019, early 2020. By metal, copper is the largest component of PM Capital’s commodity positioning today with positions in Freeport-McMoRan, TecK Resources and Capstone Copper.

The weaponisation of commodities strengthens our thesis on commodity producers. Resource nationalism could create artificial barriers for minerals supply, adding to long-term supply constraints that could further support higher prices.

Commodity underinvestment

It’s not surprisingly this new period of resource nationalism coincides with a decade of underinvestment back into the industry.

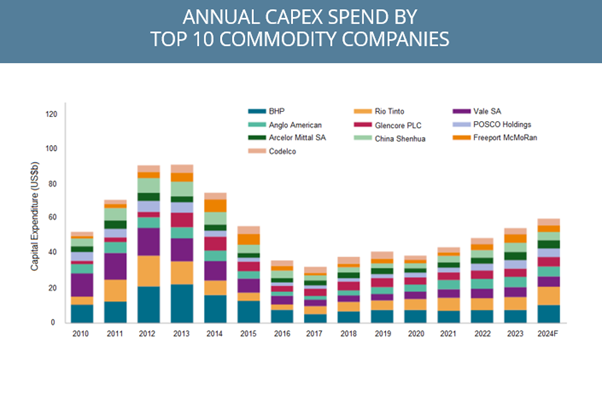

The chart below shows the annual capital expenditure by the world’s top 10 commodity companies. Their combined expenditure is less than it was a decade ago and well below the 2012-13 peak.

Rising expenditure since the 2017 trough is partly due to higher inflation and substantial increases in the capital cost of new projects over the past decade. Mining companies must spend more on projects for the same result.

Moreover, grades of key commodities have been falling, meaning resource companies are producing less, despite increasing capex. Miners are having to dig deeper to extract from existing ore bodies or pursue lower grade greenfield projects or projects in more complex jurisdictions with higher regulatory risk.

New demand drivers

As commodity supply is challenged by underinvestment into new projects, new sources of demand are emerging from the transition to renewable energy and decarbonisation but also areas like AI infrastructure.

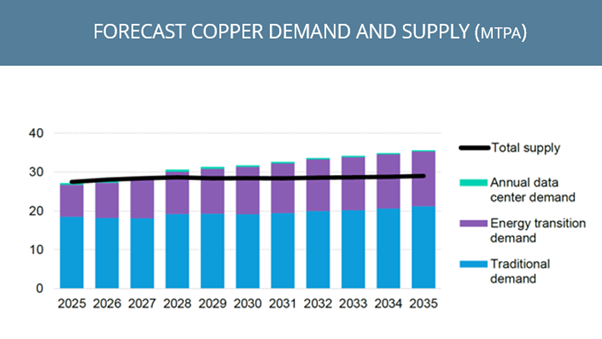

The chart below shows forecast copper demand and supply. Note the growth in energy transition demand (the purple bars) and how copper demand could substantially exceed total supply next decade.

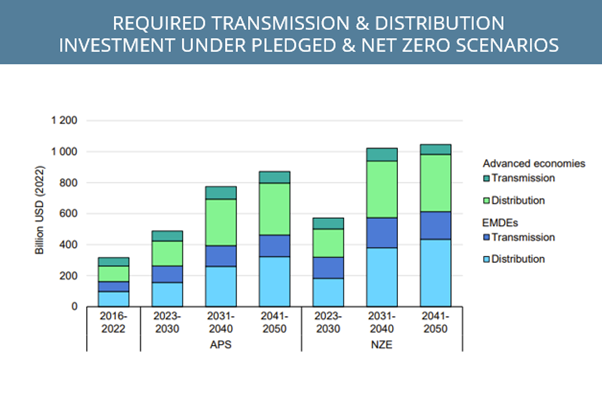

The next chart shows the infrastructure investment required to support the transition to renewables, based on pledges by governments worldwide to achieve net-zero targets for greenhouse-gas emissions. According to the International Energy Agency between 2016 and 2022, over US$300 billion was invested in transmission and distribution infrastructure worldwide. Under the net-zero scenario, that investment needs to almost double between 2023 and 2030 and increase by two times between 2031 and 2040 to ensure new power-generation sources can be adequately supported by energy grids.[ii]

Commodity weaponisation

As geopolitical tensions rise, the US is focusing on the strategic value of commodities to its national and economic security. From uranium to rare earths, copper, battery metals, aluminium and steel commodities are becoming bigger bargaining chips in US trade and diplomacy.

China, too, is engaging in commodity warfare, having increased its investment in African resource projects this decade after many Western mining companies left Africa due to ESG concerns.[iii] China now controls some of the world’s best undeveloped reserves in iron ore and copper in Africa.[iv]

Also, China supplies about 90% of the world’s rare earths and dominates production of other minerals vital for the technology and defence sectors – a strength that could leave the US vulnerable as critical minerals are politicised.[v]

As the US and China selectively ‘decouple’ from each other this decade, greater independence on natural resources is required. Trump wants more production of copper, steel and other key metals to occur in the US and is using tariffs to help achieve it.

Freeport-McMoRan – strategically important assets

Followers of PM Capital will have read about our position in Freeport-McMoran in recent years, it was one of the first positions we added in 2019 when we re-entered the commodities sector.

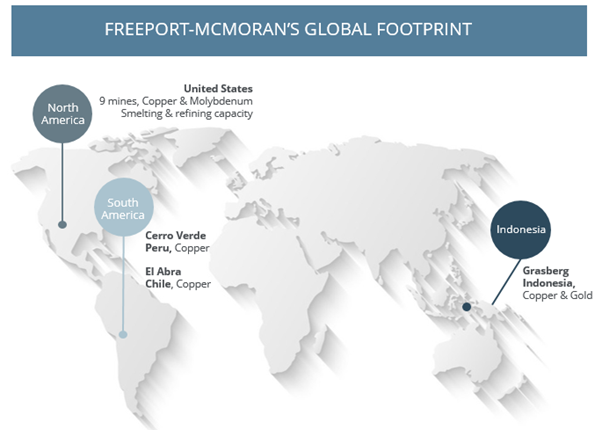

Freeport is the second largest copper producer globally, producing 1.8m tonnes annually (~8% supply). Most people associate Freeport with the Grasberg copper gold mine in Indonesia which is a top 5 copper and top 10 gold mine by production. While Grasberg is a phenomenal asset (current gold prices allows Freeport to extract copper from the mine at a negative cash cost after by-product credits) its US assets often get overlooked. Freeport-McMoRan copper mines account for around half of US copper production and its downstream copper refining facilities account for 70% of US refining capacity.

While it is impossible to predict the day to day policy machinations of the Trump administration – copper tariffs are case in point – what is clear is the US desire to push domestic independence across key metals including copper. In our view, Freeport is a direct beneficiary of favourable US government policy for domestic copper production. Freeport’s copper assets are ideally position in a world where recourse nationalism is taking centre stage, they are asset of strategic importance to the US.

Conclusion

In an increasingly multipolar world, commodities have re-emerged as strategic assets central to national security, economic resilience, and technological progress.

The weaponisation of resources, coupled with a decade of underinvestment and rising demand from energy transition and AI, has created a volatile but opportunity-rich environment for long-term investors.

The copper market exemplifies this shift, with recent US policy moves underscoring the importance of domestic supply chains and the strategic value of assets like Freeport-McMoRan.

As resource nationalism intensifies and supply constraints persist, PM Capital’s positioning across the commodities complex—particularly in copper—reflects a conviction that these dynamics will drive a sustained commodity super cycle. The intersection of geopolitics, infrastructure investment, and mineral scarcity is reshaping global trade and investment flows, and we believe this environment will continue to reward disciplined exposure to high-quality resource producers.

About the author

Kevin Bertoli is a co-Portfolio Manager responsible for PM Capital’s Global Companies Fund and Australian Companies Fund.

More PM Capital Insights are available here.

[i] Presidential Actions, ‘Addressing the Threat to National Security from Imports of Copper’. The White House. 25 February 2025.

[ii] International Energy Agency, World Energy Outlook 2022.

[iii] Reuters, ‘Post-Covid, China is back in Africa and doubling down on minerals,’. 28 May 2024.

[iv] An example is Chinese interest in West African Guinea’s Simandou iron ore reserve, which is home to the world’s largest undeveloped reserves of high-grade iron ore.

[v] Verrender, I., ‘China’s Dominance leaves US Vulnerable, as Critical Minerals become Political,’ Australian Broadcasting Corporation. 25 April 2025.

5 topics