RBA’s The Year Ahead: The key takeaways from Philip Lowe's speech

RBA Governor Philip Lowe’s The Year Ahead speech at the National Press Club was eagerly awaited. In this wire, I'll take you through the key takeaways, as well as offer some insight from Marcus Today's Henry Jennings.

Lowe's standout remark was the “plausibility” of an interest rate rise in 2022, the first time he’s conceded such a possibility, but he started by outlining each of the RBA’s “Key Economic Variable” forecasts versus the actual outcomes in 2021.

All five of them beat the central bank’s expectations.

- GDP Growth was 1.5 points higher

- Unemployment was 1.25 points lower, and

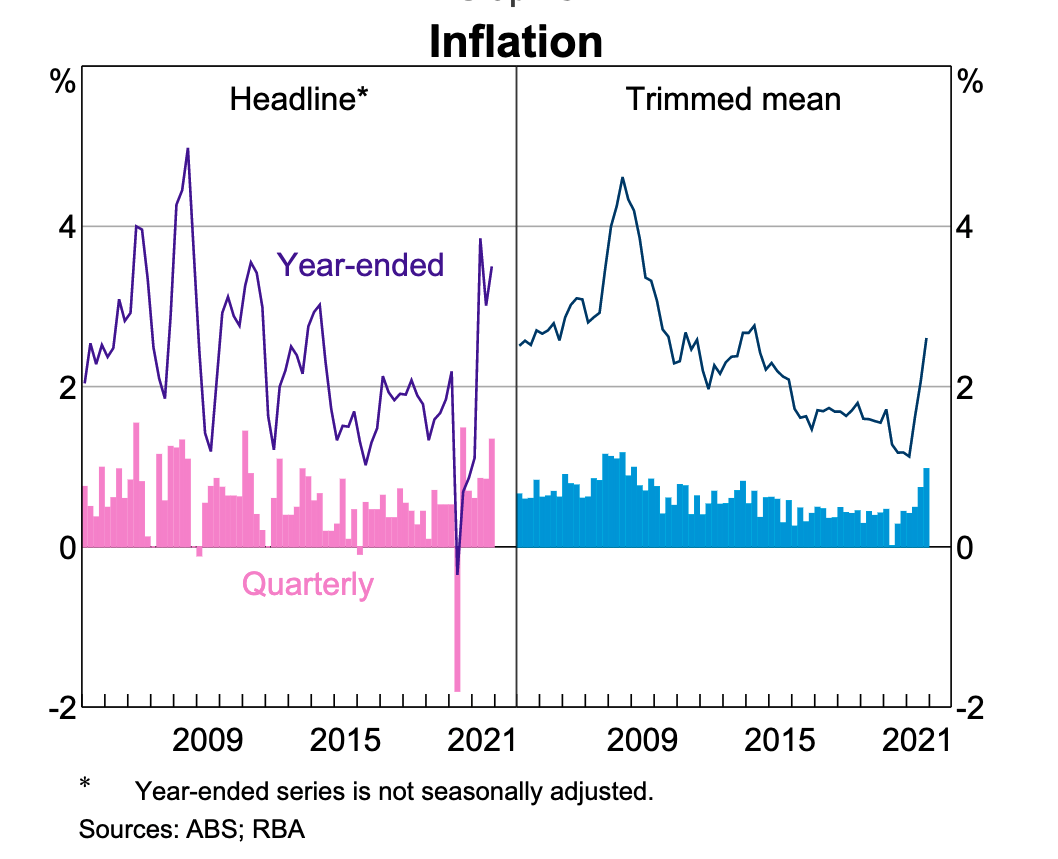

- CPI inflation, underlying inflation and the Wage Price Index (which measures changes in the cost of labour) were 2%, 1% and 0.5% better than forecast.

This perhaps partly reflects an “under-promise and over-deliver” mentality, but it’s still good news. Though it must also be tempered against the inflation lift that accompanies these stronger GDP and labour market outcomes.

“This experience is a reminder of the difficulty of economic forecasting in a pandemic, but also points to three broader observations,” Lowe said.

These are:

- A remarkably resilient economy

- The strong, active link between the “real economy” and wages

- The supply side matters to economic activity and pricing

He emphasised these will remain top of mind for the RBA throughout 2022.

A dominant theme in his speech was that of “resilience” – particularly of the economic variety.

“Australians have adjusted and adapted, and we still expect GDP to grow in the March quarter, although only modestly. The worst of the disruptive economic effects from Omicron now appear to be behind us, with supply chain and workforce management problems gradually being addressed,” Lowe said.

What’s driving the recovery?

- Solid household balance sheets, which collectively hold more than $200 billion in extra savings over the last two years

- A large pipeline of residential building activity over the next 12 months

- Supportive macro policy settings, including a big-spending approach to infrastructure and “accommodative” monetary policy.

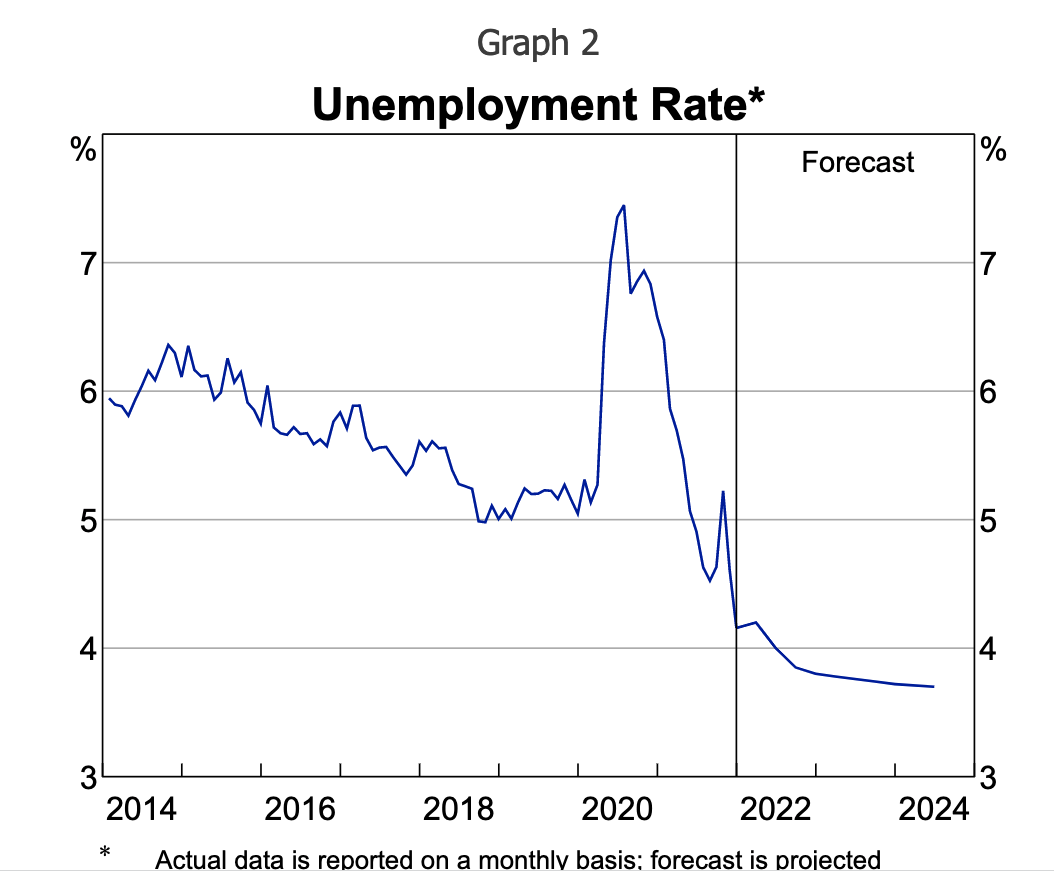

Australia’s labour market also got plenty of love in Lowe’s speech, where he lauded the impressively low unemployment rate that he expects will decline further to 3.75% by the end of this year.

“Australia has not experienced unemployment rates this low in the past half-century – the last time we had the unemployment rate below 4 per cent was in the early 1970s,” Lowe said.

Lowe said forward-looking indicators suggest strong demand for workers will continue. Importantly, he doesn’t expect the Omicron variant to upset the apple cart.

The RBA’s business liaison program finds more than half of businesses intend to increase headcount over the coming months and very few expect to reduce their workforces. There has also been an increase in staff turnover and ongoing reports of difficulties finding workers for certain roles.

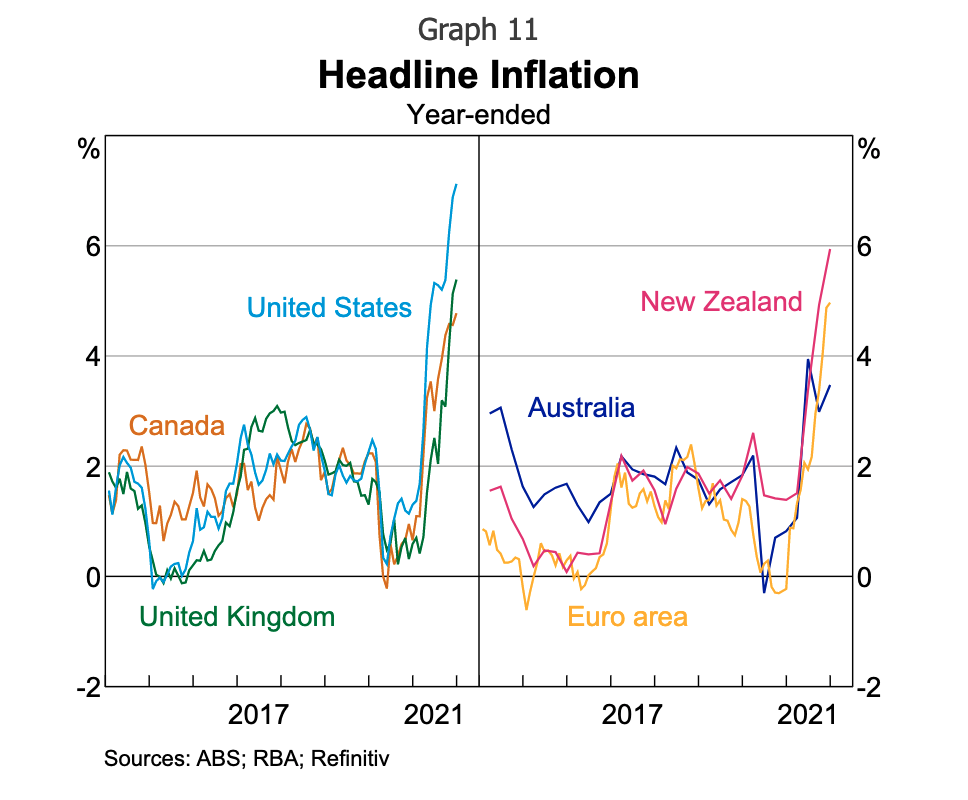

To the negative, Lowe calls out ongoing supply chain pressures – caused by a couple of factors including prior COVID lockdowns and weather events in various places around the world – that have helped drive up inflation.

His base case here is for underlying inflation to hit 2.75% over 2022 and 2023.

Uncertainties remain

Of course, especially given the ongoing pandemic and the potential for new virus variants beyond Omicron – which is still rampant in Australian communities and around the world – uncertainties remain. Key areas where there are many unknowns include:

- What the collision of strong demand in the face of impaired supply means for prices and inflation.

- How quickly demand for goods will normalise as infection rates decline

- Will higher inflation persist or will this uptick in prices be transitory?

- How will wages respond to ongoing supply-side uncertainty?

“There are many moving parts on both the demand side and the supply side of the economy and it will take time for these various issues to be resolved. This is relevant to the Board's deliberations about monetary policy,” Lowe said.

Where now for monetary policy?

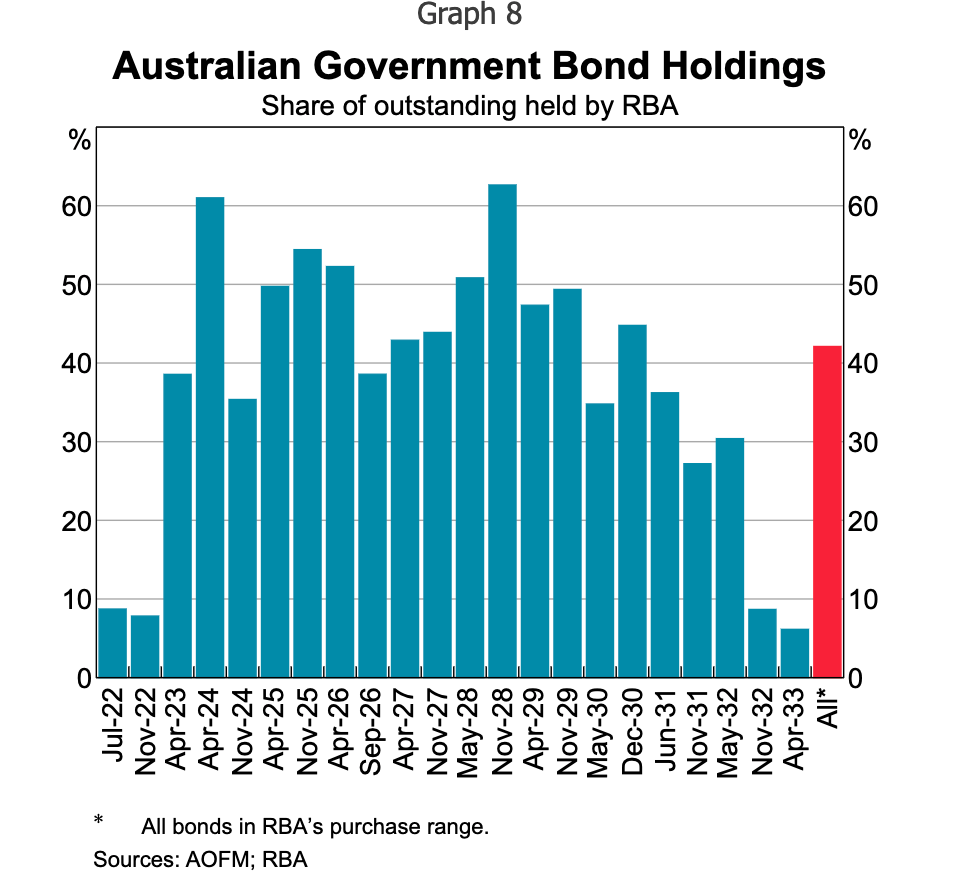

On this front, Lowe commented on the RBA Board’s decision on Tuesday to end its bond purchase program on Thursday 10 February.

Three key criteria led to this action:

- The actions of other central banks

- Australia’s own bond market functions

- Most importantly, the “actual and expected” progress towards the RBAs goal of full employment and inflation hitting its targeted level.

On the first point, he noted the Bank of Canada, Bank of England, the Riksbank, and the Reserve Bank of New Zealand have each ended their bond-buying.

“If we hadn't also done this, our bond yields and the exchange rate would have been higher than they have been and this would have impeded the recovery from the pandemic,” Lowe said.

On the second point, Lowe noted the RBA currently owns 42% and 60% of the Australian Government Securities on issue and individual bond lines, respectively. These levels could still go higher if needed but could create other pressures.

But it’s the third point – strong employment figures – that was the most influential in tipping the RBA’s hand to end bond buying.

“The unemployment rate now stands at 4.2 per cent and underlying inflation is at 2.6 per cent. For the first time in some years, the achievement of our goals is within sight. In these circumstances, the Board judged that now was the right time to draw the bond purchase program to a close,” Lowe said.

What did Marcus Today’s Henry Jennings think?

Jennings noted the non-committal language Lowe used in relaying the likelihood of an official rate rise in 2022.

“Over the last two to three years, we’ve grown used to having to pivot and to things not panning out as expected, but usually you want a nice, steady hand at the tiller of the RBA,” he said.

“And they seem in no rush to take action on interest rates, especially with an election looming.”

He suggests that if there wasn’t an election looming in the next few months, there might be more of a push to get central bank policy off the emergency settings introduced in 2020. “But they don’t want to be accused of putting in a rate rise just before an election, which is something that has happened before.”

Jennings also alludes to the increasing prospect of an inquiry into the operations and Board composition of the RBA – particularly if there is a change of government in May.

“So he was probably trying to play as straight a bat as possible,” he said.

Referring to the RBA’s comparison of its projected economic variables versus actual, each of which differed considerably, Jennings suggests it may also add to the declining public trust in the institution itself.

“They’re saying ‘trust us’, but there's a bit of a credibility issue there already and the RBA really doesn’t have a strong track record of forecasting. But the market will probably be willing to take the RBA at its word now and for a while longer,” he said.

“As Lowe said, it’s plausible that we could see rate rises this year but it depends. For the time being, I think the market is going to grasp the “patience” mantra and continue with the rebound that we’ve seen over the last couple of days.”

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

1 contributor mentioned