Ready to eat dividends?

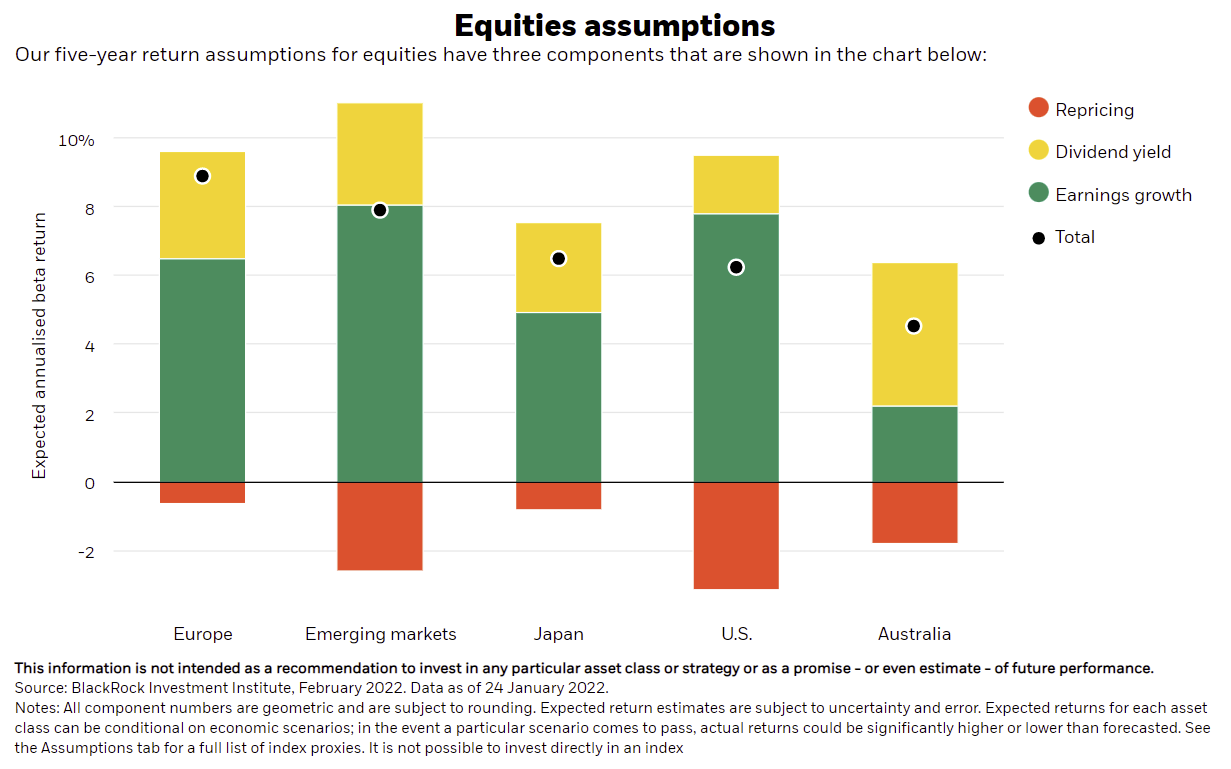

Australian equities are likely to underperform the world market over the next five years, according to the Blackrock Investment Institute. Local market returns are expected to average 4.5% over these years, compared with 6% for US markets, and 9% for Europe.

Fig 1: Blackrock five-year return forecasts (Data as of 24/1/22)

While we have chosen to focus on Blackrock’s estimates (for those interested, their interactive website is excellent), the forecasts are similar to those of other major global fund managers and asset consultants. Put simply, it’s hard to be bullish when most believe we’re entering a global tightening cycle.

If these forecasts are accurate, the reality for many Australian investors is that dividends will make up nearly 100% of expected total returns from equities over this period. Capital growth would likely prove negligible, as the positive effects from earnings growth are largely offset by falling valuations (as rates rise, valuations typically fall).

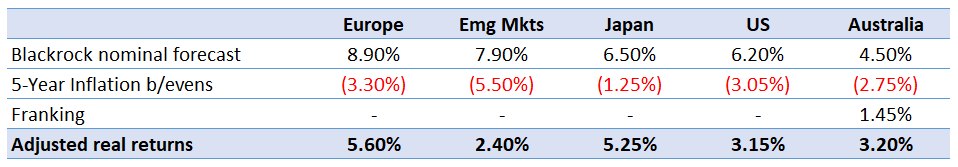

We also highlight that these are nominal returns, meaning they don’t allow for the effects of inflation. Once inflation expectations for the different regions have been added, expected growth falls by an average of 3% across the board.

For Australian investors, the value of fully franked dividends that can grow in real terms just became more important. In the chart below, we’ve also included the expected value of franking to Australian investors who can utilise this tax benefit.

Fig 2: Five-year return forecasts - inflation changes the picture

A new way to increase your dividend exposure in your portfolio

If dividends are going to be the the primary source of return the next few years, then one way to improve outcomes may be to focus on strategies that target higher dividend income as a primary source of investor return.

As we have written in recent wires, the challenge for investors remains how to access this potentially higher source of income-driven return, without introducing other unintended risks into investors’ portfolios.

In this environment, the Wheelhouse Australian Enhanced Income Fund, which aims to double the fully franked dividend yield of the ASX200, may well prove a good starting point for real return generation in an otherwise low growth market.

Please click here to find out more

.png)

3 topics