Recovery and inflation: 7 winners and 3 losers from Hofflin, Kanelleas

Dawn Kanelleas and Dr Philipp Hofflin, prominent stockpickers from two well-established Australian equity fund managers, recently gave their respective takes on local small- and large-caps.

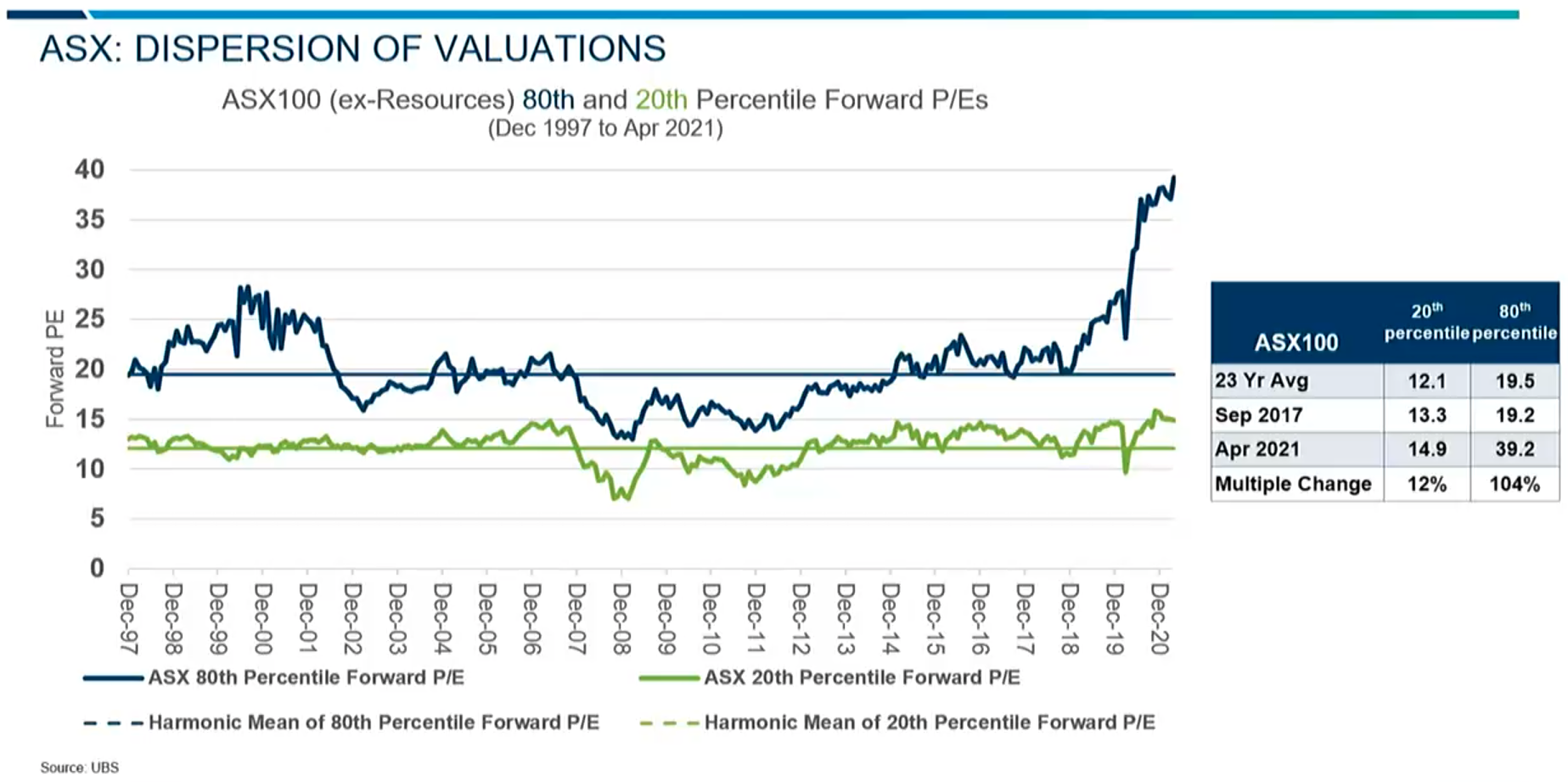

On the macro front, Lazard Asset Management portfolio manager Hofflin gave his reasoning for why local share market PE multiples are so high currently. And much of it comes down to mining companies, particularly iron ore miners such as BHP (ASX: BHP), Fortescue Metals (ASX: FMG) and Rio Tinto (ASX: RIO), whose share prices recently drove the ASX to near-record highs.

“This is an Australian reflection of the US speculative boom,” Hofflin said while presenting at the Morningstar Investment Conference last week.

“In this case, it has given us high-multiple stocks that are on probably the highest forward-multiples ever in Australian history.”

Perhaps unsurprisingly, the rusted-on Value manager emphasised how the MSCI indices show the earnings of Value companies have beaten Growth over the last one, three, five, seven and 10 years.

“There are people who say that these things are no longer relevant; the “this time it’s different” argument on steroids, if you will,” Hofflin said.

“And it is true that over the last couple years, you would’ve done best if you’d just bought the highest multiple stocks and the highest multiple sectors. The more speculative the asset has been, generally the higher it has gone up.”

He pointed to the mind-boggling prices of the cryptocurrency Dogecoin as an example. Created initially as a joke, the Bitcoin rival’s value has spiked 26,000% year-to-date.

“My point is, we don’t know how this is going to unwind, but in the US the mean reversion has started quite significantly and in Australia a little more hesitantly,” said Hofflin.

“But if history is any guide, this will probably unwind over multiple years and will have an enormous impact on what stocks do in terms of relative prices.”

Stocks that delivered upside surprises

Eschewing the murky macro-outlook, First Sentier Investors senior portfolio manager of small and mid-cap strategies Kanelleas delved straight into stocks to reveal where investors might find returns as the recovery unfurls.

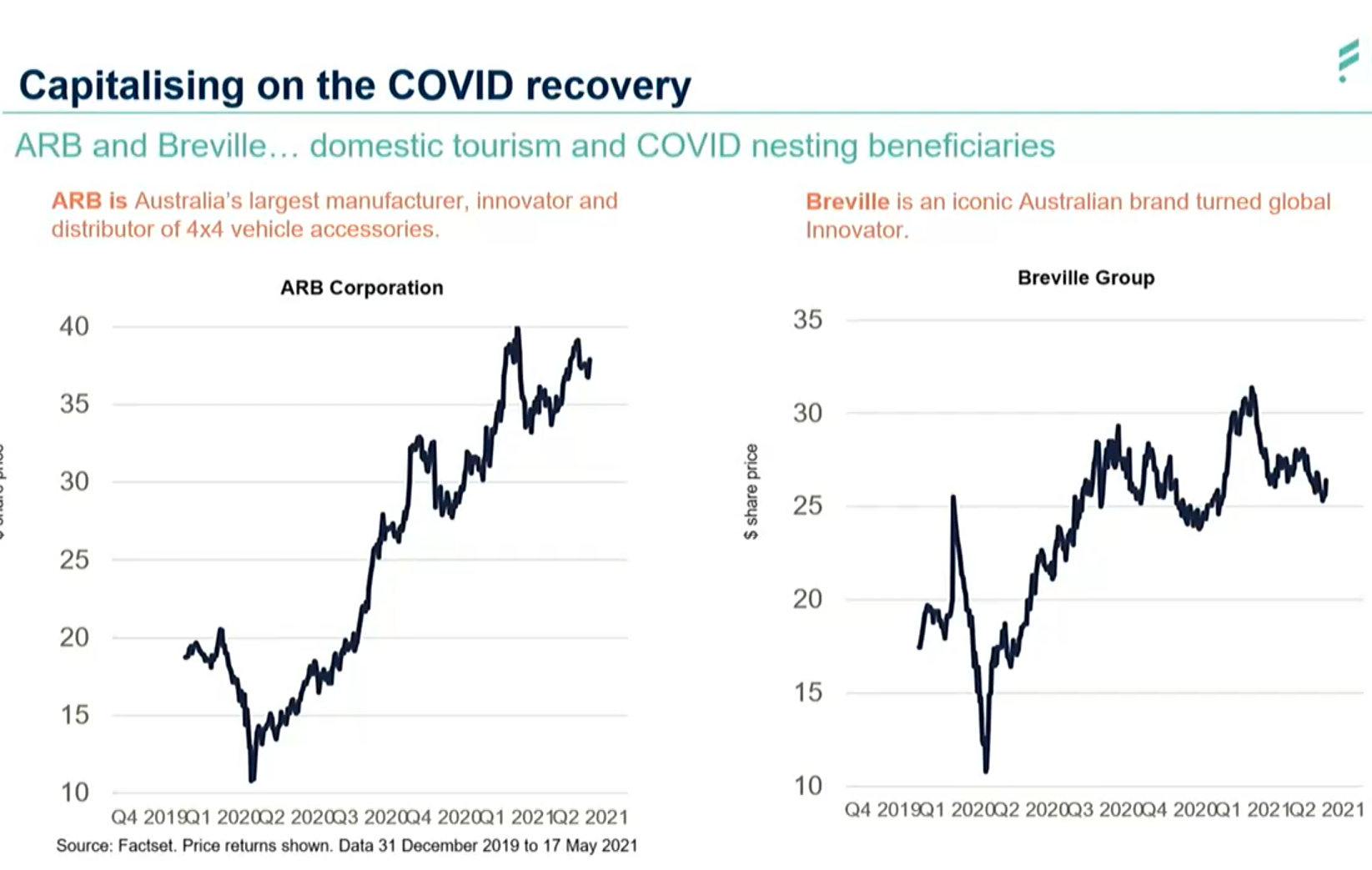

Four-wheel drive accessories manufacturer and distributor ARB (ASX: ARB) was an unlikely beneficiary from COVID lockdowns, she said, as travel bans and lockdowns saw spare cash instead funnelled into vehicle upgrades and maintenance.

“We couldn’t have predicted this, but ARB had record earnings,” Kanelleas said.

A similar surprise was in store for household appliance maker Breville Group (ASX: BRG), as home-bound consumers rushed to buy coffee machines and breadmakers.

“The business was already growing at double digits, but this obviously supercharged it,” Kanelleas said.

“Now, a lot of our peers probably sold ARB because they thought it would go broke, or that Breville would underperform because people couldn’t go to their local Myer to buy their toastie maker.”

Travel is another sector reflected in the First Sentier portfolio, with Corporate Travel Management (ASX: CTD) and Webjet (ASX: WEB) the fund manager’s preferred plays here. Corporate Travel’s share price has gained more than 300% since last year’s March selloff, trading at $21.49 at today’s open, roughly in line with its pre-pandemic level.

“Webjet still has a way to go because holiday travel still has to recover, but these are both digital platform businesses delivering travel solutions to companies and consumers,” Kanelleas said.

“It has to become a digital-only type of business and clearly COVID has brought forward the adoption of digital means of buying travel as well.”

The strong online presence of each of these companies is a key reason for their appeal, contrasting with another competitor Flight Centre (ASX: FLT), which isn’t on First Sentier’s books.

“We didn’t buy FLT because it was obviously on its knees during COVID,” said Kanelleas.

“Even though it’s recovered in some respects, we’ve taken a view around the sustainable competitive advantages of its business, that is, its brick-and-mortar presence, which is an actually enormous lease liability that has to be closed out and which is going to put pressure on its balance sheet and earnings,” Kanelleas said.

A different slant on the same travel theme is reflected in another holding, IDP Education (ASX: IEL), which delivers English-language testing to students globally, mainly via universities in the UK and North America.

Though the cliff-dive of international student numbers took a heavy toll initially, the more open border policies of both the UK and the US saw these markets hold up better than places like Australia. The company was also able to sell more of its digitally-enabled university placement platform tools, which enabled it to take market share in an area that again saw a “pull-forward” of adoption trends because of COVID.

Both Hofflin and Kanelleas were also quizzed on their positioning for a potential uplift in inflation. Hofflin likes commodities, energy and resource exposures because of their defensive characteristics and because there tends to be a higher concentration of Quality businesses, with better balance sheets, strong cash flow and greater buying power. Healthcare also ticks these boxes for the same reasons.

Echoing this view, but in the smaller end of the market, Kanelleas nominates copper producer Oz Minerals (ASX: OZL) as a stock pick for rising inflation. This is mainly because of the metal’s role in the massive worldwide decarbonisation push, including electric vehicles, and the finite nature of the resource.

“The absolute worst in this environment would be consumer durables like JB HiFi (ASX: JBH) and Harvey Norman (ASX: HVN) along with smaller cap companies which tend to have less pricing power,” Hofflin said.

He also made an important distinction in the way inflation is defined, arguing that there’s a huge difference between “reflation” versus more pronounced inflation.

“Reflation is where we get a situation where bond yields, instead of being very negative become slightly positive.

“That would be good for things like banks and companies like Challenger (ASX: CGF) and insurance companies.”

On the other hand, he said an inflation uptick of 3 or 4% would cause enormous problems for such companies. “Because that requires significant rises in interest rates to get ahead of the inflationary push, which hits asset prices. And those are balance sheet businesses, so all of them have a significant problem,” Hofflin said.

Hofflin’s top pick in a rising inflation environment is share registry company Computershare (ASX: CPU): “If inflation goes up 2%, they’ve doubled their profits without even lifting a finger.”

And international motorway operator Atlas Arteria (ASX: ALX) is an inflation-resistant company held by both Lazard and First Sentier. The two fundies call out the regulated toll road business as a “privileged asset”.

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Livewire's Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions.

Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

5 topics

13 stocks mentioned

4 contributors mentioned