‘Stick with quality’, says Charlie Aitken

Companies with pricing power, a proven track record of generating free cash flow, and conservative debt levels are the stocks that the AIM Global High Conviction Fund is sticking with, CEO and lead portfolio manager Charlie Aitken said during his firm’s recent annual investor webinar.

He was joined by co-portfolio manager Etienne Vlok, who outlined the fund’s preference for businesses that could earn sustainably high returns on capital and reinvest those returns at similarly high rates. This enables the compounding effect of capital on which the AIM investment process is built.

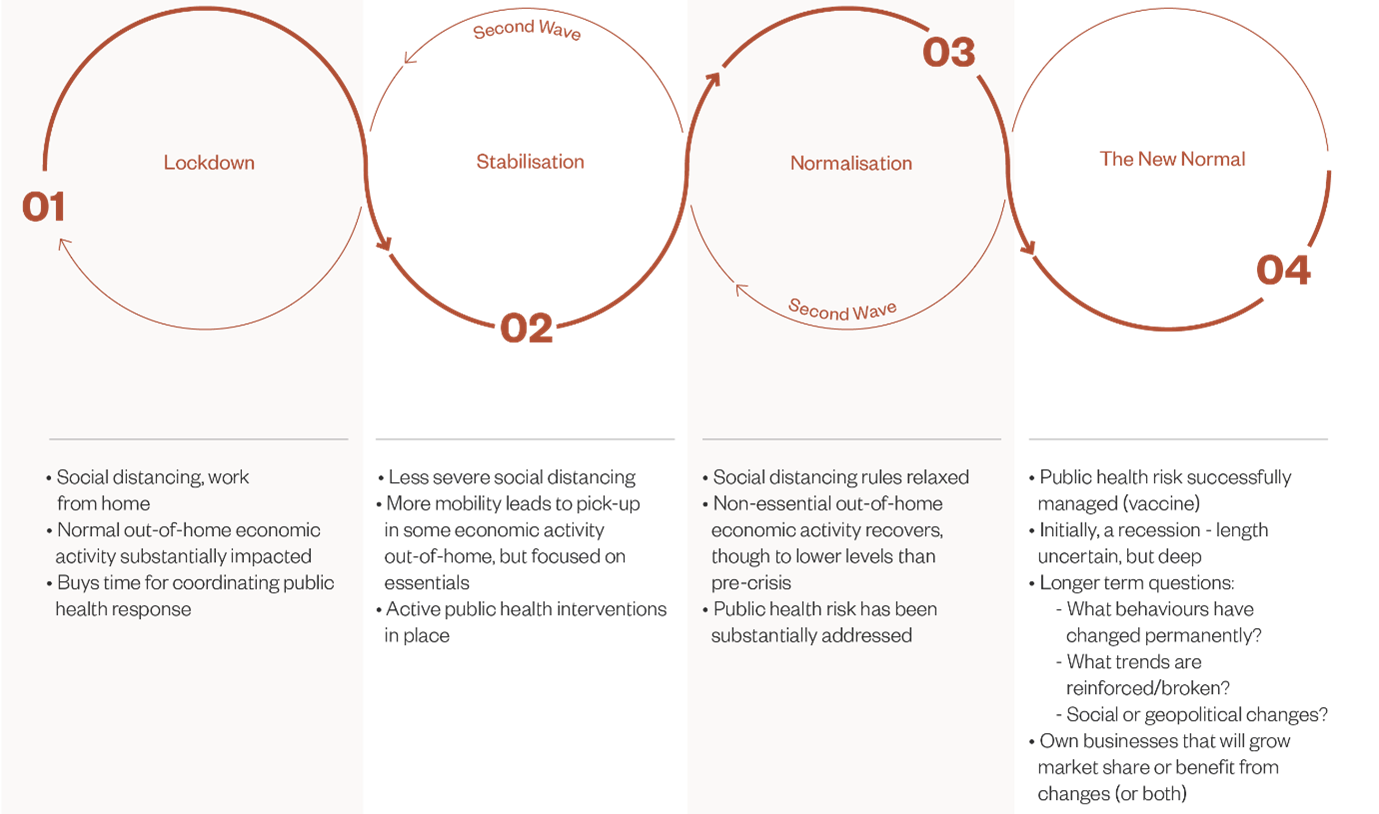

Since the market crash in March last year, the fund was positioned for a ‘phased recovery’, as indicated by the graphic below. This means the portfolio is diversified by end market and underlying economic activity, without being a one-way bet on the timing of a vaccine or any specific outcome.

The one theme tying together all the fund’s holdings was "balance sheets resilient enough to see the businesses through the crisis".

More recently, the fund has reduced its exposure to technology businesses somewhat, finding better value in names that would benefit from a normalisation of the global economy from the second half of 2021. Changes include the sale of positions in Netflix and Salesforce, while retaining businesses such as Microsoft, Accenture and PayPal.

“The tech stocks we do own are all profitable and are among the leaders of their industry,” Aitken says. Additionally, these businesses are already generating meaningful amounts of free cash flow and earn high returns on capital, making it somewhat less daunting to try and place a value on them. The fund is seeking to avoid businesses where there is no track record of cash generation, yet the future cash flows required to justify current market values are very demanding.

“Not all of the market action in technology businesses is without justification. Capital light businesses that have profitable unit economics, earning high incremental margins and returns on capital, can meaningfully compound in intrinsic value as they grow. To us, the key differentiator lies in understanding how defensible their competitive position is, as this underpins their ability to earn attractive returns. For many highly valued technology businesses, we simply do not feel we can underwrite their moat to the degree required to justify the long-term cash flows required to back into the current valuation. We could be wrong, but we’d rather err on the side of conservatism”, said Vlok.

Citing PayPal as an example, Vlok said the Fund would own businesses that exhibit the characteristics outlined above, but only when there was sufficient conviction regarding the strength of the moat.

The risk markets are not yet pricing in

While the AIM investment team believes their ‘base case’ that inflation will remain relatively benign over the next several years, the risk that it does not is the “event markets are not currently priced for”, and as such received some focus on the webinar.

Between now and the middle of 2021, there will be “a lot of ink spilt” on an anticipated inflation uptick. However, the team believes this will most likely be caused by “base-effects: the disinflation from March to July 2020 means any normalisation of price levels will mathematically look like accelerating inflation in the same period in 2021 due to weakness in the prior comparative period.”

“The inflation we're worried about is if things move sustainably higher than between 2% or 3%, which is what we believe the US Federal Reserve is guiding the market towards,” Vlok said. “If that happens, and the Fed feels they need to hike rates to keep the economy from overheating, there will be knock-on impacts.”

Learning from the past

Inflation will pose two types of risks to investor portfolios: firstly, a market risk due to higher interest rates negatively affecting the valuations of most assets, but particularly long-duration future cash flows.

More importantly for the AIM investment philosophy – which takes a ‘business-first’ rather than a ‘security-first’ perspective – is the second, more insidious risk: rising inflation erodes the return that equity owners can earn on the capital invested in a business.

Aitken and Vlok suggest investors look to icons Warren Buffett and Charlie Munger to think about managing this type of risk. Buffett and Munger navigated the last period when inflation was problematically high – the 1970’s and early-19080s – with particular success.

The key lesson they draw from the Buffett and Munger approach is not to assume that real-asset heavy businesses provide the best protection against inflation. Quoting from Buffett’s 1983 letter to Berkshire Hathaway owners, Vlok explains that asset-heavy businesses generally earn low rates of return, and barely provide enough capital to fund the inflationary needs of the existing business, let alone having excess capital to pay dividends or fund acquisitions. In contrast, a disproportionate number of the great business fortunes built up during the inflationary years arose from ownership of operations that combined intangibles of lasting value with relatively minor requirements for tangible assets.

Pricing power, clean balance sheets, and strong cash flows: in a word, quality

Some examples of businesses Aitken and his team believe have impressive pricing power are fitness apparel and footwear company Nike, luxury goods retailer LVMH and beauty & skincare giant Estée Lauder. The moat provided by the powerful brands – grown and cultivated over decades – are illustrations of the ‘intangibles of lasting value’ described by Buffett. “The goal is to capture businesses that can grow their revenues at above-inflationary rates for the long-run”, as Aitken puts it.

These kinds of dominant consumer franchises, as well as businesses that provide “business-critical, non-core goods or services” tend to exhibit the pricing power the AIM investment process wants to back. Businesses that can scale relatively quickly without a great need for tangible capital also make the grade.

By positioning the portfolio in these kinds of businesses, the Fund looks to hedge against an unexpected rise in inflation eroding the returns on capital of the underlying businesses owned.

Avoiding businesses with poor free cash flow generation – particularly if they have material debt maturities due in the next few years – is also important. “If interest rates unexpectedly rise, and these businesses need to refinance their debt at higher levels, the likelihood of balance sheet distress can be much higher. We’d prefer to avoid that kind of risk altogether,” said Vlok.

High conviction ideas

Aitken Investment Management is an independent global fund manager that aims to capture long-term secular trends by investing in high-quality businesses that can compound in value.

To find out more hit the 'CONTACT' button below.

3 topics