Survive to Thrive in India

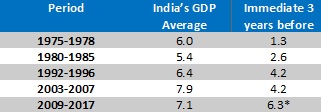

An economic boom may be defined as a period where GDP growth is high on an absolute basis (above 5%) and higher than the period preceding it. India has experienced several such economic booms in the past. The catalyst for an economic boom in India is usually a preceding US recession or weak period of growth. Usually these periods are accompanied by a lower cost of capital, liquidity injections / stimulus and rising demand for foreign investment seeking growth capital.

Source:

IMF World Economic Outlook

Correlation of US and Indian GDP

The correlation of India’s GDP to the US is -0.18. In this report we do not look for a direct link between the economies, but rather consider the resulting impact on India post a US recession or weak economy. We examine periods of weakness in the US since WWII, identifying 1970-1975, 1980-1982, 1991, 2001-2002 and 2008-2009.

India’s Economic Boom Periods

We can study India’s GDP growth in the context of US recessions and identify subsequent periods where India’s economic growth goes through a boom period. We study why that relationship might exist in this report.

Source: India Avenue Research, World Economic Outlook

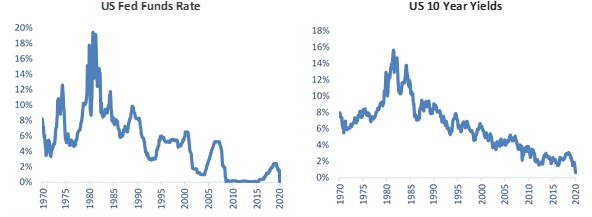

US Interest Rates are supportive

Source: Refinitiv

Typically, recessions are categorised by falling interest rates as the US Federal Reserve responds by improving liquidity and encouraging increasing demand through greater lending and risk taking in the corporate world and for investors. This typically transpires into rising economic growth, corporate earnings and thus rising stock markets.

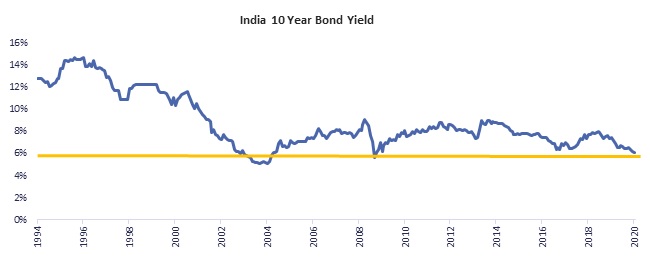

……And lead to falling cost of capital in India

India’s 10-year bond yield have typically dipped below 6% prior to an economic boom in the country. This happened in 2003-04 as well as in 2008-09 where yields dipped below 6%. Currently yields are back to 6% again. This could be a pre-cursor to rising investment once COVID-19 is over.

Source: Refinitiv

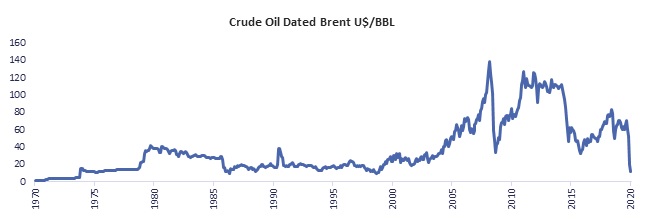

Add to this mix a falling oil price

The price of Brent Crude (similar to the Indian oil basket) has plummeted from US$68 to US$20bbl. This is a major boon for India as India imports close to 85% of its oil requirements. India’s CAD-to-GDP is often dictated to by the oil price, which given it is subsidised in India, can also provide fiscal headaches alongside currency volatility. In 2018, when oil prices rose sharply, India’s markets lost 15% in October-November. Whilst the benefits are being neutralised by the lack of demand, it is still a pressure release for an economy which needs support at present to weather the COVID-19 storm.

Source: Refinitiv

India’s macroeconomic position looks strong with a record high level of foreign reserves (US$475bn) and now moving into a current account surplus for the first time in 30 years.

Market Valuations

Valuations have come back a long way, albeit from great heights on trailing P/E’s. Assuming we discount future earnings expectations of FY21 to the same as FY20, then we can see that valuations were only cheaper during 2003-2005, 2011-2014 (both periods when India rose from cheap valuations).

Source: Motilal Oswal

It is our view that at these valuations, with lower interest rates and oil prices, the Indian stock market offers an attractive investment point for patient investors over the next 3-5 years. As India’s importance in the global supply chain increases and its comparative advantage sectors like Pharmaceuticals and Automobiles emerge, it should create a significant market cap gain. India’s market-cap-to-GDP currently sits around 60% which is well below its 10-year average of 75%.

India’s economy however is capital starved……the weakness is transmission

India requires capital to finance its growth. The access to capital is usually expensive, is rationed and quite often crowded out by Government spending. The following points are critical to India’s capital requirements:

- Corporate debt in India has limited liquidity past the 3-year mark. The shallow market makes it difficult to access capital, unless you are a highly rated and high-quality business.

- India’s banking crisis from 2010 to 2016, stemming from poor lending practices to corporate India post 2007 has led to a high level of non-performing loans and less risk capital for Banks

- India’s infrastructure needs foreign and local private investment, or else may get stalled due to bureaucracy and lack of funding. The Government cannot fund the A$2tn requirement over the next 5 years.

- Private Investment, given high cost and scarcity of capital, significant change through reform, weaker growth and low demand, has not been incentivised to invest in capacity.

In the current environment, lower rates are not being transmitted to MSME’s (of which there are 60m, employing 120m people and contribute 30% of India’s GDP), which are the lifeblood of India’s growth as NBFC’s (which typically are the lenders to this segment) are struggling to raise capital from Banks.

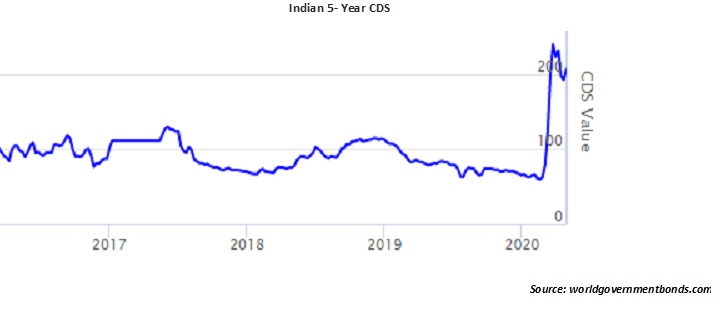

India’s five-year CDS spiked significant on COVID-19, reaching a peak of 271 on March 24th after being at a low of 58 during July 2019. Currently good corporates are paying 7%, whereas rates are as high as 9-10% for slightly below premium corporates and MSME’s are close to low teens.

Recent events have led to concerns about India’s financial systems. Firstly, one of the premier private banks (Yes Bank) had to be rescued (early 2020) and secondly Franklin Templeton had to freeze six of its fixed income schemes (April 2020) given poor liquidity and spread blowouts. The RBI has been focused on ensuring liquidity and maintaining the financial system during this time and ensuring that India’s yield curve doesn’t steepen, especially given a huge issuance to fund the burgeoning fiscal deficit.

The focus should be not only on keeping rates low, through liquidity, OMO and other monetary policy tools available, but also to ensure better transmission to areas that need it. The Central Bank is working on stimulus aimed more directly at this part of the economy, which it is likely to announce shortly.

An Environment to be Dominant

It is important to note that market leadership and market capitalisation don’t necessarily mean the same thing. What is more important in terms of incremental market cap (the key focus for investors) is the market leadership you enjoy leading to greater gains from scale, efficiency and brand value. We expect the next cycle in India to result in the following trends:

- A shift towards organised business as a result of GST and Demonetisation (the last 3 years)

- Market share gains by companies with strong cash flow generation, high liquidity / low debt and strong brand name and recognition.

- Sector consolidation and churn likely to be supportive of the largest players who not only survive, but thrive in the ensuing boom

- Several MSME’s may perish in the process or get absorbed by market leaders

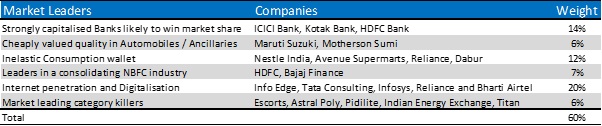

Market leaders in Automobiles (plus Ancillaries), Consumption, Technology and Banking/Finance as well as category killers in their respective industries will dominate proceedings. Such companies make up 60% of our portfolio (Reliance is counted twice, hence total is reduced to account for that):

India’s a Pharmacy to the rest of the world

Increasingly India is developing a strong competitive edge in Pharmaceuticals given a huge pool of scientists, increasing spending on R&D and cheaper cost of labour. Chances are that a COVID-19 vaccine or drug may emerge from an Indian company. Apart from purely being the world’s largest generic drug exporter, Indian pharma firms are now the largest applicant at the US FDA for new drugs.

Our Concluding Remarks

India is set for a period of improving economic growth given lower interest rates and increasing access to capital. Typically, a US recession has been just the tonic for an economic boom in India. With more conducive valuations, market leaders which account for more half of our portfolio, will continue to grow their market share in their respective industries, emerging as survivors in this crisis and then going on to thrive in the India’s next economic boom. Additionally, India will emerge from COVID-19 with some distinct comparative advantages and a greater share of the global supply chain.

4 topics