The ASX niche leaders learning from Germany’s ‘Hidden Champions’

Most seasoned investors will recall the collapse of Lehman Brothers to be the pivotal moment of 2008. Reeling from the subprime mortgage crisis, its day of reckoning had come. The S&P/ASX200 Index had cascaded from its November 2007 peak of 6800 to about 4000 by the end of September 2008. The history books now show the Index fell further to a nadir of about 3300 in early 2009, before staging a remarkable multi-year recovery.

Global markets were unravelling and concerns of financial armageddon were spreading. This was the context for my trip to Spain. Fear was a global phenomenon, and the sentiment in Europe was no different. It was then that I first learned of Germany’s ‘Hidden Champions’, the Mittelstand. The educator in this instance was a family friend and former Siemens executive, while I took on the role of keen student.

Recently retired and putting the final touches on his Mediterranean dream home, my German friend epitomised that country's much heralded efficiency and precision. With schnapps in hand, he sprung to life as he discussed the engine room of Germany, a group of companies that in many respects represent what a high quality small cap looks like.

Long considered to be the backbone of the German economy, the Mittelstand generally refers to a group of small to medium enterprises that have proved to be successful in enduring economic change and turbulence.

The 2015 publication ‘Best of German Mittelstand’ by Venohr, Fear and Witt, defined this cohort more specifically, suggesting these companies share characteristics of niche dominance, ‘enlightened’ family capitalism, world class performance in core processes, and ‘locational advantages’.

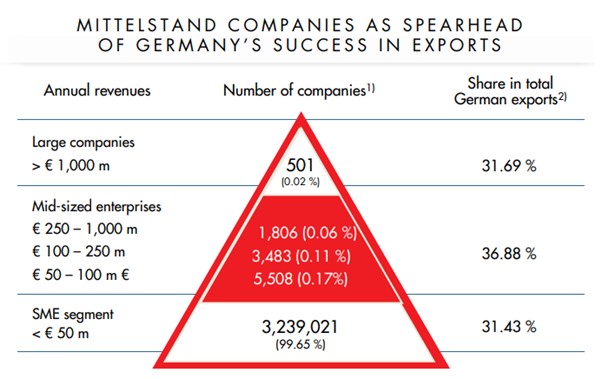

The authors concluded that ‘these companies are predominantly run by classic “owner-entrepreneurial families” seeking to sustain the business by instituting a core ideology of longevity, conservative long-term financing and operating practices’, and divided Germany's 'business landscape' into three distinct categories:

- Classic SME-type Mittelstand firms with annual revenues of less than €50 million

- Upper-sized Mittelstand firms with annual revenues of between €50 million and €1 billion

- Large companies with annual revenues in excess of €1 billion, many which are listed on the DAX

Oxford subsequently expanded on the qualitative aspects of the Mittelstand in Chapter two of its November 2015 book “The Seven Secrets of Germany: Economic Resilience in an Era of Global Turbulence.” Titled ‘Small is Beautiful’, Oxford detailed the two distinct ways in which the Mittelstand is widely understood in Germany:

The first is in quantitative and statistical terms and corresponds to small- and medium-sized enterprises (SMEs) in other European and OECD countries. The second is qualitative and refers to the values and strategies broadly pursued by the Mittelstand. This second meaning is particular and unique to Germany. The values and strategies range from the governance of the company, which involves a high prevalence of family business and management, to human resources, a focus on product niches, innovation, close linkages to the community, and a global orientation to identify and act upon opportunities.

Could this be relevant for Australian investors?

Growing volumes of evidence have linked founder led and owner manager businesses with sustained investment outperformance. In an article initially released back in November 2011, The Economist suggested that ‘family companies are ideal vehicles for long-term investments.’ In some respects, this was a reflective note as the world re-emerged from the ravages of the global financial crisis (GFC). As it turned out, the Mittelstand withstood the downturn, and powered out the other side stronger than ever. The Economist then concluded:

A decade ago investors treated the country’s middle sized companies (the Mittelstand) as mini-dinosaurs. Why stick with family ownership when going public would provide them with more money? Today they are praised as ‘hidden champions’, the dynamos of the world’s most successful export economy and the companies which provide China with the complicated machines that it requires. They have thrived precisely because they are in the hands of family proprietors who are more interested in building for the long term than in quick wins.

Generally devoid of bureaucracy, the Mittelstand have for decades been heralded for their innovation and excellence. With family-like corporate culture and management focused on long term time horizons, this has in turn generated great outcomes for German industry.

The good news for Australian investors is that, in our view, there are a number of ASX-listed companies that share many of the characteristics common to Germany’s hidden champions. And while some have clearly graduated from the realm of small to medium enterprises, the Mittelstand-like principles continuing to drive these companies remain as steadfast as ever. So, in the pages to follow, we introduce several high quality ASX-listed niche leaders that are taking on the world and winning.

ASX niche leaders cut from a similar cloth

We begin by highlighting two companies that I first met with over a decade ago, ResMed Inc. (RMD) and Carsales.com (CAR). While we now have the benefit of hindsight, it was increasingly clear that even then, each company possessed Mittelstand qualities. Both have gone from strength to strength since, and look well positioned to continue delivering for shareholders for many years to come.

ResMed Inc. (ASX: RMD)

Alongside the likes of CSL (ASX: CSL) and Cochlear (ASX: COH), RMD has been one of Australia’s greatest healthcare success stories. RMD was founded in 1989 by Dr. Peter Farrell, who has been board Chair and a Director since the company’s formation. Dr. Farrell also served as CEO from July 1990 until December 2007, and from February 2011 until March 2013, before passing the baton onto son Michael “Mick” Farrell, who has served as both CEO and as a Director since March 2013.

RMD has been a true pioneer within its niche of respiratory and sleep disorder care, having commercialised a treatment for obstructive sleep apnea, or OSA. This treatment, continuous positive airway pressure (CPAP), was the first successful non-invasive treatment for OSA. CPAP systems deliver pressurised air, typically through a mask, to prevent collapse of the upper airway during sleep. In turn, patients enjoy better quality sleep and all the benefits that flow from that.

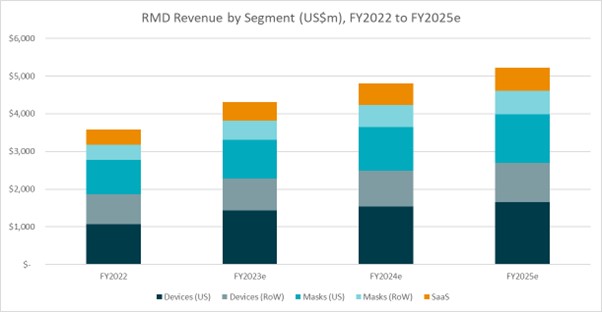

RMD have since expanded to provide technology solutions, ventilation devices, diagnostic products, mask systems for use in the hospital and home, headgear and other accessories. Today, RMD is the global market leader in its category. Its earnings can be broadly divided into three core divisions: devices, masks and SaaS, while geographically, earnings are split between the core US market and the rest of the world (RoW).

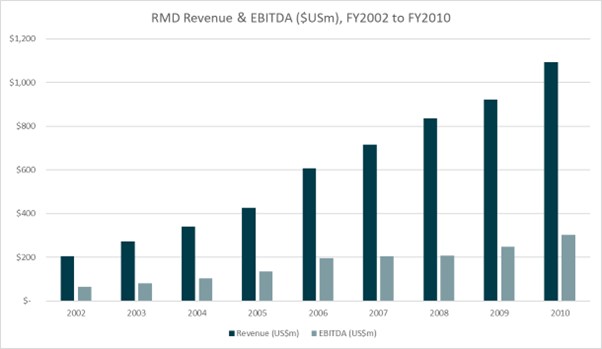

As introduced above, I first had the opportunity to meet with RMD management back in about 2011. While the company was already well on its way with a multi-billion dollar market capitalisation, it wasn’t the healthcare juggernaut that it is today, having just pushed through the ‘upper-sized Mittelstand’ marker of US$1 billion in annual revenues. In the 8 years to 2010, RMD had respectively compounded revenue and EBITDA at 23.3% and 21.4% per annum.

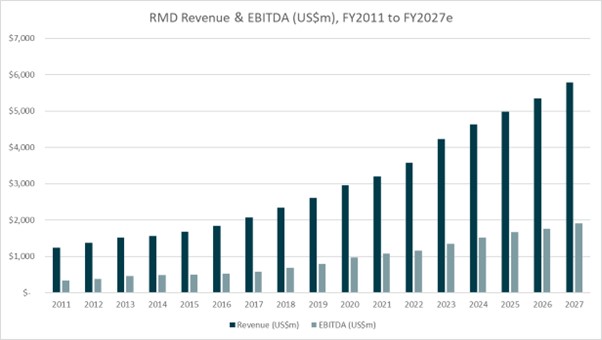

The burgeoning track record, accompanied by a raft of Mittelstand like characteristics caught the eye back then. What has been achieved since is even more impressive. With an immense opportunity to grow into a globally underpenetrated market, RMD has maintained its focus on its sleep disordered breathing niche, while consistently investing in R&D. In more recent times, RMD has also been the beneficiary of a product recall issued by its major competitor, Philips. As a result, RMD’s market share has surged beyond 60%, while profits have continued to compound at healthy double digit rates.

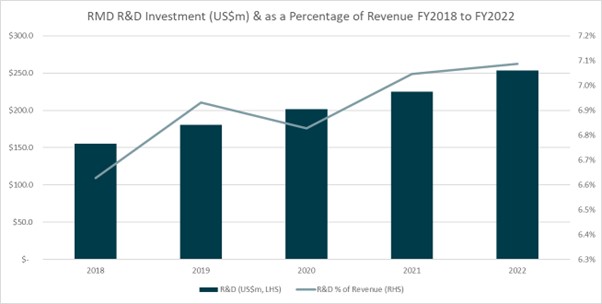

The culture of innovation lives on at RMD. Since 2018, RMD’s R&D expenditure has grown from US$155m to US$254m, representing a compound annual growth rate (CAGR) of 13.1%. R&D as a percentage of revenue has also grown incrementally in recent years, from 6.6% in FY2018 to 7.1% in FY2022, a figure we expect to keep edging higher in the coming years.

We remain optimistic on the outlook for RMD. The company has grown to hold a dominant market position in sleep therapy products and associated devices and technology. Favourable demographics and a rapidly growing, underpenetrated market also represent meaningful tailwinds.

Alongside thousands of ‘ResMedians’ that are on a mission to improve the lives of 250 million patients by 2025 (from 156 million currently), the Farrell father-son duo have built a company that the Mittelstand heartland would be proud of. The company now employs over 8000 people and sells products in over 140 countries through a combination of wholly owned subsidiaries and independent distributors.

Conservatively financed with a strong balance sheet and a consistently strong generator of cash, RMD remains well placed to grow for years into a global market with still significant latent potential. RMD’s numbers of the last 20 years suggest their end customers are sleeping well at night, and it’s probably fair to say their shareholders are as well.

Carsales.com (ASX: CAR)

CAR is the leading online automotive marketplace business in Australia, and has a growing global presence in Asia and the Americas. The company also operates a number of market leading websites in non-automotive verticals including motorcycles, boats, caravans, trucks and heavy machinery.

Founded in 1997 and listed on the ASX in 2009, CAR has become one of Australia’s premier marketplace businesses, having benefitted immensely from the powerful network effects that come with being the number one provider. Over the past decade particularly, the company has taken its technology, innovation and know-how to key offshore markets such as Brazil, South Korea and the United States, with great effect.

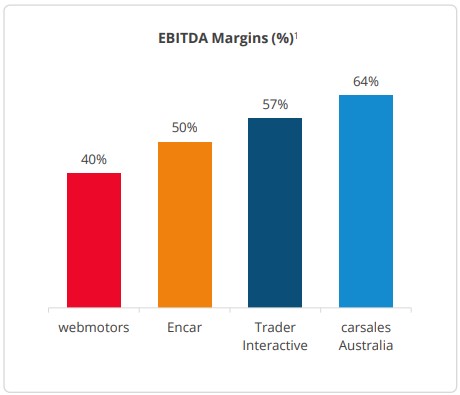

Revenue from international markets now exceeds 50% of group revenue, and looks set to continue pushing higher in the years to come. But as is evidenced by the margin differentials highlighted below, opportunity still abounds and we get the feeling that the best may still be yet to come.

Although not technically a ‘founder led’ business anymore, the Board and senior management have a sound mix of tenure, quality and skin in the game. Founding Chairman Wal Pisciotta remains on the Board and still owns 8.3 million shares, while CAR has only ever had two Chief Executive Officers (CEOs) as a listed entity. Co-Founder Greg Roebuck led the company until his retirement in 2017, before handing over the reins to long term CFO/COO Cameron McIntyre, who has been with the company since 2009 and remains as CEO today.

Recently ranked as one of the AFR’s best places to work in technology, CAR has cultivated a family-like corporate culture that would be the envy of many Australian businesses. This was perhaps best exemplified in recent comments made in the AFR (Chanticleer, “The imaginary nepotism that drives Carsales global growth”, 27 March 2023):

The owner-operator mentality that Carsales has become known for can be traced back to McIntyre’s predecessor, Greg Roebuck, and it’s clear McIntryre has put his own stamp on it.

“We’ve always seen Carsales as our own business, we always treat every dollar like it’s our own,” he says. “We want to run this business like we’re setting it up so that our children can work in [it] one day.”

Imaginary nepotism sounds like a slightly odd concept, but McIntyre says it’s an effective tool for encouraging long-term thinking and an approach of stewardship. The power of this idea shows up in Carsales’ long-term returns: since 2009, the company’s value has grown 10-fold.

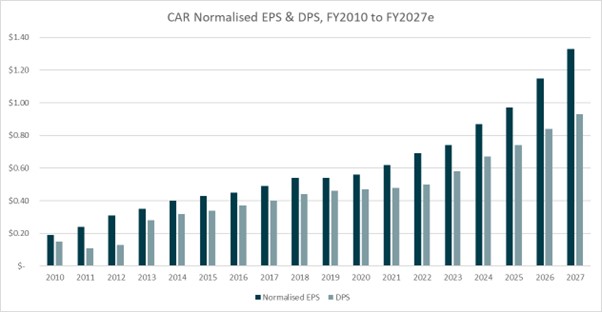

Again, the characteristics commonly associated with the best of Germany’s Mittelstand are on display at CAR. Management has retained its ‘owner-entrepreneurial’ spirit as well as its focus on a well defined niche, one backed by a culture of innovation and excellence. Finally, a ‘global orientation to identify and act upon opportunities’ has been increasingly evident over the past decade at CAR, a factor that we believe will drive double digit compound earnings growth over the medium term.

ARB Corporation (ASX: ARB)

The origins of ARB date back to 1975, when company founder Tony Brown was toughing it out on an arduous four wheel driving adventure through Northern Australia. Several damaged bull bars and roof racks later and the idea for ARB was born. There was a clear need for well-engineered, durable equipment that would meet the vigorous demands of four wheel driving, both here and abroad. And Anthony Ronald Brown (ARB) would be the man to provide it.

Decades on and the business has thrived. From its humble Melbourne beginnings, ARB is today Australia’s largest manufacturer and distributor of 4x4 accessories. The company now has a truly global presence, with large market opportunities in the US and Europe still largely untapped.

Andrew and Roger Brown joined the business in 1987 and have held various roles in the years since. Alongside the recently retired John Forsyth, the next generation Browns formed the bridge that carried the company and its founder-led culture into the next century. The Browns remain on the Board today, and the owner-entrepreneurial spirit of innovation still burns brightly. The FY2022 ARB Annual Report highlights this neatly:

ARB maintains its long-term competitive advantage through investments in product development and innovation. A significant element of the Company’s investment in product development is the permanent employment of in excess of 100 engineers across Australia, Thailand, New Zealand and the US. A new Engineering centre located at the Company’s corporate head office in Melbourne, Australia, is under construction and due for completion in October 2022. The new centre will consolidate the Australian engineering teams and provide state of the art facilities for collaboration, design, product development and testing.

As alluded to in the above passage, ARB has invested heavily in capex in recent years. This positions the company well for medium term growth, albeit has come at a time when the company is feeling the effects of a Covid comedown, while also occurring in the midst of an economic slowdown.

Looking ahead, ARB management recently suggested that the company ‘maintains a positive outlook based on its continuing strong order book, which is in line with order levels throughout 2022. ARB is focused on supporting export markets and pursuing various market opportunities, whilst managing input costs and global supply chain pressures.’

While the core Australian aftermarket division remains solidly positioned as a clear market leader, global expansion increasingly beckons over the coming 5 to 10 years. Bespoke strategic partnerships with original equipment manufacturers (OEMs) like Ford, Toyota and Isuzu provide long-term growth opportunities, particularly in large offshore markets like the US.

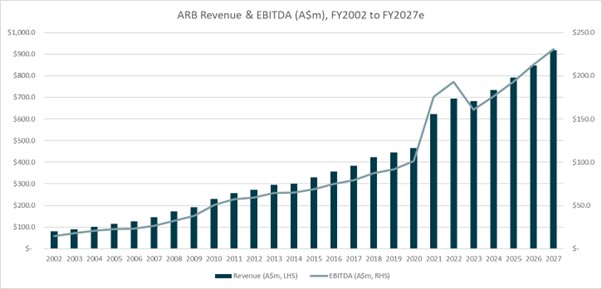

As illustrated below, peak Covid coincided with a period of outsized revenue and earnings growth for ARB. It would appear landlocked four wheel drive enthusiasts happily spent up on accessories in FY21 and FY22, with a return to a more ‘normal’ trends forecast to resume after a slowdown in FY23. However, any excessive short term focus would belie the long term opportunity for another high quality company with a number of Mittelstand like qualities - one that compounded EBITDA at an annual rate of 13.8% from 2002 to 2022.

Jumbo Interactive (ASX: JIN)

For anyone who has tried their hand at winning a $100 million Powerball online, chances are you've had an interaction with Jumbo’s ozlotteries.com brand at some stage. JIN is a digital lottery specialist, while in recent years the company has also provided their proprietary lottery software platforms and lottery management expertise to the charity and lottery sectors.

Established in 1995 by CEO Mike Veverka, JIN is the ASX’s only pure play digital lotteries business. The company forms part of an effective duopoly with The Lottery Corporation (ASX: TLC) with its Lottery Retailing division, while its SaaS and Managed Services divisions add breadth to its earnings profile, both in Australia and select international markets.

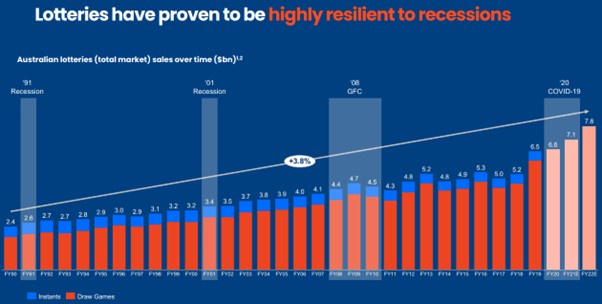

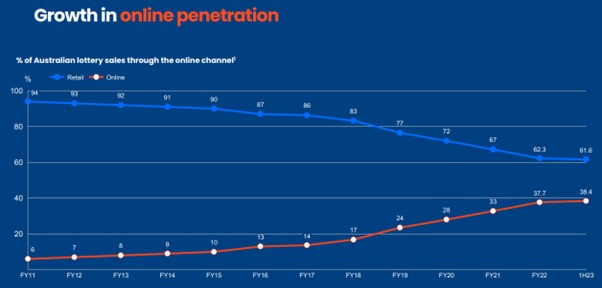

While many of its attractive company-specific characteristics warrant attention, it’s important to start with two key foundational aspects of the lotteries market. Firstly, as illustrated below, the total lotteries market in Australia has proven to be both consistent and highly resilient over the past three decades.

Secondly, the share of tickets being sold online continues to march higher, year on year. While Covid appeared to accelerate this trend for a period, we expect online sales penetration to continue incrementally increasing for the foreseeable future. So, not only is the total lotteries market consistently growing, the digital share of sales continues to grow as well. In turn, this provides an ever growing pool of opportunity for JIN.

Focused and founder led, highly cash generative and with a strong net cash balance sheet, JIN has many of the hallmarks of quality so often associated with Germany’s hidden champions. Having invested heavily in its technology over the past decade, JIN has best in class software that rates highly for user experience, which when coupled with sensible business management, is ultimately reflected in high margins and profitability.

In 2022, JIN was certified as a Great Place to Work in Australia, with in excess of 90% consensus amongst employees. It’s a great credit to Mike Veverka and his long tenured executive committee, who look to have cultivated a strong sense of purpose and community throughout the JIN ranks.

Looking ahead, we expect JIN to deliver solid growth in its domestic core of lotteries retailing over the medium to long term. And while its measured expansion into offshore jurisdictions like Canada and the UK adds a degree of execution risk, it also opens up significant opportunities for multi-year earnings growth. JIN’s mix of quantitative and qualitative characteristics see it currently ranked highly in Elvest’s ASX shortlist scoring, which is reflected in its position as one of the top holdings in The Elvest Fund.

Before concluding, it's worth highlighting that when mapping out this update, we initially flagged PWR Holdings (ASX: PWH) as a potential inclusion for discussion. Another father-son duo that started out in the late 1990s, PWH has since gone on to carve out a near monopoly position in high performance cooling solutions for motorsports and the automotive industry. For those that are interested, please take a look at last year’s ‘The small cap stairway to heaven’, an article that profiles PWH and several other high quality small caps that might also fit the Mittelstand bill.

Final Thoughts

Amidst the global doom of the 2008 financial crisis, my trip to Spain proved to be a memorable one. Not all holidays will provide opportunities to learn from experienced German executives and investors, but often they do allow investors time to slow down and take stock.

Taking cues from the daily cut and thrust of bleak newspaper headlines seldom serves investors well. Instead, as we strive to deliver returns for investors, we advocate for the consistent adherence to a sound set of principles. And as I’ve learned over the years, many of these can be found in a good number of ‘hidden champions’, both here and abroad.

We’re always on the lookout for focused, founder led companies with long term time horizons and high performance cultures to match. Dedicated to their niche and with a commitment to innovation, these companies can achieve great things, often on a global scale.

We believe that buying Mittelstand-like ASX companies at sensible prices, and then holding them through times of macroeconomic concerns, will lead to good investment outcomes over time. As we look into the eyes of a potential 2023 recession, investors will be best served by maintaining a focus on factors associated with long term value creation. Long term returns will then take care of themselves.

3 topics

5 stocks mentioned