The hidden risks in markets today

What would you nominate as the most under-appreciated risk in the market today? There seems to have been an endless carousel of macro ‘bogeymen’, yet markets keep inching higher. So which risks really matter, and which ones have investors overlooked?

We asked a panel of leading economists for their take. Alex Joiner, Chief Economist at IFM Investors, questions the global growth narrative. Geoff Wood, Head of Macro and Risk at Morphic Asset Management asks if the implications of a trade war are as big as the market fears. Finally, Cameron Kusher, Principal at CoreLogic, discusses the effects a normalisation of rates would have on the residential housing market.

Growth narrative won’t last forever

Alex Joiner, Chief Economist, IFM Investors

From a macroeconomic perspective, I suspect the challenge to investors is likely to come as we move deeper into 2019. This is as the downside risks to the synchronous global economic upswing continue to build – with fractures in this narrative already beginning to appear.

To date, remaining long developed market equities versus developed government bonds has remained a comfortable place to be. Global central banks continue to tell us that there’s more growth to come, accompanied with inflation and an exit from accommodative monetary policies. This is especially true, and justifiable, in the US where the economy and company earnings have been underpinned by aggressive fiscal stimulus.

This has made the task for the Fed unambiguous and is allowing it to raise rates with at least some degree of certainty. This is as inflation is accelerating due to strong demand and underpinned by wages. The US growth trade long equities, short bonds is particularly crowded (with downside risks to US bonds also coming from the blowout in US fiscal metrics).

However, the growth narrative won’t last forever, either globally or indeed in the US.

And it remains possible, and perhaps likely, that other central banks including the ECB, BoJ and also the RBA will have an ever-diminishing window in which to remove policy accommodation that remains in place, before the Fed stops raising rates.

Economic growth cycles are increasingly dated, most notably in the US and threats to growth are building from trade wars and emerging market volatility. There is also the possibility that the Fed may overshoot a neutral policy rate level, driving US growth lower.

These dynamics are likely well appreciated by global investors. The risks, and arguably opportunities, seem to lie in how and when to de-risk portfolios, and position for what may turn out to be a much more sombre outlook for global growth.

Trade war fears are likely overblown

Geoff Wood, Head of Macro & Risk, Morphic Asset Management

Google search trends show that the US/China trade war is a hot area of interest, while the Bank of America Merrill Lynch Fund Manager survey shows it is seen as the biggest tail risk since the Eurozone crisis of 2012.

However, unlike 2012 when a possible collapse of the Eurozone could have sent us back into the GFC, the actual materiality of a trade war on economic growth is relatively small in comparison.

Various research bodies such as the IMF show that the impacts on both growth and inflation from a trade war of the scale currently threatened remain limited. The primary reason is the currency moves would offset the tariffs. The bottom line is if the Chinese currency can continue to trade freely, then it should act as a buffer. In the last two months, the Renminbi weakening of 10% against the US dollar would already offset a large chunk of a 25% tariff on $250 bil of goods, should it go ahead.

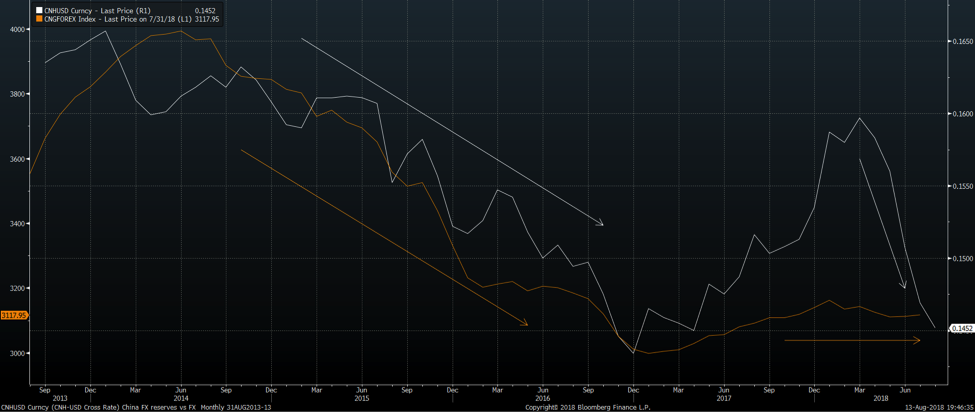

In addition, unlike 2015 where rapidly weakening Chinese Renminbi (The white line in the chart below) lead to destabilising capital outflow (orange), this is not occurring this time.

Chinese officials have done a good job of plugging the capital flight loopholes, and official FX reserve shows that Chinese money is staying firmly in China. This improvement in Chinese capital stability reduces another possible risk.

What will rising rates do to property prices?

Cameron Kusher, Principal, CoreLogic

One of the risks that is being underestimated for the housing market is what will happen as the Reserve Bank begins to normalise the cash rate over the coming years.

We’ve already seen in Sydney and Melbourne the impact of higher interest rates to investors. While the current cash rate is still seen as being at an ‘emergency’ low setting, an increase in the cash rate has historically led to a slowdown in dwelling value growth.

Over the past 25 to 30 years, Australian property owners have become accustomed to strong returns, which have occurred over a period whereby interest rates have been trending lower.

Interest rates seem unlikely to go lower and at some point will have to increase.

What that means for property owners is that the returns over the past 30 years or so seem unlikely to be repeated.

Particularly when household debt has increased to such a high level that mortgagees have become more sensitive to changes in interest rates.

Enjoyed that?

In this next wire, our panelists nominate their number one chart in markets today. First up, Cameron Kusher, Principal at CoreLogic, tells us what the market’s been missing in residential housing. Next, Alex Joiner, Chief Economist at IFM Investors, looks at monetary policy and the challenges non-US central banks face. Finally, Geoff Wood, Head of Macro and Risk at Morphic Asset Management takes us to the doctor’s – Doctor Copper that is – and the results aren’t good. Read on here: (VIEW LINK)

3 topics