The Long and the Short of it

Presenting recently on the state of the market and its behaviour, I was asked about some of the most risky elements currently at play.

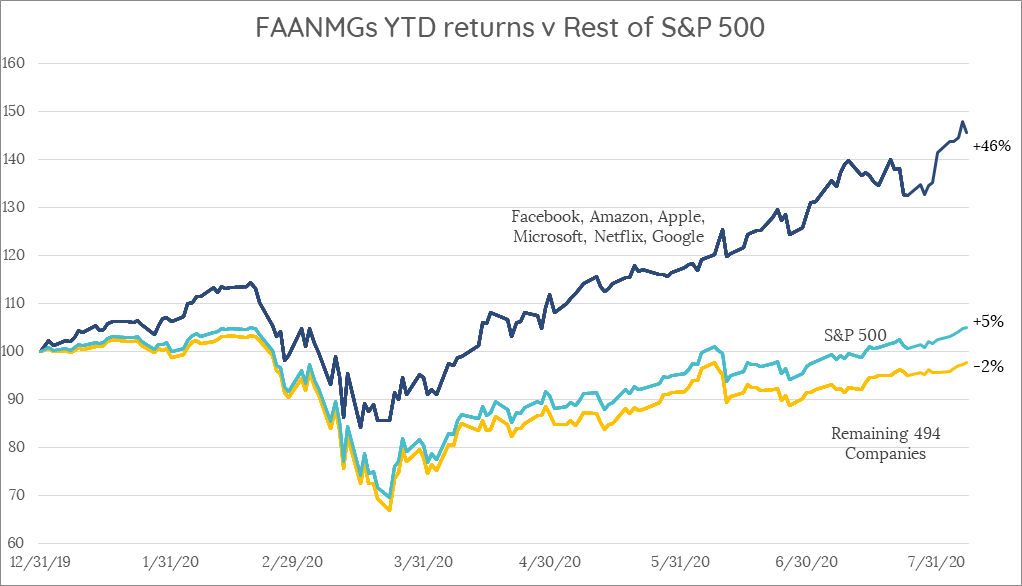

I’ve written previously about market concentration and how a few players are skewing the index performance of the S&P 500, and this is definitely still the case as the below chart shows.

Source: Bloomberg, As at 7/8/20

In fact the combined market cap of Apple, Amazon, Facebook, Microsoft, Netflix and Google are now bigger than the entire Japanese stock market.

So if you’re chasing the index and growth stocks now, it’s risky. 30 years ago, Japan was the place to invest with an economy growing when other developed countries were not. However, for those that invested at the Nikkei’s peak, they are yet to have made back their investment.

This goes to the notion of buying or holding long return versus short return equities. Those Nikkei investors are still waiting for a return on their initial investment – so they are long duration. Similarly the current darlings of the market in tech and consumer discretionary are long duration for anyone buying now.

Back to today and looking at consumer discretionary stocks (of which Amazon is by far the largest component), they have had the highest correlation to US real interest rates (i.e. real yields lower, stocks higher), with the technology sector close behind.

What do both sectors also have in common? They’re getting larger.

So there’s greater concentration of a few stocks, that are longer and longer duration.

But this also applies to bonds where the total amount of bonds owned by investors has grown in the last two years. These bonds are longer in duration, increasing by 5% over the two years to a record high, as both corporates and governments have taken advantage of low yields to extend maturity.

In the end, equity and credit markets can weather a modest rise in yields, fuelled by better data. But the rise in duration across bonds and equities, means investors need to be wary about their exposure to that duration.

If there’s one thing we are sure of, there’s still a great deal of uncertainty out there.

5 topics