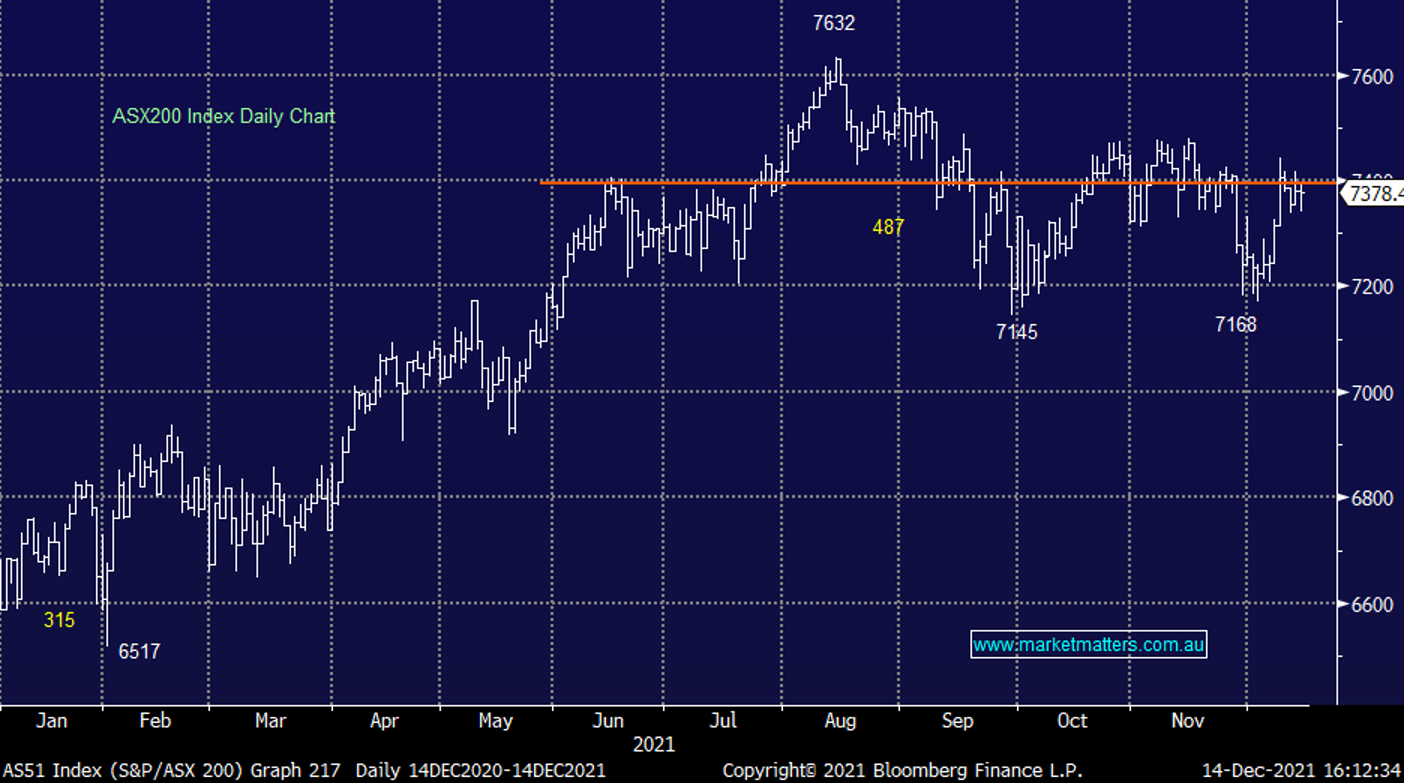

The Match Out: ASX Flat, Woolworths slides on weak trading update

It was a solid session by the end of the day after a weak open saw the market down -37 points at its worst before a spirited fightback led to an unchanged session. You’d almost call it a bullish day given that consumer staples fell by nearly 4% on a weak update from Woolworths (ASX: WOW) and a negative broker report on Coles (ASX: COL).

- The ASX 200 finished flat at 7378.

- Buying in Real-Estate and Materials did their best to offset the large sell-off in the Supermarkets.

- Woolworths (ASX: WOW) -7.67% delivering a weak trading update due to COVID-related costs.

- Mesoblast (ASX: MSB) -17% was also weak after Novartis ended its deal, MSB closing at $1.40 today, it was around $5.60 a little over a year ago.

- On the flip side, PolyNovo (ASX: PNV) +15.44% rallied on a good US sales update.

- VRT company Virtus Health (ASX: VRT) +34.55% on private equity interest.

- Nitro (ASX: NTO) +8.27% on the back of directors buying small amounts of stock.

- HUB 24 (ASX: HUB) +1.70% held its AGM today and talked to the strong year it has had. Management also said strong FUA growth has been achieved in FY22 to date, with more detail to come at its half-year results in February. We own HUB in our Flagship Growth Portfolio.

- Uranium shares were under the pump today, Paladin (ASX: PDN) down around 10% to close at 74 cents as Uranium prices pullback – we’ll cover this in more detail in tomorrow’s Portfolio Report, including what we intend to do with Paladin.

- Gold was flat again in Asia today at $US1785 at our close.

- Ditto for Iron Ore which is holding on to recent gains of around $US119 in Singapore.

- Asian markets were lower today, Nikkei -1.12%, Hong Kong -1.26% and China -0.31%.

- US Futures are up a tad, circa 0.10% higher.

ASX 200

Woolworths (ASX: WOW) $37.45

WOW -7.67%: Woolies has come out with a disappointing trading update today that is weighing on WOW shares, along with Coles (ASX: COL). Management expects EBIT for the first half to come in well below expectations at around $1.2 billion, despite sales remaining strong, the issue being higher COVID costs and the impost of supply chain disruptions, while poor weather, especially in NSW, has also been an issue. The CEO called it “one of the most challenging halves we have experienced in recent memory” in the update, with costs as a result of the pandemic higher than the peak of lockdowns last year. These costs are likely to subside into the second half and a strong festive trade is expected to lift the full-year result. But this update leaves the supermarket chain a long way behind full-year consensus expectations of $2.95 billion EBIT that’s currently priced in. Also out today was a piece from Jefferies analyst Michael Simotas, who posed that Woolies EBIT would take a 12% hit if Australia was to adopt a similar tobacco crackdown as seen in New Zealand. Coles would be most impacted with a 14% hit.

Woolworths

Mesoblast (ASX: MSB) $1.405

MSB -17%: crashed to an 18-month low today after Swiss healthcare giant Novartis walked from a deal around treatment for COVID-related respiratory issues. Novartis and Mesoblast penned a collaboration agreement last year which saw Novartis make an initial US$50 million upfront payment with a US$25 million equity stake. The deal could have been worth US$1.25 billion. The Remestemcel-L treatment was to achieve certain commercialisation targets and sales milestones but Novartis pulled the plug today, around 12 months after the initial day. Mesoblast remains confident the treatment is effective and trials have shown a fall in mortality rates in trials on COVID ARDS patients.

Mesoblast

Virtus Health (ASX: VRT) $7.01

VRT +34.55%: Rallied hard today on the back of an unsolicited, non-binding indication of interest from BGH Capital to acquire the IVF provider for $7.10 cash per share. BGH has bought 8.5 million shares, representing a 9.99% interest at the $7.10 level, and also entered into an agreement with UBS that has yet to settle in respect of 8.6 million shares, representing a 10% interest in Virtus. That flowed onto sector peer Monash IVF (ASX: MVF), which rallied as much as 12%. If we price MVF on the same multiple as today's bid for VRT, MVF should be trading at around $1.24 versus today's close of $7.01.

Virtus Health

Broker moves

- Costa Raised to Buy at Citi; PT A$3.45

- Vulcan Steel Rated New Outperform at Forsyth Barr

- SiteMinder Ltd Rated New Neutral at Goldman; PT A$6.90

- Bapcor Cut to Neutral at Goldman; PT A$6.70

- Altium Cut to Hold at Bell Potter; PT A$45

- Regis Healthcare Cut to Hold at Morgans Financial Limited

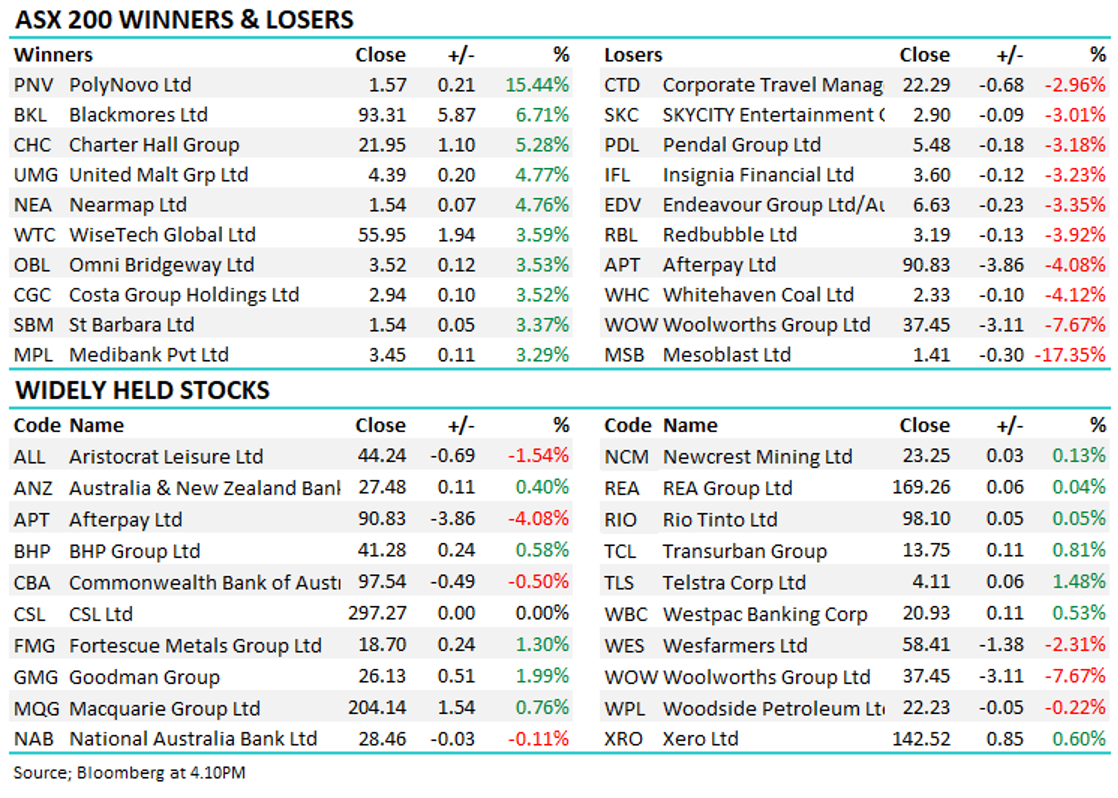

Major movers today

Have a great night

James, Harry and the Market Matters Team.

2 topics

8 stocks mentioned