The Match Out: ASX meanders into a new week, Defensive sectors solid, Energy not so

Markets @ Midday: Listen Here each morning

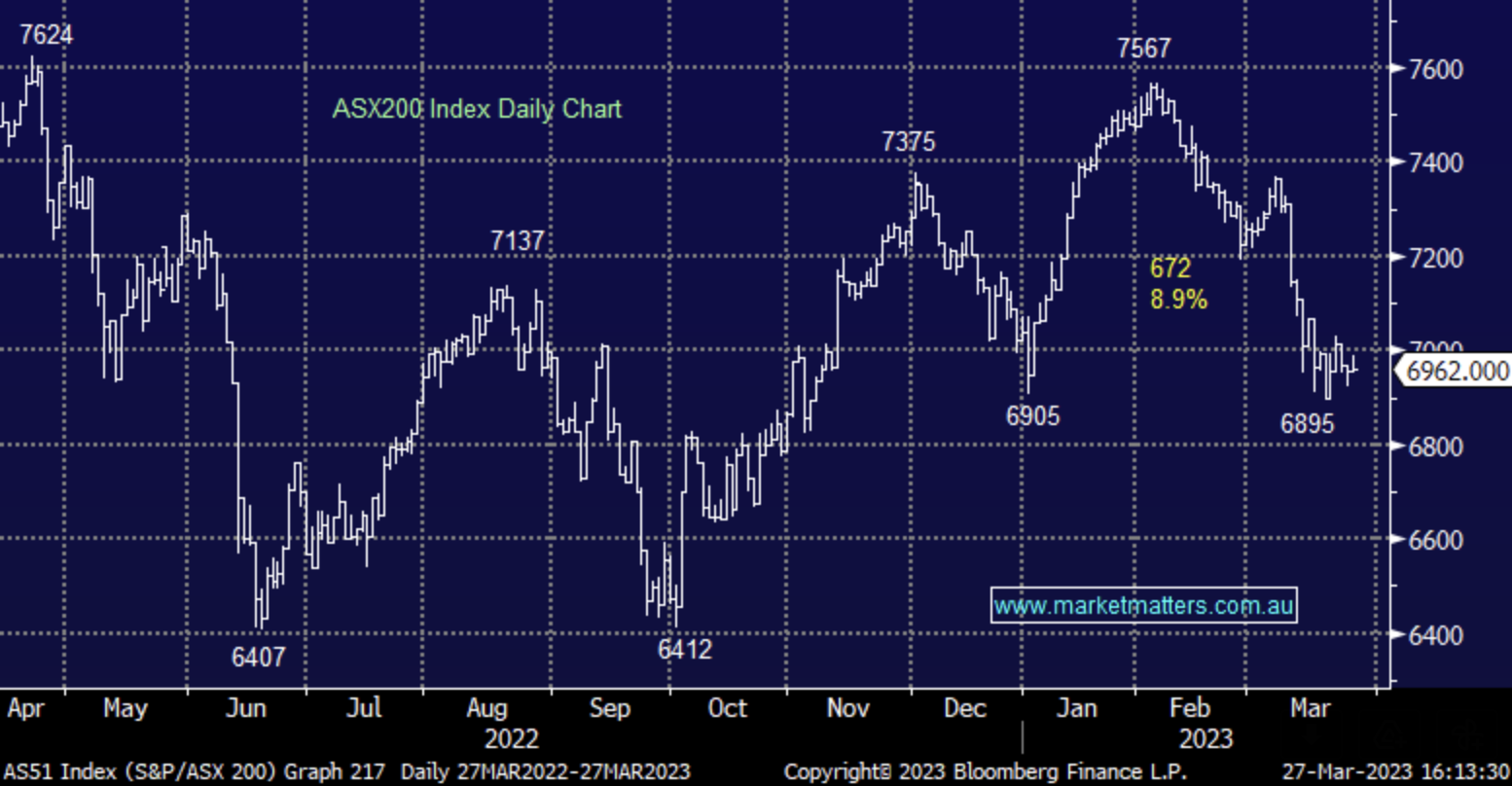

A bit of a nothing session today for the ASX, the best of it was seen early with the index up ~30pts at its highs before a lacklustre afternoon session saw the gains evaporate, Energy the biggest drag overall while the banks came off as the day wore on.

- The ASX 200 finished up +6pts/ +0.10% at 6955

- The Utilities sector was best on ground (+2.14%) while Property (+1.11%) & Healthcare (+0.73%) were also strong.

- Energy (-2.30%) and Consumer Discretionary (-0.28%) the weakest links.

- Premier Investments (ASX: PMV) -2.49% lower today despite reporting strong 1H23 results. More on that below.

- AGL Energy (ASX: AGL) +3.22% was a strong mover again today with the stock closing at $7.69, now up ~13% in the last 10 days. The market has transitioned from an uber-bearish stance to a more neutral one.

- Lake Resources (ASX: LKE) -13.54% hit hard as the non-exec chair Stuart Crow sold ~ 8m shares realising just shy of $4m, meeting personal financial obligations to blame!

- Healius (ASX: HLS) +2.06% had its two biggest shareholders (Perpetual & Tanarra Capital) who speak for ~21% of the stock call last weeks bid from Australian Clinical Labs (ACL) as unappealing. HLS retains it’s ‘take no action’ stance.

- Bank of Qld (ASX: BOQ) flat, more changes at the top, Patrick Allaway to relinquish the Chairman’s role to focus on the MD/CEO gig he took on in November last year, with Warwick Negus to take over the Chairman’s role. A search is underway to find Allaway’s replacement.

- Tyro Payments (ASX: TYR) +2.12% moved to reassure investors that talks with potential buyer Potentia remain ongoing despite little news flow since their half-year result a month ago. A binding, non-binding, or transaction of any kind may or may not occur, but it still might. Clear as mud!

- Coal stocks opened higher following strength in the underlying coal price, but sold off by the close, Whitehaven Coal (ASX: WHC) -1.54% and New Hope (ASX: NHC) – 1.28%

- Iron Ore ticked up ~1% higher in Asia today, Fortescue (ASX: FMG) flat while RIO fell -0.59%

- Gold was down a touch, nothing too significant, sitting at ~US$1974 at our close. Newcrest (ASX: NCM) was solid up +1% and hitting its highest level since May 2022.

- Asian stocks were mixed, Hong Kong down -0.96%, Japan +0.30% while China was off -0.75%

- US Futures are all up, around +0.40%

ASX 200 Chart

Premier Investments (ASX: PMV) $24.70

PMV -2.49%: the retail group reported 1H numbers today which were well ahead across most metrics, however, the initial rally in its shares was sold into, ending the session lower. Sales were a ~15% beat to expectations while Retail EBIT was around 5% ahead of the market. The company’s balance sheet is in great shape with ~$400m cash along with significant investments in Myer (MYR) and Breville Group (BRG), giving the company plenty of flexibility to look at further growth through M&A while they continue to execute on their store roll-out and geographical expansion plan. The company will pay a 54cps dividend (inline) and a 16cps special dividend, both fully franked. Trading for the first 6 weeks of the new half was also strong, up 7.7% on pcp. The only issue we had with the result was lower margins, mostly as a result of their FX exposure while manageable costs were controlled well.

Broker Moves

- Syrah Reinstated Outperform at Macquarie; PT A$2.30

- Estia Health Cut to Hold at Jefferies; PT A$3

- Renascor Rated New Outperform at Macquarie

- TPG Telecom Reinstated Reduce at CLSA; PT A$5

- SiteMinder Ltd Rated New Buy at CLSA; PT A$4.05

- Helloworld Rated New Buy at Shaw and Partners; PT A$3

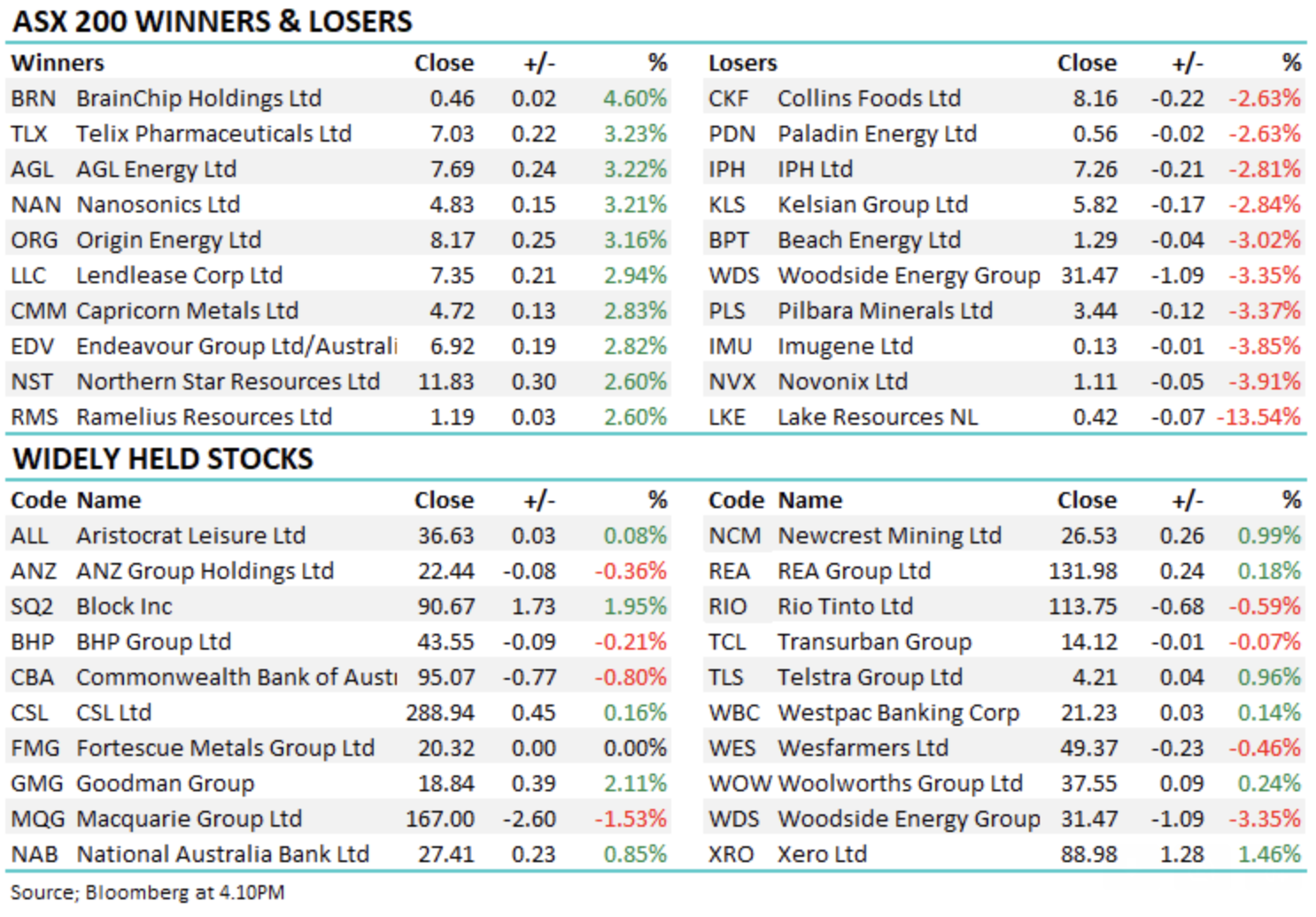

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned