The Match Out: ASX rallies with Energy the standout, Lynas (LYC) gets reprieve

A bullish start to the trading week with the risk-on sectors doing best following a stellar session on Wall Street all the way back on Friday night. Lots of analysis out this morning as brokers re-cut their numbers following a flow of trading updates last week (a result of MQG conference), with a lot of news flow stemming from some of the more interesting sectors – namely Lithium & Rare-Earths – more on these sectors in the AM report.

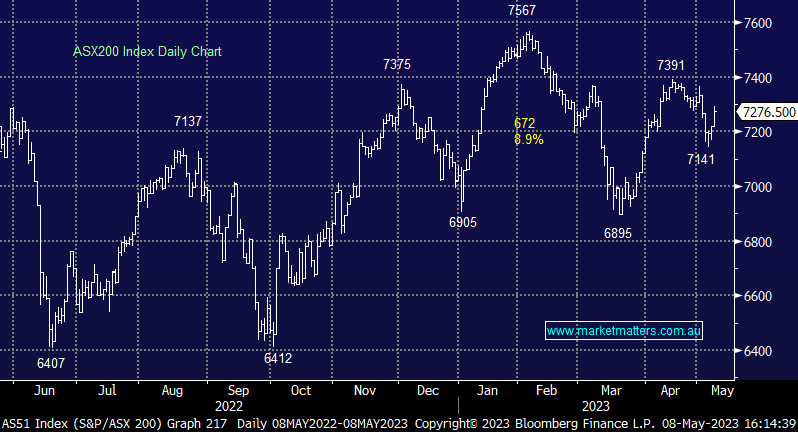

- The ASX 200 finished up +56pts/ +0.78% at 7276

- The Energy sector was best on ground (+2.48%) while Materials (+1.58%) & IT (+1.00%) were also strong.

- Staples (-0.87%) the only sector to lose ground while Healthcare (+0.03%) & Communications (+0.26%) underperformed.

- Inflation is an east coast problem, according to Western Australian Premier Mark McGowan. “Western Australia is not the heart of the inflationary pressures of Australia…”

- As ludicrous as the comment sounds, it does have some validity with Perth’s CPI +0.9% in the March QTR compared to the capital city average of 1.4%, domestic gas reserves a big help for the West…but c'mon Mark!

- Westpac (ASX: WBC) +2.08% a ~4% profit beat and an inline 70cps dividend for the last of the bank Half Year reports. NIM was 190bps for the half, and while the exit NIM was slightly lower at 188bps, this was better than expected after peers printed far softer numbers. Costs beat, -1% for the half and though they walked from FY24 targets, the market was pricing that in. Probably the best of the 3 majors that were reported in the last few sessions, and it showed in the rally today.

- Lithium stocks continued to fire with growing signs the market has bottomed – Pilbara (ASX: PLS) +4.77%, Mineral Resources (ASX: MIN) +1.42% & Global Lithium (ASX: GL1) +7.48%, although all were best early in the day.

- Woodside (ASX: WDS) +2.96% & Santos (ASX: STO) +2.03% enjoyed a ~4% recovery in Oil prices overnight while the government’s tax plan for offshore LNG producers was more benign than it could have been – some positive commentary around it being a ‘good balance’.

- Iluka (ASX: ILU) +5.46% rallied on a broker upgrade with Macquarie saying more clarity around their Mineral Sands outlook is a positive – they raised to BUY equivalent and $12.30 PT.

- Lynas (ASX: LYC) +12.01% stormed higher after Malaysia agreed to extend the deadline for licence amendments due to come in on July 1 - they were also upgraded to Buy at CLSA, with an $8.05 PT

- Worley (ASX: WOR) +3.62% won an engineering and design services contract with Shell ahead of their strategy day tomorrow – we’ll be watching closely!

- GQG Partners (ASX: GQG) -0.35% edged lower despite saying funds under management (FUM) experienced net inflows of $US5.4 billion in the first four months of this year. They now have $US94.5bn under management.

- Perpetual (ASX: PPT) +2.95% rallied today, we spent some time looking at the fund manager today and gee, it continues to look cheap versus comps.

- ARB Corp (ASX: ARB) +3.79% bounced back after last week’s softness following a trading update that the market took as a downgrade, we thought it was steady.

- Syrah (ASX: SYR) -5.42% whacked again - this thing can really move. We were asked a question for our Weekly Q&A a week or so ago and wrote the following (Click Here) which still stacks up.

- Treasury Wines (ASX: TWE) -1.75% tracked lower following a move to cut costs.

- Iron Ore was ~2.5% higher in Asia today supporting Fortescue (FMG) +1.93% & RIO +2.37%

- Gold was down overnight to ~US$2017 before tracking up US$4 in Asian trade today, settled $US2021 at our close.

- Asian stocks were okay Hong Kong up +1%, Japan fell -0.60% while China added +1.82%

- US Futures are largely flat

- Stocks we own in the US reporting this week: Paypal (PYPL US) tonight, The Trade Desk (TTD US) & Disney (DIS US) on the 10th & YETI Holdings (YETI US) on the 11th.

- To view the Market Matters International Equities Portfolio – Click Here

ASX 200 Chart - Intraday

ASX 200 Chart - Daily

Lynas Rare Earths (ASX: LYC) $7.37

LYC +12.01%: the rare earths company saw shares jump to a ~2-month high today after Malaysia agreed to extend the deadline for licence amendments due to come in on July 1. The 6-month extension allows Lynas to continue operations as usual at their processing facility in the country after a long-running battle to ease the restrictions. Lynas, the world’s largest rare earths producer outside of China, has also been granted avenues to review the conditions that can further extend the facility's life which de-risks the ramp-up of their new WA facility due to come online in the next 2 months.

Broker Moves

- Lynas Raised to Buy at CLSA; PT A$8.05

- ANZ Group Cut to Neutral at Macquarie; PT A$24

- Orica Raised to Overweight at JPMorgan; PT A$17.20

- Iluka Raised to Outperform at Macquarie; PT A$12.30

- Insurance Australia Rated New Buy at Jefferies; PT A$5.74

- Suncorp Rated New Buy at Jefferies; PT A$14.45

- QBE Insurance Rated New Buy at Jefferies; PT A$18.08

- ALS Cut to Hold at Jefferies; PT A$13.50

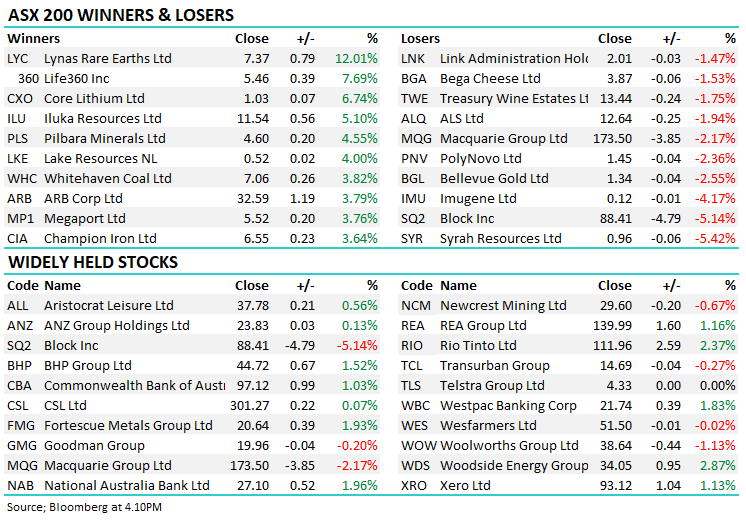

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned