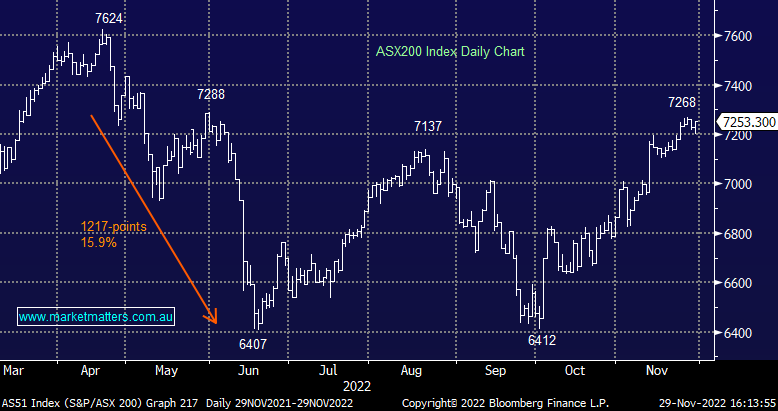

The Match Out: ASX recovers early losses to finish higher, Resources up on Chinese stimulus

The market was weaker this morning as concern bubbled over from Chinese protests on the weekend centred on their futile Covid-zero policy, however that pessimism turned to optimism on leaks that the policy will be scrapped, while the Government also relaxed some regulations around property developers – a conciliatory / pro-growth move. Asian stocks rallied, Hong Kong shares +4.5% around our close and that underpinned a ~50pt turnaround for the local market.

- The ASX 200 finished up +24pts/ +0.33% at 7253

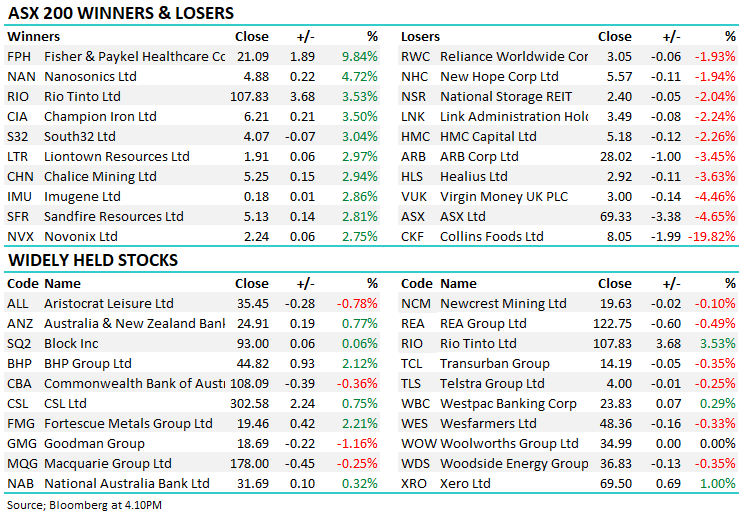

- The Materials sector was best on ground (+1.68%) while Healthcare (+0.56%) & IT (+0.25%) were also higher.

- Property (-0.82%) and Consumer Discretionary (-0.48%) the weakest links.

- ANZ (ASX: ANZ) getting more bearish around house prices saying they will fall another 11% next year as rate rises put pressure on a significant chunk of the mortgage market.

- Collins Foods (ASX: CKF) -19.82%, struggled today following the HY result siting further inflation was weighing on margins. They’ve also put plans for new Taco Bell sites on hold for now as they work on improving operational efficiency, however, more price hikes at KFC stores are likely.

- Fisher & Paykel (ASX: FPH) +9.84%, 1H result saw revenue down -23%, but around 20% above pre-COVID levels. The company expects higher revenue in the 2H while margins should improve by 200bps after falling below 60%.

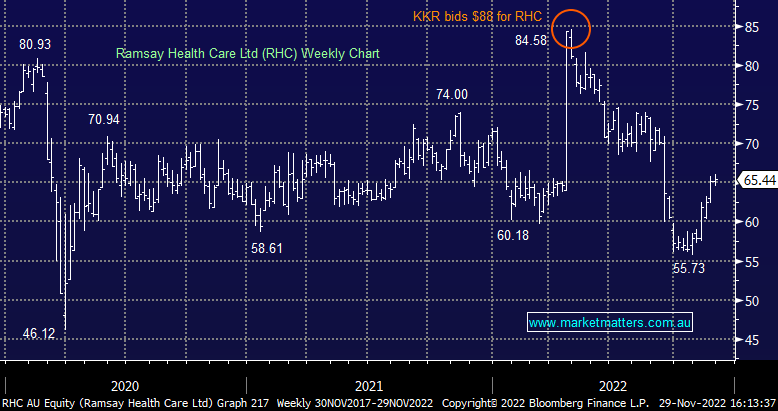

- Ramsay Healthcare (ASX: RHC) +0.88% said they did everything they could to engage with KKR, at their AGM today.

- Woodside Energy (ASX: WDS) -0.35% on weaker production guidance.

- Healius (ASX: HLS) -3.63% fell again following yesterday’s downgrade – 3 days down a general rule post downgrade for some semblance of support.

- City Chic (ASX: CCX) -8.78% was 3rd day down today post their AGM while volume remained incredibly high – looked a lot like capitulation selling this morning. Not one we own (thankfully). Shares down from $1.39 closing today at 67.5c. They were ~$6 a year ago.

- Iron Ore was back up above ~US$100/tonne, up ~3% on the session.

- Gold was higher in Asian up USS/12 to ~US$1753 at our close.

- Asian stocks bounced nicely Hong Kong up +4.08%, Japan Flat while China was up +2.15%

- US Futures are all up, around +0.30%

ASX 200 Chart

Ramsay Healthcare (RHC) $65.44

RHC +0.88%: The private hospital operator held their AGM today and there was a lot of focus on the failed takeover tilt by KKR and why it didn’t complete. The RHC Chairman Michael Siddle saying the board did "everything" to help facilitate the talks which were protracted. "I want to make it clear - very clear - we did not reject the proposals, they were withdrawn. There was no proposal to consider. In the end, we did not have anything to consider. Your board always remains open to plans or proposals to consider that create value."

While we think there is more to play out over time with RHC and a suitor given the appeal of splitting the property holdings and the operating company, we think this will be a story for mid to late 2023, and the variable remains in what happens with property prices globally between now and them. Operationally, RHC said they see a gradual recovery in the business through FY23 and more normalised conditions from FY24 onwards with the usual Covid-induced caveat to all of this.

Woodside (WDS) $36.83

WDS -0.35%: the energy company provided guidance ahead of their investor day later this week, with shares holding up despite the numbers disappointing, The company expects CY23 production of between 180-190mmboe with the market hoping for a number just above 200mmboe. Some of the miss can be explained by changes in their oil equivalent conversions, while the company also assumes no contribution from Sangomar which is due to come online near the end of the period. Most of the miss though comes from site works planned for Pluto in Q2 which may see the asset out of production for 4 weeks.

Broker Moves

- Santos Cut to Accumulate at CLSA; PT A$8.11

- Healius Cut to Underweight at Jarden Securities; PT A$2.90

- Australian Clinical Labs Raised to Outperform at RBC; PT A$4.25

- Alumina Cut to Neutral at Citi; PT A$1.60

- Bank of Queensland Cut to Neutral at Credit Suisse; PT A$7.50

- Fortescue Cut to Sell at Citi; PT A$16.70

- Pilbara Minerals Raised to Buy at Jefferies; PT A$5.15

- New Hope Raised to Neutral at Citi; PT A$4.50

- Adrad Holdings Rated New Buy at Bell Potter; PT A$1.70

- Healius Cut to Underperform at Jefferies; PT A$3

- NRW Holdings Rated New Buy at Citi; PT A$2.90

- Monadelphous Rated New Sell at Citi; PT A$12.35

Major Movers Today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned